It is no secret that investors love dividends and stock buybacks. In recent years, there has been a larger shift into companies buying back shares of common stock, even while they have grown their dividends. Standard & Poor’s has now shown that the first quarter of 2016 saw a 12% rise in buyback spending to a whopping $161.4 billion.

If this sounds impressive, note that it is actually the second largest buyback spending for a quarter on record. For the 12 months ending March 31, S&P said that the actual S&P 500 companies spent an almost unbelievable record total of $589.4 billion for buybacks. That is so much stock buying that it is almost like taking Apple private.

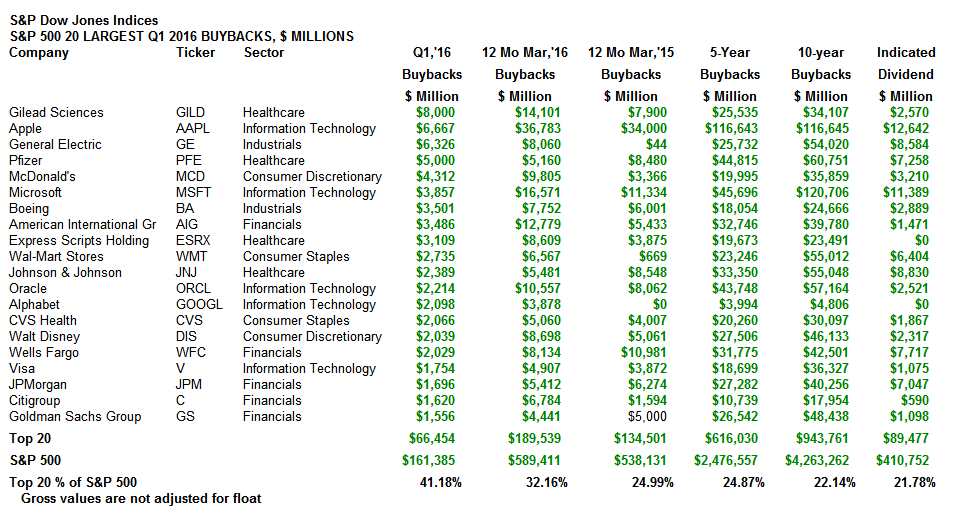

24/7 Wall St. wanted to break out the top S&P 500 companies buying the most stock in 2016. This data is for the first quarter, but it appears that every single one of these companies remains a serial buyer of their own shares. Another figure to consider is that this also marked the ninth consecutive quarter in which over 20% of the S&P 500 index members shrank their diluted share count by 4% or more in a year.

Total shareholder return, which is dividends plus buybacks, also saw a quarterly record of $257.6 billion in the first quarter of 2016. The trailing 12-month period for dividends and buybacks combined was a record $974.6 billion.

When 24/7 Wall St. looked at just the top 20 buyers of the most stock from the S&P 500 components, it turned out that these 20 companies alone spent a total of $616 billion in the past five years buying back stock. The cumulative total is a whopping $943 billion in the trailing 10-year period. Additional color has been added on each buyback to show relative value. Also shown are the market caps, the consensus analyst price targets compared with the current prices and the 52-week ranges. Dividend yields also have been included.

Gilead Sciences

In the first quarter of 2016, Gilead Sciences Inc. (NASDAQ: GILD) spent $8.000 billion on buybacks, for a total of $14.101 billion in the trailing 12-month period. This was part of a $12 billion buyback plan, which was meant to follow the completion of the previous $15 billion authorized share buyback plan. Is it ironic that the world’s largest biotech outfit is outspending the largest drug companies on buybacks?

Gilead shares closed most recently at $82.45, with a market cap of $110 billion. The consensus analyst price target is $110.89, and the stock has a 52-week trading range of $81.28 to $123.37. The dividend yield is 2.3%.

Apple

Apple Inc. (NASDAQ: AAPL) may be on the way to being the largest share buyback player of all-time, but maybe that is to be expected for the company that has shared the title of the “largest market cap in the world” and with a sub-market price-to-earnings (P/E) ratio and cheap access to capital. Apple’s buyback tab was $6.667 billion during the first quarter of 2016, but it was $36.783 billion for the trailing 12 months. Apple has now spent $116 billion in five years buying its stock.

Apple closed at $95.55, with a market cap of $523 billion. Its consensus price target is $124.79, and it has a 52-week range of $89.47 to $132.97. The dividend yield is 2.4%.

GE

As General Electric Co. (NYSE: GE) wants to get down to 8 billion shares or so, it likely will continue on its buyback warpath. GE spent $6.326 billion in the first quarter and had spent $8.06 billion total in the trailing 12 months. GE also keeps paring down financial assets, and that cash is being used to shrink its float. GE has now spent over $54 billion over 10 years on buybacks. Again, it is likely to remain aggressive.

