More than 70% of Americans say that the fact that some corporations do not pay their fair share in taxes bothers them either some or a lot, according to a recent Pew Research Center survey. Though there is often disagreement about what the appropriate tax rate should be, most Americans agree corporations should pay more in taxes.

The statutory corporate federal tax rate on profits is supposed to be 21%, but through a string of loopholes, tax breaks, avoidance schemes, tax shelters, and other financial dealings, dozens of companies paid $0 in federal taxes on their profits in 2020.

To determine the companies that avoid paying taxes, 24/7 Wall St. reviewed the list of companies that paid $0 in income taxes for 2020, as compiled by the Institute of Taxation and Economic Policy. Companies were ranked based on their U.S. pre-tax income for the same year.

There are at least 55 companies with publicly available data that turned a profit in 2020 but did not pay a penny in taxes – and almost all of them actually received millions in tax rebates. The 55 companies earned a combined $40.5 billion and took in nearly $3.5 billion in rebates.

Had these companies paid the 21% rate, that would have pumped $8.5 billion into the government’s coffers. Though the U.S. collects more total tax revenue than any other country, it has one of the lowest tax revenue to GDP ratios among wealthy nations. These are the countries collecting the most taxes.

The companies that avoided paying taxes in 2020 represent a wide variety of industries, including technology, utilities, telecommunications, food and beverages, manufacturing, pharmaceuticals, and more. Some of these companies are among the largest and best known brands in the world, pulling in over a billion dollars per year. These are the most valuable brands in the world.

Click here to see the companies that avoid paying taxes

55. Treehouse Foods

> U.S. pre-tax income: $8 million

> Federal income tax (including rebates): -$96 million

> Effective tax rate: -1,167.1%

> Industry: Food, beverages, tobacco

[in-text-ad]

54. Akamai Technologies

> U.S. pre-tax income: $40 million

> Federal income tax (including rebates): -$2 million

> Effective tax rate: -4.4%

> Industry: Technology

53. Albemarle

> U.S. pre-tax income: $42 million

> Federal income tax (including rebates): –

> Effective tax rate: -0.3%

> Industry: Chemicals

52. Owens & Minor

> U.S. pre-tax income: $74 million

> Federal income tax (including rebates): -$4 million

> Effective tax rate: -6.0%

> Industry: Retail and wholesale trade

[in-text-ad-2]

51. Howmet Aerospace

> U.S. pre-tax income: $86 million

> Federal income tax (including rebates): -$2 million

> Effective tax rate: -2.3%

> Industry: Miscellaneous manufacturing

50. Mohawk Industries

> U.S. pre-tax income: $87 million

> Federal income tax (including rebates): -$34 million

> Effective tax rate: -38.9%

> Industry: Miscellaneous manufacturing

[in-text-ad]

48. Ecolab

> U.S. pre-tax income: $95 million

> Federal income tax (including rebates): -$50 million

> Effective tax rate: -52.6%

> Industry: Chemicals

48. Sanmina-SCI

> U.S. pre-tax income: $95 million

> Federal income tax (including rebates): -$1 million

> Effective tax rate: -1.0%

> Industry: Technology

47. Tutor Perini

> U.S. pre-tax income: $96 million

> Federal income tax (including rebates): -$36 million

> Effective tax rate: -37.7%

> Industry: Engineering and construction

[in-text-ad-2]

46. Seaboard

> U.S. pre-tax income: $136 million

> Federal income tax (including rebates): -$50 million

> Effective tax rate: -36.8%

> Industry: Food and beverages and tobacco

45. Xilinx

> U.S. pre-tax income: $140 million

> Federal income tax (including rebates): -$2 million

> Effective tax rate: -1.5%

> Industry: Technology

[in-text-ad]

