With the first quarter soon coming to an end, many investors are looking to print some solid gains for the first three months of 2021, while turning their attention to what could be a very strong second quarter for the economy and for stocks. With a huge tailwind from the massive stimulus program and the reopening of the economy as spring begins, now is the time to move from momentum to strong growth stocks.

[in-text-ad]

In a new research report, Goldman Sachs has screened its research universe looking for companies with strong growth potential and solid positive free cash flow. The analysts said this about stocks that meet those criteria:

As vaccination-driven reopening continues to take hold, there could be some questions over the durability of growth for those that fared well in 2020. However, not all growth is created equal. While we do not take a view on the future direction of rates and its implications, we believe top-line growers that offer margin improvement or solid free cash flow yields provide ballast on a relative basis. Against this set up, we look to find profitable growers that hold their top lines in 2020 and that our analysts expect will post stronger growth than before the pandemic. We refine this by including those with (a) margin tailwinds from operating leverage/ improved cost structure; and (b) valuation support in the form of robust near-term free cash flows.

Here we zeroed in on the top technology and biotech names and found four outstanding ideas for aggressive growth investors. It is still important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Amgen

This biotech giant remains a top stock for investors to buy and a safe way to play the massive potential growth in biosimilars. Amgen Inc. (NASDAQ: AMGN) has been a biotechnology pioneer since 1980 and has grown to be one of the world’s leading independent biotech companies. It has reached millions of patients around the world and is developing a pipeline of medicines with breakaway potential.

Amgen develops, manufactures and markets biologic therapies for oncology and inflammation. The company’s five key marketed products are among the top-selling pharmaceutical products in the world, with expected collective revenues of more than $25 billion in 2020.

Goldman Sachs sees a solid pipeline and noted this:

2021 should see strong commercial execution across the base business, favorable capital deployment, along with additional data on KRAS inhibitor Sotorasib. First-time 2021 guidance was in-line with consensus, but will likely prove conservative — particularly on the bottom line.

Shareholders receive a 2.98% dividend. The Goldman Sachs price target for the shares is $277, and the Wall Street consensus price target is $255.41. Amgen stock closed on Tuesday at $240.32 a share.

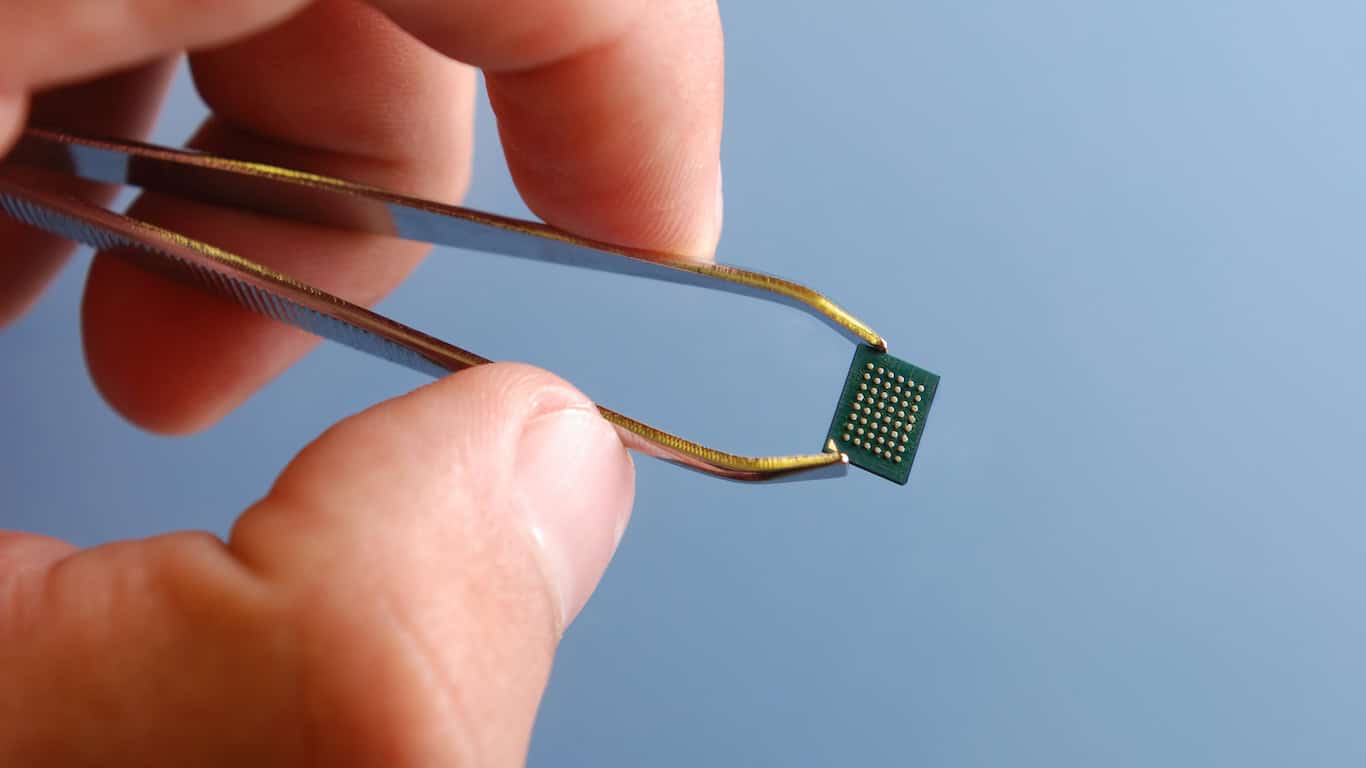

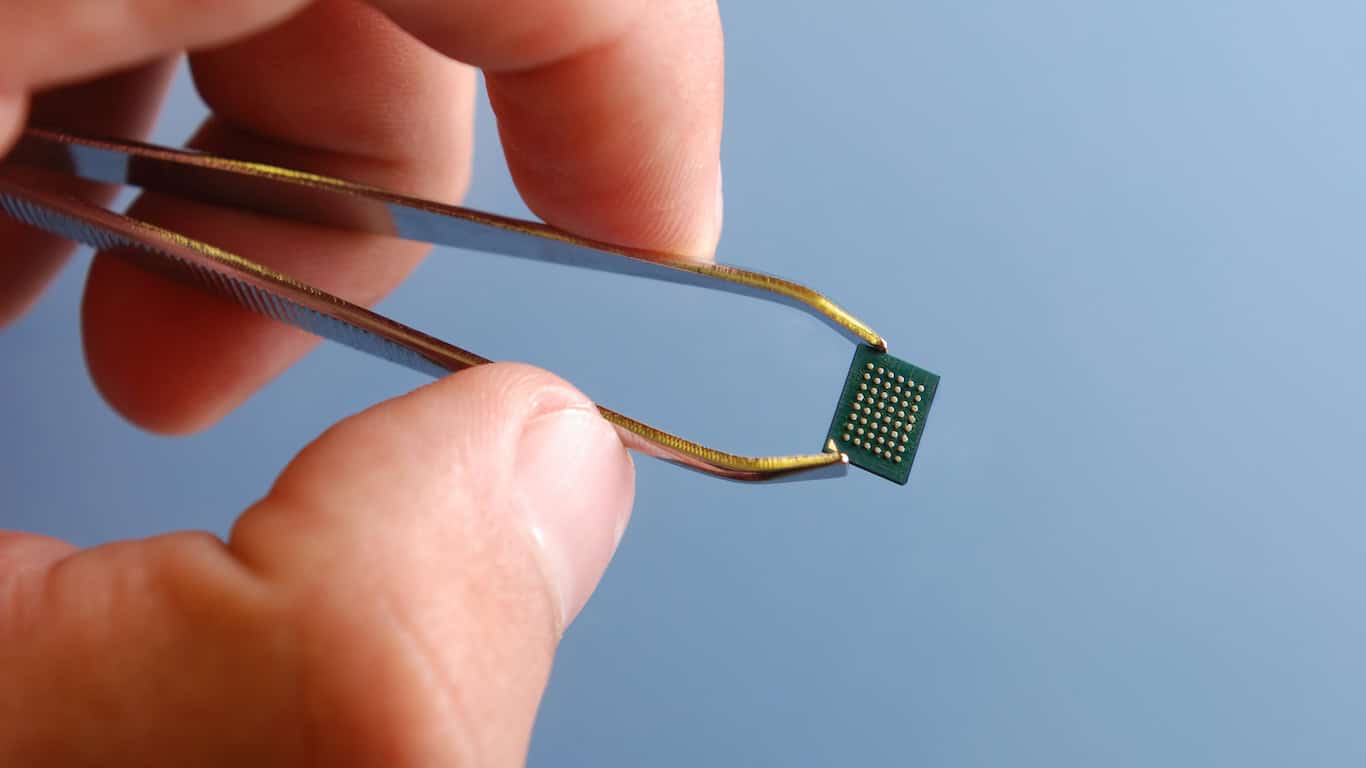

Applied Materials

This is one of the premier semiconductor capital equipment stocks. Applied Materials Inc. (NASDAQ: AMAT) provides manufacturing equipment, services and software to the semiconductor, display and related industries. It operates through three segments.

The Semiconductor Systems segment develops, manufactures and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits. This segment also offers various technologies, including epitaxy, ion implantation, oxidation/nitridation, rapid thermal processing, physical vapor deposition, chemical vapor deposition, chemical mechanical planarization, electrochemical deposition, atomic layer deposition, etching and selective deposition and removal, as well as metrology and inspection tools.

The Applied Global Services segment provides integrated solutions to optimize equipment and fab performance and productivity comprising spares, upgrades, services, remanufactured earlier generation equipment and factory automation software for semiconductor, display and other products.

The Display and Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes and other display technologies for TVs, monitors, laptops, personal computers, electronic tablets, smartphones and other consumer-oriented devices, as well as equipment for processing flexible substrates.

Investors receive just a 0.84% dividend. Goldman Sachs recently raised the price target to $133 from $118. The consensus target is right in line at $133.72. Applied Materials stock closed trading on Tuesday at $118.50, up over 3% on the day.

[in-text-ad]

Lam Research

This remains one of the top chip equipment picks across Wall Street. Lam Research Corp. (NASDAQ: LRCX) designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits worldwide.

The company offers ALTUS systems to deposit conformal films for tungsten metallization applications, SABRE electrochemical deposition products for copper damascene manufacturing, SOLA ultraviolet thermal processing products for film treatments and VECTOR plasma-enhanced chemical vapor deposition atomic layer deposition products.

It also provides SPEED gapfill high-density plasma chemical vapor deposition products and Striker single-wafer atomic layer deposition products that provide multiple dielectric film solutions. In addition, the company offers Flex for dielectric etch applications, Kiyo for conductor etch applications, Syndion for through-silicon via etch applications and Versys metal products for metal etch processes.

Lam Research’s Coronus bevel clean products enhance die yield. Its Da Vinci, DV-Prime, EOS and SP address a range of wafer cleaning applications, and Metryx mass metrology systems offer high precision in-line mass measurement in semiconductor wafer manufacturing.

Investors receive a 0.97% dividend. The $616 Goldman Sachs price target is well above the$592.43 consensus figure. Lam Research stock closed at $547.18 on Tuesday.

Qorvo

This company was formed from the merger of RF Micro Devices and Triquint Semiconductor back in 2015. Qorvo Inc. (NASDAQ: QRVO) is a leading provider of core technologies and RF solutions for mobile, infrastructure and aerospace/defense applications. Qorvo has more than 7,000 global employees dedicated to delivering solutions for everything that connects the world.

Qorvo exceeded investor expectations in 2020, as the company managed to grow revenue 18% based on fourth-quarter calendar company guidance, despite a double-digit percentage decline in global smartphone units and the geopolitical headwinds.

The analysts are very positive going forward and the report said this:

Positive content trajectory across mobile and its Infrastructure and Defense Products segments to drive robust revenue growth. Improving mix, continued capital discipline and execution on its ongoing cost down initiatives supports gross margin expansion and higher free-cash-flow margin, and in turn, balance sheet optionality.

Goldman Sachs has set a $191 price target, about the same as the $191.18 consensus target. Qorvo stock closed at $180.54, after rising over 2% on Tuesday.

Clearly, the analysts are favoring semiconductor capital equipment stocks, and with good reason. The chip sector has underperformed some over the past year, and demand for chips has ratcheted higher, especially in the auto arena. While better suited for investors with higher risk tolerance, these are all outstanding stocks for long-term portfolios. Plus, they have the important metrics the Goldman Sachs analysts feel could provide extra strength in a pricey stock market.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.