By David Callaway, Callaway Climate Insights

Avoiding energy and fossil fuels helps sustainable equity funds in volatile markets, says Morningstar’s Jon Hale.

By Robert Powell

(About the author: Robert Powell, CFP, is a longtime financial journalist whose work appears regularly in TheStreet.com, USA Today and AARP. He is the editor of TheStreet’s Retirement Daily. He can be reached at [email protected].)

BOSTON (Callaway Climate Insights) — Less exposure to energy, high-carbon and high fossil-fuel companies, and more exposure to tech companies, helped push a majority of sustainable equity funds into the top half of their Morningstar peer groups in the first quarter of this year.

So for investors who don’t want to sacrifice performance, and who are wondering if they can do well while they do good, the answer — at least for this period — is yes.

Some 70% of sustainable equity funds finished in the top half of their Morningstar peer groups in the first quarter of 2020, according to Jon Hale, the head of sustainability research for Morningstar.

As we publish today, Hale had not yet finished crunching the numbers and writing his first-quarter report, but he told Callaway Climate Insights in an interview that investors didn’t have to sacrifice performance, at least in the first quarter.

According to Hale, there are at least two reasons why ESG mutual funds and ETFs did well in the first quarter.

First, ESG-tilted funds had less exposure — not surprisingly — to energy, high-carbon and high fossil-fuel companies, and they had more exposure relative to other funds in technology companies. And the latter tends to be at the forefront of ESG-related activities such as climate change.

And second, ESG funds, as a general rule, tend to invest in high-quality companies.

During the interview, Hale also addressed whether sustainable equity funds are doing what they claim to be doing, which was the subject of a column he recently wrote for Morningstar.

According to Hale, the answer is: “For the most part, yes, but many fall short on some dimensions.”

As part of his research, he examined three factors.

Sustainable funds and the Morningstar Sustainability Rating

All these funds say that they are evaluating companies on the basis of how well they are handling various ESG issues. And so, the question is this: Is there any evidence that they’re doing that?

In response, Hale reviewed the Morningstar Sustainability Rating for Funds, which provides a reliable, objective way to evaluate how investments are meeting environmental, social and governance challenges. That rating is now available for more than 20,000 funds worldwide.

What Hale found is that more than 80% of sustainable funds received the company’s top ratings (four or five globes) and that puts them in the top third of their peer groups. By comparison, in the overall universe, only about a third of funds get four or five globes.

“When we launched the globe ratings (in 2016), it was a big question in our mind whether these ESG funds would perform significantly different from conventional funds,” he said. “And we have consistently seen that that is the case when it comes to the ESG ratings of the companies that they hold.”

Low carbon and fossil-fuel-free sustainable funds

According to Hale, when most investors and advisers think about sustainable investing they likely think in terms of climate change and fossil-fuel exposure. And there’s an assumption that ESG funds have less exposure to climate risk and fossil-fuels.

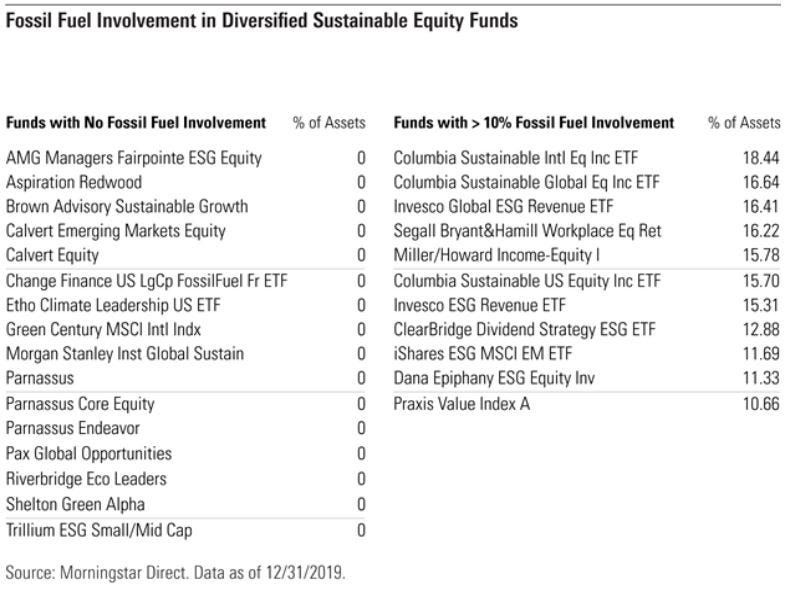

So, he examined fossil-fuel involvement with sustainable funds.

