Bank of Montreal (NYSE:BMO) operates one of Canada’s largest diversified financial institutions, spanning Canadian personal and commercial banking, U.S. banking, wealth management, and capital markets. After a strong fiscal 2025, the bank declared a quarterly dividend of $1.67 CAD per share for Q1 2026, a 5% increase year-over-year. The current yield sits at 4.61%. With 27 years of uninterrupted payments and consistent quarterly increases, can BMO sustain this dividend through economic cycles?

| Metric | Value |

|---|---|

| Annual Dividend | $6.44 per share |

| Dividend Yield | 4.61% |

| Most Recent Increase | 5% (Q1 2026) |

| Payment History | 27 years without suspension |

The Payout Ratios Look Comfortable

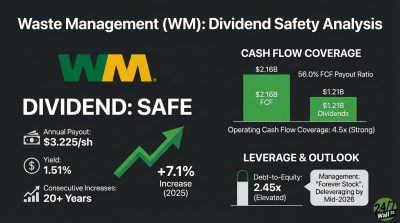

BMO’s earnings payout ratio stands at 77%, calculated from annual dividends of $6.44 against trailing twelve-month earnings per share of $8.36. This leaves room for dividend maintenance even if earnings dip modestly. For fiscal 2025, the bank paid $5.03 billion in dividends against $8.51 billion in free cash flow, producing a 59% free cash flow payout ratio. That’s healthy territory, providing a meaningful cushion.

| Metric | FY2025 Value | Assessment |

|---|---|---|

| Earnings Payout Ratio | 77% | Elevated but manageable |

| FCF Payout Ratio | 59% | Healthy |

| Operating Cash Flow | $10.24B | Strong coverage |

Operating cash flow of $10.24 billion exceeded the dividend outlay by more than 2x. The bank maintained its dividend even during quarters with negative operating cash flow in Q2 and Q3 2025, relying on cash reserves and overall annual cash generation rather than cutting payments during temporary working capital swings.

Balance Sheet Strength With Some Leverage

BMO’s balance sheet shows $88.1 billion in shareholder equity against $1.48 trillion in total assets as of fiscal year-end 2025. The debt-to-equity ratio sits at 4.71x, up from 4.43x the prior year. That’s elevated but typical for large banks. The capital position remains solid with a CET1 ratio of 13.3%, down slightly from 13.5% last quarter but still well-capitalized by regulatory standards.

| Metric | Value | Assessment |

|---|---|---|

| Debt-to-Equity | 4.71x | Elevated but typical for banks |

| CET1 Ratio | 13.3% | Well-capitalized |

| Cash on Hand | $70.3B | Adequate liquidity |

The rising leverage warrants attention, but the bank’s strong return on equity of 10.1% and improving credit quality support the dividend. Provision for credit losses dropped sharply to $755 million in Q4 2025 from $1.52 billion the prior year, a positive signal for earnings stability.

Management Signals Confidence

CEO Darryl White stated on the Q4 earnings call: “We’re deploying capital to drive future growth and higher shareholder returns.” The bank also repurchased 8 million shares during Q4 2025, demonstrating capital allocation flexibility beyond the dividend. The combination of buybacks and dividends returned nearly all free cash flow to shareholders in fiscal 2025, showing confidence but leaving limited retained cash for unexpected downturns.

This Dividend Looks Secure

Dividend Safety Rating: Safe

BMO’s dividend is well-supported by earnings and free cash flow, with a 59% FCF payout ratio providing room for economic softness. The 27-year payment streak and recent 5% increase reflect management confidence. Watch the rising debt-to-equity ratio and ensure credit quality trends remain favorable, but the current dividend appears sustainable through normal business cycles.