The stock market in 2020 has gone from a raging bull market to panic mode in very short order. The impact of the coronavirus dealt a knockout blow to China. It has spread around Asia and into Europe (and most countries) and is now posing a major threat to the United States. The United States already is feeling the economic pinch as the number of coronavirus cases rises. Consumers are canceling flights and hotel bookings, and they are stockpiling certain goods. Companies are canceling major conferences, restricting employee travel and even turning to work-from-home efforts. The S&P 500 had risen handily in 2020 for a peak gain of 5% as recently as February 19, 2020, but now the market is over 8% lower year to date and down 12.4% from the peak.

The volatility in the past two weeks alone has turned even most of the biggest bulls into timid cows. Some investors are now worried that the bull market is dead and that the coronavirus outbreak will send the U.S. economy into stagnation or perhaps even into a recession. While a falling stock market is often bad for most stocks, even the crummiest of stock markets can still produce some serious winners. It turns out that many stocks have risen handily even through the carnage in 2020. Some stocks have performed so well that investors should wonder how well they could have performed had the stock market remained firm.

24/7 Wall St. has screened for stocks that have been performing well on a one-week, one-month and year-to-date basis. Many of these companies are rather well known by the investing community and the public alike. While no logical investor can reasonably expect a stock to rise forever or stay up if the market continues decides to go from bad to worse, screening criteria were used in looking for the top stocks in this crummy stock market.

Small-cap stocks were screened out, with a $3 billion market cap level used as a general floor. The very speculative stocks that have seen exponential growth due solely to their claims or efforts tied to the coronavirus were also screened out. Many of these companies have been around for many years, and some are profitable and even pay dividends. We even have looked at both sides of the coin to identify whether lurking risks or valuation concerns need to be considered.

Here are the 10 stocks that have incredibly strong stock charts and strong performance despite the crummy market conditions that have been seen so far in 2020. A chart montage was also provided at the end of this article.

Campbell Soup Co. (NYSE: CPB) had been ticking along like a steady heartbeat in most of 2020, and despite selling off toward the end of February, its earnings became more than enough of a catalyst to send shares higher with its quarterly report and stronger 2020 guidance. Some investors are treating Campbell Soup as a coronavirus pick due to people buying up canned and prepackaged foods, while some could argue it was finally time for the food to giant to win. With a market cap of about $15.8 billion, Campbell Soup was up about 14.7% over the past week, but it was up “only” about 5.6% in the past month and about 4.7% year to date. This company’s checkered past performance will have some investors on edge, but any breakouts above $53 don’t have any resistance on the five-year charts up to $57 and $60 or so.

Cogent Communications Holdings Inc. (NASDAQ: CCOI) seems to be in the sweet spot for small and midsized businesses by offering high-speed fiber internet access, as well as private networks and data center colocation space. It is up over 1,000% since 2010, but its $4 billion market cap is not high enough that analysts or investors would say it has no room for growth. That said, it has high multiples at about 87 times expected 2020 earnings and close to seven times expected sales. It also has been growing, with its 3% dividend yield and a blend of income (46%) and return of capital (54%). Cogent shares were last seen trading up 19% in the past week, up over 21% in the past month and 32% higher year to date. Its performance has been strong enough that its shares are now higher than all the analyst targets.

Gilead Sciences Inc. (NASDAQ: GILD) has several things going for the company at once. One is actually the coronavirus, as the company’s remdesivir is among the hopefuls as a treatment for the COVID-19. That has been a big driver, but Gilead was a sleeping value stock entering 2019, with low valuations and low expectations. The company also just announced a $4.9 billion acquisition of a company called Forty Seven Inc. (NASDAQ: FTSV) in immuno-oncology to boost its cancer ambitions.

Gilead has been dead money for a long time and had been among the targeted companies under the political/social criticisms for high-priced drugs targeting hepatitis and HIV/AIDS in past years. There is some risk here, if remdesivir is not a widely accepted treatment ahead, but that remains to be seen. Its shares were back above $80 on Friday and broke above the past $77 to $78 resistance level, and there is another overhang on the chart at $83 to $86 from 2017 and 2018. Gilead is up over 15% in the past week, almost 22% higher in the past month and up 23.5% year to date.

