Source: Thinkstock

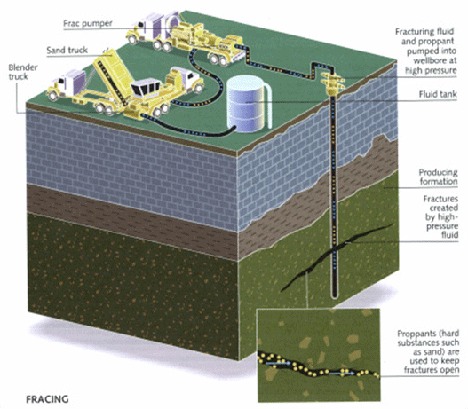

Virtually all the increase in U.S. crude oil production is due to hydraulic fracturing, aka fracking. And fracking requires enormous volumes of water. In many parts of the U.S., producers buy that water from rights holders who no longer want to sell it. In the Midwest, water rights are often held by farmers who have been willing to sell millions of barrels of water at prices as low as $0.35 a barrel. According to a CNNMoney, the same farmers are now refusing to accept as much as $0.75 a barrel.

At some point, production will decline either due to the high cost of water or the inability of the producers to obtain water at any cost. The lower flow of natural gas will continue to push up the price. The same thing could happen with the natural gas liquids and crude oil that is now produced by fracking, but the impact on consumers likely will be smaller and later than the impact from natural gas prices.

All those air conditioners need electricity, and the continuing hot weather presages a continuing high demand for natural gas, which now generates more than 30% of U.S. electricity. But natural gas in storage remains well-above the historical five-year average, which means that unless more production goes off-line, recent price hikes may be wishful thinking.

The United States Natural Gas Fund (NYSEMKT: UNG) closed yesterday at $21.91 in a 52-week range of $14.25 to $42.24.

Paul Ausick

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.