That Walt Disney Co. (NYSE: DIS) has reportedly struck a deal to sell the remaining 21 regional sports networks (RSNs) it recently acquired from Fox Corp. (NASDAQ: FOXA) is no surprise. After all, the company’s deal with federal regulators called for the sale of 22 RSNs as a condition of Disney’s $71 billion acquisition of 21st Century Fox.

The sale process began with an auction period last December, during which Disney, already the owner of the ESPN franchise (as well as one of the U.S. companies with the best reputations), reportedly was looking to sell its regional sports networks for up to $20 billion. Sinclair Broadcast Group Inc. (NASDAQ: SBGI) went into that auction with its wallet open but came away with no immediate deal. The Wall Street Journal reported late Thursday that Sinclair has agreed to buy the 21 sports channels in a deal valued at more than $10 billion.

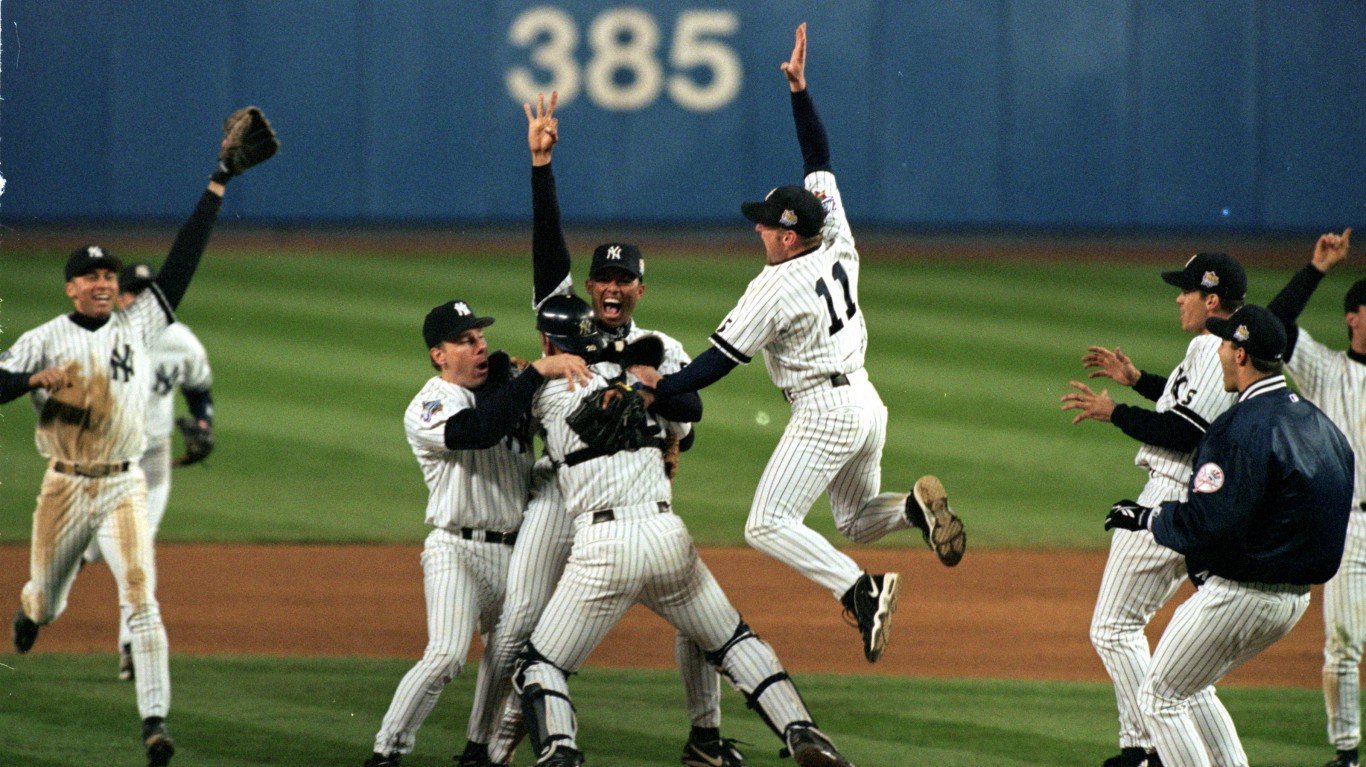

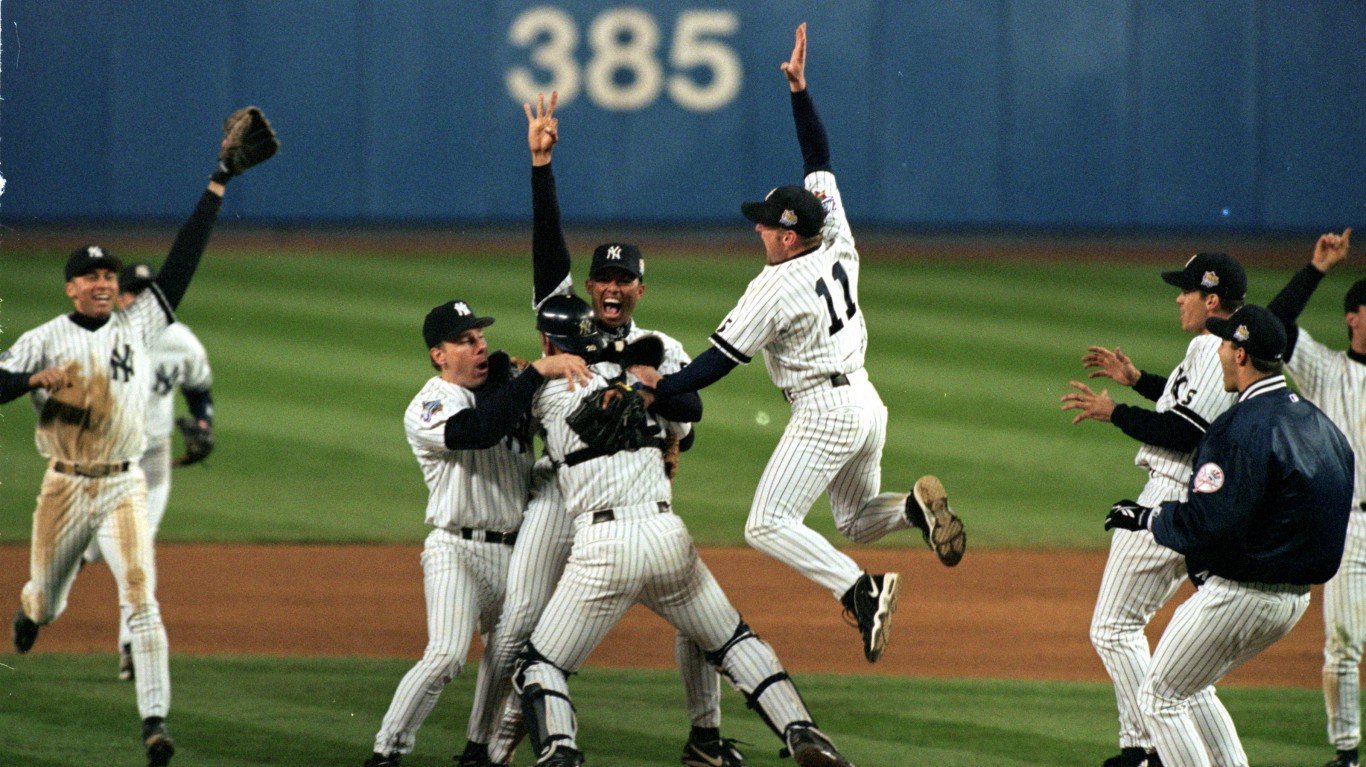

The crown jewel of the 22 RSNs that Disney acquired from Fox was the (New York) Yankees Entertainment and Sports Network, aka YES. In early March, the Yankees, along with partners Blackstone Group L.P. (NYSE: BX), Amazon.com Inc. (NASDAQ: AMZN) and Sinclair, paid Disney $3.5 billion to acquire the 80% of the YES network that the team did not already own.

Sinclair, which is the country’s largest owner of local TV channels, operates some 191 stations in 89 U.S. markets broadcasting 605 channels. Its sole cable property is the Tennis Channel. Beefing up its cable presence may appear to be too little, too late, given the declining profitability of cable networks in general (cord-cutting hurts).