Iovance Biotherapeutics Inc. (NASDAQ: IOVA) is now worth $4.9 billion and is a cancer immunotherapy developer using novel T cell-based cancer immunotherapies. In mid-February, Iovance gave an update along with financial results that sent shares higher. The company’s tumor-infiltrating lymphocyte (TIL) is anticipated to be commercialized, and the company is building its internal manufacturing capability and expanding its own commercial team and infrastructure. The company expects its TIL to be the first potential cell therapy in solid tumors. On March 4, Barclays started coverage as Overweight with a $45 target price. On February 26, Oppenheimer (Outperform) raised its target to $35 from $32 and H.C. Wainwright (Buy) raised its target to $36 from $32. JMP issued a new Outperform rating with a $38 target at the end of 2019. After a $38.85 a share close on Friday, it would seem that those older calls either will have to get refreshed target prices or see valuation downgrades.

Iovance hit new highs on Friday, with shares up 18% in the past week, up about 64% over the past month and 40% higher so far in 2020 (and it’s up 283% over the past year).

Kroger Co. (NYSE: KR) has more than one issue going for it. It recently came into focus as a new stock purchase by one of Warren Buffett’s portfolio managers at Berkshire Hathaway Inc. (NYSE: BRK-B). Kroger also performed very well after earnings despite some profit-taking or consolidation on Friday. The Buffett stake got its recovery started, and the earnings report is what punched Kroger above February’s highs. The stock rose by almost 14% in the past week, despite a 4% drop on Friday, and that’s up just over 14% in the past month and about 10.5% higher year to date. If its breakout can hold, then it has little resistance up until around $35 (from 2016) and then closer to $40 (from 2015) from the past five years.

Newmont Corp. (NYSE: NEM) is the top dog when it comes to gold mining, with a $44 billion market cap after its $10 billion merger with Goldcorp more than a year ago. That merger has proven, at least so far, to be far more successful than the Barrick merger with Randgold that currently has a $40 billion market cap. The driving force here has been the stellar rise of gold prices (last seen at close to $1,675 per ounce, up 10% year to date and 30% over a year). The company also has low all-in sustaining costs of under $1,000 per ounce, so every added dollar per ounce of gold may be free profits that can be dropped right down into higher dividends for its shareholders.

Newmont had seen its shares dip, but in the past week it rose by 17%, for a gain of 18% over the past month and about 20.5% year to date. Barrick shares are up 11.5% in the past week, over 17% higher in the past month and up more than 14% year to date.

Regeneron Pharmaceuticals Inc. (NASDAQ: REGN) may have had a dicey performance in January, but it came roaring back in February, starting in mid-February even as the stock market was getting spooked. Regeneron’s market cap is now $54 billion, and the stock recently hit a high of $500.00. That’s right back at where the stock peaked in 2017, but it was a $550 stock back in 2015.

While Regeneron has gained along with others as a coronavirus hopeful, it also has drugs such as Eylea for macular degeneration, Dupixent for dermatitis and asthma, Praluent for hereditary high cholesterol, Kevzara for rheumatoid arthritis and a host of other approved drugs and over 20 combined Phase 2 or Phase 3 studies in its drug study pipeline. Regeneron was up 11% in the past week, and 33% in the past month and about 32% so far in 2020.

Safehold Inc. (NYSE: SAFE) is an externally managed real estate investment trust (REIT) under iStar Inc. (NYSE: STAR) that helps real estate owners unlock the value of the land under their buildings to generate higher returns with less risk. With a focus on major markets in the United States, it has no real exposure to foreign markets, and its market cap is now just above $3 billion. Its shares are up 17% over the past week, 31% over the past month and 59% year to date. Its iStar manager and largest holder has a $1.4 billion market cap and is also higher in 2020, but its gain was a less robust 7% in the past week and month, with a year-to-date gain of about 11%.

Virtu Financial Inc. (NASDAQ: VIRT) has been able to win from the market volatility in high-frequency trading and market making. Its market cap is back up to $4.5 billion, but Virtu’s operating metrics in the first two months of 2020 alone were shown to be between $226 million and $234 million in trading income, with its adjusted net trading income between $230 million and $240 million. Its adjusted net trading income per day was shown to be between $5.75 million and $6.00 million. It is still too soon to know what the quarter’s performance will look like, and its highs in 2019 were in the $24.50 to $25.50 per share range.

Virtu’s chart looks much better in 2020 (like the Eiffel Tower) than over the past year, but its run has been more than impressive. Its shares were up over 24% in the past week, 35% higher over the past month and up over 46% so far in 2020.

Vivint Smart Home Inc. (NYSE: VVNT) is a “smart home” provider, with its Total Front Door package that comes with a traditional key lock, a password key lock, a doorbell camera, garage door control and outdoor cameras and smart thermostat controls. Vivint shares were up 39% for the past week and 88% over the past month.

