Strategy (NASDAQ:MSTR) has bet everything on Bitcoin (CRYPTO:BTC), transforming from a software firm into the world’s largest corporate holder of the digital asset. But 2025’s crypto winter has frozen that strategy, with bitcoin prices sliding amid interest rate uncertainty and macroeconomic headwinds. A $1,000 investment in Strategy at the start of the year would now be worth about $637, a 37% drop, while the S&P 500 has climbed 16% on tech and AI gains.

Online defenders on X and in chat rooms hail chairman Michael Saylor as a 4D chess master, outmaneuvering a market that is playing checkers. This sentiment intensified after Saylor’s recent pivot: After years of vowing to “never sell Bitcoin,” he admitted Strategy might offload the crypto to cover dividends if its market net asset value (mNAV) — a ratio of market cap to Bitcoin holdings — dips below 1 for an extended period.

With Bitcoin rebounding above $91,000, the question lingers: Is Saylor the visionary chess grandmaster, or is this just high-stakes speculation that is unraveling?

The Sell-and-Rebuy Plan: Just a House of Cards?

Saylor’s defenders spin his potential Bitcoin sales as 4D brilliance: Dump coins to tank prices, then scoop up more at a discount, tightening supply and boosting Strategy’s per-share holdings. It’s a cycle of engineered volatility to amplify gains. But this isn’t chess — it’s a speculative gamble loaded with risks for retail investors chasing the hype.

The core issue is its execution relies on perfect timing in an unpredictable market. If sales trigger a deeper crypto rout, Strategy could face forced liquidations, eroding confidence and spiraling losses. Worse, the plan ignores Strategy’s core weakness: relentless shareholder dilution to fund Bitcoin buys.

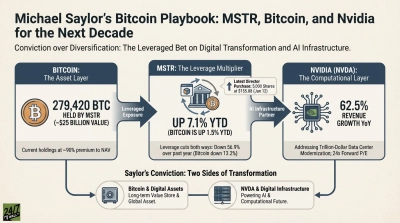

Throughout 2025, Strategy has issued millions of new shares through at-the-market offerings, raising billions but slashing existing holders’ stakes by over 22% year-to-date. This isn’t value creation — it’s an erosion of shareholder value, turning Strategy into a leveraged Bitcoin proxy with extra fees.

Borrowing Against a Volatile Dream

Adding fuel to the fire, Strategy’s balance sheet groans under $8.2 billion in convertible debt (and another $7.8 billion in stock), much of it low-interest notes issued to buy Bitcoin at peaks. Saylor recently raised $1.4 billion by selling stock, earmarking it for a USD reserve to service preferred dividends and interest payments — an admission his “never sell” mantra has limits. This buffer covers 21 months of payments, but it’s a bandage on a gushing wound.

As mNAV currently hovers near the 1.0 threshold — but has dipped below the mark several times — markets are souring. Will investors keep snapping up shares at declining values or subscribe to fresh debt? History says no: Bond yields on Strategy’s offerings have spiked 200 basis points in 2025, reflecting ballooning risk.

Higher rates mean steeper interest costs, squeezing cash flow just as Bitcoin’s volatility bites deep. If rates climb further to 7% to 8%, Strategy’s debt service could devour 40% of operating revenue, forcing more dilution or sales. Saylor’s “digital credit” vision sounds innovative, but it’s scrambling to plug leaks in a ship listing from over-leverage.

Cracks in the Foundation

Beyond the headlines, deeper flaws expose this as damage control, not mastery. Strategy’s software business, once its backbone, now generates just $500 million annually — peanuts against $49 billion in Bitcoin holdings (Strategy bought nearly $1 billion more last week) — yet funds none of the frenzy.

Regulatory clouds loom, too, as the SEC probes the broad crypto treasury strategy along with a global crypto crackdown, such as the EU’s MiCA rules, that threaten liquidity.

Insider moves raise eyebrows, too. Saylor’s personal Bitcoin evangelism pumps retail excitement, but Strategy’s board approved a 10x share authorization increase earlier this year, priming the stock for endless dilution. And with mNAV breaches correlating to 15% stock drops, short interest has risen above 10%, betting on an unwind. These aren’t chess moves; they’re desperate patches hoping Bitcoin’s recovery bails out the bet.

Key Takeaway

Unwavering trust in any guru, whether Saylor or Warren Buffett, breeds disaster. Hero worship and metaphors like “4D chess” distract from performing due diligence, luring small investors into overvalued traps. Skepticism isn’t cynicism; it’s a survival instinct.

Bitcoin holds long-term promise as digital gold, but nothing’s guaranteed as volatility cuts both ways. Famed economist John Maynard Keynes once noted the market can stay irrational longer than you can stay solvent. It was an admonition against shorting, but HODLing through steep drawdowns can bankrupt you just as fast if conviction overrides facts.