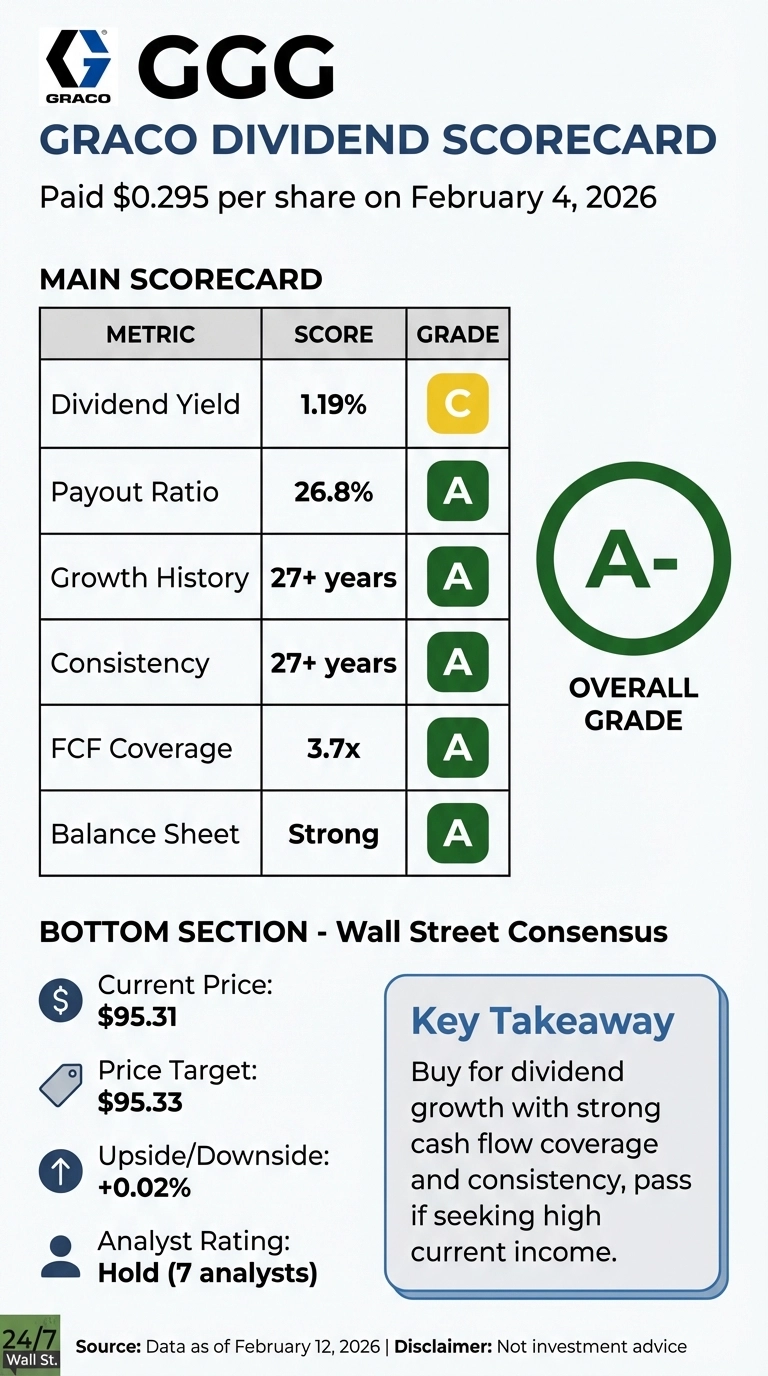

Graco just paid investors $0.295 per share on February 4, 2026, marking the company’s 27th consecutive year of quarterly dividend payments. This industrial equipment manufacturer has quietly built one of the more consistent dividend growth records in the specialty machinery sector, with a 5-year compound annual growth rate of approximately 9.4%. But consistency alone doesn’t tell the full story—investors need to understand whether this dividend is sustainable, how it stacks up against peers, and what the latest financials reveal about Graco’s ability to keep raising payouts.

The Dividend Profile: Modest Yield, Strong Growth

Graco’s current dividend yield sits at just 1.19%, well below the yields offered by traditional income stocks in sectors like telecommunications or consumer staples. AT&T yields 4.05%, Verizon delivers 5.77%, and General Mills offers 4.97%. Even within industrials, Caterpillar’s yield of 0.8% trails Graco by only 39 basis points.

