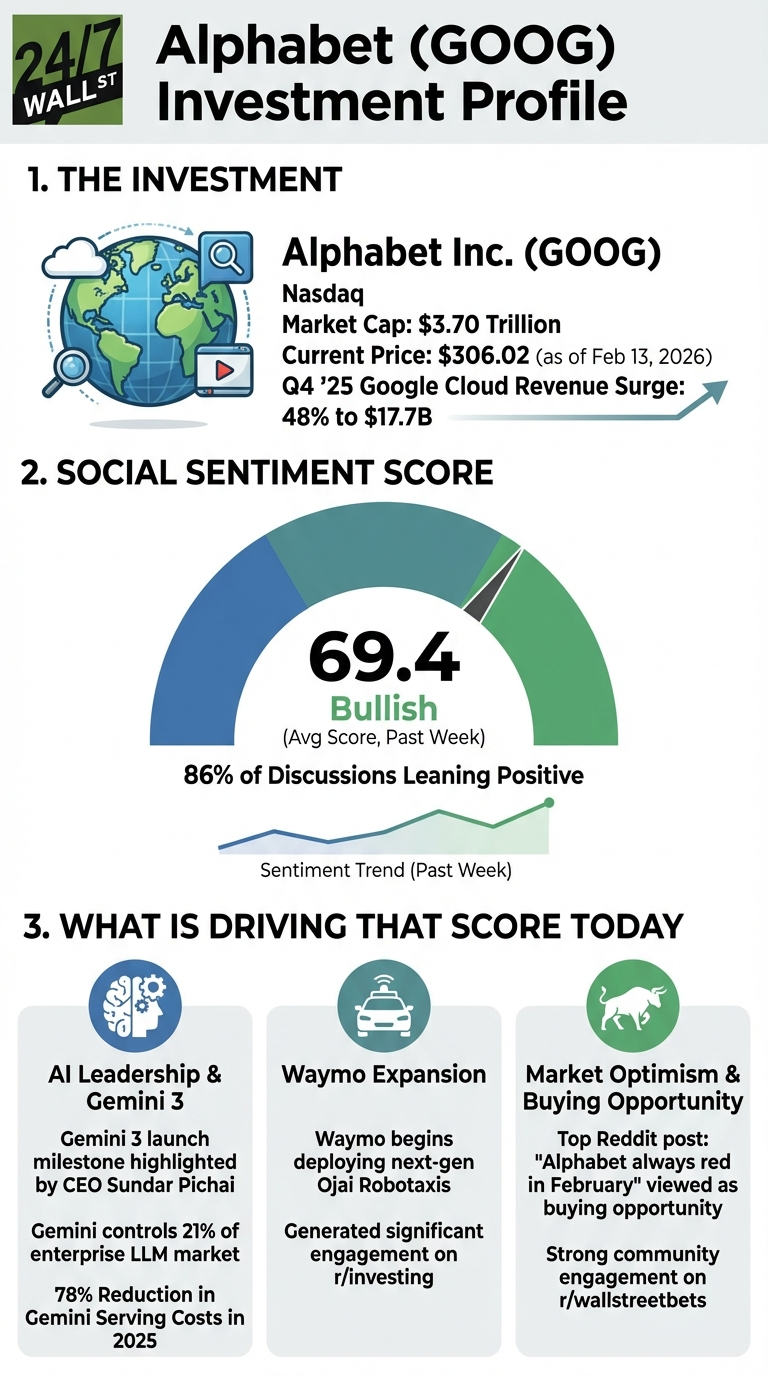

If you’re watching shares of Google (NASDAQ:GOOG), which dropped 5.3% over the past week, it won’t come as any surprise that it coincides with a shift in retail investor sentiment on Reddit. Despite the pullback, sentiment remains predominantly bullish, with 86% of discussions leaning positive across r/wallstreetbets and r/investing. The attention stems from Google’s Q4 2025 earnings report, filed on February 4, in which Google Cloud revenue surged 48% to $17.7 billion, and the company announced its Gemini 3 launch milestone.

Why Reddit Still Believes in Google’s AI Future

As a result of all the activity, online discussions intensified over the past two weeks, particularly on r/wallstreetbets, where one trader turned $6,000 into $54,000 betting on Google’s strength. The post garnered 537 upvotes and 118 comments, demonstrating strong community engagement with Google’s AI potential. A popular post noting “Alphabet always red in February” accumulated 608 upvotes and 81 comments, suggesting investors view the seasonal weakness as a buying opportunity.

$6k->$54k

by u/[author] in wallstreetbets

The bullish case centers on three fundamental strengths:

- Gemini controls 21% of the enterprise LLM market and is rapidly gaining share while ChatGPT’s dominance erodes

- Google lowered Gemini serving costs by 78% in 2025 through model optimizations, proving they can scale AI profitably

- Google’s TPU chips give it a presence on both hardware and software sides of AI development, competing directly with NVIDIA’s infrastructure

Waymo’s autonomous vehicle expansion also generated excitement, with a post about the next-gen Ojai robotaxis garnering 83 upvotes in the investing community. This diversification beyond core search and cloud demonstrates multiple growth paths.

Waymo begins deploying next-gen Ojai Robotaxis

by u/[author] in investing

Analysts See 14% Upside Despite the Dip

Wall Street’s conviction remains strong. 44 analysts rate Google a “Strong Buy” with a consensus price target of $348, representing a 13%+ upside from current levels. This compares favorably to Microsoft (NASDAQ:MSFT | MSFT Price Prediction), which has fallen 17% year-to-date on cloud competition concerns, while Google is down just 2.5%.

For investors tracking the AI race, Google’s combination of $402.8 billion in revenue, 32% operating margins, and $175-$185 billion in 2026 capex demonstrates the financial firepower to outspend competitors without strain. With Gemini’s growing user base and the company maintaining search dominance, analysts see the recent dip as temporary noise in a long-term AI leadership story.

Alphabet always red in February

by u/[author] in wallstreetbets

Data Sources

- Analyst Ratings Data: Used to establish the strong buy consensus of 44 analysts and $348 price target showing 13.7% upside potential

- Nasdaq Article on AI Stocks: Provided key insights on Gemini’s 21% enterprise market share, Google’s 78% cost reduction in AI serving, and the company’s $402.8B revenue with 32% margins