Shares of GE closed at $30.80, within a 52-week range of $19.37 to $32.05. The consensus price target is $32.53. The market cap is roughly $283 billion, and the dividend yield is 3.0%.

Pfizer

Pfizer Inc. (NYSE: PFE) may not be able to move overseas like it once wanted to, and its shares may be looking for direction. The drug giant spent $5.0 billion buying stock in the first quarter, and a total of $5.16 billion for the trailing 12 months. That $5 billion was an accelerated repurchase plan, but Pfizer is now over $60 billion deep in buyback spending over the trailing 10 years.

Pfizer closed at $34.48, with a market cap of $209 billion. Its consensus price target is $38.62. The 52-week range is $28.25 to $36.46, and the current dividend yield is 3.5%.

McDonald’s

Thought McDonald’s Corp. (NASDAQ: MCD) spent $4.312 billion in the first quarter of 2016, it spent a total of $9.805 billion in the trailing 12 months. As a reminder, McDonald’s borrowed money to boost its buyback and dividend, even at the cost of a credit downgrade.

At the close of $120.62, McDonald’s has a market cap of $106 billion. Its consensus price target is $132.00, and the 52-week range is $87.50 to $131.96. The dividend yield is 2.9%.

Microsoft

In the first calendar quarter of 2016, Microsoft Corp. (NASDAQ: MSFT) spent $3.857 billion buying back stock, but that was $16.571 billion for the trailing 12 months. While this may not seem as impressive, Microsoft has spent $120 billion in the trailing 10-year period buying back stock. It’s also now acquiring LinkedIn and said that it will continue buying back shares under its commitments.

Shares of Microsoft closed most recently at $50.99. The market cap is $401 billion, and the dividend yield is 2.9%. The consensus price target is $57.76 and compares with a 52-week range of $39.72 to $56.85.

Boeing

Boeing Co. (NYSE: BA) used some $3.5 billion for buybacks in the first quarter, but that was a larger portion of its trailing 12-month buyback tally of $7.752 billion. As of May, Boeing had spent $19 billion buying back stock in just three years. Some analysts wonder if this marked the top of airplane spending cycle.

Shares closed at $131.78, and the market cap is $84 billion. Boeing has a consensus price target of $148.06 and a 52-week range of $102.10 to $150.59. The dividend yield is 3.4%.

AIG

While dealing with ongoing activist pressure, American International Group Inc. (NYSE: AIG) is still reshuffling itself into whatever it will be in the years ahead. AIG’s tally for buybacks was $3.486 billion in the first quarter, and that was a part of $12.779 billion for the trailing 12 months.

AIG shares closed at $53.68, with a market cap of $60 billion. The consensus price target is $63.35, and the 52-week trading range is $50.20 to $64.93. AIG’s dividend yield is 2.4%.

Express Scripts

Thought Express Scripts Holding Co. (NASDAQ: ESRX) may have no dividend, its repurchase tally of $3.109 billion for the first quarter was a part of $8.609 billion in total buyback spending for the trailing 12 months.

Shares of Express Scripts closed at $75.59, with a market cap of $48 billion. Its consensus price target is $80.50 and it has a 52-week range of $65.55 to $94.61.

Wal-Mart

Wal-Mart Stores Inc. (NYSE: WMT) keeps buying back stock, and some people accuse the Waltons of doing it to keep such strong control. The world’s largest retailer spent $2.735 billion in the first quarter of 2016. That is above the quarterly average by far, versus the trailing 12-month tally of $6.567 billion.

The stock closed at $71.74, with a market cap of about $223 billion. The consensus price target is $69.11, and Wal-Mart has a 52-week range of $56.30 to $74.14. The retail giant also has a dividend yield of 2.8%.

Johnson & Johnson

It may keep buying back stock, but now Johnson & Johnson (NYSE: JNJ) is also involved in an acquisition, and that will make it interesting to see if it alters the buyback spending. The first quarter of 2016 saw a total of $2.389 billion spent on buybacks, out of $5.481 billion in the trailing 12 months, ending March 31.

Shares of Johnson & Johnson closed at $116.48, within a 52-week trading range of $81.79 to $117.74 and with a consensus price target of $117.89. The market cap is roughly $320 billion, and the consumer products and medical products giant has a dividend yield of 2.8%.

Oracle

In the first calendar quarter of 2016, Oracle Corp. (NYSE: ORCL) spent $2.214 billion buying back common shares. That made for a trailing year tally of $10.557 billion.

The most recent close of $40.02 came with a market cap of $166 billion. The consensus price target is $43.82, and Oracle has a 52-week range of $33.13 to $42.00. The dividend yield is 1.5%.

Alphabet

The former Google, Alphabet Inc. (NASDAQ: GOOGL), has only just recently started spending money on stock buybacks, and it pays no dividend. The king of search (and other things) spent $2.098 billion buying back stock in the first quarter, and that made for a total of $3.878 billion for buybacks in the trailing 12 months. That may have come close to offsetting Sergey and Larry’s insider selling of Alphabet shares.

