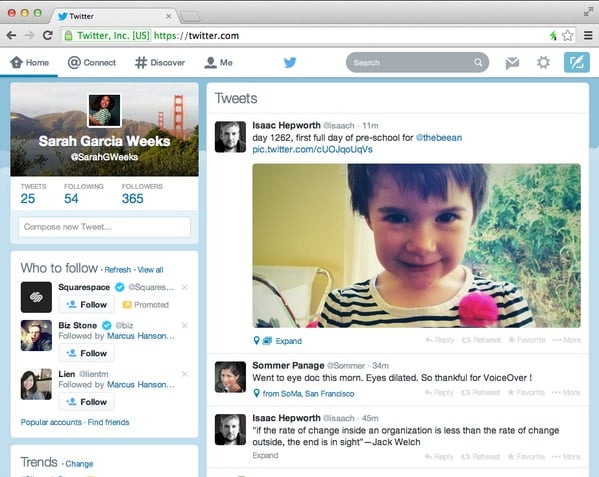

Twitter Inc. (NYSE: TWTR) will report its second-quarter earnings after the market closes on Tuesday. The social news and information network is expected to post a small loss at -$0.01 per share. We would caution readers that this will only mark the second full quarterly earnings period since it came public, although it is technically the third formal earnings report. Source: courtesy of Twitter

Source: courtesy of Twitter

While Thomson Reuters has an estimate of -$0.01 per share, the website WhisperNumber.com sent us a note that the so-called whisper number is for Twitter to report $0.00 per share. In short, that is a call for the hyper-social media player to break even. We also saw that the range of whisper numbers was -$0.07 to as high as $0.05 per share.

The Thomson Reuters estimate is for revenues of $283 million, versus a prior guidance of $270 million to $280 million. New advertising efforts are supposed to account for much of that growth. Still, new user growth will be closely watched, along with internal ad metrics, rather than just the raw revenue number.

Twitter’s growth rate is expected to slow in 2014 and in 2015, even if that growth remains more than impressive. Revenue in 2013 was $664.89 million, up almost 110% from the $316.93 million in 2012. Revenue growth is expected to be 90% to $1.27 billion this year, followed by revenue growth of another 62% to $2.06 billion in 2015.

User growth in monthly active users should be north of 5% to almost 270 million users. Still, it would likely have to be a total of less than 265 million to be considered a total dud and north of 275 million to be considered a home run.

Twitter still trades at more than 140 times expected 2015 earnings per share, and that is after having been cut in half from the post-IPO peak. Twitter also trades at almost 11 times expected 2015 revenues.

Twitter shares were north of $38.50 shortly ahead of earnings in midday trading on Tuesday, in a 52-week trading range of $29.51 to $74.73.

ALSO READ: 6 Analyst Stock Picks Under $10 With Massive Upside

We showed this before, but here are the user metrics reported by Twitter on its last earnings report in April:

- Average Monthly Active Users (MAUs) were 255 million as of March 31, 2014, an increase of 25% year-over-year.

- Mobile MAUs reached 198 million in the first quarter of 2014, an increase of 31% year-over-year, representing 78% of total MAUs.

- Timeline views reached 157 billion for the first quarter of 2014, an increase of 15% year-over-year.

- Advertising revenue per thousand timeline views reached $1.44 in the first quarter of 2014, an increase of 96% year-over-year.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.