More than one-third of the 30 companies included on the Dow Jones industrial average are scheduled to report earnings this week. All told, nearly 500 companies are on the earnings calendar for this week.

In addition to our weekend looks at the Dow stocks reporting this week and at several others with heavily traded shares, here’s a bit more detailed look at five stocks set to report either Tuesday afternoon or Wednesday morning.

[in-text-ad]

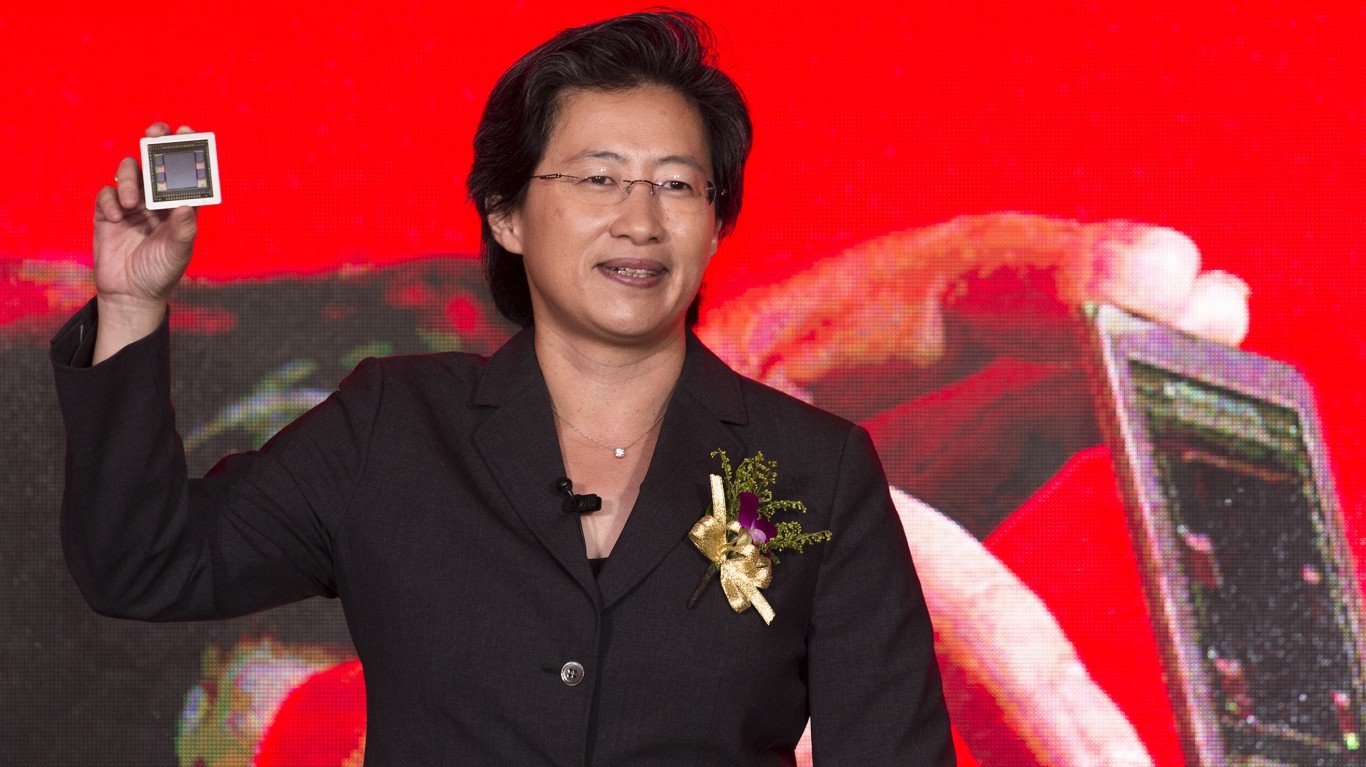

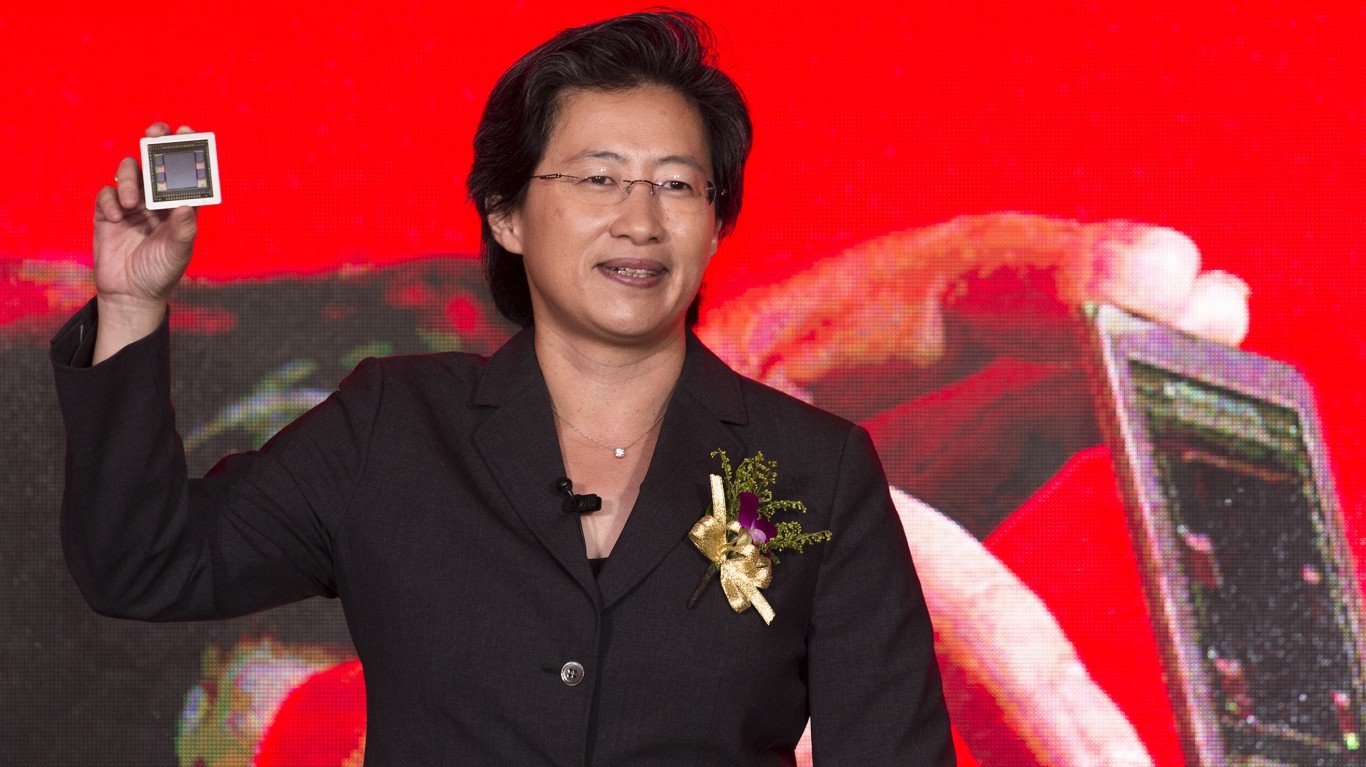

AMD

Advanced Micro Devices Inc. (NASDAQ: AMD) stock doubled last year and has added just over 3% so far in January. The company has taken advantage of Intel’s missteps in manufacturing technology to steal a march on the larger company’s desktop and server business. Add to that AMD’s gains in graphics processors, and it’s not hard to see why the share price soared in 2020.

When AMD reports fourth-quarter results after markets close Tuesday, analysts are expecting earnings per share (EPS) of $0.47 on sales of $3.02 billion. The totals represent year-over-year increases of 47% in EPS and 42% in revenue. EPS for the full year is expected to double to $1.23, and sales are forecast to rise by 42%.

Shares traded up about 3% early Monday morning at around $95.60, above the consensus price target of $93.34 and at around 76 times expected fiscal 2020 earnings. The stock’s multiple to estimated 2021 EPS is about 53. AMD does not pay a dividend.

Microsoft

After the closing bell Tuesday, Microsoft Corp. (NASDAQ: MSFT) is expected to report second-quarter fiscal 2021 results. Microsoft is among the companies that have benefited substantially from the pandemic-induced move to working from home. This has boosted demand for the company’s Azure cloud service and for new computers running the company’s venerable Windows software. All this sets the stage for continuing growth in 2021 as the global economy recovers.

Analysts are forecasting second-quarter EPS of $1.64, up 8.6% year over year, and revenue of $40.2 billion, up 8.9%. For the full fiscal year ending in June, EPS are expected to rise by more than 17% to $6.76 and revenue is forecast to rise by nearly 11% to $158.3 billion. Microsoft stock added about 42.5% in 2020 and trades up about 2.5% so far this year.

At a current price of around $228 per share, the stock trades at about 34 times expected 2021 EPS and 31 times expected 2022 earnings. The current consensus price target on the stock is $243.33, implying an upside of about 2.8%. Microsoft’s dividend yield is 0.99%.

Starbucks

Starbucks Corp. (NASDAQ: SBUX) is scheduled to report first-quarter fiscal 2021 results on Tuesday as well. Despite improving late in the quarter, Starbucks is still tabbed to post lower year-over-year same-store sales, although the company sees a “significant rebound” in its 2021 fiscal year and “outsized growth in fiscal 2022” with adjusted EPS rising by more than 20% in the year.

The consensus Starbucks EPS estimate has dropped by a penny in the past week to $0.55, a year-over-year decline of 30%, while revenue is forecast to slide by 2.5% to $6.92 billion. Current estimates for the full fiscal year call for EPS of $2.81, up about 140%, and sales up 21% to $28.5 billion. At a recent trading price of around $104, shares are trading within 2% of the consensus price target and at nearly 37 times expected 2021 EPS and about 30 times expected 2022 EPS.

[in-text-ad]

The consensus price target on Starbucks stock is $103.56, and the high target is $122 from analysts at Barclays. The coffee purveyor pays a dividend yield of 1.73%.

Boeing

Dow component Boeing Co. (NYSE: BA) will report fourth-quarter and full-year results that are not expected to show much improvement, even though the company’s bread-and-butter 737 Max aircraft has been cleared by aircraft regulators to return to the skies. Boeing delivered 31 of the planes in December, up from just nine in December 2019. It’s a good start, but more than 400 parked 737 Max jets remain to be delivered. Boeing plans to deliver about half this year and the rest in 2022. The company also still has to figure out what it will do next to keep from falling further behind rival Airbus.

For the fourth quarter, analysts are expecting a net loss per share of $1.80, an improvement of $0.53 per share compared to the fourth quarter of 2019. Revenue is estimated to reach $15.07 billion, down nearly 16% year over year. For the full year, Boeing is expected to report a loss of $9.73, approaching triple its loss in 2019, while revenue is forecast at $57.94 billion, down more than 24% year over year.

At around $201 per share, the stock trades nearly 16% below its price target. The company is expected to post a profit of around $2.10 a share in 2021 and the stock trades at about 96 times expected earnings. Based on estimated EPS of $7.05 in 2022, the shares traded at a multiple of nearly 29. Boeing suspended its dividend in 2019.

AT&T

AT&T Inc. (NYSE: T) saw its shares fall by more than 21% last year as the company’s WarnerMedia division suffered through the closure of U.S. movie theaters as a result of the COVID-19 pandemic. The company also has had to increase investment in building out its 5G network, promoting its new HBO Max streaming service and trying to find a buyer for satellite service DirecTV.

The big success so far appears to be HBO Max, where WarnerMedia has announced the simultaneous release of new 2021 movies for both streaming and theatrical release. Late last week, several news outlets indicated that private equity firm TPG is interested in buying at least part of DirecTV, no doubt at a significant discount to the $67 billion (including debt) that AT&T paid for the satellite service in 2016.

AT&T is expected to report EPS of $0.73 (down 18% year over year) on sales of $44.55 billion (down nearly 5%) for the fourth quarter. Full-year EPS are tabbed at $3.14, a drop of 12% compared to 2019, and revenue is expected to total nearly $171 billion, down nearly 6%.

At a current price of around $29, the implied gain at the consensus price target is about 6.8%. The high price target is a whopping $43 a share. Shares traded at around nine times expected 2020, 2021 and 2022 estimated EPS. AT&T’s major attraction may be its dividend yield of around 7.2%.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.