On February 23, 2023 at 15:05:23 (ET) an unusually large $62.50K block of Put contracts in Viewray (VRAY) was sold, with a strike price of $4.50 / share, expiring in 22 days (on March 17, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 1.41 sigmas above the mean, placing it in the 99.77 percentile of all recent large trades made in VRAY options.

Analyst Price Forecast Suggests 65.59% Upside

As of February 22, 2023, the average one-year price target for Viewray is $7.29. The forecasts range from a low of $5.56 to a high of $8.40. The average price target represents an increase of 65.59% from its latest reported closing price of $4.40.

The projected annual revenue for Viewray is $139MM, an increase of 58.68%. The projected annual EPS is -$0.57.

What is the Fund Sentiment?

There are 337 funds or institutions reporting positions in Viewray. This is an increase of 13 owner(s) or 4.01% in the last quarter. Average portfolio weight of all funds dedicated to VRAY is 0.17%, a decrease of 27.23%. Total shares owned by institutions decreased in the last three months by 6.79% to 168,448K shares. The put/call ratio of VRAY is 3.02, indicating a bearish outlook.

What are large shareholders doing?

Artisan Partners Limited Partnership holds 16,679K shares representing 9.19% ownership of the company. In it’s prior filing, the firm reported owning 17,243K shares, representing a decrease of 3.38%. The firm increased its portfolio allocation in VRAY by 19.73% over the last quarter.

Hudson Executive Capital holds 15,752K shares representing 8.68% ownership of the company. No change in the last quarter.

Pura Vida Investments holds 12,549K shares representing 6.92% ownership of the company. In it’s prior filing, the firm reported owning 13,665K shares, representing a decrease of 8.89%. The firm increased its portfolio allocation in VRAY by 0.77% over the last quarter.

ARTJX – Artisan International Small-Mid Fund Investor Shares holds 11,030K shares representing 6.08% ownership of the company. In it’s prior filing, the firm reported owning 10,892K shares, representing an increase of 1.25%. The firm increased its portfolio allocation in VRAY by 48.57% over the last quarter.

Neuberger Berman Group holds 9,864K shares representing 5.44% ownership of the company. In it’s prior filing, the firm reported owning 9,126K shares, representing an increase of 7.49%. The firm decreased its portfolio allocation in VRAY by 99.94% over the last quarter.

ViewRay Background Information

(This description is provided by the company.)

