Transportation

Richard Branson Strikes Again: Virgin America Files for IPO

Published:

Last Updated:

Richard Branson is coming to America yet again. Branson’s Virgin Group Ltd. has filed its paperwork with the U.S. Securities and Exchange Commission (SEC) for its Virgin America Inc. to come public via an initial public offering (IPO). This filing has been expected for months. Source: SEC Filing

Source: SEC Filing

No formal terms were given in the first filing, but the amount presented was up to $115 million in common stock. No stock ticker has been proposed, and the filing does not say whether the IPO will come on the Nasdaq or the New York Stock Exchange.

The only two underwriters named in the preliminary paperwork were Barclays and Deutsche Bank Securities.

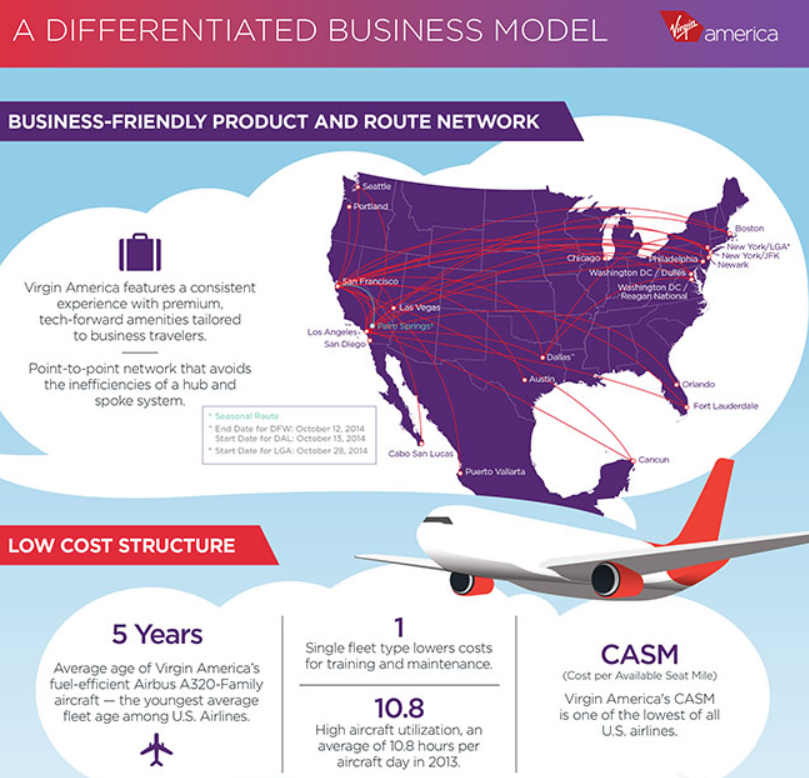

It turns out that the airline is now running at profitability. It also claims to have one of the lowest costs per available seat mile of all major carriers as well, and its fleet is uniform with an average fleet age of only five years. As of March 31, 2014, Virgin America provided service to 22 airports in the United States and Mexico with a fleet of 53 narrow-body aircraft.

For 2013, Virgin recorded operating revenues of $1.4 billion, operating income of $80.9 million and net income of $10.1 million. The carrier increased its revenue per average seat mile by 9.3% in 2013 compared to 2012, which the carrier shows as being the largest increase of any major U.S. airline. Its cost per average seat mile of 10.98 cents was up 0.7%.

ALSO READ: IPO Week Ahead: GE Spins Out Synchrony in a Whirl of 22 IPOs

Virgin also completed a recapitalization of a majority of its operating lease and debt obligations in May 2013. This led to a $34.7 million decline in aircraft rent expense and a $44.8 million decline in interest expense for 2013 versus 2012.

In 2014, Virgin had a net loss of $22.4 million in the first quarter during its seasonally weakest quarter. This compares to a net loss of $46.4 million in the first quarter of 2013. Its revenue per available seat mile in the first quarter of 2014 increased by 0.9% from the prior year period, but its cost per available seat mile in the first quarter of 2014 increased by only 0.2%.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.