Technology

Top Wall Street Semiconductor Analyst Says Stay With 2 Hot Sector Leaders

Published:

Last Updated:

Typically many Wall Street analysts are the kings and queens of after-the-fact calls. Often, but not always, they continue to pound the table on a company, even when the fundamentals are weakening. Then when the company misses numbers, lowers guidance or both, these analysts often cut the rating and lower the price target.

One analyst that we have followed for years is the semiconductor analyst at Jefferies, Mark Lipacis, and with good reason. He was among the first on the bus for two stocks that have exploded over the years for investors, and he has maintained his Buy rating on both.

In two new reports, Lipacis updates investors on stocks that still have room to run, and they may even be more solid ideas from a thesis standpoint now than in the past.

This top company has clearly turned the corner, and it had some solid news this week. Advanced Micro Devices Inc. (NYSE: AMD) is one of the largest suppliers of PC microprocessors and graphics processors worldwide to computing original equipment manufacturers. The company’s main product lines include desktop, notebook and graphics processors, and embedded/semi-custom chips.

Last year the company released its first major offering in five years, the Ryzen chipset, which many feel is uniquely positioned to compete with the big players like Intel and Nvidia in the $50 billion total addressable market for personal computers, gaming, artificial intelligence and servers.

While last quarter’s earnings were somewhat disappointing, new catalysts could drive the shares, with AMD having a generational share gain opportunity. EPYC 2/Rome can leverage the software and qualification work started with EPYC 1, and most expect Rome to ramp in the second half of 2019. The new Vega GPU will be industry’s first at seven nanometers, and AMD is already annualizing $100 million or so in data center GPU sales, addressing a $10 billion potential opportunity.

The new Google partnership was a shot in the arm for the stock, and Jefferies report noted this:

Shares rose on the back of Google’s announcement concerning Stadia at GDC. While the AMD CEO had noted that Google’s cloud gaming platform was using AMD Radeon GPUs, the announcement confirmed it and the close partnership suggests that Google may ultimately announce that it will use EPYC 2 server MPUs. We note that a server announcement would be more important Near-term than the GPU announcement. Our AMD earnings-per-share estimates for 2019 and 2020 are ahead of consensus.

Jefferies reiterates its Buy rating and the price target is set at $30. That compares with a lower Wall Street consensus target of $24.52. The shares closed Wednesday’s trading at $25.70.

