24/7 Wall St. has chosen its list of the “Worst CEOs In America” for 2017. All the executives on this list have done serious damage to the companies they lead. In some cases it will take years for the businesses to recover, if they ever can.

We used several criteria to select the chief executive officers on the list. Among the factors we considered were stock price changes, earnings and revenue, and tenure at the company. CEOs must have led their companies for two years, or been in the No. 2 position during that period.

This list includes CEOs who departed earlier this year because of poor performance.

It can also include those with the chairman’s title who are not the CEO, but who control the company and make major strategic decisions. For example, The New York Times Co., which is not on this list, is led by Arthur O. Sulzberger, Jr., chairman and, until recently, publisher. President and Chief Executive Officer Mark Thompson works for him, although on paper he reports to the board

Some of these CEOs are still at the companies they run, while others could be gone soon.

Click here to see the worst CEOs in America.

These are the worst CEOs of 2017.

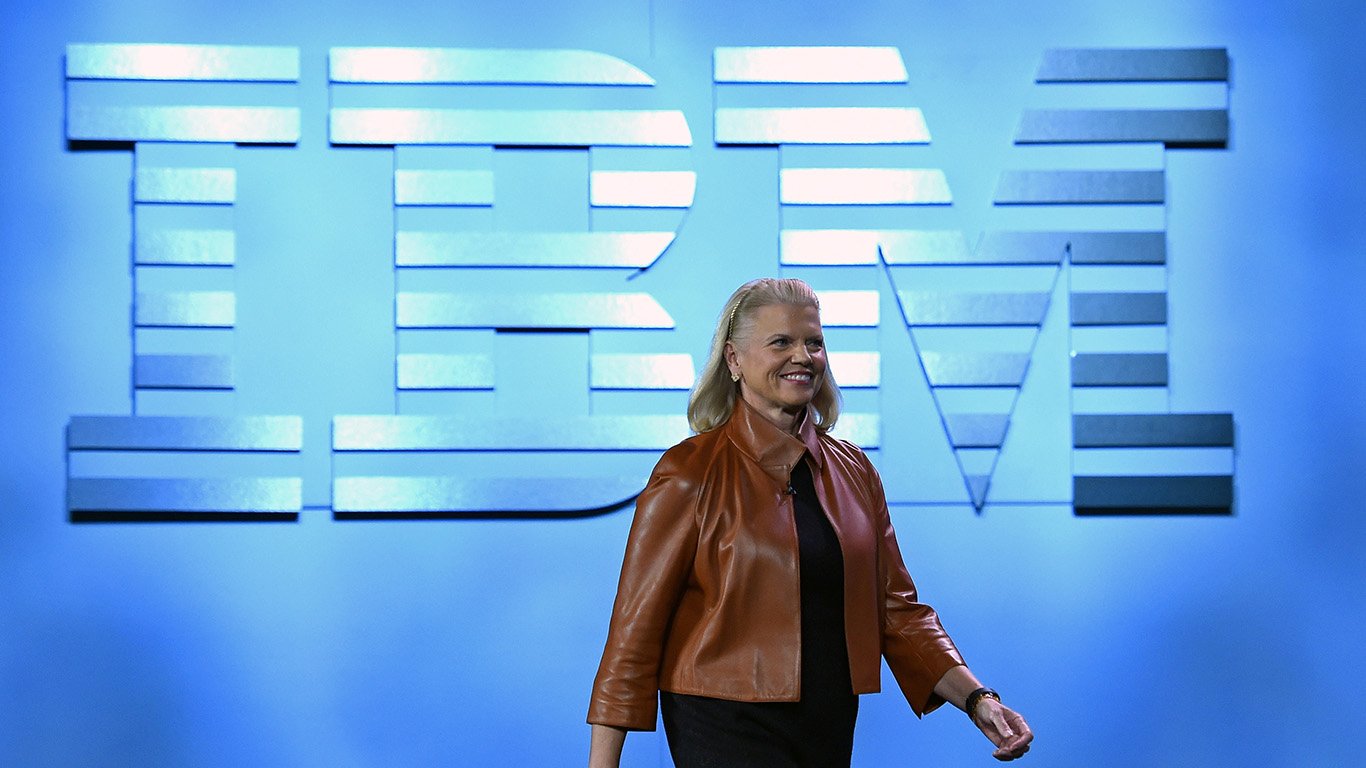

1. Ginni Rometty

> Company: International Business Machines Inc.