On top of that, sports leagues have shown more interest lately in retaining their own cable and broadcast rights because sports programming continues to pay off. Citing media research firm MoffettNathanson, MediaPost in January estimated that the 22 RSNs that Fox owned would generate $1.9 billion in 2018 pretax earnings. And that was a reduction from an earlier estimate of $2.35 billion due to “longer-term secular concerns with those networks.”

RSNs are hugely popular among viewers. According to MediaPost, in 2017 in Chicago, the local NBC Sports Chicago channel pulled a prime-time rating of 1.08, higher than any other cable network, including ESPN (1.07), MSNBC (1.06), TBS (1.04) and Fox News (0.99). The NBC RSN in San Francisco also outpolled all its prime-time rivals, and Philadelphia’s NBC regional sports channel ranked fifth.

The long-term concerns for RSNs center around deep-pocketed tech firms like Amazon, Twitter and Facebook that already have bid successfully for streaming NFL games and some NBA games, and all of which have plenty of cash to buy more. Sinclair, which has a market cap of around $4 billion and about $1 billion cash, had to put a stake in the ground, but the company is going way out on a limb with its reported $10 billion bid for Disney’s RSNs. How the deal is structured will get a lot of scrutiny from analysts once it’s revealed.

Disney may have hoped to raise $20 billion from the sale of the RSNs to help pay down what it paid for Fox, but this is likely the best deal it could get. Added to the $3.5 billion the company received for the YES network, the total value of the RSNs works out to around $13.5 billion. In real life, the field of potential buyers was limited and Disney had to sell.

Sinclair shares are up about 1.3% Friday morning, at $44.27 in a 52-week range of $25.13 to $46.16. The 12-month consensus price target on the stock is $42.38.

Disney’s traded essentially flat at $134.13 a share, in a 52-week range of $98.58 and $142.37. The consensus price target is $140.61.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.