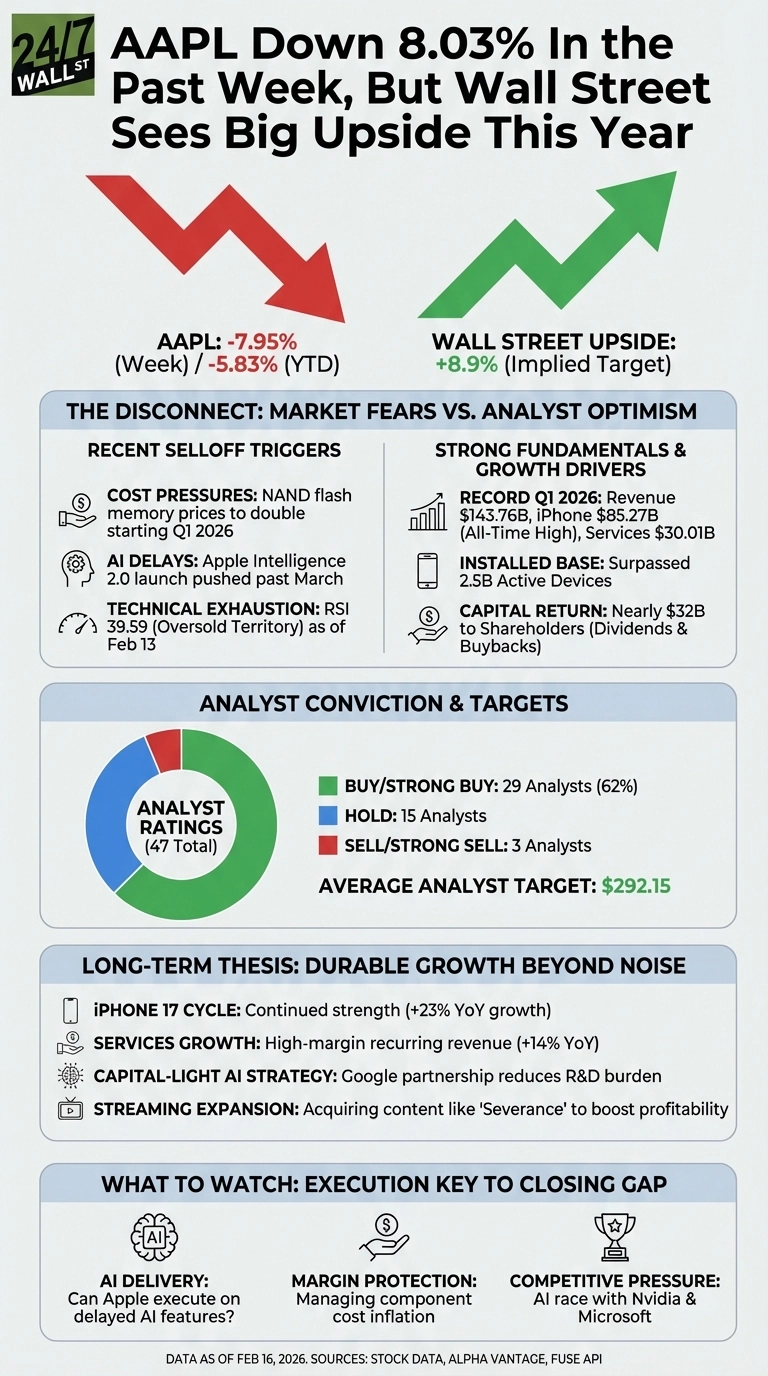

Apple (NASDAQ: AAPL | AAPL Price Prediction) closed at $255.78 on February 13, down 7.95% from the previous week’s $277.86. Yet Wall Street analysts still see the stock climbing to an average target of $292.15, implying 10% upside from current levels. That disconnect raises a question: is the market pricing in risks analysts are missing, or did the selloff create an entry point?

The drop came despite Apple reporting a blowout quarter in late January. Revenue hit $143.76 billion, beating estimates, while iPhone sales reached an all-time quarterly high of $85.27 billion. The company returned nearly $32 billion to shareholders and saw its installed base surpass 2.5 billion active devices. Yet the stock has struggled in the weeks since, falling 5.83% year to date while the S&P 500 has remained essentially flat at negative 0.02%.