> Industry: Technology

> Tenure: January 2012 to present

> YTD share price change: -8.0%

The majority of America’s biggest technology companies have reported huge revenue growth in recent years and have seen their stock prices soar, but not IBM (NYSE: IBM).

Warren Buffett, once a staunch supporter of CEO Ginni Rometty’s turnaround plan, has sold a large portion of his stake in the company. Buffett’s decision seems wise.

Rometty has constantly pushed the success of IBM’s cloud and artificial intelligence initiatives, often under the brand name Watson (named after IBM founder Thomas Watson). IBM has spent so much on marketing that the Watson brand is nearly as visible as IBM itself.

Although IBM beat Wall Street estimates on earnings per share and revenue in its most recent quarter, revenue declined for the 22nd straight reporting period. Almost every IBM division continues to falter, and Watson has been no savior.

[in-text-ad]

2. Jeff Immelt

> Company: General Electric Co.

> Industry: Conglomerates

>Tenure: 2001 to August 2017

> YTD share price change: -45%

Jeff Immelt, who is gone after 16 years at the helm of General Electric (NYSE: GE), is a classic case of how a CEO can damage a once well-run company. Immelt managed countless restructurings at GE, including the sale of several operations. Most notably, Immelt downsized GE’s once mighty financial services segment after it had incurred severe losses during the global financial crisis in 2008.

Immelt also put together many large operations in unrelated sectors. New CEO John Flannery, who took the reins from him in August, plans to focus on three: aviation, health care, and energy and power. It may be too late to fix the patchwork corporation that Immelt called a company.

