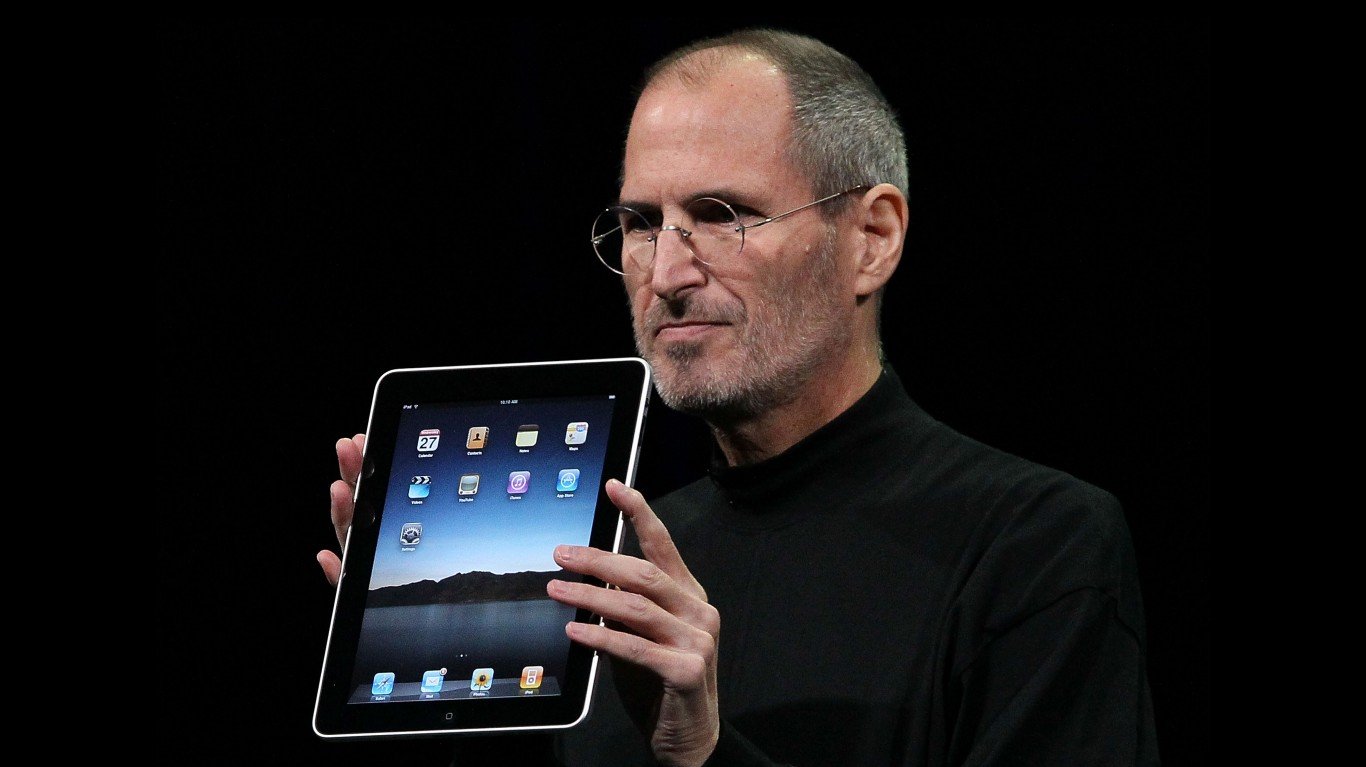

Shares of Intel Corp. (NASDAQ: INTC) hit a new 52-week low this morning after the stock was downgraded yet again and the target price was lowered. The overall weakness in the market for desktop PCs has hit the shares hard this year, as the market for smartphones and tablets continues to grow.

Shares of Intel Corp. (NASDAQ: INTC) hit a new 52-week low this morning after the stock was downgraded yet again and the target price was lowered. The overall weakness in the market for desktop PCs has hit the shares hard this year, as the market for smartphones and tablets continues to grow.

One issue is gross margins, which one analyst expects to drop both this year and next. Another is a belief that whatever bounce Intel might see from the introduction of the new Windows 8 operating system from Microsoft Corp. (NASDAQ: MSFT) has already been factored in.

The big factor, though, appears to be inventory levels. As inventory piles up the company will have to lower production, which will raise unit costs and cause margins to erode. We noted last week that shipments of Intel-based Ultrabooks are running at about half the originally forecast rate due to the high sticker price for the machines and the hold that tablets have on consumers’ imagination.

If there’s any good news it’s that any unexpected growth in PC sales will be incremental, and should have a positive effect on the stock price.

Intel’s shares are trading down about 2.7% at $21.92 just before noon today after posting a new 52-week low of $21.86 earlier this morning. The previous 52-week range was $22.27 to $29.27.

Paul Ausick

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.