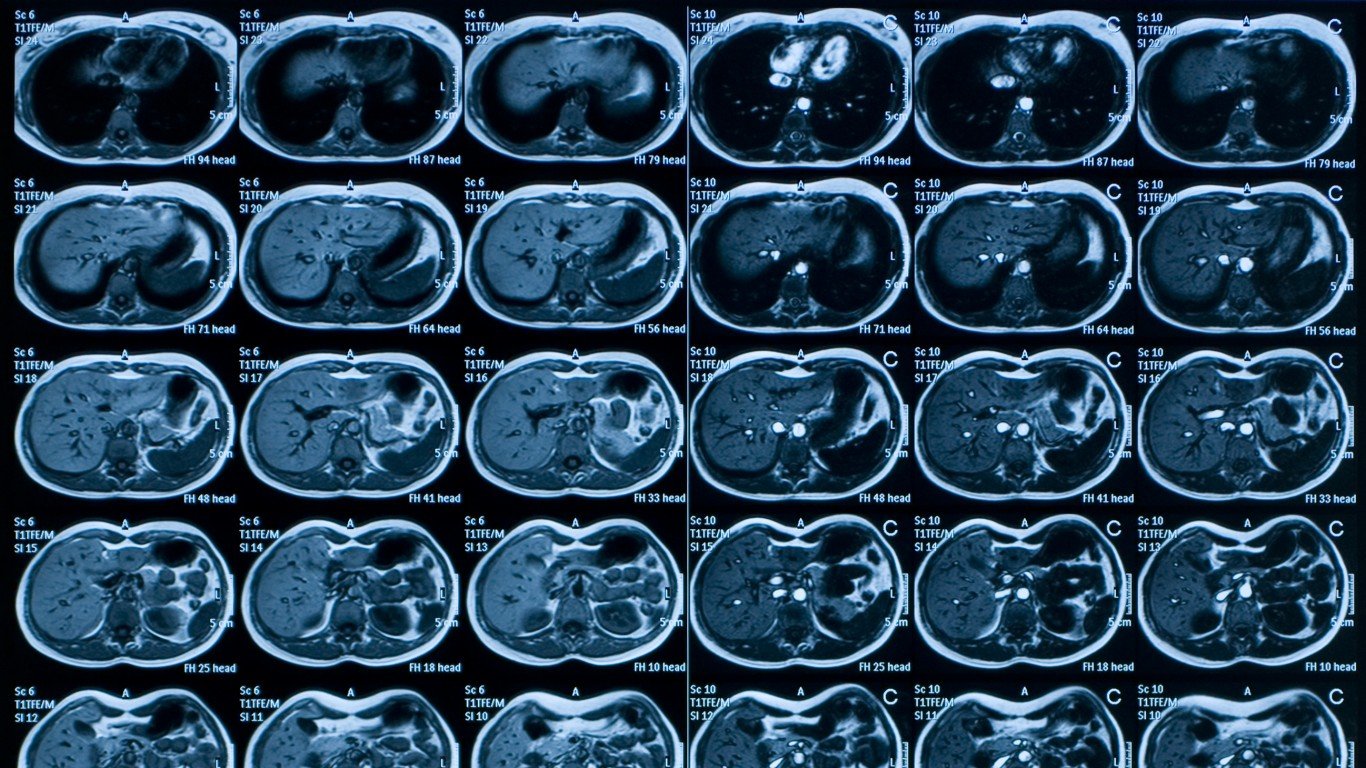

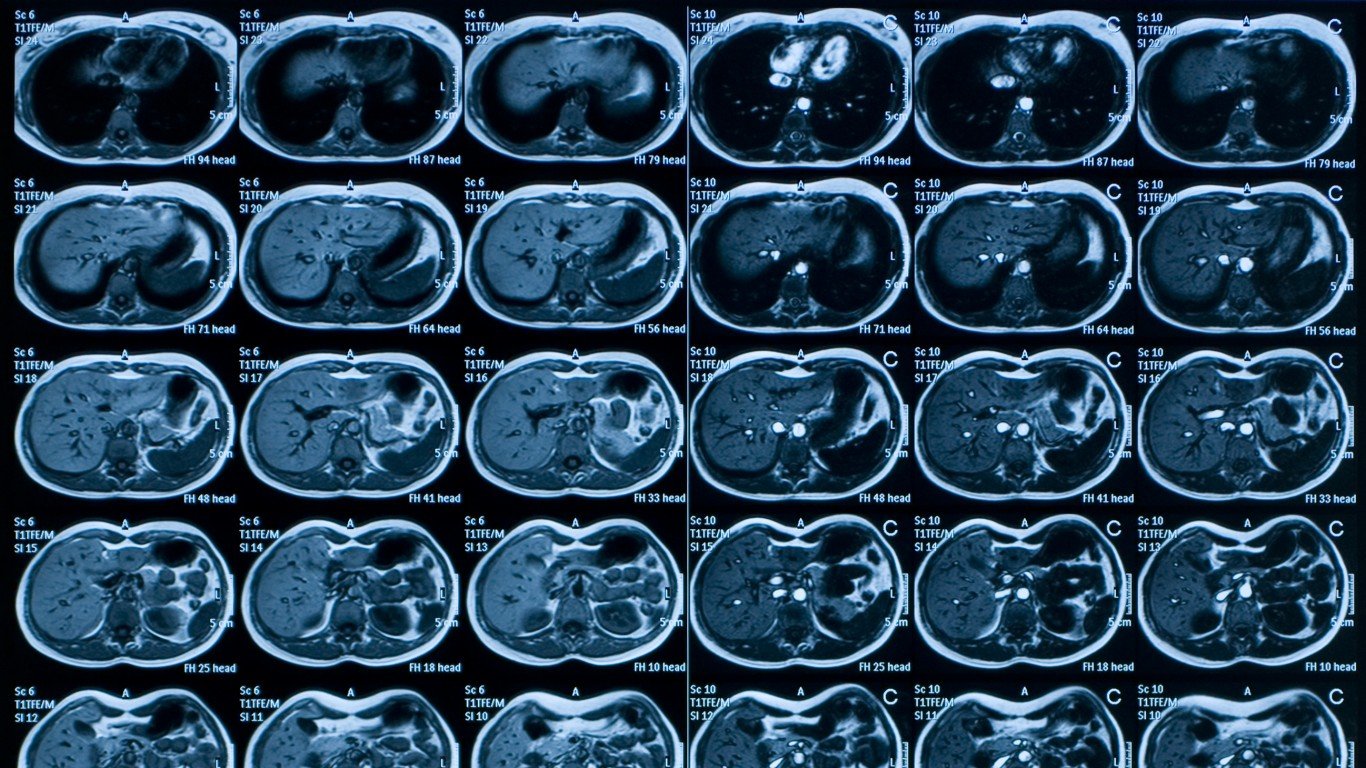

ViewRay, Inc., designs, manufactures, and markets the MRIdian® MR-Guided Radiation Therapy System. MRIdian is built upon a proprietary high-definition MR imaging system designed from the ground up to address the unique challenges and clinical workflow for advanced radiation oncology. Unlike MR systems used in diagnostic radiology, MRIdian’s high-definition MR was purpose-built to address specific challenges, including beam distortion, skin toxicity, and other concerns that potentially may arise when high magnetic fields interact with radiation beams. ViewRay and MRIdian are registered trademarks of ViewRay, Inc.

This article originally appeared on Fintel

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.