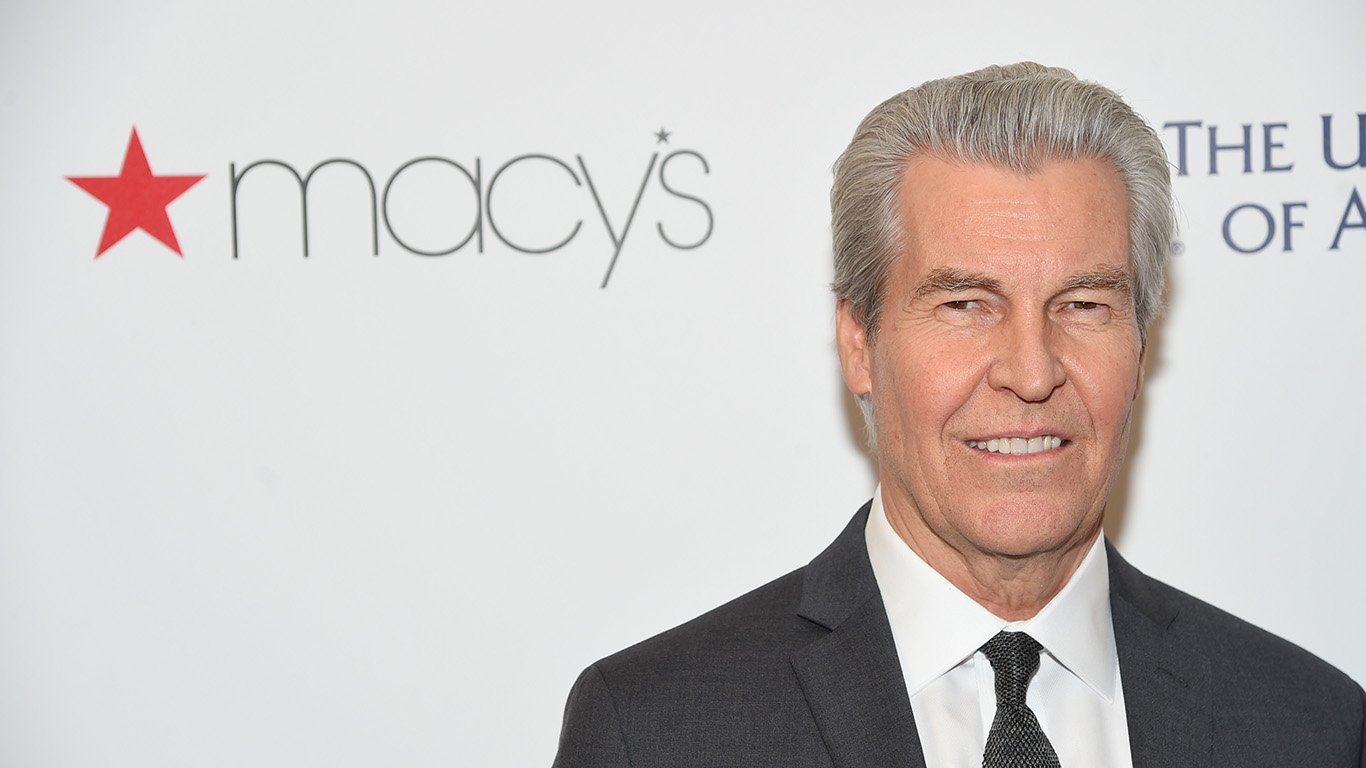

3. Terry Lundgren

> Company: Macy’s Inc.

> Industry: Retail

> Tenure: February 2003 to March 2017

> YTD share price change: -28%

Terry Lundgren, who was CEO of Macy’s (NYSE: M) from 2004 until this year, presided over one of the worst retail disasters of the modern era.

The rise of Amazon and omnichannel retailing would have put pressure on the company regardless of who was leading the Macy’s parade. Still, Lundgren was not aggressive enough or fast enough in fighting the Amazon-dominated world.

The most recent closure of 100 underperforming stores was necessary, but many Macy’s locations also need a major facelift. Macy’s has reported multi-year revenue declines, which can be expected for the foreseeable future.

There is even some concern that the $1.51 annualized dividend will be trimmed if financial erosion continues. Macy’s stock buybacks may have helped bolster earnings per share but did not keep the company’s value from plummeting.

Macy’s took steps earlier in 2017 to accelerate actions Lundgren should have taken much sooner. Jeff Gennette, who was elected president of Macy’s in 2014, is now CEO. Unfortunately, he has been at Macy’s for decades and appears to be Lundgren’s handpicked successor, so investors should not expect any meaningful strategic changes or shifts.

4. Kevin Plank

> Company: Under Armour Inc.

> Industry: Retail

> Tenure: February 2003 to present

> YTD share price change: -45%

Under Armour (NYSE: UA) is a great story of a company that grew from a basement operation into a powerhouse in a relatively short time, and Kevin Plank deserves much of the credit for that. Yet sometimes the founder of a company is not the best captain of the ship when navigating choppy waters.

The sports-apparel business is dominated by Nike and Adidas, and Under Armour grew enough that it is now in a war for market share and faces constant margin pressure.

Plank made one attempt to remedy the situation by bringing in outsider Patrik Frisk to be president and chief operating officer. However, with Plank remaining as chief executive and chairman, Frisk might find it harder to bring about change. The company’s April 2016 stock split effectively gave Plank a super-vote and control of the company, and the stock has fallen even more since the split.

[in-text-ad-2]

5. Matt Salzberg

> Company: Blue Apron Holdings Inc.

