When 3D Systems Corp. (NYSE: DDD) reported its third-quarter financial results before the markets opened on Thursday, it posted $0.14 in earnings per share (EPS) and $156.4 million in revenue. Thomson Reuters consensus estimates had called for $0.09 in EPS and revenue of $160.16 million. In the same period of last year, the company posted EPS of $0.01 and $151.57 million in revenue.

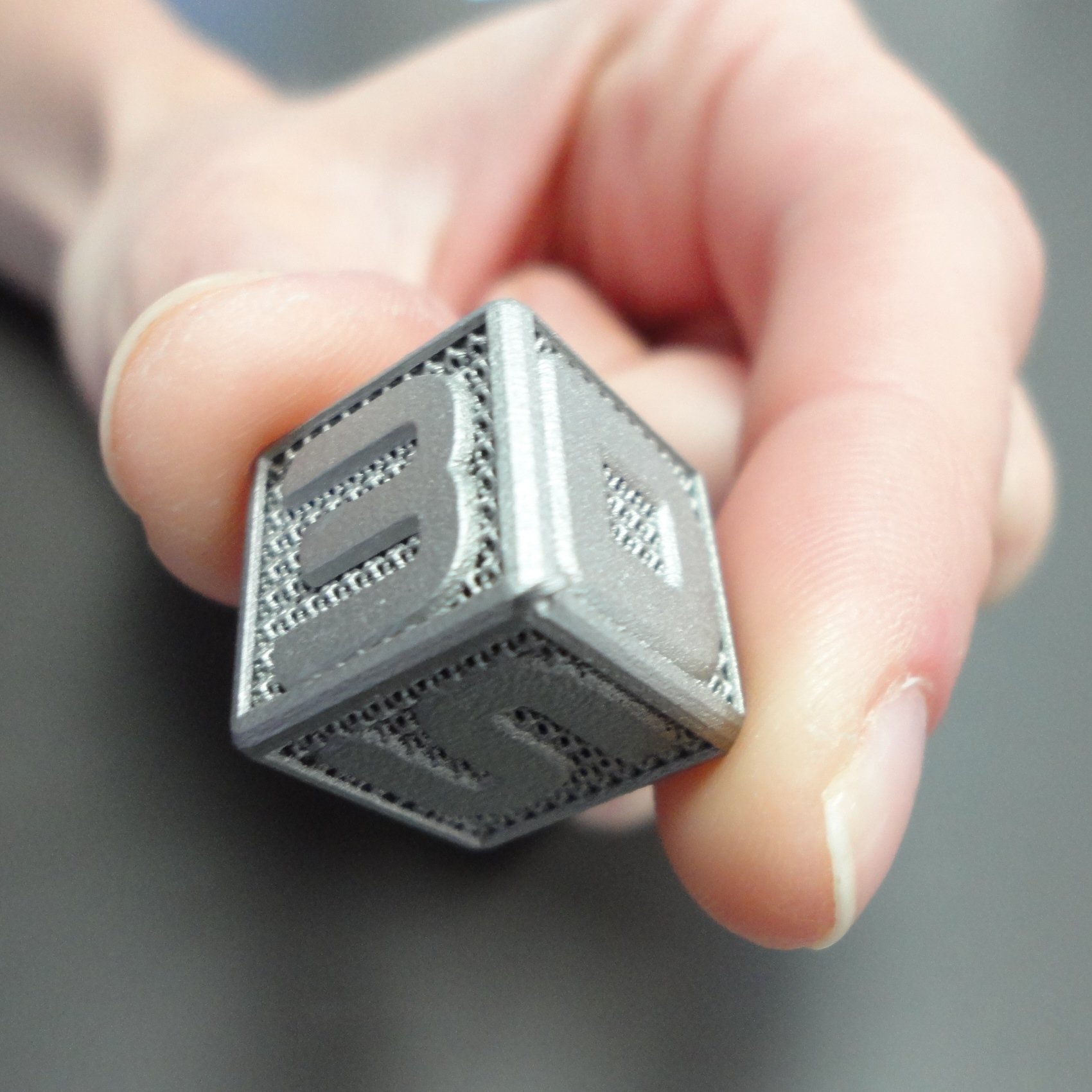

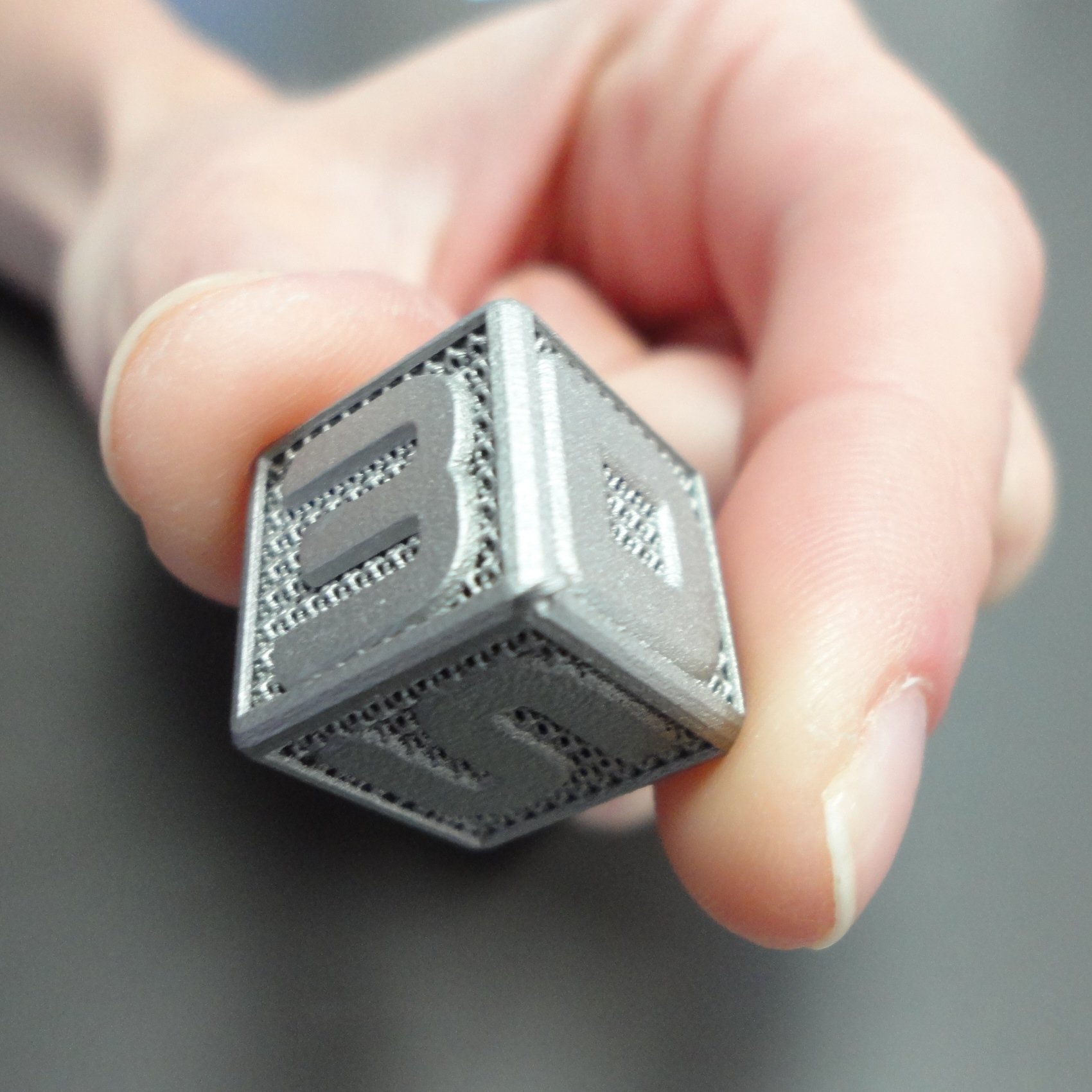

Higher sales of 3D printers and materials into production applications, as well as strong demand for the company’s software and health care solutions, resulted in a 3% increase in revenue compared to the third quarter of 2015.

Gross profit margin for the third quarter of 2016 was 44.1%. Gross profit margin was negatively affected by non-recurring charges of $10.7 million related to prioritizing products and resources, consistent with the company’s recently announced strategy. Excluding these charges, gross profit margin was 51.0%.

The company generated $7.2 million of cash from operations during the quarter. On the books, 3D Systems cash and cash equivalents totaled $179.36 million at the end of the quarter, up from $155.64 million at the end of 2015.

CEO Vyomesh Joshi commented:

We believe strong demand for our production printers, materials and software as well as healthcare solutions during the quarter is indicative of our growth potential and market opportunities.

John McMullen, executive vice president and chief financial officer, added:

Our focus is to drive operational excellence and build an appropriate cost structure, which will provide capacity to invest into quality, reliability and innovation. We believe this will position us to drive profitable growth and continued positive cash generation.

Shares of 3D closed Wednesday down 3% at $13.07, with a consensus analyst price target of $14.88 and a 52-week trading range of $6.00 to $19.76. Following the release of the earnings report, the stock was up 2% at $13.34 in early trading indications Thursday.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.