Alphabet most recently closed at $710.47, with a market cap of $488 billion. Its consensus price target is $911.18, and it has a 52-week trading range of $539.54 to $810.35.

CVS Health

The $2.066 billion that CVS Health Corp. (NYSE: CVS) spent on buybacks in the first quarter was part of the total of $5.06 billion spent in the trailing 12 months.

Shares of CVS closed at $93.74, with a market cap of $101 billion. The consensus price target is $113.60. The 52-week trading range is $81.37 to $113.65. The pharmacy and prescription benefits management outfit has a dividend yield of 1.8%.

Disney

In the first calendar quarter of 2016, Walt Disney Co. (NYSE: DIS) spent $2.039 billion, but that made for a total of $8.698 billion in the trailing 12-month period ending March 31. Over the past decade or so, Disney has spent billions acquiring Star Wars for $4 billion, Marvel for $4 billion and Pixar for $7.4 billion.

Disney shares closed at $98.79, with a market cap of $160 billion. Its consensus price target is $109.11, and the 52-week range is $86.25 to $122.08. The entertainment giant has a dividend yield of 1.4%.

Wells Fargo

Wells Fargo & Co. (NYSE: WFC) remains a serial buyback giant. In fact, Warren Buffett’s on and off buying through time, along with the buybacks, now have the Oracle of Omaha at or very close to the 10% ownership threshold. Wells Fargo spent $2.029 billion in the first quarter on buybacks, for a total 12-month trailing buyback tab of $8.134 billion.

The stock closed at $46.97, with a market cap of $239 billion. Its consensus price target is $54.80, and it has a 52-week range of $44.50 to $58.77. The dividend yield is 3.3%.

Visa

The buybacks at Visa Inc. (NYSE: V) were slightly above average. The credit card processing giant spent $1.754 billion in the first quarter for share repurchases, for a total of $4.907 billion in its trailing 12 months.

Shares of Visa closed at $76.54. The consensus price target is $88.81, and the 52-week range is $60.00 to $81.73. The dividend yield is 0.7% and the market cap is $183 billion.

JPMorgan

Regulators are about to set JPMorgan Chase & Co. (NYSE: JPM) free to get its way on buybacks, at least that is the hope. CEO Jamie Dimon’s crew spent $1.696 billion for stock buybacks in the first quarter of 2016, for a total of $5.412 billion in its trailing 12-month period.

Shares closed at $62.71, with a market cap of $230 billion. The consensus price target is $70.74. The 52-week range is $50.07 to $70.61. The dividend yield is 3.1%.

Citigroup

Still subject to the Comprehensive Capital Analysis and Review (CCAR) stress tests, Citigroup Inc. (NYSE: C) is therefore limited on how much it can spend on buybacks. Its dividend remains almost insulting. The company spent $1.620 billion in the first quarter on share buybacks, for a total of $6.784 billion in its trailing 12 months.

After shares closed at $42.66, Citigroup’s market cap is $125 billion. The consensus price target is $55.88, and the 52-week range is $34.52 to $60.95. The dividend yield is 0.5%.

Goldman Sachs

Though Goldman Sachs Group Inc. (NYSE: GS) spent $1.556 billion buying back stock in the first quarter of 2016, that was actually some $4.44 billion in the trailing 12-month period.

Goldman Sachs closed at $148.17, with a market cap of $65 billion. Its consensus price target is $185.39, and it has a 52-week range of $139.05 to $217.00. The dividend yield is 1.8%.

If you did not notice, 12 of the top 20 buyback companies in the S&P 500 are also members of the Dow Jones Industrial Average and another two of these 20 are former Dow stocks.

As far as why we are confident these will remain aggressive buyers of shares, most of these companies have cheap capital access and large cash reserves. That being said, how international cash locked up overseas gets treated after this presidential election, as well as the future of interest rates and the economic growth pattern, will all play a big role in the future of stock buybacks beyond 2016. S&P even said in its release:

The fourth quarter 2015 uptick in buybacks was a surprise to many in the market, but it continued in the first quarter of 2016. The pace of buybacks was partially driven by companies supporting their stock during the opening downturn of the year, which coincidentally started in early February when many earnings lock-ups ended.

The upswing in both expenditures and participation appears to persist in the market, meaning that the upturn in the fourth quarter was not a single-shot. Looking at the second quarter of 2016, the share count reduction trend is already baked in, as more than 20% of the issues have reduced their share count by at least 4% from the second quarter of 2015.

The table below shows how each company’s buyback trends look versus the prior year and on a longer-term basis. It also shows how much each company’s indicated dividend liability is for a relative comparison. As a reminder, these are the largest buybacks from S&P 500 members. There may be other stocks that have recently gone after large buybacks that are not yet members of the S&P 500.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.