> Industry: Retail

> Tenure: February 2003 to present

> YTD share price change: -60%

Blue Apron Holdings (NYSE: APRN) was supposed to be a great technology-driven play in the growing meal-creation business. However, founder Matt Salzberg may have waited too long for its initial public offering in June 2017. The IPO likely suffered from unfortunate timing, occurring shortly after Amazon announced it was buying Whole Foods.

Still, the IPO is but a small issue in the company’s larger struggles. Salzberg tried to address some of the problems with layoffs just a few months after the IPO. He would like Wall Street to value Blue Apron as a technology company that can put off profits for growth. The reality is Blue Apron is simply a mail-order food delivery club sending cookie-cutter meals to customers, and those customers now have many choices.

Blue Apron recently decided it was time for new blood to help fix what may be a broken model. Salzberg has been ousted as CEO but remains chairman. Chief Financial Officer Brad Dickerson — who was previously chief operating officer and CFO at Under Armour — is replacing Salzberg.

6. Evan Spiegel

> Company: Snap Inc.

> Industry: Technology

> Tenure: 2012 to present

> YTD share price change: -38%

Shortly after Snap’s initial public offering in 2017, its market cap soared to more than $30 billion.

Even ahead of the IPO, Snap tried to call itself a camera company rather than a social media company, a move that raised eyebrows in the investment community. At the first earnings announcement as a public company, CEO Evan Spiegel disappointed Wall Street.

Despite securing media deals for its Snapchat platform, Snap has struggled to find newer or more lucrative avenues in its monetization efforts. The company also seems unable to prevent Facebook from copying its every move.

The recent redesign could have been made long ago, and the main solution to the problem of how to monetize a product that vanishes in a few seconds remains elusive.

The company’s voting structure has so far prevented any attempts to oust Spiegel and will likely make any future attempt difficult.

[in-text-ad]

7. Jack Dorsey

> Company: Twitter Inc.

> Industry: Social media

> Tenure: September 2015 to present

> YTD share price change: +50%

Jack Dorsey returned to Twitter (NYSE: TWTR), the company he co-founded, in October 2015, when it became clear that management could not figure out how to make money from one of the world’s most visible brands. Dorsey’s return has not improved the situation at the company. Twitter shares have staged a substantial recovery to $24.22 but are still down from their post-IPO high of $69.96 four years ago.

In comparison with the share price of large rival Facebook, these results are particularly painful for shareholders.

Twitter has become nearly ubiquitous as a social medium because of the constant presence of President Donald Trump and a slew of celebrities who have tens of millions of Twitter followers. Katy Perry tops the list with about 108 million followers.

However, Twitter’s user growth has all but stalled at 330 million, and its revenue has begun to decline. That’s not supposed to happen at a growth company. Some analysts believe Dorsey is too busy running Square, another public company, when he needs to devote his time to the deeply troubled Twitter.

8. Steve Mollenkopf

> Company: Qualcomm Inc.

> Industry: Technology

> Tenure: March 2014 to present

>YTD share price change: -1%

Qualcomm (NASDAQ: QCOM) had been one of the greatest growth stories of the modern era, dominating the smartphone and mobile internet products landscape. Much of the company’s expansion occurred under the leadership of the Jacobs family.

Before taking over as chief executive in 2014, Steve Mollenkopf was Qualcomm’s chief operating officer and president from 2011 to 2014. Before that, he had led much of the company’s development for years.

The company has been mired in litigation over royalty and antitrust issues, including with Apple, which Qualcomm could lose as a customer. Many industry observers claim settling these issues would have benefited Qualcomm, but so far management has chosen to contest them.

Investors also are concerned about the company’s future growth and its ability to diversify beyond chips for mobile. To that end, Qualcomm was going to acquire NXP Semiconductors NV to gain access to the automotive market and self-driving cars. So far, however, it seems like Qualcomm has fumbled the deal.

Recently, the stock jumped to around $64 after trading in the $50s for much of 2017 on deal talks with Broadcom Ltd., but that has turned into a hostile takeover battle, further complicating any other deals Qualcomm wants to make.

