On March 14, 2023, Cantor Fitzgerald initiated coverage of Cipher Mining with a Overweight recommendation.

Analyst Price Forecast Suggests 68.13% Upside

As of March 14, 2023, the average one-year price target for Cipher Mining is $3.06. The forecasts range from a low of $3.03 to a high of $3.15. The average price target represents an increase of 68.13% from its latest reported closing price of $1.82.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Cipher Mining is $105MM. The projected annual non-GAAP EPS is -$0.17.

What are Large Shareholders Doing?

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 1,308K shares representing 0.53% ownership of the company. No change in the last quarter.

VITAX – Vanguard Information Technology Index Fund Admiral Shares holds 942K shares representing 0.38% ownership of the company. In it’s prior filing, the firm reported owning 243K shares, representing an increase of 74.20%. The firm increased its portfolio allocation in CIFR by 56.09% over the last quarter.

Geode Capital Management holds 877K shares representing 0.35% ownership of the company. In it’s prior filing, the firm reported owning 917K shares, representing a decrease of 4.62%. The firm decreased its portfolio allocation in CIFR by 60.75% over the last quarter.

IWM – iShares Russell 2000 ETF holds 831K shares representing 0.34% ownership of the company. In it’s prior filing, the firm reported owning 796K shares, representing an increase of 4.25%. The firm decreased its portfolio allocation in CIFR by 57.96% over the last quarter.

Renaissance Technologies holds 645K shares representing 0.26% ownership of the company. In it’s prior filing, the firm reported owning 35K shares, representing an increase of 94.56%. The firm increased its portfolio allocation in CIFR by 693.47% over the last quarter.

What is the Fund Sentiment?

There are 174 funds or institutions reporting positions in Cipher Mining. This is a decrease of 1 owner(s) or 0.57% in the last quarter. Average portfolio weight of all funds dedicated to CIFR is 0.08%, a decrease of 2.41%. Total shares owned by institutions decreased in the last three months by 58.00% to 15,460K shares. The put/call ratio of CIFR is 0.41, indicating a bullish outlook.