The one caveat here is that Vivint Smart Home does not have proper year-to-date performance that can be measured on an apples-to-apples basis because this came out of a SPAC, or blank-check company, formerly known as Mosaic Acquisition. That means it does not have the traditional history many technicians can count on for long-term metrics, and as it is new we did not apply traditional market cap and other criteria we might have used on other stocks. The company recently reported total revenue growth of 10% for 2019 to $1.2 billion, and the company’s smart home services guidance was to end 2020 with 1.62 million to 1.66 million subscribers and revenues rising to $1.25 billion to $1.29 billion.

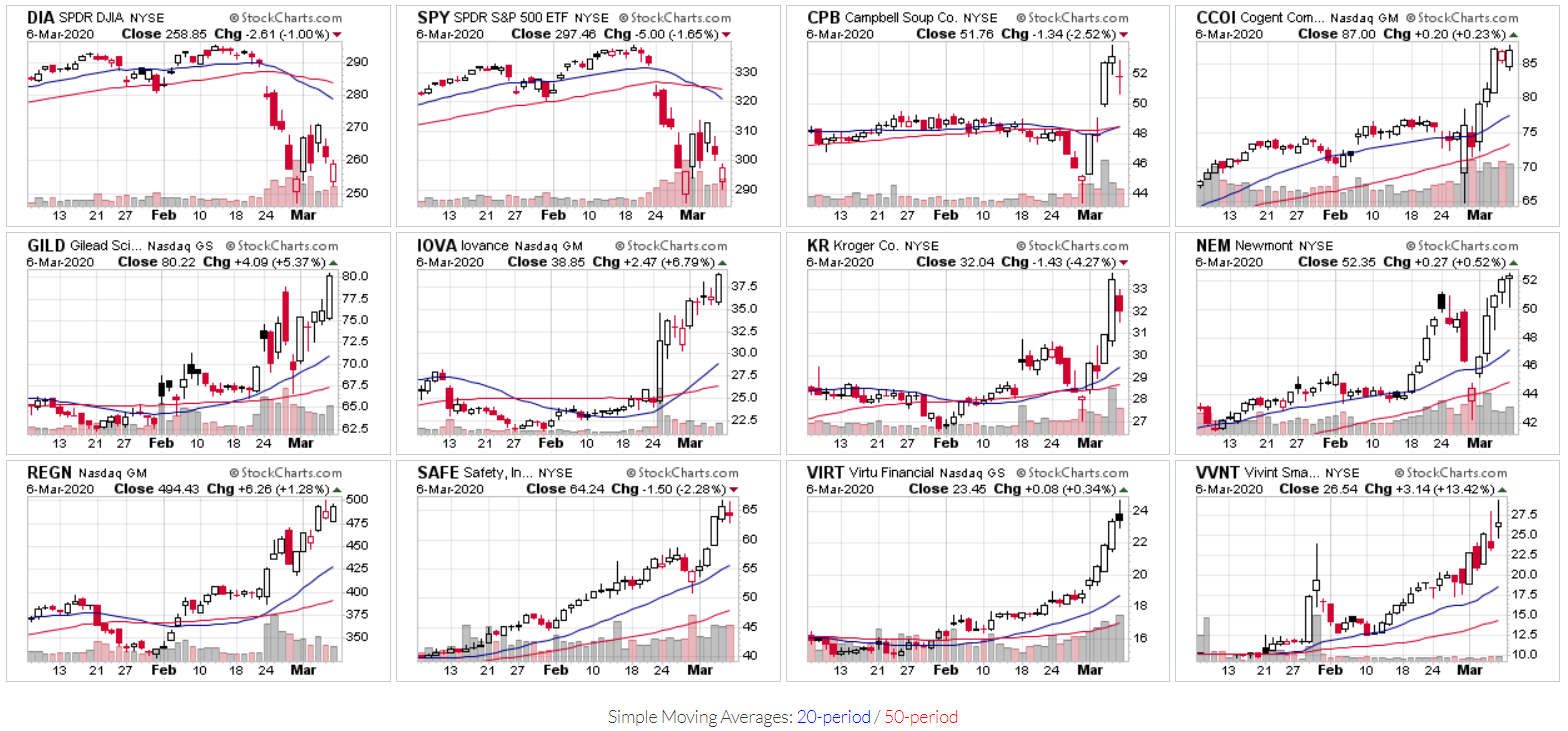

We have provided an expandable stock chart montage with 20-day and 50-day moving averages below, along with the Dow Jones industrial average and S&P 500 ETF charts, from StockCharts.com for a reference.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.