9. Tim Sloan

> Company: Wells Fargo & Co.

> Industry: Banking

> Tenure: October 2016 to present

> YTD share price change: +12%

When the board at Wells Fargo (NYSE: WFC) dumped former CEO John Stumpf because bank employees had opened some 1.5 million checking and 500,000 credit card accounts without customers’ consent, the bank installed its No. 2 executive, Tim Sloan, in his place. The decision was made even though the problems had happened on Sloan’s watch as well.

Since Sloan took over as CEO, matters have gotten worse. Among the most notable problems involving Wells Fargo was a racketeering lawsuit, settled for $50 million late last year, that alleged the bank had overcharged homeowners hundreds of thousands of dollars after they defaulted on their mortgages. Then regulators fined Wells Fargo and other businesses a total of $14.4 million for record-keeping problems that may have allowed company and customer documents to be altered.

The San Francisco, California-based bank has had to face other issues, too. There were accusations that it conducted business practices that hurt mortgage and car loan clients. And Wells Fargo was also charged with overcharging foreign exchange customers. Sloan’s short tenure has been horrible for customers.

[in-text-ad-2]

10. Oscar Munoz

> Company: United Continental Holdings Inc.

> Industry: Airlines

> Tenure: September 2015 to present

> YTD share price: -8%

Oscar Munoz has had to respond to several embarrassing incidents at United (NYSE: UAL) since he became CEO two years ago — and he did not always handle them well. The worst incident was when a passenger was beaten by security personnel as he was taken off a plane in April. The reaction by Munoz, which was to ignore the issue and then blame the customer, was widely condemned.

Such events do not make or break a CEO. But United’s board might have doubts about Munoz’s leadership. In April, the board amended a plan to make Munoz chairman. That action occurred shortly after the incident regarding the passenger.

Also, recent financial results and forecasts have disappointed Wall Street, and analysts have downgraded the stock. As Morningstar opined recently, “Management credibility looks increasingly shaky.” United is developing a reputation as an airline not run as well as its primary competitors.

11. Nick Woodman

> Company: GoPro Inc.

> Industry: Technology

> Tenure: 2002 to present

> YTD share price change: -9%

GoPro (NASDAQ: GPRO) was initially a significant growth company that sold its helmet-mounted action cameras for extreme sporting enthusiasts. Founder and CEO Nick Woodman scraped together cash from family and from selling shell jewelry and belts out of a Volkswagen van to launch GoPro.

The rise of the company was quite impressive. Unfortunately, even considering the newer drone sales, GoPro more or less still feels like a one-hit wonder. Its stock vaulted higher after the IPO, moving to $93.70 in September 2014. Since sales tanked in 2016, however, GoPro shares have languished at less than $10. The stock’s faltering performance alone would spell out a call for outside help to run the company.

According to a CNBC story on Woodman in early 2017, GoPro ran into production problems, and new launches have failed to engage the public. The company missed out on capitalizing on the rise and dominance of smartphones.

In addition to running GoPro, Woodman has undertaken philanthropy and was a guest-host on “Shark Tank,” the entrepreneur reality funding show. There may be too much going on in Woodman’s life and he needs to focus more on GoPro.

[in-text-ad]

12. Mark Fields

> Company: Ford Motor Co.

> Industry: Automotive

> Tenure: July 2014 to May 2017

> YTD share price change: +4%

Mark Fields was forced out of Ford (NYSE: F) in May. The Ford family has a great deal of control over the board, which includes Executive Chairman William Clay Ford, Jr. The automaker has had eight CEOs since Ford joined the board.

The board fired Fields over performance issues and because Ford’s share price fell 35% during his nearly three-year tenure.

Investors — and the Ford family — have been concerned about the company’s strategic moves. Even as most car manufacturers moved into the electronic vehicle and autonomous car sectors, Fields did not push aggressively enough for the company to join in these new, potentially high-growth areas. Ultimately, this meant Ford continued to rely on its industry sales leader, the F-150 pick-up.

