Amazon.com Inc. (NASDAQ: AMZN) proved that something was rotten in its most recent earnings report. The quest of Jeff Bezos to dominate anything and everything online is just coming with too big of a price. Our first take on the Amazon earnings is that Bezos wants his stock market supported $140 billion market cap to be run like a nonprofit. The reality is that Amazon’s current path is just not going to be supported. Source: Thinkstock

Source: Thinkstock

24/7 Wall St. recently named Amazon on our list of companies that destroyed long-term prospects for investors. In fact, it was the first one!

If you do not trust our view on this, what about Greenlight Capital’s David Einhorn? This well-known hedge fund manager has just talked up (well, down) the “bubble basket” list of short sale stocks. Amazon is on the list.

Einhorn keyed on the notion that the Bezos path was one in which the company grew so fast that profits were in the backseat, but now growth is slowing and the result is even larger losses. In his take on Amazon, Einhorn signaled that this growing too fast to be profitable narrative will ultimately prove false.

ALSO READ: Analysts Stepping Over Themselves for Alibaba Price Target Hikes

24/7 Wall St. has covered the Amazon drop handily, and we were critical of the company’s endless unprofitable growth when shares were rising from $300 to $400. Amazon shares were down about 8% to $287 after posting a loss and after Bezos gave fourth-quarter guidance for a loss of $570 million to earnings of $430 million, as well as $27.3 billion to $30.3 billion in revenue — versus consensus estimates of $0.67 in earnings per share and $30.89 billion in revenue.

Other key issues we have:

- Amazon had negative margins, so every net dollar of sales now generates losses.

- Amazon is now about 20 years old and has been public since the 1990s — you cannot run it as a nonprofit this far into the game.

- Being valued at “more than 150-times next year’s earnings” cannot go on forever.

- Bezos is taking on too many aspects of the Walmarting of America, minus the profits.

- Amazon is getting into a potential black hole of spending money on its own content, where raw profits through time could easily be elusive.

- A new class of investors will demand more regarding profits and shareholder accountability.

- Analysts simply did not brace themselves, only lowering price targets while maintaining Buy and Outperform ratings. If this continues, they will do worse than just lower their price targets.

Having David Einhorn against you is not necessarily the end of the world. After all, he and his team make mistakes too. Still, the additional realization here is that Amazon being down more than $100 from the peak just isn’t cheap enough. If Bezos keeps his current plans in place, shares of Amazon might be down another $100 — and that still will not look cheap on any forward earnings basis.

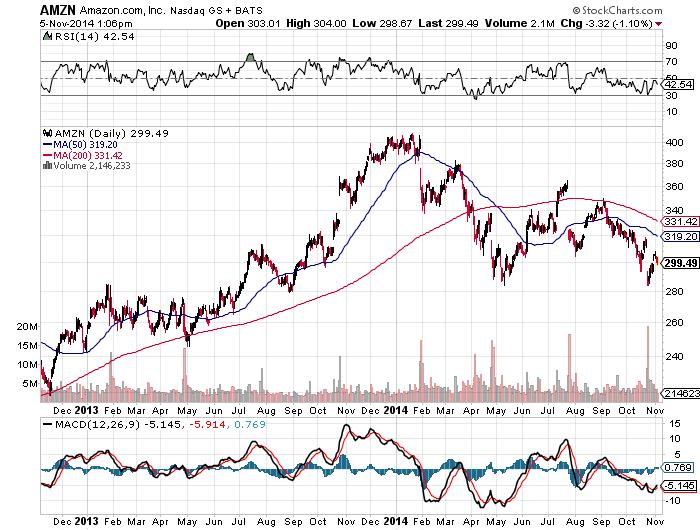

Amazon shares were down 1.1% at $299.30 in mid-Wednesday trading. Its 52-week trading range is $284.00 to $408.06, and the market cap is now $138.5 billion. Analysts have a consensus price target of $353.61 as of Wednesday. Can you guess what we think of that valuation? A two-year stock chart from StockCharts.com has been provided below.

ALSO READ: 8 Companies That Seriously Damaged Their Long-Term Prospects

Regardless of what lies ahead, it is not hard to argue that valuations have matured in this now five-and-a-half-year-old bull market. Investors will ask themselves if a company, even under the great Jeff Bezos, should be worth well over $100 billion if it is going to keep losing money or make the same amount of profits as a small-cap or mid-cap value stock.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.