And what he found is this: “There are probably fewer funds that have no fossil-fuel involvement in this sustainable funds universe than you might expect,” Hale said.

In fact, only 91 of the 303 sustainable funds are fossil-fuel-free or even “low carbon” by prospectus, and only 16 funds had no fossil-fuel involvement in their most recent portfolio.

So on this score, Hale said, “it’s important to look under the hood and to determine whether a sustainable fund is exposed to fossil fuels or not… don’t automatically assume that they’re fossil-fuel-free.”

(Of note, two of the funds highlighted above — Calvert Emerging Equity and Calvert Equity — fall under the stewardship of Calvert’s Anthony Eames, who we interviewed last week. )

And, despite Larry Fink’s recent missive to CEOs, the iShares ESG MSCI EM exchange-traded fund (ESGE) has more than 10% of its holdings in companies with fossil-fuel involvement.

According to Hale, that’s more a case of the fund trying to invest in what it considers to be the best-in-class companies in energy and utilities, based on ESG ratings. “But that doesn’t mean that they’re avoiding fossil fuels,” he said.

Read What’s in that low-carbon ETF?

How the largest equity diversified sustainable funds voted on ESG resolutions

Hale also looked at sustainable funds’ proxy voting on ESG-related shareholder resolutions. He referred to this as “active ownership.” It’s how a fund engages with the companies it owns, votes proxies, and seeks to provide measurable impact beyond financial return.

According to Hale, there were 177 ESG-related shareholder resolutions in the 2019 proxy year. And what they found is that sustainable funds were significantly more likely than conventional funds to support shareholder resolutions addressing environmental and social risks. And that on average, sustainable funds supported these resolutions 68% of the time compared with 37% — which was a record high — for other funds.

“If 38% of your shareholders are voting in favor of a shareholder resolution on a particular issue, you’re going to start paying attention to their concerns,” he said, “You know, you may not address them to their satisfaction, but it’s not something that you can just sweep under the rug.”

Read Climate change shareholder initiatives edge up in 2020 proxy season

Still, there is a full range of behavior among sustainable funds on proxy voting, Hale said. “There are some funds that supported 100% of the shareholder resolutions that they voted on and some that voted that supported a 0%,” he said. “So, there is truly a wide range.”

In fact, some of the bigger asset managers — Vanguard, Dimensional Fund Advisors and iShares — supported the fewest proxy votes. For instance, Vanguard FTSE Social Index (VFTAX) supported only 2% of the 104 resolutions on which it voted. DFA US Sustainability Core (DFSIX) supported only 12%, and the two iShares funds on the list below supported only 19% and 23%.

By contrast, companies that are more traditionally focused on sustainability such as Calvert, Parnassus, Domini, and PAX support nearly 90 to 100% of the ESG-related resolutions.

“It’s a significant difference,” Hale said. “If somebody is very interested in sustainable investing you generally are going to want an asset manager that’s going to use the full array of tools when it comes to active ownership.”

Where might investors who want to toe dip into ESG funds start?

According to Hale, search first for funds that are “intentionally sustainable.” Funds that, for instance, have a four or five globe rating from Morningstar’s Sustainability Rating service is one place to find such funds. Look, too, for those funds that have a good performance record and read what the fund has to say about its proxy voting, it’s active ownership.

Do all that and “it’s possible to construct an entire portfolio around a sustainable funds,” said Hale.

Free Callaway Climate Insights Newsletter

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.