Ford’s product mix was too heavy on sedans and coupes and too light on crossovers and SUVs. The company also lacked major success in China. These issues hampered Fields during his tenure.

The Fords wanted Fields out, and had good reason.

13. Kosta Kartsotis

> Company: Fossil Group Inc.

> Industry: Retail

> Tenure: October 2000 to present

> YTD share price change: -71%

Fossil (NASDAQ: FOSL) has been a disaster for shareholders. The company’s shares traded at more than $127 in November 2013, but plunged to around $7 in early November 2017.

This is a hard time to be in the business of branding and selling fashion watches and jewelry, handbags, small leather goods, belts, and sunglasses.

Fossil has its own retail stores and also sells through department stores and other retailers. Even though it has developed an e-commerce presence, that has not been enough to stop the onslaught from competitors. The reality is that a business built on watches is going to have a tough time in a world of smartphones, smartwatches, and fitness trackers. CEO Kosta Kartsotis has presided over Fossil since 2000, after taking over from his brother who founded the company. He has reportedly not taken any salary or received any stock awards since 2004.

After pledging shares as collateral for a bank loan earlier in 2017, Kartsotis sold those recently and now holds less than 8% of the company.

14. Eddie Lampert

> Company: Sears Holdings Corp.

> Industry: Retail

> Tenure: January 2015 to present

> YTD share price change: -60%

The length of Eddie Lampert’s tenure as CEO is a little misleading. He has been the largest shareholder of Sears Holdings Corp. (NASDAQ: SHLD), the parent of Sears and Kmart, since the company was created in March 2005.

Sears Holdings has been among the most poorly run of many poorly run bricks-and-mortar retailers. Its same-store sales have plunged as its stores have aged, and the company has not effectively positioned itself in the e-commerce business.

Lampert has staved off disaster by closing stores and laying off workers. He has complained that his critics have been misguided. However, his only contribution to the company is to keep it afloat through loans from businesses related to his hedge fund ESL Investments.

[in-text-ad-2]

15. Marcelo Claure

> Company: Sprint Corp.

> Industry: Telecommunications

> Tenure: August 2014 to present

> YTD share price change: -33%

Sprint (NYSE:S) is the result of the combination of Sprint, Nextel, Clearwire, and Virgin Mobile, and it has been an absolute disaster for shareholders. Since December 2013, the shares have slid 46% from $10.75 to $5.84 in late December.

Marcelo Claure has been CEO of Sprint since 2014. The company provides service to 54 million customers in nearly 200 countries. In 2013, the Japanese telecommunications company SoftBank Group Inc. made a multi-billion dollar investment in Sprint, acquiring a 70% stake. Ever since that deal, some industry observers have regarded the Sprint shares as more or less a tracking stock under Softbank.

Publicly, things have not been going well for Sprint. Claure is feuding with T-Mobile US’s John Legere, and Sprint’s acquisition by T-Mobile US recently fell apart because SoftBank CEO Masayoshi Son was not prepared to relinquish control of Sprint.

Sprint’s debt load and leverage may prevent it from being able to diversify out of mobile communications.

Sprint, the smallest of the four U.S. nationwide carriers, appears to be too challenged for anyone who has outside interests and demands.

Sprint failed to execute a merger under Claure and the company’s shares have lost much of their value in a raging bull market.

16. Michael Polk

> Company: Newell Brands Inc.

> Industry: Retail

> Tenure: July 2011 to present

>YTD share price change: -31%

Michael Polk has presided as chief executive of Newell Brands (NYSE: NWL) since July 2011. The company is best known for its Rubbermaid plastic storage containers, Sharpie pens, Calphalon cookware, Graco baby carriers, and Yankee Candle, among other brands.

Polk led a successful turnaround since rolling out his growth game plan in 2012, but the $15 billion acquisition of Jarden that closed in early 2016 may have marked a zenith for the CEO. Newell shares have fallen 44% from $54.85 in mid-June to $30.21 in mid-December.

