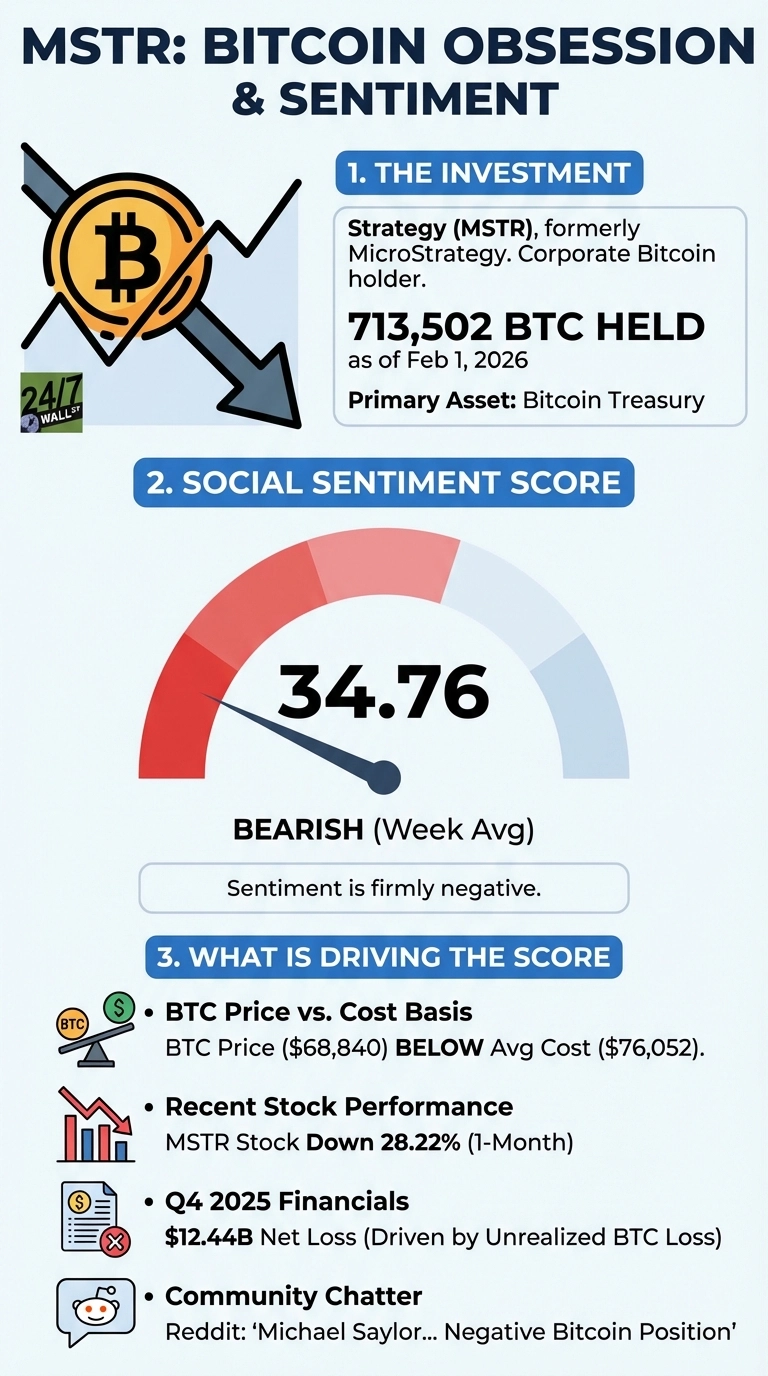

If you have spent any time on Reddit, you’ve seen that Strategy (NASDAQ:MSTR) shares have collapsed 62% over the past year, and Reddit investors are not holding back. With Bitcoin trading at $68,840 as of February 17, 2026, well below Strategy’s $76,052 per coin cost basis, the company’s aggressive treasury strategy is facing its toughest test yet.

Bitcoin’s Brutal Slide Hammers MSTR

All of this leads directly to where you might think in that Strategy’s stock price fell from $173.71 a month ago to $125.20 today, a 27.93% decline mirroring Bitcoin’s struggles. The cryptocurrency plunged from a January 29 peak of $84,513 to as low as $60,001 on February 6, a 31.7% drop in just eight days.

The company’s Q4 2025 earnings, filed on February 5, 2026, showed a $12.44 billion net loss, driven by a $17.44 billion unrealized loss on digital assets. Shockingly, Strategy holds 713,502 bitcoins valued at $59.75 billion against a cost basis of $54.26 billion, leaving the company essentially underwater on its massive bet.

Reddit Turns Bearish on Saylor’s Vision

Strategy’s Reddit sentiment score sits at a dismal 34.76 for the week and 28.53 for the month. Discussion on r/investing and r/wallstreetbets has turned skeptical, with “Michael Saylor 3% away from Negative Bitcoin Position” drawing 968 upvotes and 444 comments.

Michael Saylor 3% away from Negative Bitcoin Position

by u/throwaway_investing42 in investing

“At what point does the board step in? He’s leveraged the entire company on a single asset and now they’re underwater. This isn’t a treasury strategy anymore, it’s a bet.” — u/throwaway_investing42, r/investing

Strategy raised $25.3 billion in capital during 2025 to fund its Bitcoin buying spree, making it the largest U.S. equity issuer for the second consecutive year. With Bitcoin now below the company’s average purchase price, the leverage that amplified gains in bull markets is now working against it.

The Contrarian Case Still Has Believers

Wall Street analysts have not turned on the stock. Eight of 13 rate Strategy a “Strong Buy,” with a consensus price target of $369.08, representing 196% upside from current levels. It shouldn’t come as a surprise that no analyst has a “Sell” rating.

The company maintains $2.30 billion in cash reserves and has debt structured to avoid near-term forced liquidation. CEO Phong Le remains focused on expanding the STRC preferred stock program to drive Bitcoin-per-share growth, betting current weakness is temporary. The math is straightforward: above $76,052 per coin, Strategy’s leverage amplifies gains, and the thesis holds. As Bitcoin’s price falls by $1, the gap between cost basis and market value widens, putting pressure on a balance sheet built on continued appreciation.