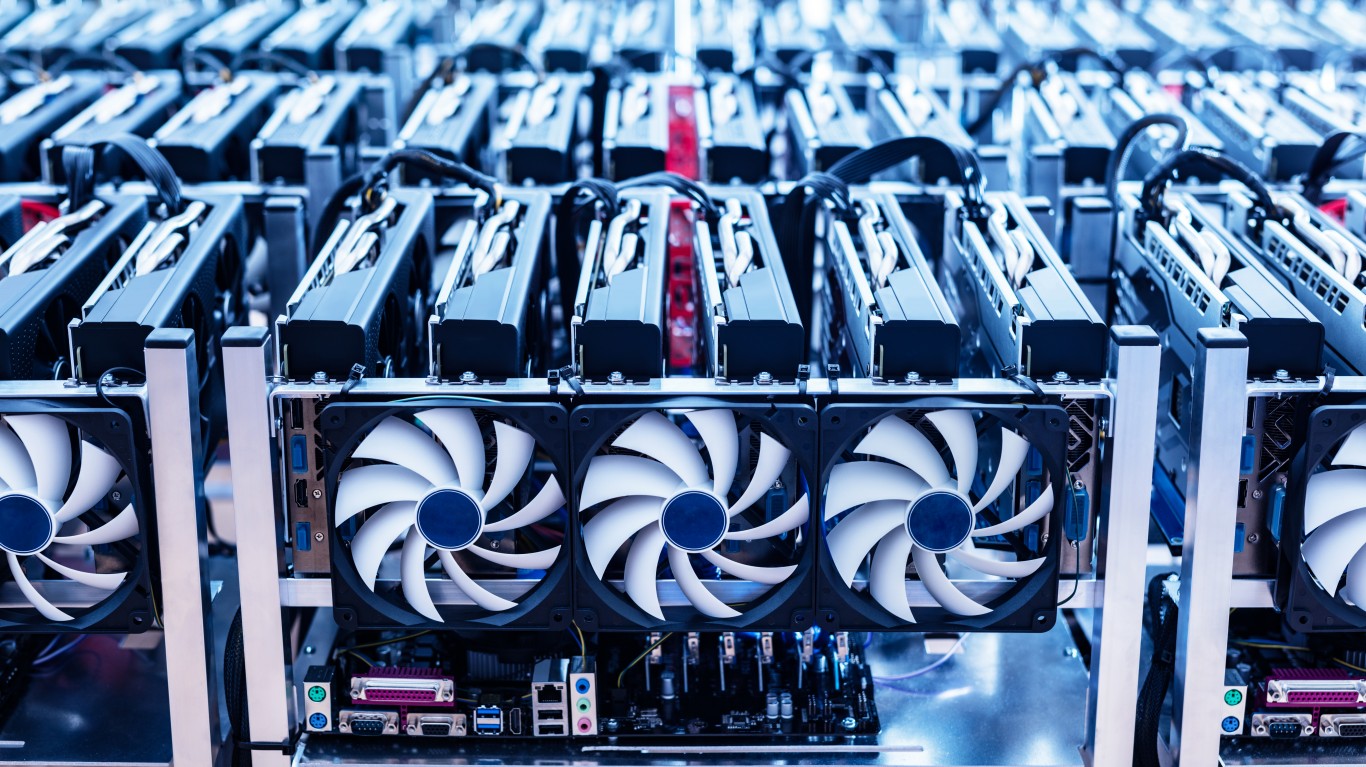

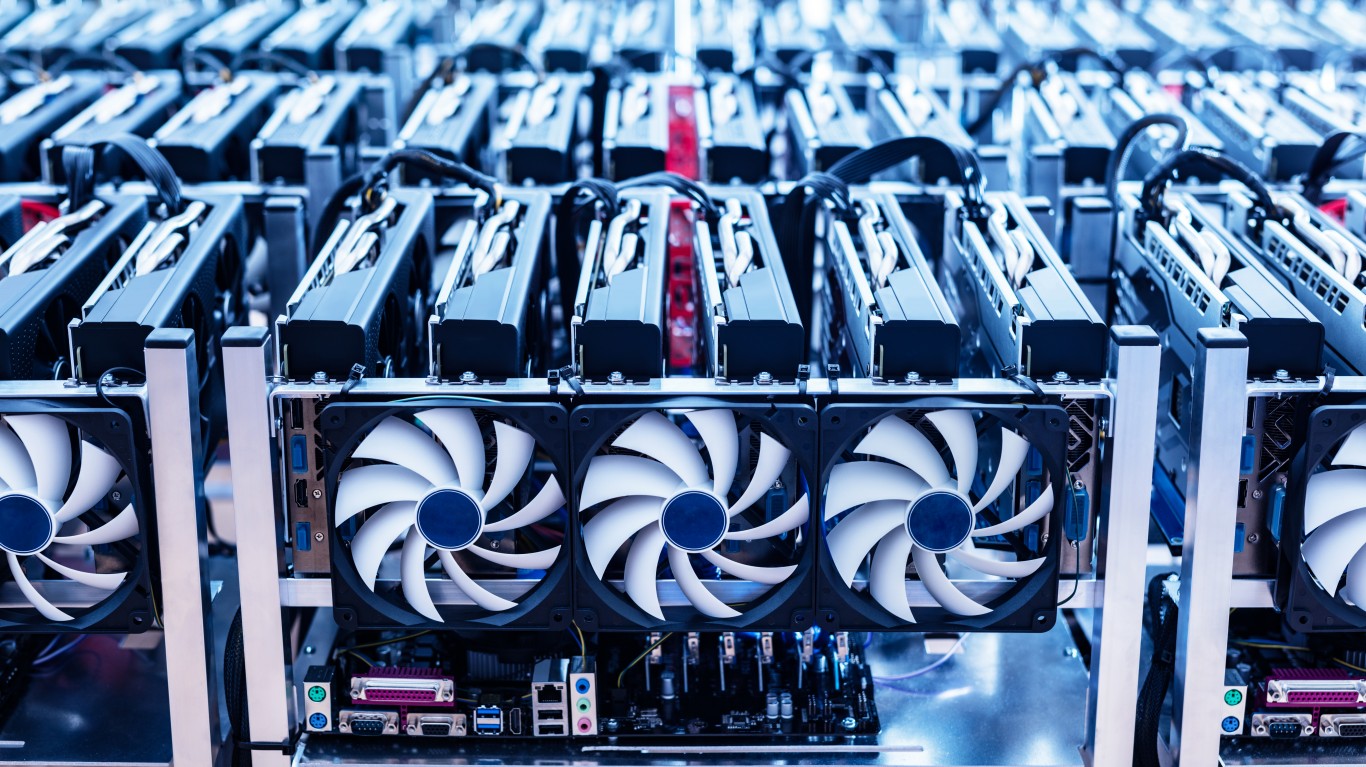

Cipher Mining Background Information

(This description is provided by the company.)

Cipher Mining, Inc. operates as a Bitcoin mining ecosystem in the United States.

This article originally appeared on Fintel

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.