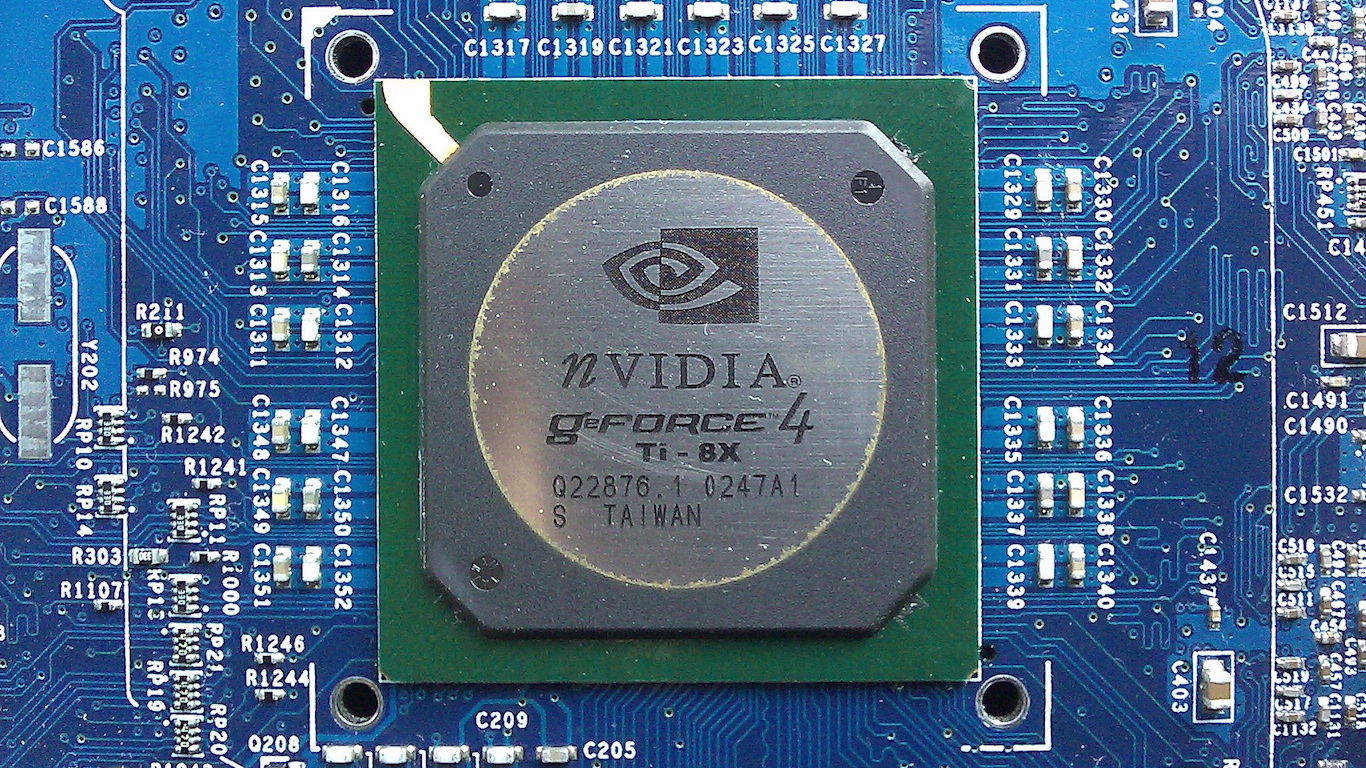

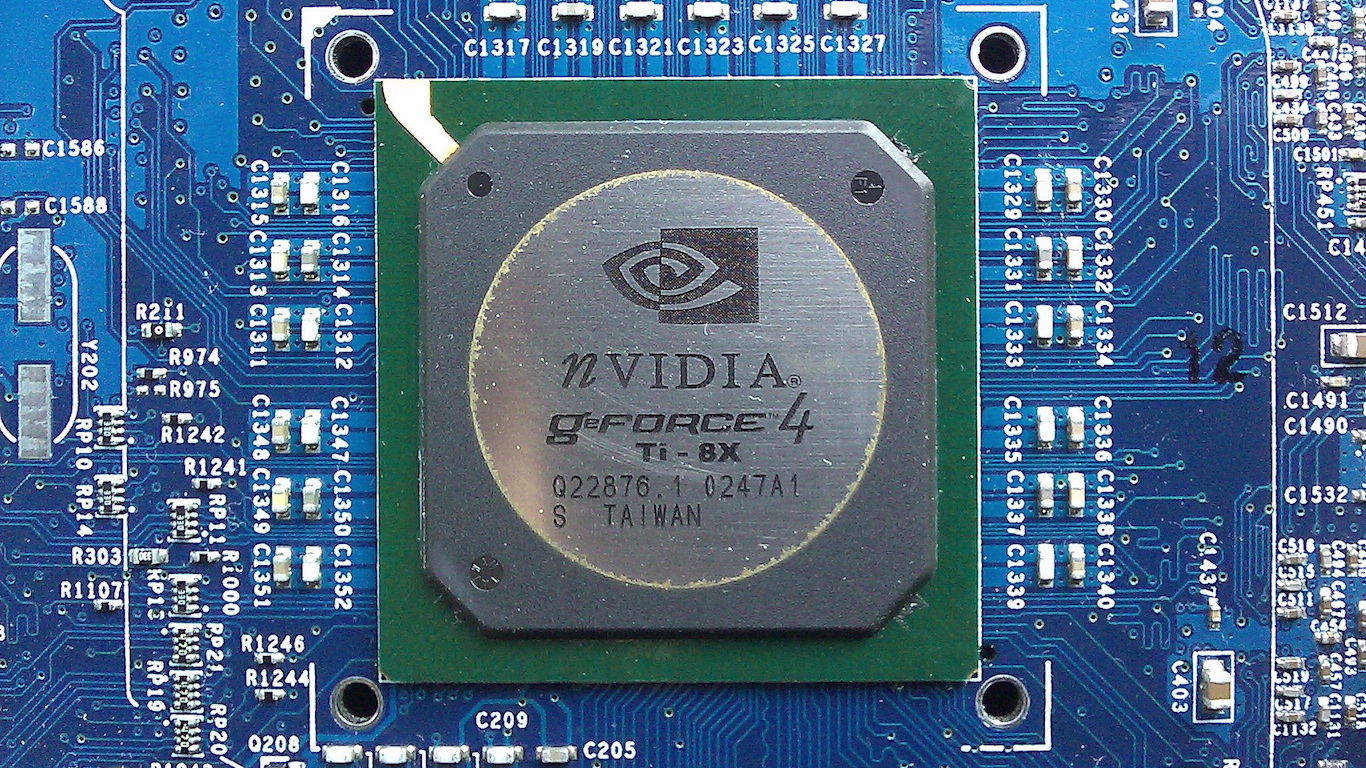

It only takes one deal to get a sector to heat back up, and Nvidia Corp. (NASDAQ: NVDA) which rarely has grown through acquisitions, buying Mellanox and paying $6.9 billion in cash lit the fire. In what actually was somewhat of a duel, Nvidia knocked out Intel in its bid to buy the chipmaker, and the deal will help Nvidia boost its business of making data center chips that help power cloud computing.

Mellanox’s BlueField intelligent network adapters are another version of data center co-processing acceleration. Top Wall Street analysts see the combination of Nvidia and Mellanox as a definite threat to Intel’s data center CPU dominance of workloads. This indirect competition could ultimately be a problem for Intel shareholders.

Lipacis was on the Nvidia rocket ship years before others and was one of the few that didn’t run and hide from shares when the company posted disappointing numbers. He continues to stand behind the company, even though he did remove it from the firm’s Franchise List a week before the earnings implosion. Jefferies said this in the new report:

We attended the NVIDIA analyst day and came away with higher conviction that the company is positioning itself to become the defacto standard as computing continues toward a parallel model. The company continues to see a $50 billion total addressable market for the data center by 2023, with automotive adding another $30 billion TAM by 2025. In the nearer term, the company highlighted 3 potential levers for upside in gaming, including: competitive gaming, MaxQ gaming notebooks and PC gaming in the cloud through GeForce Now. Our earnings per share estimates remain ahead (of consensus).

The $185 Jefferies price target compares with the consensus target of $186.38. The shares closed most recently at $174.40 apiece.

Again, in the wishy-washy world of stock analysts and analysis, we continue to remain impressed with the solid work and the semiconductor thesis path from Jefferies. While these stocks are only suitable for more aggressive account with a high risk tolerance, at least you can count on dependable coverage from Jefferies.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.