The trade-off becomes clear when examining dividend growth. Graco increased its quarterly payout from $0.275 in Q1 2025 to $0.295 in Q1 2026—a 7.3% year-over-year increase. Compare that to AT&T, which has maintained its quarterly dividend at $0.2775 for 13 consecutive quarters following a 46.6% cut in early 2022. Verizon has raised its dividend for 19 consecutive quarters, but recent increases have been modest—ranging from 1.88% to 3.73%.

Financial Foundation: Cash Flow Tells the Real Story

Dividend sustainability hinges on cash generation, not just reported earnings. Graco generated $683.6 million in operating cash flow during fiscal 2025 while paying out $183.4 million in dividends—a payout ratio of just 26.8%. That coverage ratio of 3.7x provides substantial cushion for continued dividend growth even if business conditions soften.

The company’s free cash flow of $637.9 million (after $45.7 million in capital expenditures) left $454.6 million available after dividend payments. Graco deployed much of that excess cash toward $423.1 million in share repurchases—a capital allocation strategy that prioritizes shareholder returns while maintaining conservative dividend payout ratios.

The earnings picture reinforces this financial strength. Graco reported $521.8 million in net income for fiscal 2025 on revenue of $2.24 billion, translating to a 23.3% net profit margin. That profitability has remained remarkably stable—net margins have held in the 23%+ range across the past three fiscal years despite varying revenue growth rates.

Peer Comparison: Different Strategies, Different Outcomes

Bristol Myers Squibb offers an instructive contrast in dividend strategy. The pharmaceutical giant raised its quarterly dividend to $0.63 in Q1 2026, marking its 17th consecutive annual increase. With a current yield of 4.09%, BMY delivers more than three times Graco’s income—but faces patent cliff concerns on key drugs like Eliquis that could pressure future growth.

CVS Health maintained its quarterly dividend at $0.665 through 2024 and 2025, yielding 3.51%. The healthcare giant generated $105.7 billion in Q4 2025 revenue, but lowered its 2026 cash flow guidance to at least $9 billion amid regulatory investigations and Medicare Advantage reimbursement pressure. That caution reflects the dividend risk that comes with high yields in challenged industries.

AbbVie increased its quarterly dividend by 5.49% to $1.73 effective January 16, 2026, delivering a 2.99% yield with strong growth prospects tied to its immunology portfolio. American Tower raised its quarterly dividend by 4.94% to $1.70, though the REIT’s 3.76% yield comes with real estate-specific risks.

Valuation and Total Return Context

Graco trades at 31x trailing earnings and 30x forward earnings—premium multiples that reflect the market’s confidence in the company’s business model but also limit margin of safety for dividend investors. The stock has delivered 13.45% total return over the past year and 16.66% year-to-date through February 12, 2026.

That price appreciation matters for dividend investors because it affects yield on cost and total return calculations. An investor who bought Graco five years ago at $67.57 has seen the stock climb 41.05% to $95.31 while collecting steadily increasing dividends—a combination that generates meaningful total returns despite the modest current yield.

The Sustainability Verdict

Graco’s dividend earns high marks for sustainability based on three key factors. First, the 26.8% payout ratio relative to operating cash flow provides substantial room for continued increases even if earnings growth moderates. Second, the company’s 23.3% net margin and minimal $2.9 million in annual interest expense indicate a healthy balance sheet without leverage concerns. Third, management’s cautiously optimistic outlook for Q4 2025, noting that “our acquisition pipeline remains strong”, suggests confidence in future cash generation.

The trade-off is straightforward: investors accept a 1.19% current yield in exchange for consistent high-single-digit dividend growth backed by strong free cash flow and disciplined capital allocation. That profile suits investors seeking dividend growth rather than immediate income—a different value proposition than the 4-6% yields available from slower-growth dividend stocks in telecommunications or consumer staples.

Graco’s 27+ year track record of quarterly dividend payments and 5-year compound annual growth rate of 9.4% demonstrates management’s commitment to returning cash to shareholders. With $454.6 million in free cash flow remaining after dividends and a conservative payout ratio, the company has both the capacity and the track record to continue this pattern. For dividend growth investors willing to accept lower current yield in exchange for reliable increases, Graco’s latest payment reinforces that value proposition.