Investors may be worried about higher debt levels — still more than $11 billion in long-term debt alone. Any major acquisitions could further add to debt. Investors are also concerned that the company might trim 10% of its portfolio of brands and that, if not properly executed, could generate more losses. The company has sold brands tied to its tools and winter sports segment.

Newell was a great growth story for years, and the company seemed to be able to do no wrong. But these days it is harder being a brands company operating in a world dominated by Amazon and omnichannel-style retail. Newell now has to sell itself to investors as a value stock — a tough sell in a roaring bull market.

[in-text-ad]

17. James Park

> Company: Fitbit Inc.

> Industry: Consumer electronics

> Tenure: September 2007 to present

> YTD stock price: -18%

According to many investors, some companies should never become public. These investors generally refer to corporations that do not have business models that can sustain support from shareholders. Fitbit (NYSE: FIT) fits that description.

CEO James Park co-founded the company in 2007 after realizing the potential of using sensors in wearable activity trackers.

Fitbit operates in a sector that includes China consumer electronics giant Xiaomi and Apple (NASDAQ: AAPL). Among the mistakes Park has made is to focus on the crowded health-care and fitness segments of the wearables market, which Xiaomi and Apple have taken positions in.

Fitbit’s third-quarter revenue slumped 21.8% to $393 million from $503 million in the same quarter last year. Fitbit also posted a loss of $113 million in the quarter after reporting a profit of $26.1 million in last year’s quarter. Some analysts have downgraded the shares.

Park took Fitbit public and then pushed it in the wrong direction.

18. Daniel McCarthy

> Company: Frontier Communications

> Industry: Consumer electronics

> Tenure: September 2007 to present

> YTD share price change: -86%

Daniel McCarthy became chief executive officer of Frontier Communications (NASDAQ: FTR) in April 2015, after joining its board the previous year. Frontier offers fixed-line phone, internet, and video communications (copper and fiber) to residential customers in 29 states and to businesses.

This is a tough business to be in as the world goes wireless. Finding a CEO replacement may be difficult. Still, Wall Street investors would probably love for Frontier to bring in new blood.

The problem is not just a lack of growth, as Frontier is a company that derived its dividend from cash flows rather than earnings per share. Its stock is down more than 90% since February 2015, when its shares traded at $125.70, and is now trading around $7. Reverse stock splits and cutting dividends are strategies that are hard to explain as beneficial to shareholders, but sometimes the situation becomes dire enough that few choices remain.

Frontier is also a company with many shareholder class-action suits against it. Frontier’s stock is down by about 87% so far in 2017.

