Energy

Federal Royalties on Energy Resources Remain at 1951 Levels

Published:

Last Updated:

When an oil company wants to drill on federal land, it does so by participating in an auction for lease rights to land that the Bureau of Land Management (BLM) has put up for lease. The BLM’s base bid is $2 an acre, but potential bidders win the rights by making the highest “bonus” bid, typically well above the base bid. Winners typically pay annual leases of $1.50 per acre for five years and $2 per acre for the remaining term of the lease. Once production begins, the royalty rate paid to the federal government is at least 12.5% of the value of the production.

Royalty rates for onshore production of oil, gas and coal have not changed since the 1920s. For offshore oil and gas production, primarily in the Gulf of Mexico, rates run 12.5% for water depths less than 200 feet and 18.75% for depths greater than 200 feet.

[in-text-ad]

The lease and royalty rates for onshore production have not been changed since 1951 in some cases and since 1960 in others. The lease rates have not even been adjusted to account for inflation, according to a new report from the Government Accountability Office (GAO), published Tuesday, comprising testimony from GAO director for natural resources and environment Frank Rusco before the U.S. House Subcommittee on Energy and Mineral Resources.

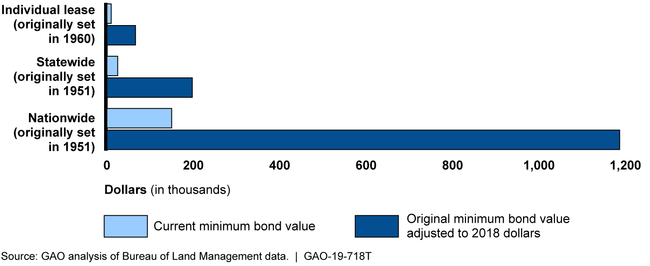

The GAO’s Rusco also testified that required oil and gas bonds don’t provide enough financial assurance that the company has set aside sufficient funds to pay reclamation costs. As with the leasing prices, bonding amounts have not changed or been adjusted for inflation since they were imposed.

The following chart from the GAO’s report shows the minimum bond values for both when the values were first set and their inflation-adjusted value in 2018 dollars.

Source: U.S. Government Accountability Office

Source: U.S. Government Accountability Office

GAO also commented on emissions from natural gas production. The agency noted that in a 2010 report it found that the federal government was losing $23 million a year related to the industry’s practice of venting unwanted methane and flaring (burning) unwanted carbon dioxide. The GAO’s testimony also commented on the impact of venting and flaring on the environment:

Natural gas consists primarily of methane, and methane … is 34 times more potent by weight than carbon dioxide … in its ability to warm the atmosphere over a 100-year period, and 86 times more potent over a 20-year period, according to the Intergovernmental Panel on Climate Change.

In his testimony, Rusco noted that a GAO study in 2017 concluded that raising oil and gas royalty rates to 16.67%, 18.75% or 22.50% would increase federal revenue by $5 million to $38 million annually. Raising the royalty rate on coal to 17% or 29% could increase federal royalty collections by up to $365 million annually after 2025.

The GAO also has noted that several states charge higher royalty rates for production on state-owned lands. Texas, for example, charges a minimum lease rate of $10 an acre and a minimum bonus bid requirement of $10 an acre. The royalty rate in Texas is 25%.

Regarding reclamation bonding, the GAO commented that in 2017, eight states held coal self-bonds worth more than $1.1 billion. Self-bonds allow “states to let an operator guarantee the cost for reclaiming a mine on the basis of its own finances … rather than by securing a bond through another company or providing collateral, such as cash, letters of credit, or real property.” If a self-bonded operator files for bankruptcy and the state regulator can’t collect the reclamation bond, taxpayers could have to pick up the cost.

The average balance held by the BLM for oil and gas wells in 2018 was $2,122, according to a GAO report published earlier this month. These bonds do not provide sufficient funds to prevent operators from failing to pay full reclamation costs in the event the wells are “orphaned,” that is abandoned and not reclaimed by their operators. Of 89 new orphaned wells identified between July 2017 and April 2018, potential reclamation costs were estimated at $46 million. The BLM would be stuck paying the difference between available bonding funds of $188,858 and $46 million to complete reclamation of the well site.

Over the past decade, the GAO also has recommended that natural gas flaring and venting be more carefully monitored and that operators be made to pay royalties on flared and vented gas. The added annual payments total of $23 million annually is not hugely significant, but the environmental damage caused by venting methane and flaring natural gas could and should be avoided. In November of 2016, the Obama administration’s Interior Department, following the GAO’s recommendations, issued regulations to reduce these emissions. In June of 2017, the Interior Department postponed the implementation of those rules, and in September of last year issued revised regulations “that are not consistent with the findings and recommendations in [GAO’s] prior work.”

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.