Cost Pressures and AI Delays Triggered the Selloff

The decline accelerated in mid-February as specific concerns emerged. Apple agreed to contract terms with Kioxia that will see NAND flash memory prices double starting in Q1 2026, with quarterly repricing thereafter. That signals ongoing component cost inflation even as the company locks in short-term supply.

More troubling for investors betting on an AI-driven growth cycle, Evercore ISI reported anticipated delays in the Apple Intelligence 2.0 launch, potentially pushing the release past March. The firm cited testing headwinds and Apple’s privacy-first approach as reasons for the multi-phase rollout, with a complete Siri overhaul not expected until fall 2026. Regulatory scrutiny also intensified, with the FTC raising concerns about alleged political bias in Apple News while antitrust litigation continues.

Technical indicators confirm the severity of the move. The Relative Strength Index dropped to 39.59 as of February 13, down from 69.03 on February 6. That 29-point swing in seven days pushed the stock into oversold territory, a level historically associated with near-term bounces.

Analysts See the Long-Term Thesis Intact

Despite the selloff, 29 of 47 analysts covering Apple maintain Buy or Strong Buy ratings. Evercore kept its Outperform rating with a $330 price target even after flagging the AI delays. The firm argued that Apple’s privacy focus and seamless integration justify the slower rollout.

The bull case centers on durable growth drivers that extend beyond quarterly noise. The iPhone 17 cycle continues to show strength, with 23% year-over-year growth in the most recent quarter. Services reached a record $30.01 billion, up 14% year over year, providing high-margin recurring revenue. Apple’s partnership with Google on AI features reduces R&D burden while maintaining ecosystem control. The company is also expanding into streaming content, recently acquiring rights to Severance for approximately $70 million as it works to make Apple TV+ profitable.

Jim Cramer called Apple “the greatest free rider in history” for its Google AI partnership, arguing the company gains cutting-edge capabilities without the massive capital expenditure rivals face. That strategic positioning matters as Nvidia and Microsoft pour billions into AI infrastructure.

By the Numbers

Current Situation:

- Current Price: $255.78

- Average Analyst Target: $292.15

- Implied Upside: 10%

- Number of Analysts: 47

- Recent Performance: Down 7.95% over one week

Analyst Ratings Breakdown:

- Strong Buy: 6

- Buy: 23

- Hold: 15

- Sell: 1

- Strong Sell: 2

Comparison to S&P 500:

- AAPL YTD: negative 5.83%

- S&P 500 YTD: negative 0.02%

The data shows Apple underperforming the broader market by nearly 6 percentage points year to date, with the gap widening sharply in recent weeks. Yet analyst conviction remains strong, with 62% of coverage at Buy or better. The disconnect suggests either the market is ahead of Wall Street in pricing execution risks, or short-term concerns are masking a compelling setup.

What to Watch Going Forward

Investors are monitoring whether Apple can execute on AI features without further delays and manage component cost inflation without margin compression. The fundamental story remains intact: record iPhone demand, expanding services revenue, and a capital-light AI strategy that avoids the massive spending competitors face. Trading at 32 times trailing earnings with 27% profit margins and $42.10 billion in quarterly net income, the valuation reflects expectations for continued execution.

The technical setup also suggests potential for a near-term bounce. Previous oversold readings in January recovered within two weeks, and the current RSI of 39.59 suggests capitulation selling. If Apple delivers on the delayed AI features by summer and component costs stabilize, the path back to $292 analyst targets becomes more achievable.

Key risks include AI delays extending beyond fall or margin pressure intensifying. The doubled NAND pricing signals that component inflation hasn’t peaked. If Apple Intelligence 2.0 slips further or adoption disappoints when it does launch, the premium valuation becomes harder to justify. Competitive pressure from Nvidia and Microsoft in AI, combined with regulatory headwinds, could keep the stock range-bound even as fundamentals hold up.

The risk-reward calculation depends on execution. Retail sentiment turned bearish during the decline, with Reddit activity showing sentiment scores between 25 and 42 through mid-February, well into bearish territory. That contrarian indicator, combined with oversold technicals and analyst conviction, suggests the selloff may have been overdone. But the company needs to prove it can deliver on AI promises and protect margins, or the 9% gap to analyst targets could widen rather than close.