iShares Silver Trust

NYSE ARCA: SLV

$24.99

Closing price April 23, 2024

The price of silver has pushed above $30 an ounce shortly after Monday's opening bell. Is this the result of another burst of enthusiasm from small investors?

Published:

Bitcoin is within a few percent of closing at an all-time high. Will it make it? If it does, will the high last longer than a week?

Published:

There is still much economic uncertainty facing the economy and the stock market. This uncertainty also pertains to bonds, as well as the recent trading in gold and silver. The tech-heavy NASDAQ had...

Published:

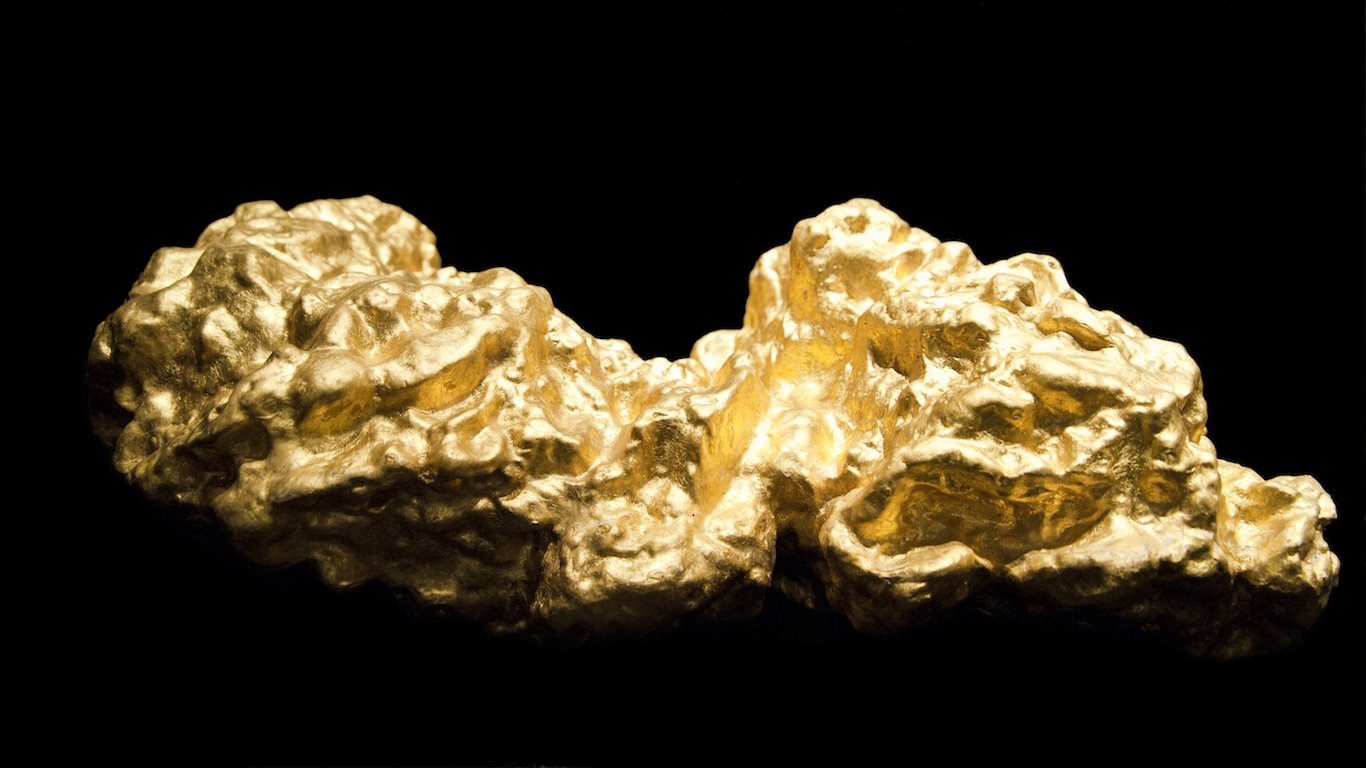

There are many reasons to believe that gold and silver can go much higher, but there also are many reasons to believe that this is yet another bubble in the works.

Published:

Companies that benefit from the moves in gold are generally the miners, but in reality, every company has its own nuances about how its role plays into gold and silver.

Published:

While many investors are hyper-focused on gold, the issue that may be overlooked by much of the investing public is what happens to the price of silver in the coming weeks.

Published:

Silver is supposed to track gold to a certain extent, but in 2020 that just is not the case. Silver is proving to live up to its nickname the "Devil's Metal."

Published:

Last Updated:

Silver is supposed to be correlated to gold, so it should be rising by close to the same amount. Yet, there has been a disparity in the metals market.

Published:

If tariffs and an ongoing trade war with China were not enough, now gold bugs get to cheer in silence at a 5% tariff implemented on goods coming from Mexico as an economic tool to fight illegal...

Published:

With the overhang and larger media frenzy around bitcoin and cryptocurrencies having witnessed a death of a thousand cuts, the interest in gold has been coming back with a rising price.

Published:

Last Updated:

Gold has had a rough 2018. Despite some of the international trade worries and international suspense, the reality is that most investors are just not looking for the "ultimate safety trade."

Published:

Last Updated:

Here is a look at what 2015 may have in store for top gold and silver miners. Will the bleeding continue at its current pace or will it slow down next year?

Published:

Last Updated:

The prices of gold and silver have cratered from their highs. So, why is the U.S. Mint saying that 2014 has been a record breaker for sales of American Eagle silver bullion coins?

Published:

Gold prices have lost nearly 3% Friday morning following the surprise announcement of an increase in the Bank of Japan's planned asset purchases.

Published:

Last Updated:

As gold prices have fallen, many investors have begun to actively seek alternatives from among the many possible choices available today. These are five unusual alternatives investments to gold.

Published: