Investing

Warren Buffett's 10 Most Profitable Investments of 2017

Published:

Last Updated:

Berkshire Hathaway Inc. (NYSE: BRK-A) has released its annual letter for 2016, and 24/7 Wall St. has already broken out many of the top trends and takeaways from that report. Covered here are the most profitable positions in the Berkshire Hathaway portfolio. When Warren Buffett speaks (or invests), people tend to listen. Having attained the status of the world’s wealthiest person on paper makes people care. Buffett is also considered to be the greatest investor of the modern era.

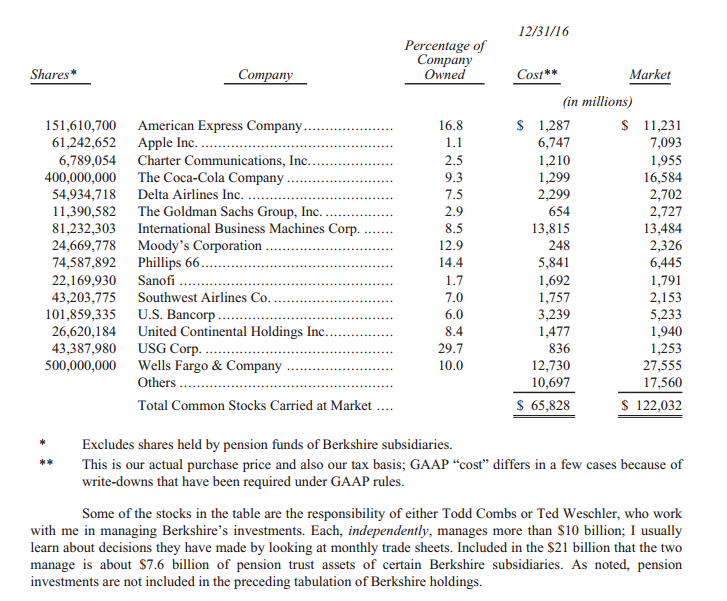

While the full annual report was far more in-depth, it shows that the top 15 common stock holdings of Berkshire Hathaway by size have a cost basis of $65.828 billion. The market value of these investments on the last day of 2016 was $122.032 billion, so just 15 stock trades have given Buffett, his portfolio managers and his shareholders more than $56 billion in profits.

What should stand out here now is that the $56 billion in profits would be an investment gain of 85%. Some of these positions date back many years, while others have been added or raised quite recently.

One thing you will see here on the longer-term holdings, which are not very exciting, is that Buffett’s cost basis is so low that there is almost no reason for Berkshire Hathaway to sell them and have to pay out taxes. Buffett even breaks out how taxes would hit the gains if the sales were locked in.

Another issue to consider in the top holdings and the contributions made by them was that Berkshire Hathaway’s book value per share rose by 10.7% in 2016. Its own common shares rose 23.4%, versus a dividend adjusted gain of 12.0% for the S&P 500. Berkshire Hathaway’s 2016 after-tax earnings from operations were $17.57 billion in 2016, including interest and dividends from investments but excluding capital gains or losses. Berkshire Hathaway’s capital gains were $6.5 billion.

Buffett included a full table in this annual report showing what percentage of each large stake in a company Berkshire Hathaway owned. We also have included wildly profitable positions that are not yet common stocks because of such large gains. 24/7 Wall St. has even made adjustments based on 2017 performance to see which of the largest positions were the most profitable in as close to “real-money terms” as we could get.

One issue that should stand out about the 2017 portfolio is that more changes were made in 2016’s stock holdings than what has ever been seen before. Here are the 10 most profitable positions of Berkshire Hathaway and Warren Buffett for 2017, in alphabetical order.

1. American Express: $10 Billion Profit!

American Express Co. (NYSE: AXP) may have not been as loved by investors as it has been by Buffett. Buffett’s stake is over 151.6 million shares, some 16.8% of the company, and the stake originally dates back to the 1980s. Buffett’s cost basis is a mere $1.287 billion on paper and was worth $11.23 billion at the end of 2016. This gain of about $9.5 billion comes with an even happier sound to Buffett’s ears: at $79.76, American Express shares were last seen up another 7.6%.

2. Apple: $1.6 Billion Profit!

Apple Inc. (NASDAQ: AAPL) has been quite profitable, and this was taken by one of his portfolio managers (and perhaps grown by Buffett and/or Munger). Berkshire Hathaway owned 61.24 million Apple shares at the end of 2016, with a cost basis of more than $7.74 billion, or about $110 per share. While this would have been a $350 million profit at the end of 2016, it was a $26 per share profit as of Friday, for a gain of more than $1.6 billion so far.

3. Bank of America: $11 Billion or More Profit!

It is not a common stock holding of Buffett in the classic sense, but Buffett made a $5 billion preferred stock investment in Bank of America Corp. (NYSE: BAC) after the recession. Berkshire Hathaway gets paid $300 million per year in income from this, but the big kicker in that investment was a warrant allowing Berkshire Hathaway to purchase 700 million common shares of Bank of America for $5 billion at any time before September 2, 2021. At the end of 2016, that would have delivered a profit of $10.5 billion. If it wishes, Berkshire can use its preferred shares to satisfy the $5 billion cost of exercising the warrant. And the post-election rally has been rather favorable to the bank for lower regulatory costs and higher net interest margins. With shares most recently at $24.23, Bank of America shares were up over 9.6% from the end of 2016. Buffett’s report outlined what will create a conversion ahead:

If the dividend rate on Bank of America common stock – now 30 cents annually – should rise above 44 cents before 2021, we would anticipate making a cashless exchange of our preferred into common. If the common dividend remains below 44 cents, it is highly probable that we will exercise the warrant immediately before it expires.

4. Coca-Cola: $15 Billion or More Profit!

It is a dead money stock to the rest of the world, but Buffett’s stake of 400 million Coca-Cola Co. (NYSE: KO) shares is a whopping 9.3% of the company. Buffett’s cost basis is just $1,299 billion (which we have speculated is almost free if you count the dividends and likely income Buffett has been able to make from stock loans). The current value of Coca-Cola was listed as $16.584 billion, a gain of more than $15 billion.

5. Goldman Sachs: $2.1 Billion Profit!

Goldman Sachs Group Inc. (NYSE: GS) is a bank stake that was originally a preferred stake dating back to the recession. The warrants that came with the stock are now 11.39 million shares for a 2.9% stake, but the profit of today does not include the 10% preferred coupon that was paid for years. Buffett’s costs basis is a mere $654 million, worth some $2.727 billion at the end of 2016, implying a profit of almost $2.1 billion. At $247.35 on last look, Goldman Sachs shares were up 3.3% more in 2017.

6. Kraft Heinz: $20.4 Billion Profit!

Kraft Heinz Co. (NASDAQ: KHC) is a stake of 325,442,152 shares that is carried on the balance sheet with a GAAP figure of $15.3 billion. Its year-end value of $28.4 billion represents a profit of more than $13 billion, but Buffett said in his letter that the real cost basis for the shares is $9.8 billion. And to add in a kicker here, Kraft Heinz shares were at $93.08 and were up 6.5% more from the end of 2016. If you look at the real cost basis, Buffett’s profit here from his investment alongside 3G would be a whopping $20.44 billion, considering the gains seen in 2017.

7. Moody’s: $2.5 Billion Profit!

The stake in Moody’s Corp. (NYSE: MCO) was more embarrassing for Buffett during the recession, as giving triple-A ratings to that toxic mortgage and loan sludge almost toppled the company. After suits and fines, Moody’s is back to being used in every credit rating conversation, without even a pencil jab about how bad of a job it did with credit ratings in the years prior to 2009. Berkshire owns 24.669 million shares, a 12.9% stake in Moody’s, but this is actually far lower than what the stake used to be. Berkshire Hathaway’s cost basis is a mere $248 million, but its $2.326 billion value at the end of 2016 generated a gain of almost $2 billion. Now we have to consider that Moody’s shares (last trading at $113.29) had risen another 20% so far in 2017. That new profitability would be almost $2.55 billion.

8. U.S. Bancorp: $2.3 Billion Profit!

U.S. Bancorp (NYSE: USB) is a stake of 101.859 million shares that has grown through time (to a 6.0% stake in the bank) for Berkshire Hathaway. The cost basis of $3.239 billion had a market value of $5.233 billion at the end of 2016, for a profit of just over $1.99 billion. This profit is now well over $2 billion, since U.S. Bancorp shares have risen another 7.3% in 2017. That new profit would be over $2.37 billion.

9. Wells Fargo: $16.2 Billion Profit!

Wells Fargo & Co. (NYSE: WFC) has been the grand prize of Berkshire Hathaway over the years. Buffett has added endlessly to this position, but he did pause buying shares during the account opening scandal and the John Stumpf ouster. Berkshire Hathaway owned 500 million shares for a 10.0% stake. The cost basis was listed as $12.73 billion, and the year-end value of $27.555 billion would generate a $14.82 billion profit. But at $57.81, Wells Fargo shares were up another 4.9% in 2017 and would be worth over $28.905 billion. Buffett’s new profit would be closer to $16.2 billion.

10. Major Airlines: $1.6 Billion Profit!

While 24/7 Wall St. has focused on the individual stocks, it turns out that Buffett’s portfolio managers broke ranks with the Buffett and Munger view that airlines are losers. Buffett hated airlines for years (except for the richy-rich NetJets service, of course), but Todd Combs and/or Ted Weschler decided that the airlines having fewer competitors (wider moats on routes) and the ability for airlines to add on whatever fees they can come up with is now a good investment. Buffett confirmed that each manager now independently manages more than $10 billion. Their bets on the airline sector did not include American Airlines in the top holdings because it was a smaller investment, and that may undercount this profitability on the major airlines bet. The top four airlines were shown as follows:

One more consideration here is that the actual Berkshire Hathaway ecosystem may own even more shares than have been counted here. The notes from the table shown below say that the number of total shares excludes shares held by the pension funds of Berkshire subsidiaries. And on the cost basis, this has been shown as the actual purchase price and also the tax basis, while the GAAP cost differs in a few cases because of write-downs that have been required under GAAP rules.

If you want to know why Buffett is not exactly a huge fan of selling some stakes that may seem stale or boring to investors today (e.g., Amex, Coca-Cola), Buffett outlined the simple corporate math. Every $1 of capital gains that a corporation realizes carries with it 35 cents of federal income tax, and often state income tax as well. The tax on dividends received from domestic corporations, however, is consistently lower, though rates vary depending on the status of the recipient. Buffett further outlined how dividend and capital gains taxes are treated for Berkshire Hathaway:

For a non-insurance company – which describes Berkshire Hathaway, the parent – the federal tax rate is effectively 10.5 cents per $1.00 of dividends received. Furthermore, a non-insurance company that owns more than 20% of an investee owes taxes of only 7 cents per $1 of dividends.

Berkshire’s insurance subsidiaries pay a tax rate on dividends that is somewhat higher than that applying to non-insurance companies, though the rate is still well below the 35% hitting capital gains. Property/casualty companies owe about 14% in taxes on most dividends they receive. Their tax rate falls, though, to about 11% if they own more than 20% of a U.S.-based investee.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.