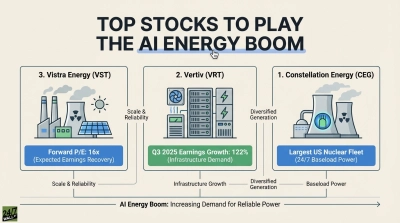

Constellation Energy Corp (NASDAQ:CEG) surged 10.33% this week, closing at $288.43 on Friday, February 13. The move reversed recent losses, though the stock remains down 18.35% year-to-date. Three storylines drove the week: major data center power deals, bullish analyst calls, and renewed conviction around nuclear energy’s role in powering AI infrastructure.

Performance: Bouncing Back From a Rough Start to 2026

CEG’s 10.33% weekly gain outpaced the broader utilities sector, but it was a very good week across the utilities space in general.

The Utilities Select Sector SPDR Fund (NYSEARCA:XLU) gained 7.27% over the same period. Despite the bounce, CEG is nursing losses from a brutal January. The stock peaked at $412.23 over the past year before sliding to current levels.

The one-month picture: CEG is down 12.7% from $330.38 on January 14. This week’s rally provides relief but not full recovery. The stock trades at a 32x trailing P/E with a $100 billion market cap.

Storyline 1: Data Center Power Deals Accelerate

On February 9, Constellation announced a 380 MW power agreement with CyrusOne for a new Texas data center, with an exclusive option for an additional 380 MW. This brings Constellation’s total commitment to CyrusOne in Texas above 1,100 MW. The deal leverages Constellation’s “Powered Land Capabilities” model, bundling power generation, grid connectivity, and site infrastructure for data center operators.

The same day, Constellation secured a 20-year agreement with the Tennessee Titans to power the new Nissan Stadium with an on-site energy plant targeting 20% efficiency improvements. While less headline-grabbing, it extends Constellation’s footprint in Nashville, where it’s managed the Metro Nashville District Energy System since 2003.

These deals demonstrate Constellation’s ability to lock in long-term revenue streams tied to infrastructure buildout behind AI and cloud computing. Data centers need reliable, always-on power, and Constellation’s nuclear fleet is uniquely positioned to deliver it.

Storyline 2: Analysts See a Buying Opportunity

The week brought a chorus of bullish analyst calls. Wells Fargo (NYSE:WFC)’s Shahriar Pourreza lowered his price target from $478 to $460 but maintained an Overweight rating, calling CEG the “Best IPP Idea” based on asset opportunities and data center momentum. Barclays (NYSE:BCS) initiated coverage with a Buy rating and a $356 target. UBS (NYSE:UBS) reiterated its Buy rating with a $420 target, while TD Cowen set a $440 target tied to the Calpine acquisition.

Zacks Investment Research flagged CEG’s +3.13% Earnings ESP, suggesting the company will likely beat expectations when it reports. The consensus: the recent pullback is a buying opportunity, not a red flag.

Storyline 3: Nuclear Energy’s AI Moment

The broader narrative driving Constellation’s resurgence is recognition that AI infrastructure requires massive, reliable power. Uranium spot prices exceeded $100 per pound in January 2026, reflecting tightening supply and surging demand. The Tennessee Valley Authority reversed plans to retire coal plants, citing “accelerated increase in electricity demand from data centers and population growth.”

Constellation’s nuclear fleet is the cornerstone of its competitive advantage. The company produced 46,477 GWhs of nuclear energy in Q3 2025, up from 45,510 GWhs a year earlier. As CEO Joe Dominguez said on the last earnings call, “Momentum continues to build around reliable, clean nuclear energy as a cornerstone of America’s energy strategy.” That momentum is translating into deals, and this week’s stock move suggests more upside could be ahead.