44. Tyler Technologies

> U.S. pre-tax income: $176 million

> Federal income tax (including rebates): -$11 million

> Effective tax rate: -6.0%

> Industry: Technology

43. Ball

> U.S. pre-tax income: $193 million

> Federal income tax (including rebates): -$33 million

> Effective tax rate: -17.1%

> Industry: Miscellaneous manufacturing

42. Voya Financial

> U.S. pre-tax income: $195 million

> Federal income tax (including rebates): -$9 million

> Effective tax rate: -4.6%

> Industry: Financial

[in-text-ad-2]

41. Jacobs Engineering Group

> U.S. pre-tax income: $213 million

> Federal income tax (including rebates): -$37 million

> Effective tax rate: -17.4%

> Industry: Engineering and construction

40. Westlake Chemical

> U.S. pre-tax income: $227 million

> Federal income tax (including rebates): -$208 million

> Effective tax rate: -91.6%

> Industry: Chemicals

[in-text-ad]

39. Cabot Oil & Gas

> U.S. pre-tax income: $240 million

> Federal income tax (including rebates): -$32 million

> Effective tax rate: -13.2%

> Industry: Oil, gas and pipelines

38. Dexcom

> U.S. pre-tax income: $265 million

> Federal income tax (including rebates): $0

> Effective tax rate: 0.0%

> Industry: Pharmaceuticals and medical products

36. Textron

> U.S. pre-tax income: $278 million

> Federal income tax (including rebates): -$1 million

> Effective tax rate: -0.4%

> Industry: Aerospace and defense

[in-text-ad-2]

36. Williams

> U.S. pre-tax income: $278 million

> Federal income tax (including rebates): -$29 million

> Effective tax rate: -10.4%

> Industry: Oil, gas and pipelines

34. Interpublic Group

> U.S. pre-tax income: $284 million

> Federal income tax (including rebates): -$53 million

> Effective tax rate: -18.5%

> Industry: Miscellaneous services

[in-text-ad]

34. Telephone & Data Systems

> U.S. pre-tax income: $284 million

> Federal income tax (including rebates): -$175 million

> Effective tax rate: -61.6%

> Industry: Telecommunications

33. Michaels

> U.S. pre-tax income: $322 million

> Federal income tax (including rebates): -$11 million

> Effective tax rate: -3.5%

> Industry: Retail and wholesale trade

31. Community Health Systems

> U.S. pre-tax income: $323 million

> Federal income tax (including rebates): -$1 million

> Effective tax rate: -0.3%

> Industry: Health care

[in-text-ad-2]

31. Sealed Air

> U.S. pre-tax income: $323 million

> Federal income tax (including rebates): -$14 million

> Effective tax rate: -4.4%

> Industry: Miscellaneous manufacturing

30. Kansas City Southern

> U.S. pre-tax income: $327 million

> Federal income tax (including rebates): -$2 million

> Effective tax rate: -0.6%

> Industry: Transportation

[in-text-ad]

