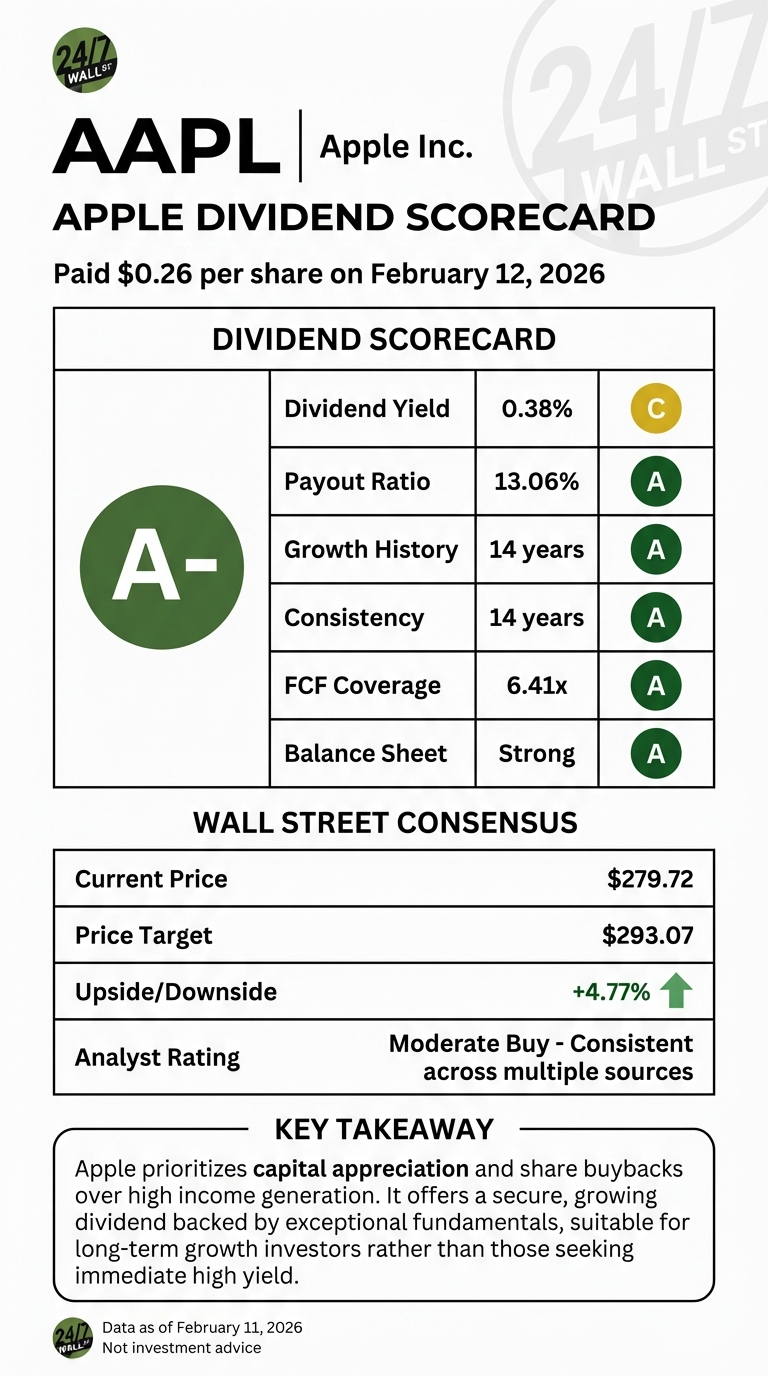

Apple (Nasdaq: AAPL) | AAPL Price Prediction just distributed $0.26 per share to shareholders on February 12, 2026, marking another quarterly payment in the company’s uninterrupted dividend streak spanning over a decade. With a current yield of 0.38% and shares trading at $279.72, Apple’s dividend profile reflects a company prioritizing capital appreciation and share buybacks over income generation. Here’s how the tech giant’s dividend stacks up across key sustainability metrics.

Dividend Grade: A-

Apple earns an A- grade for dividend quality, driven by exceptional coverage ratios and robust cash generation despite a yield well below market averages. The company’s 13.06% payout ratio leaves substantial room for future increases, while operating cash flow of $111.5 billion in fiscal 2025 covered dividends by 7.23 times. This cushion positions Apple to maintain payments even during market downturns.

The grade reflects a tension between safety and income. Apple’s dividend is extraordinarily secure — backed by $435.6 billion in trailing revenue and 27% profit margins — but the 0.38% yield trails both the 2.45% average of the Vanguard High Dividend Yield ETF and the broader income-focused universe. Investors seeking current income will find better yields elsewhere; those prioritizing safety and growth potential will appreciate Apple’s fortress balance sheet.

Recent Dividend Growth

Apple increased its quarterly dividend from $0.25 to $0.26 per share in May 2025, representing a 4% increase. The current annualized rate stands at $1.04 per share, up from $1.00 the prior year. While modest, this growth trajectory has remained consistent since Apple reinstated dividends in 2012 after a 16-year hiatus.

The company’s capital allocation strategy favors share repurchases over aggressive dividend hikes. In fiscal 2025, Apple returned $106.1 billion to shareholders through $15.4 billion in dividends and $90.7 billion in buybacks. This 6-to-1 ratio demonstrates management’s preference for reducing share count — a strategy that benefits long-term holders through earnings-per-share accretion rather than immediate income.

Cash Flow Coverage and Sustainability

Apple’s dividend sustainability is among the strongest in technology. The most recent quarter showed operating cash flow of $53.9 billion covering the $3.9 billion quarterly dividend by 13.76 times. Free cash flow of $98.8 billion in fiscal 2025 provides ample cushion for both dividends and buybacks while funding $12.7 billion in capital expenditures.

The company’s $152.9 billion in EBITDA and 35.4% operating margin underscore operational efficiency. With quarterly earnings growth of 18.3% year-over-year, Apple generates sufficient cash to support dividend growth without straining the balance sheet. The 13.06% payout ratio means the company could theoretically increase dividends sevenfold before reaching a 100% payout threshold, an unlikely scenario but one illustrating the dividend’s safety margin.

Total Return Context

While the 0.38% yield appears underwhelming, Apple’s total return profile compensates. The stock has gained 20.76% over the past year and 112.13% over five years, delivering substantial capital appreciation alongside its dividend payments. Combined with dividends, this performance positions Apple as a growth-oriented holding that happens to pay dividends rather than a traditional income investment.

The company’s $4.02 trillion market capitalization and trailing P/E of 34.73 reflect investor confidence in continued capital appreciation. For income-focused portfolios, Apple’s contribution will remain minimal. For balanced portfolios seeking quality companies with modest but growing dividends backed by exceptional fundamentals, Apple’s A- grade reflects a dividend that prioritizes sustainability and long-term growth over immediate yield.