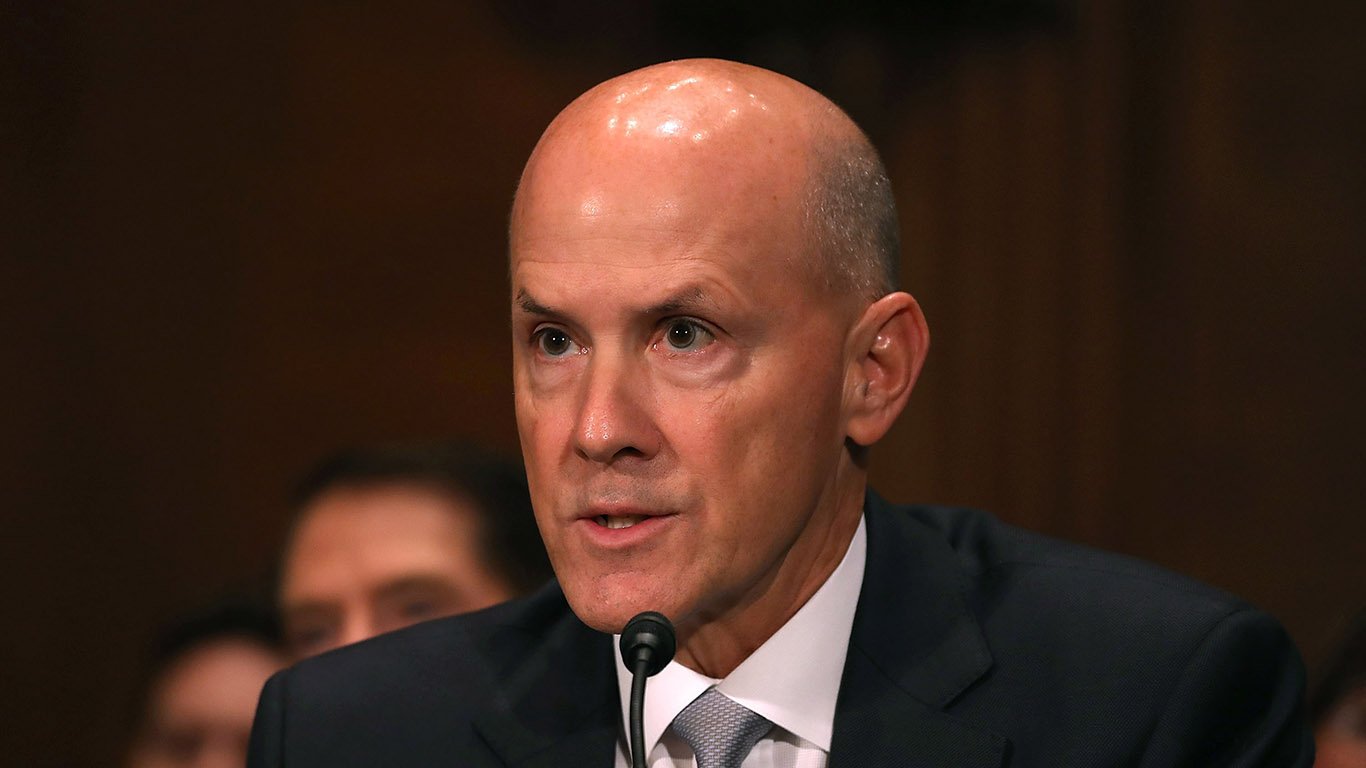

19. Richard Smith

> Company: Equifax Inc.

> Industry: Financial services

> Tenure: December 2005 to September 2017

> YTD share price change: +1%

A consumer credit reporting agency with records on more than 750 million people and 80 million business should be as secure from cyberattacks as any company in the world. That was not the case with Equifax (NYSE: EFX), which was hacked this year and more than 145 million records were exposed.

Oddly, the company said the hack occurred in May and June, but management did not know about the problem until late July. The timeline deeply concerned customers, the federal government, and investors. It also cost Smith his job. Smith retired from Equifax in September, reportedly with a payout worth as much as $90 million.

That same month, Equifax was forced to remove arbitration language from the terms of use on its data breach notification site. That followed a firestorm of protest when it was discovered that Equifax had inserted arbitration clauses that limited consumers’ ability to join class-actions against the company.

[in-text-ad-2]

20. Steve Ells

> Company: Chipotle Mexican Grill Inc.

> Industry: Restaurants

> Tenure: 1993 to present

> YTD share price change: -22%

Steve Ells in November announced he would step down as CEO and continue on Chipotle’s board with the title of executive chairman. At the time, lead independent director Neil W. Flanzraich said, “Now is the right time to identify a new CEO who can reinvigorate the brand and help the company achieve its potential.”

What has Ells been doing all of these years? Most recently, making decisions that have undermined the brand in reaction to a series of food-poisoning incidents that have caused investors and consumers to question the food chain’s health standards.

Tainted-food incidents are not the only issue hurting the Chipotle (NYSE: CMG) brand. In April, a huge data breach exposed hundreds of thousands of customer records.

It is not unusual for a founder to be forced out when a company gets into trouble. Chipotle’s board may have waited too long.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.