29. UGI

> U.S. pre-tax income: $420 million

> Federal income tax (including rebates): -$85 million

> Effective tax rate: -20.2%

> Industry: Utilities, gas and electric

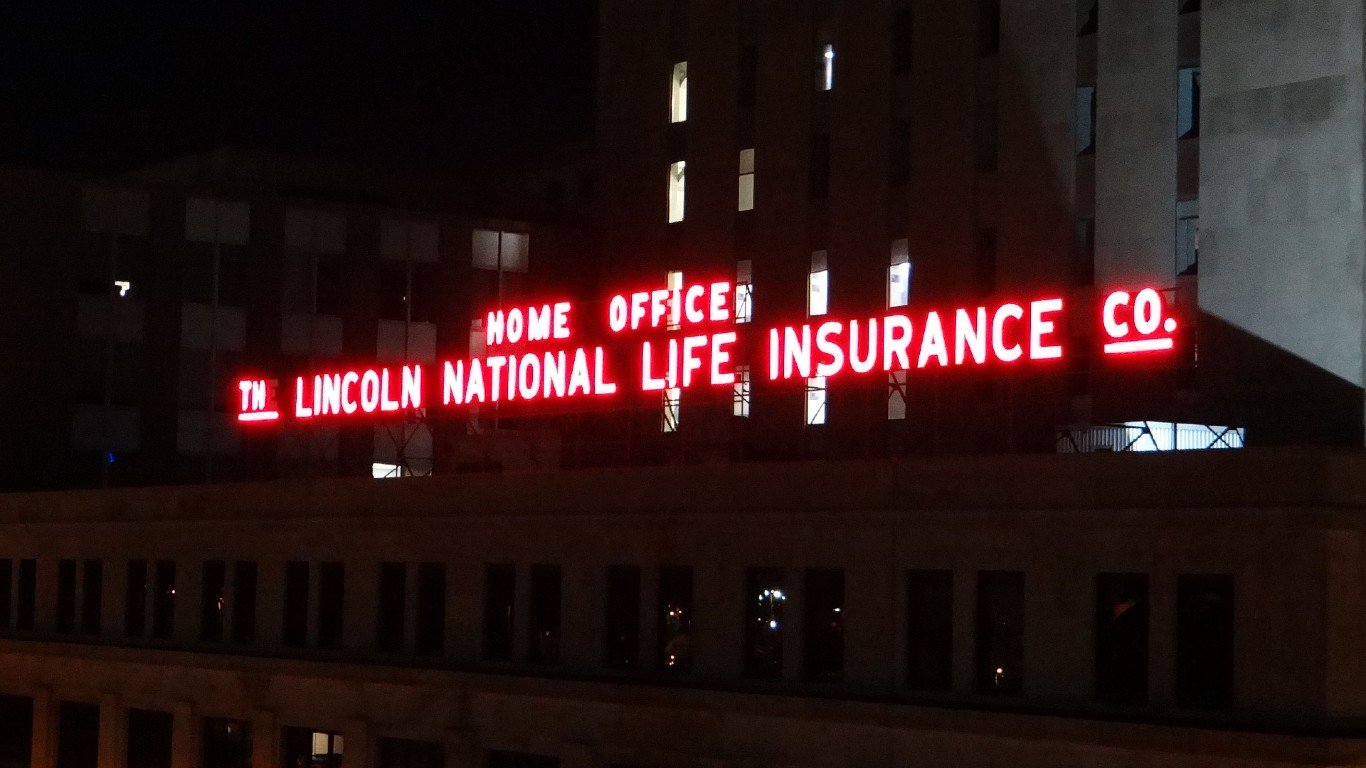

28. Lincoln National

> U.S. pre-tax income: $423 million

> Federal income tax (including rebates): -$61 million

> Effective tax rate: -14.4%

> Industry: Financial

27. Archer Daniels Midland

> U.S. pre-tax income: $438 million

> Federal income tax (including rebates): -$164 million

> Effective tax rate: -37.4%

> Industry: Food and beverages and tobacco

[in-text-ad-2]

26. Verisign

> U.S. pre-tax income: $447 million

> Federal income tax (including rebates): -$124 million

> Effective tax rate: -27.7%

> Industry: Technology

25. Penske Automotive Group

> U.S. pre-tax income: $505 million

> Federal income tax (including rebates): -$78 million

> Effective tax rate: -15.5%

> Industry: Motor vehicles and parts

[in-text-ad]

24. Booz Allen Hamilton Holding

> U.S. pre-tax income: $561 million

> Federal income tax (including rebates): -$3 million

> Effective tax rate: -0.5%

> Industry: Technology

23. Kinder Morgan

> U.S. pre-tax income: $654 million

> Federal income tax (including rebates): -$20 million

> Effective tax rate: -3.1%

> Industry: Oil, gas and pipelines

22. Qurate Retail Group

> U.S. pre-tax income: $687 million

> Federal income tax (including rebates): -$8 million

> Effective tax rate: -1.2%

> Industry: Internet services and retailing

[in-text-ad-2]

