On April 22 last year, Rite Aid Corp. (NYSE: RAD) completed a one-for-20 reverse stock split, lifting the share price from about $0.45 to around $9.00. On Wednesday, shares closed at $12.87 and have jumped to as high as $16.25 following the company’s fiscal first-quarter earnings report.

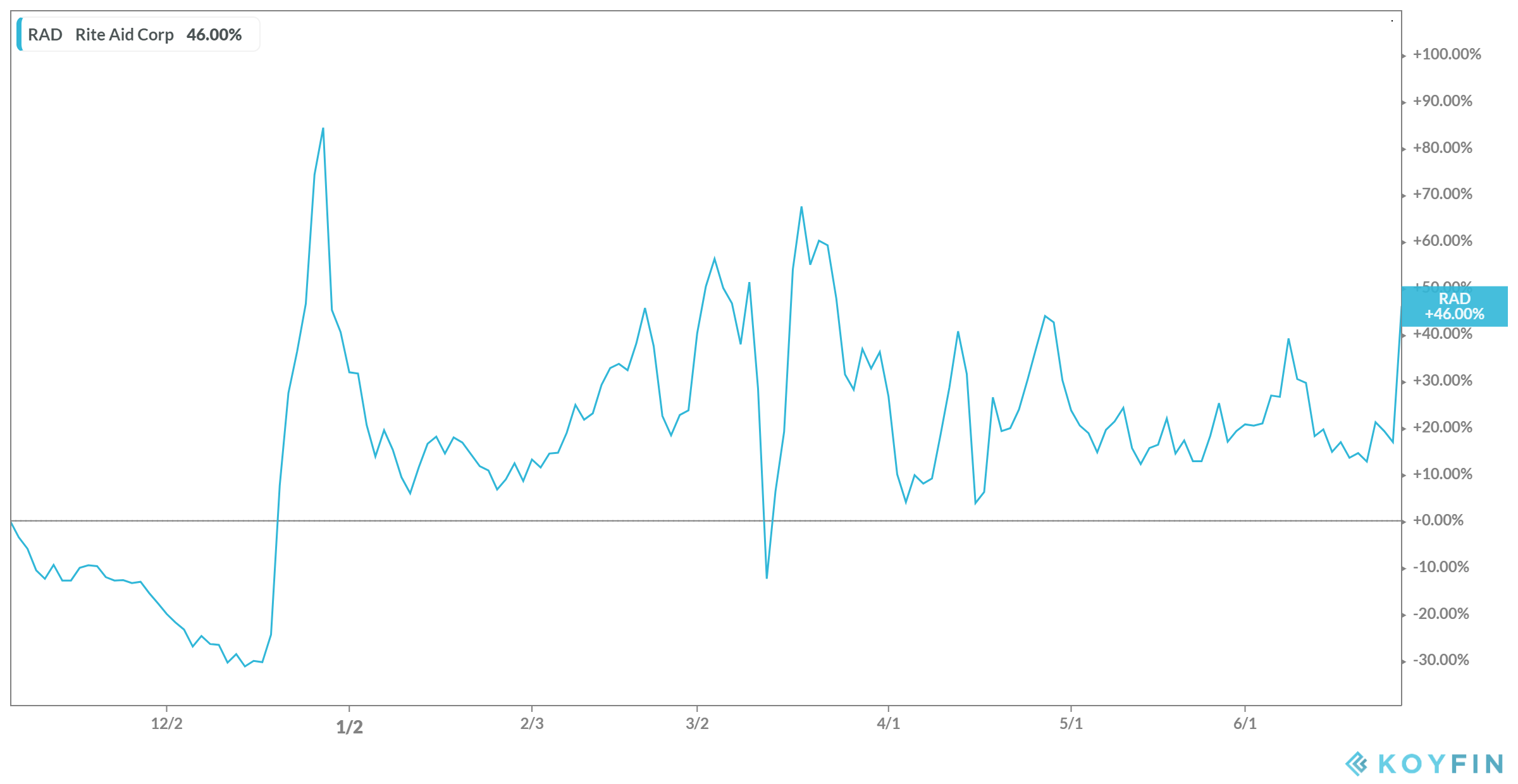

Rite Aid shares have experienced big and fast share price swings following its third-quarter earnings report last December and its fourth-quarter earnings report in March. Yet, the March spike was lower than the one in December, and it looks like this spike will be lower than the one in March.

[in-text-ad]

The following chart shows Rite Aid’s share price moves since early November of last year. The big spike in December followed quarterly earnings, as did the spike in March.

In its first quarter of the 2021 fiscal year, Rite Aid reported an adjusted loss per share of $0.04 against a consensus estimate for a loss of $0.38 per share. Revenues rose by 12.2% to $6.03 billion year over year.

The adjusted net loss excluded $35.7 million in restructuring costs, nearly $30 million an intangible asset impairment charge and $24.4 million in amortization expense. The adjusted net loss for the quarter was $2.01 million, compared to $7.52 million in the first quarter of last year.

Since its reverse stock split, Rite Aid shares have risen by nearly 20% as of Wednesday’s closing price. Shares of Walgreens Boot Alliance Inc. (NASDAQ: WBA) have lost just over 20% in the same period, while CVS Corp. (NYSE: CVS) has added more than 24%.

Compared to CVS, which operates about 11,000 retail stores and clinics, and Walgreens, which operates nearly 14,000 stores worldwide, Rite Aid’s 2,400 U.S. retail store count is not impressive. However, comparable store sales in Rite Aid’s retail pharmacy segment rose 6.6% year over year, with front-end sales up more than 14% and pharmacy sales up 2.2%.

The rise and eventual fall of Rite Aid stock could be due in part to short covering. Over the past 10 trading days, short interest in Rite Aid has more than doubled, and about 26.4% of the company’s float was short as of Wednesday’s close. Rather than continue playing the short bet, some short sellers may have just decided to cut their losses.

Interestingly, though, there appear to be fewer short sellers who want to exit their short position every time Rite Aid stock spikes following an unexpectedly good earnings report. Analysts at Evercore ISI put a Sell rating on the stock in August of 2019, while Guggenheim and Deutsche Bank both lifted Sell ratings this year to Hold. That’s it for current analyst ratings.

While Rite Aid has performed well over the past six months or so, investors simply aren’t committed to the stock. The company pays no dividend, so it has to be thought of as a growth play and that is a hard position to sell.

Except on days like today. Rite Aid shares were up nearly 24% in the noon hour Thursday, at $15.91 in a 52-week range of 5.04 to $23.88. The consensus 12-month price target is $6.67.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.