Thermo Fisher Scientific Inc

NYSE: TMO

$565.23

Closing price April 12, 2024

For health care investors, 2020 looks like a potentially good year after an especially fruitful JPMorgan Healthcare Conference this past week.

Published:

The top analyst upgrades, downgrades and initiations seen on Tuesday included AFL, Agilent, Allergan, Barrick Gold, Cognex, Hilton, Lloyds, MetLife, Slack and Wingstop.

Published:

Health care stocks still have plenty of upside in them. Agilent, Danaher, Thermo Fisher are all stocks to buy.

Published:

The Merrill Lynch team noted that these four stocks had bullish technicals that were most aligned with bullish fundamentals.

Published:

Last Updated:

Here are five top health care stocks that provide investors with different avenues to invest in the sector. They all should be solid additions to growth portfolios for 2019.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Thursday included AT&T, Boeing, Hilton, KB Home, Microsoft, Norfolk Southern, Pandora and UPS.

Published:

Last Updated:

Here are the 15 companies that appear most likely to enter or get back into the $100 billion market capitalization club among U.S. stocks.

Published:

Last Updated:

Managers of the UBS Q-GARP portfolio continue searching for high-quality U.S. growth companies that are trading at attractive valuations. They maintain that recent volatility in the market has had no...

Published:

Last Updated:

According to a recent analyst report by Janney, the National Institute of Health budget that was approved last Friday could be a big boost for some select biopharma stocks.

Published:

Last Updated:

According to Merrill Lynch, the health care sector should act as a good hedge against volatility. Even biotech was shown to offer growth at a reasonable price.

Published:

Last Updated:

The include BioCryst Pharmaceuticals, Exxon Mobil, Fiat Chrysler Automobiles, Hewlett Packard Enterprise, IAMGOLD, Mallinckrodt and Rockwell Collins.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Tuesday include Alibaba, Best Buy, Deere, Jinko Solar, Motorola Solutions, Mylan, Redfin and VMware.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Friday include Autodesk, IBM, Lumber Liquidators, NVIDIA, Salesforce.com, Symantec, T-Mobile and Wal-Mart.

Published:

Last Updated:

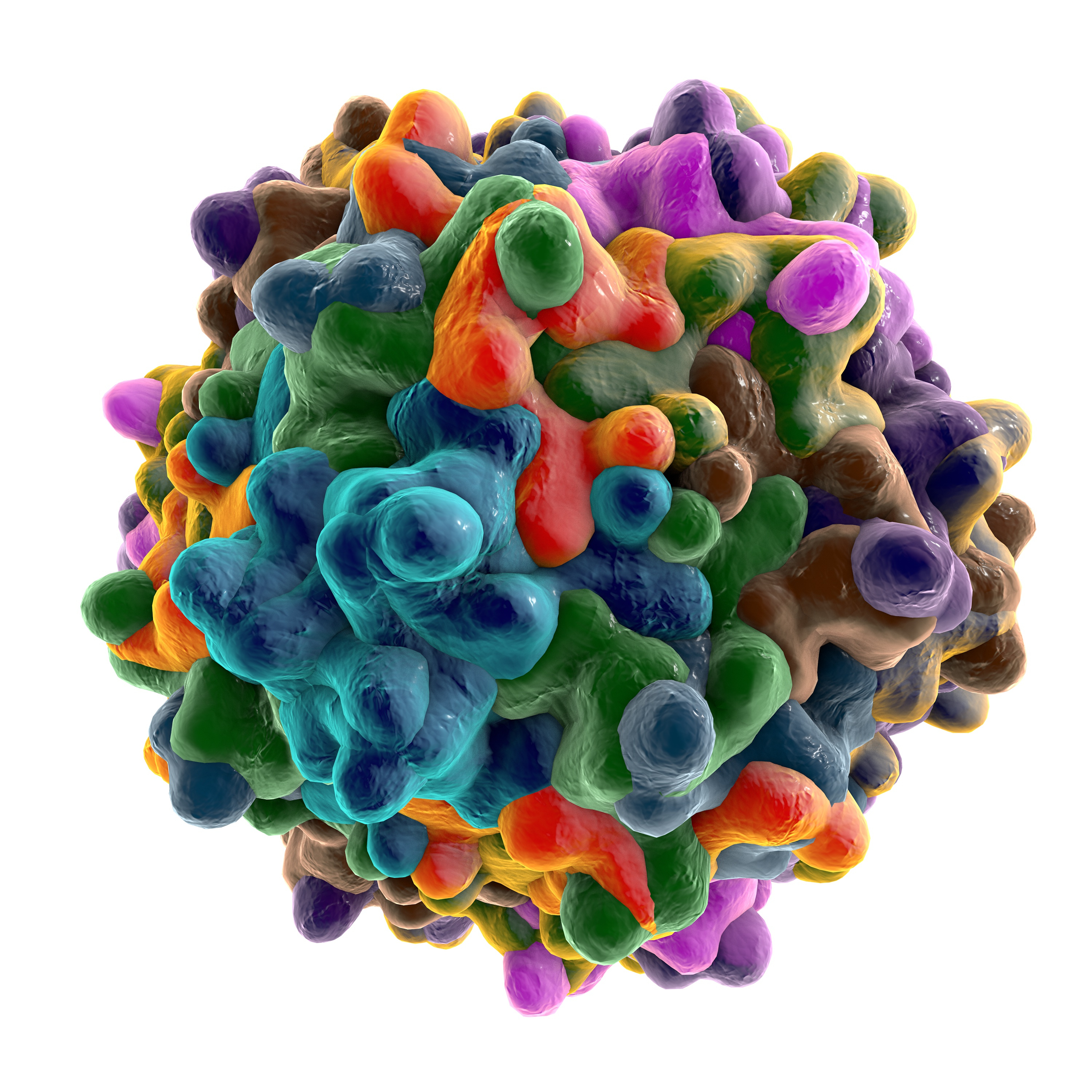

Pantheon shares saw a huge gain on Monday following the announcement that the company will be acquired by Thermo Fisher Scientific.

Published:

Last Updated:

Thermo Fisher Scientific said Friday morning that it has agreed to acquire FEI for approximately $4.2 billion in cash.

Published:

Last Updated: