Analog Devices Inc

NASDAQ: ADI

$196.50

Closing price April 24, 2024

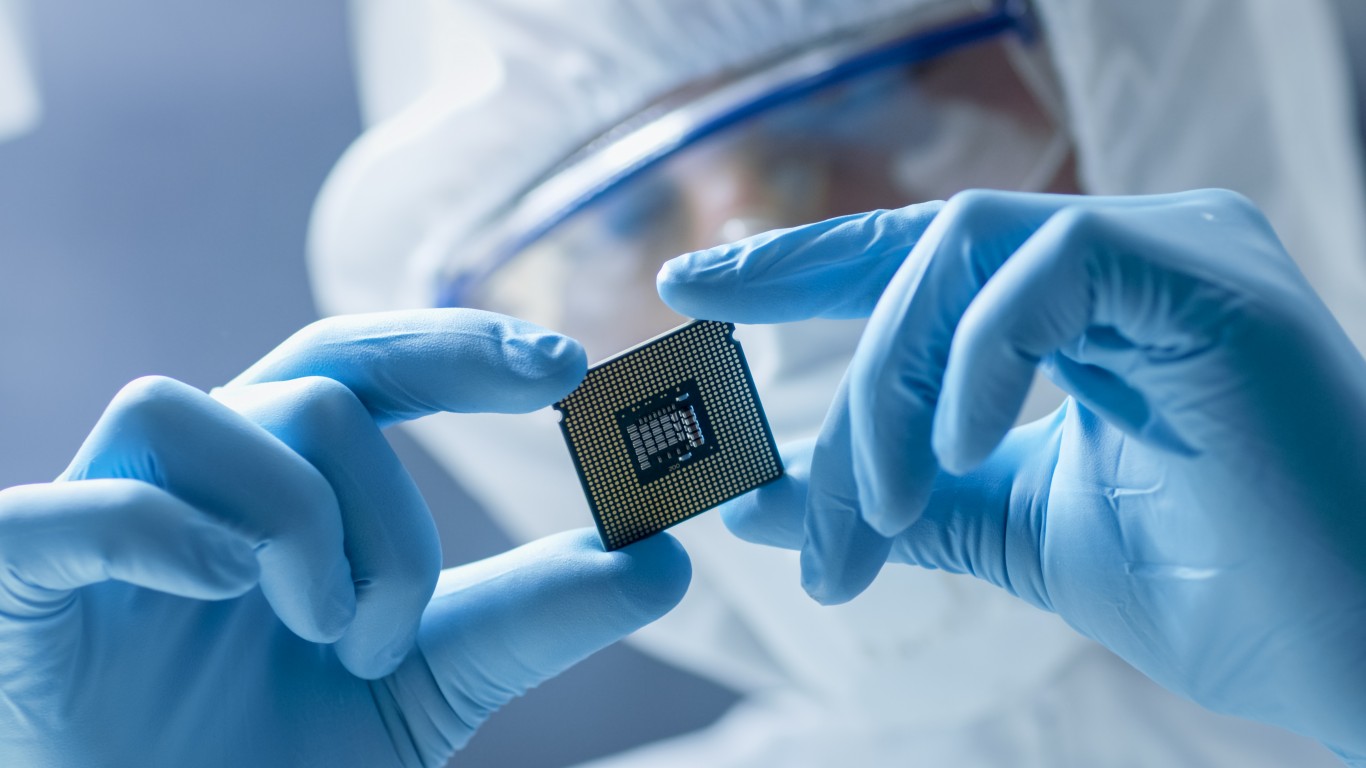

The good news for aggressive growth investors eyeing the semiconductor industry is the sideways trading since February could be ready to break out to the upside. Buying these four solid stocks could...

Published:

Thursday's top analyst upgrades and downgrades included Advanced Micro Devices, Analog Devices, Chipotle Mexican Grill, Coinbase Global, Intel, SolarEdge Technologies, Stamps.com and ViacomCBS.

Published:

Semiconductor shortages are causing some severe problems across many industries. Given the increased demand, buying any of these four chip stocks could be a great short-term and long-term strategy...

Published:

The five stocks that the top hedge funds are shorting the most are some of the top companies in their respective sectors. They look like great ideas for aggressive growth traders, especially if they...

Published:

Goldman Sachs raised the price targets on four stocks of top tech companies that delivered the goods in a big way during earnings season and look to still have some very solid upside potential. They...

Published:

One of Wall Street's top economists sees the potential for the United States economy to experience the best growth in 40 years. These five cyclical stocks offer solid value and big upside potential,...

Published:

Despite a sluggish growth rate over the past three years, BofA Securities is very positive on semiconductors for 2021. They feel the path is well paved for these five large-cap market leaders.

Published:

These five top semiconductor companies all have a long history of success and innovation. Most importantly, their stocks still offer a reasonable upside to the Goldman Sachs 2021 price targets.

Published:

A new Jefferies research report suggests the firm's forecasts for the semiconductor industry for the first half of 2021 could end up proving to be very conservative. Here are five picks for investors...

Published:

One solid way to increase the chances for investment success with stocks is to combine solid fundamental research with outstanding technical patterns. These four stocks should whet the appetite of...

Published:

Wednesday's top analyst upgrades and downgrades included Analog Devices, Apple, Best Buy, Dell Technologies, Dollar Tree, Ford, General Electric, General Motors, HP, Medtronic and Zscaler.

Published:

The demand for semiconductors in almost every segment is keeping sequential growth rising year after year. These five stocks are great ideas for aggressive growth investors looking to have or add to...

Published:

Monday's top analyst upgrades and downgrades included Albermarle, Biogen, Fisker, General Motors, Livent, Marriott International, Uber Technologies and Yelp.

Published:

Last Updated:

After a torrid rise in 2019, investor enthusiasm for semiconductor stocks has cooled somewhat. Still, most chip stocks continue to add to their share prices even if the gains are more moderate. Is...

Published:

Tuesday's top analyst upgrades and downgrades included Automatic Data Processing, GrowGeneration, Hilton Worldwide, Lululemon Athletica, Lyft, Netflix, Spotify, Tesla, Twitter, Visa and Wayfair.

Published: