Here’s a quick look at some earnings reports that were released after markets closed on Wednesday or before Thursday’s opening bell.

With just over a month left in the current earnings season, the number of reports issued every day has dropped from a few hundred to a few dozen. Earlier this week, we had reports from Lordstown Motors, Nordstrom and Zscaler.

[in-text-ad]

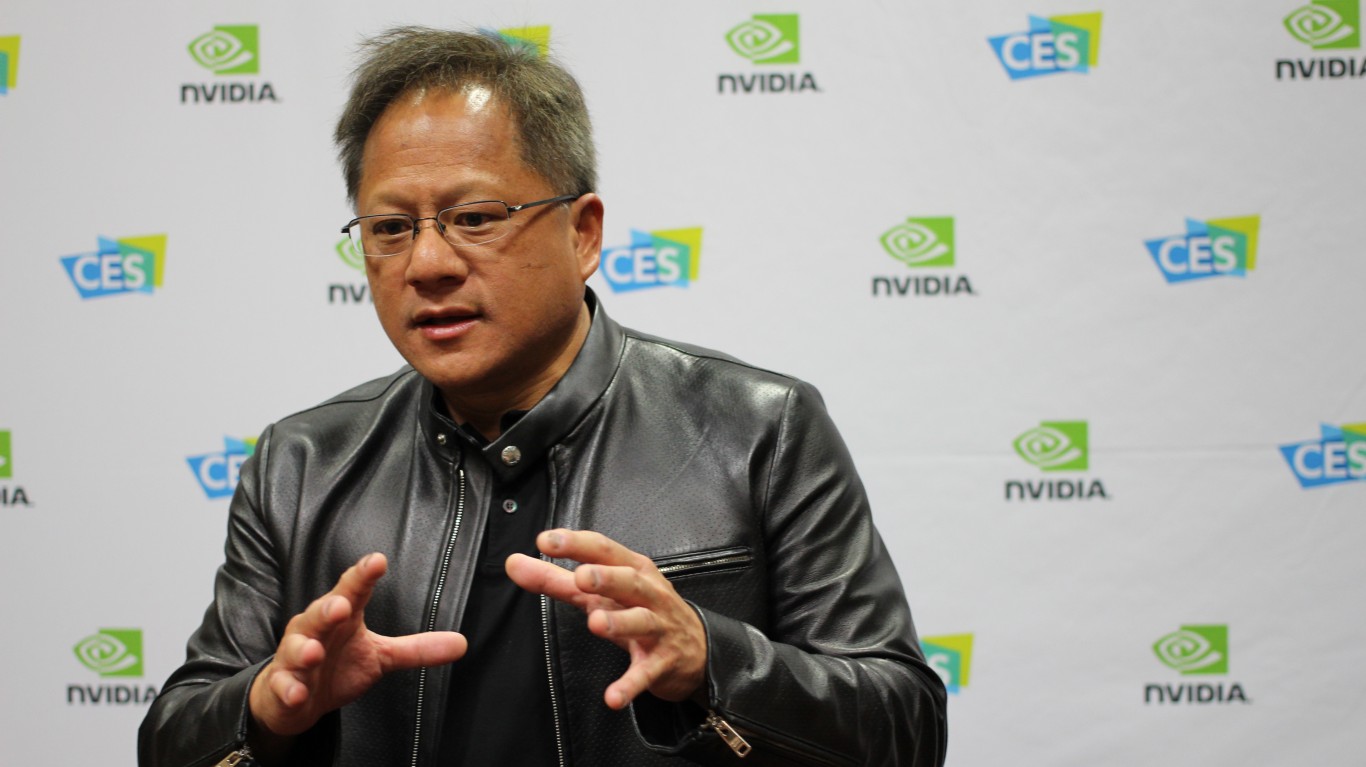

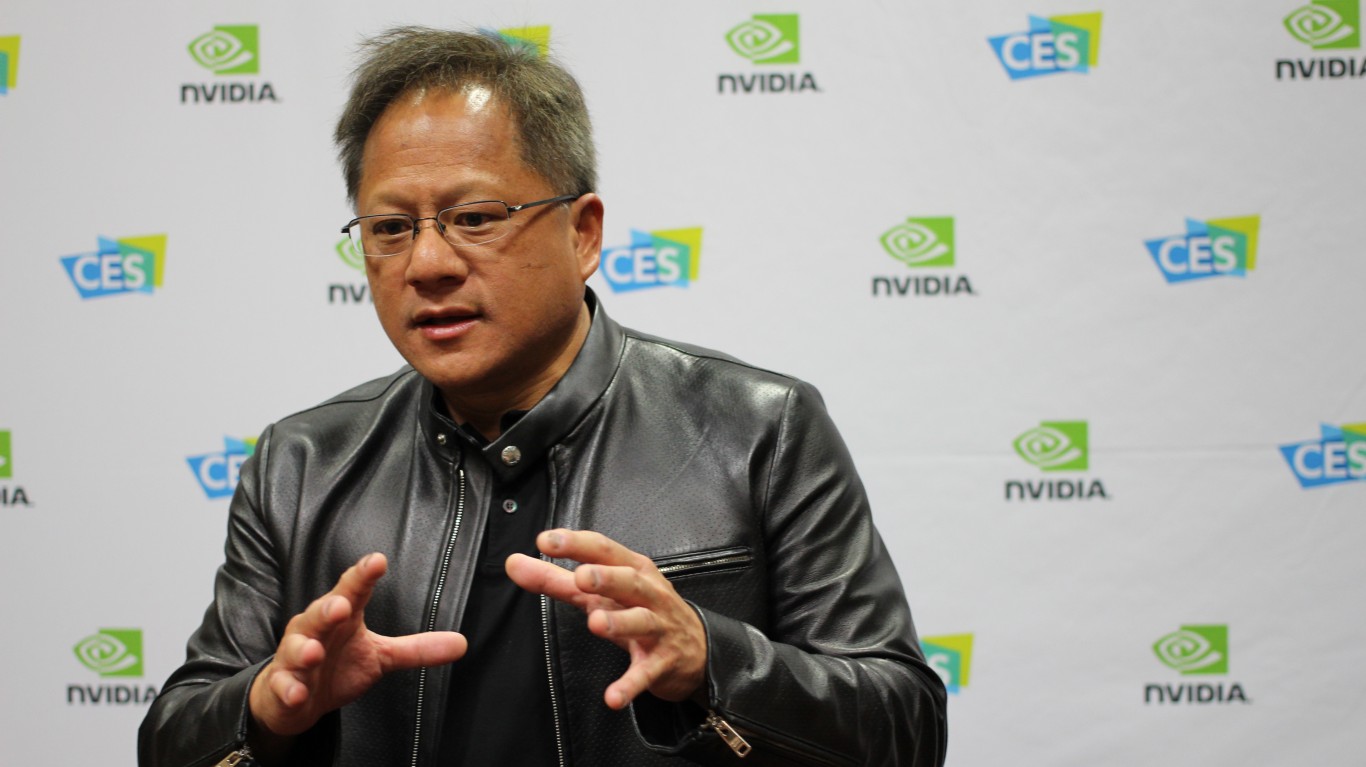

Nvidia

Chipmaker Nvidia Corp. (NASDAQ: NVDA) beat consensus estimates on both the top and bottom lines. Earnings per share (EPS) totaled $3.66, some 11.6% better than forecast. Revenue of $5.66 billion beat the forecast by 4.6%. Nvidia also raised revenue guidance for the current (second) fiscal quarter to a range of $6.15 billion to $6.43 billion, well above the S&P Capital IQ estimate of $5.48 billion.

The stock got only a small boost in Thursday’s premarket trading, and after the opening bell it was down less than 1% to $623.68. The 52-week trading range is $335.17 to $648.57, and the consensus price target is $669.16.

Pure Storage

Pure Storage Inc. (NYSE: PSTG) reported results Wednesday evening that exceeded both top-line and bottom-line expectations. EPS broke even, better than the expected loss per share of $0.06, and revenue of $412.7 million topped the forecast of $405.9 million.

The stock traded down about 2.5% to $18.71 early Thursday, in a 52-week range of $13.91 to $29.53. The consensus price target is $28.33.

Snowflake

Cloud platform supplier Snowflake Inc. (NYSE: SNOW) posted mixed results Wednesday evening, with revenue of $228.9 million (more than double year over year) beating the forecast of $213.4 million, while the expected loss per share of $0.16 came in much worse at $0.70. Snowflake guided fiscal second-quarter revenue to a range of $235 million to $240 million (up by around 90% year over year) and full fiscal year revenue in a range of $1.02 billion to $1.04 billion, up from its prior forecast of $1.0 billion to $1.02 billion.

Early Thursday, the stock traded down about 4%, at $226.24 in a post-IPO range of $184.71 to $429.00. The consensus price target is $296.28.

Best Buy

Best Buy Co. Inc. (NYSE: BBY) posted solid beats on both EPS and revenue Thursday morning. The electronics retailer reported EPS of $2.23, which was 57% better than expected, and revenue totaling $11.64 billion, nearly 12% above the forecast. Enterprisewide same-store sales rose 37.2% year over year. The company said it expects same-store sales to rise by 3% to 6% for the 2022 fiscal year, sharply better than the prior forecast for a range of a 2% loss to a 1% gain.

The stock traded up about 3.1% to $120.68, in a 52-week range of $75.27 to $128.57. The consensus price target on the stock is $118.85.

Medtronic

Medical device maker Medtronic PLC (NYSE: MDT) reported Thursday morning that EPS totaled $1.50 for its fiscal fourth quarter and revenue came to $8.19 billion. The company guided fiscal 2022 EPS in a range of $5.60 to $5.75, compared to the S&P Capital IQ consensus of $5.72. Medtronic also increased its cash dividend beginning with the first quarter of fiscal 2022 to $0.63 per quarter, a jump of 9%. The annual dividend will rise from $2.32 to $2.52.

The stock traded up slightly early Thursday to $126.54. The 52-week range is $87.68 to $132.30, and the consensus price target is $135.11.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.