21. Evergy

> U.S. pre-tax income: $722 million

> Federal income tax (including rebates): -$27 million

> Effective tax rate: -3.7%

> Industry: Utilities, gas and electric

20. Duke Energy

> U.S. pre-tax income: $826 million

> Federal income tax (including rebates): -$281 million

> Effective tax rate: -34.0%

> Industry: Utilities, gas and electric

[in-text-ad]

19. HP

> U.S. pre-tax income: $861 million

> Federal income tax (including rebates): -$24 million

> Effective tax rate: -2.8%

> Industry: Technology

18. PPL

> U.S. pre-tax income: $878 million

> Federal income tax (including rebates): -$9 million

> Effective tax rate: -1.0%

> Industry: Utilities, gas and electric

17. CMS Energy

> U.S. pre-tax income: $885 million

> Federal income tax (including rebates): -$35 million

> Effective tax rate: -4.0%

> Industry: Utilities, gas and electric

[in-text-ad-2]

16. Hologic

> U.S. pre-tax income: $887 million

> Federal income tax (including rebates): -$62 million

> Effective tax rate: -7.0%

> Industry: Health care

15. Unum Group

> U.S. pre-tax income: $923 million

> Federal income tax (including rebates): -$98 million

> Effective tax rate: -10.7%

> Industry: Financial

[in-text-ad]

14. Fiserv

> U.S. pre-tax income: $1.1 billion

> Federal income tax (including rebates): -$25 million

> Effective tax rate: -2.3%

> Industry: Financial data services

13. FirstEnergy

> U.S. pre-tax income: $1.1 billion

> Federal income tax (including rebates): -$14 million

> Effective tax rate: -1.3%

> Industry: Utilities, gas and electric

12. Advanced Micro Devices

> U.S. pre-tax income: $1.2 billion

> Federal income tax (including rebates): $0

> Effective tax rate: 0.0%

> Industry: Technology

[in-text-ad-2]

11. FedEx

> U.S. pre-tax income: $1.2 billion

> Federal income tax (including rebates): -$230 million

> Effective tax rate: -18.9%

> Industry: Miscellaneous services

10. Nucor

> U.S. pre-tax income: $1.2 billion

> Federal income tax (including rebates): -$177 million

> Effective tax rate: -14.5%

> Industry: Metals and metal products

[in-text-ad]

9. Consolidated Edison

> U.S. pre-tax income: $1.2 billion

> Federal income tax (including rebates): -$2 million

> Effective tax rate: -0.2%

> Industry: Utilities, gas and electric

8. Xcel Energy

> U.S. pre-tax income: $1.5 billion

> Federal income tax (including rebates): -$13 million

> Effective tax rate: -0.9%

> Industry: Utilities, gas and electric

7. DTE Energy

> U.S. pre-tax income: $1.5 billion

> Federal income tax (including rebates): -$247 million

> Effective tax rate: -16.1%

> Industry: Utilities, gas and electric

[in-text-ad-2]

6. Danaher

> U.S. pre-tax income: $1.6 billion

> Federal income tax (including rebates): -$321 million

> Effective tax rate: -20.3%

> Industry: Miscellaneous manufacturing

5. American Electric Power

> U.S. pre-tax income: $2.2 billion

> Federal income tax (including rebates): -$138 million

> Effective tax rate: -6.4%

> Industry: Utilities, gas and electric

[in-text-ad]

4. Dish Network

> U.S. pre-tax income: $2.5 billion

> Federal income tax (including rebates): -$231 million

> Effective tax rate: -9.1%

> Industry: Telecommunications

3. Salesforce.com

> U.S. pre-tax income: $2.6 billion

> Federal income tax (including rebates): -$12 million

> Effective tax rate: -0.5%

> Industry: Technology

2. Nike

> U.S. pre-tax income: $2.9 billion

> Federal income tax (including rebates): -$109 million

> Effective tax rate: -3.8%

> Industry: Miscellaneous manufacturing

[in-text-ad-2]

1. Charter Communications

> U.S. pre-tax income: $3.7 billion

> Federal income tax (including rebates): -$7 million

> Effective tax rate: -0.2%

> Industry: Telecommunications

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.