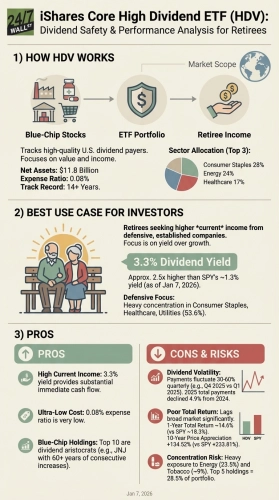

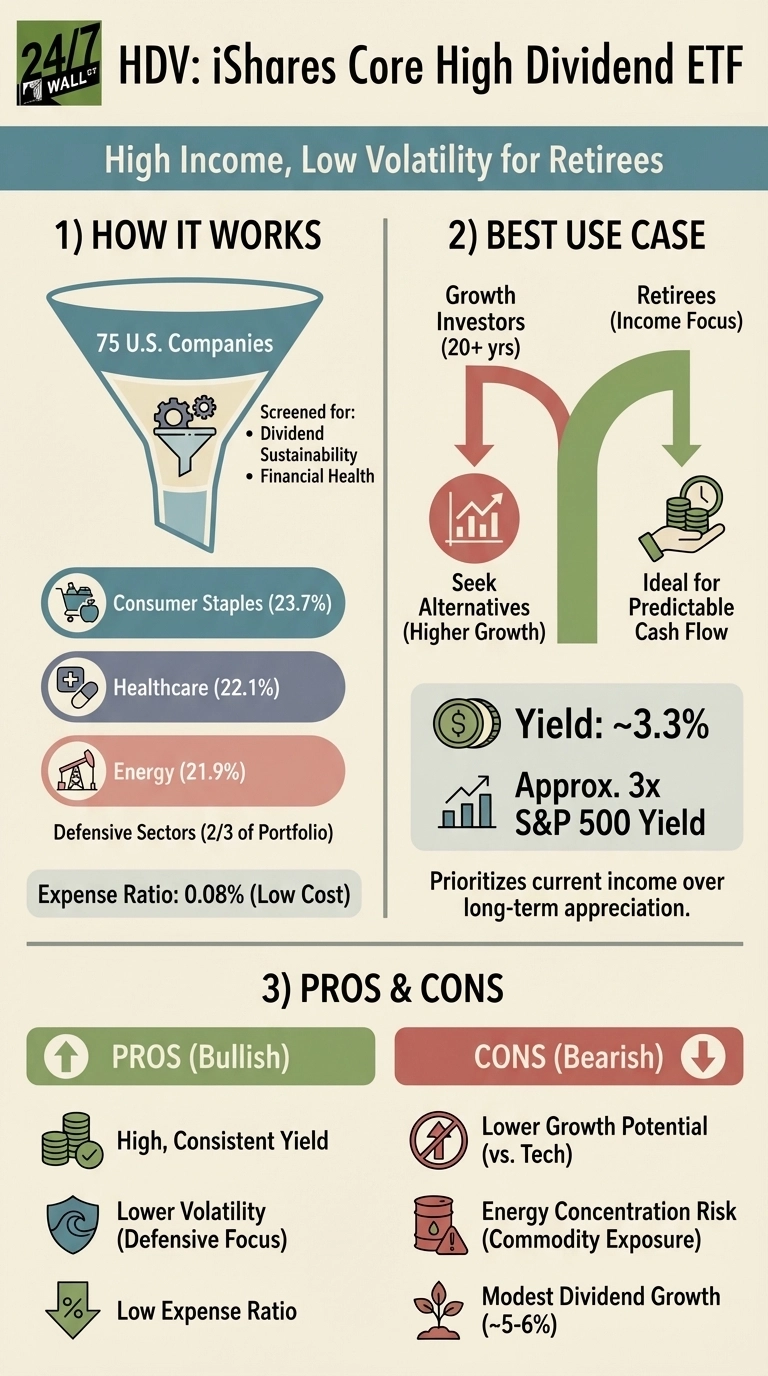

When income matters more than growth, retirees turn to funds that deliver quarterly checks without volatility. The iShares Core High Dividend ETF (NYSEARCA:HDV) yields 3.3%, triple the S&P 500’s 1.03%. That difference translates to predictable cash flow for investors who need their portfolio to pay bills.

Built for Income, Not Speculation

HDV tracks 75 U.S. companies screened for dividend sustainability and financial health. The fund concentrates in defensive sectors where cash flow holds up when growth stocks stumble. Consumer staples make up 23.7% of holdings, healthcare 22.1%, and energy 21.9%. These three sectors represent two-thirds of the portfolio.

Top holdings include Exxon Mobil (NYSE:XOM) at 8.9%, Johnson & Johnson (NYSE:JNJ) at 7.1%, and AbbVie (NYSE:ABBV) at 6.2%. These are established dividend payers with decades of operating history. The fund’s 0.08% expense ratio keeps costs low.

Quarterly dividends have been consistent. In 2024, HDV paid $4.115 per share. In 2025, payments totaled $3.911 through December. Over the past three years, dividends grew 5.7% from 2023 to 2024.

Does It Work for Retirees?

The fund delivers on its income promise. Across Reddit’s dividend investing communities, HDV appears frequently in retirement portfolio discussions. One investor seeking a 3% yield with inflation protection received a straightforward recommendation: “HDV, VYM, SCHD. Then enjoy your life.”

HDV gained roughly 11% in 2025 including dividends, recovering from an April drawdown that saw shares drop 13% from March highs. The fund’s defensive positioning tends to cushion declines compared to growth-heavy alternatives.

The Tradeoffs You Accept

Energy concentration creates commodity exposure. When oil prices fall, HDV’s top holdings feel it. The 21.9% energy weighting is nearly double the S&P 500’s allocation, amplifying both upside and downside.

Dividend growth lags the best dividend aristocrats. While HDV’s payouts have increased modestly, the fund prioritizes current yield over growth. Investors who want dividends that meaningfully outpace inflation may find the 5-6% annual growth insufficient.

Tax efficiency matters in taxable accounts. ETF distributions can include return of capital or short-term gains depending on portfolio turnover. HDV’s 82% turnover is moderate but worth noting for tax planning.

Who Should Avoid HDV

Growth investors building wealth for retirement in 20 years don’t need this fund. The defensive positioning that protects retirees also limits upside when technology and growth sectors lead.

Income seekers who need 5% or higher yields should look elsewhere. HDV’s 3.3% is solid, but covered call strategies and higher-risk income funds offer more.

Consider SCHD as an Alternative

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) yields 3.8% and emphasizes dividend growth more aggressively than HDV. SCHD holds 104 stocks selected for 10-year dividend growth track records. Its sector allocation tilts less toward energy and more toward industrials and financials.

SCHD’s expense ratio is 0.06%, two basis points lower than HDV. Its dividend growth has outpaced HDV historically, making it a better fit for retirees who want income that keeps up with rising costs. The tradeoff is slightly more volatility during energy rallies.

HDV works best for retirees who prioritize current income over growth and accept energy sector concentration as the price of a 3.3% yield.