Special Report

America's 50 Best Cities to Live

Published:

Last Updated:

There are nearly 20,000 villages, towns, and cities, across the nearly 3.8 million square miles that comprise the United States. More than 1-in-10 Americans move each year, and suffice it to say, when it comes to choosing a place to settle down, they have options.

For many, deciding on a place to call home is influenced by subjective or personal variables like climate, proximity to friends and family, or a job opportunity. For those with greater flexibility, however, there are dozens of objective factors to consider, as overall quality of life can vary considerably from town to town and city to city.

In an ideal community, the streets are safe and those who want a job have little difficulty finding one. An ideal city is also an affordable one, a place where residents can keep more of their disposable income. A range of transportation options and easy access to entertainment and cultural attractions can also improve quality of life.

24/7 Wall St. created a weighted index of over two-dozen measures to identify the best American cities to live in. The communities on this list span the country from coast to coast but are disproportionately concentrated in the Midwest.

Though every city on this list is relatively small — home to fewer than 25,000 people — many are located within a major metropolitan area and are well within commuting distance of a large city.

While there is no such thing as a perfect city, the advantages of living in the cities on this list largely outweigh any drawbacks. Not all cities are created equal — and these are the best American cities to live in.

For comparison purposes, boroughs, census designated places, cities, towns, and villages were all considered. To avoid geographic clustering, only the top ranking community in a given county was included on this list. We only reviewed communities with at least 8,000 residents.

Click here to see the best cities to live in.

Click here to see our detailed findings and methodology.

50. Williston, North Dakota

> Population: 23,902

> 5 yr. population change: +65.5% (top 10%)

> Median home value: $223,800 (top 20%)

> Median household income: $90,875

Williston, North Dakota, is a modern day boom town, one of many cities in the state rapidly transformed by oil extraction. People are flooding into Willison and other nearby towns at a high rate. Over the past five years, Williston’s population exploded by 65.5%.

Due in part to the oil boom, the city’s five-year average unemployment rate of just 2.2% is well below the average U.S. unemployment rate of 7.4% over the same time. Many of the jobs in the area are also high paying as Williston’s median household income of $90,875 is well above the $55,322 national median household income.

[in-text-ad]

49. Grove City, Pennsylvania

> Population: 8,170

> 5 yr. population change: -1.7% (bottom 20%)

> Median home value: $119,400

> Median household income: $44,310

Like many communities on this list, Grove City’s high quality of life is supported by a strong job market. Over the last five years, the city’s average unemployment stood at just 2.3%, less than a third of the comparable national unemployment rate. Among the area’s largest employers are a General Electric engine plant and University of Pittsburgh Medical Center.

Grove City residents also have a wide range of entertainment options and cultural amenities. The population-adjusted concentration of venues like restaurants, movie theatres, libraries, and golf courses is far greater in Grove City than is typical nationwide.

48. Snyder, Texas

> Population: 11,541

> 5 yr. population change: +4.4%

> Median home value: $87,500 (bottom 10%)

> Median household income: $50,325

Snyder, Texas, was originally known as “Hide Town” for its early buffalo-hide dwellings, and “Robber’s Roost” for the criminals that would often pass through it in the late 19th century. After the discovery of oil in the surrounding Scurry County in 1948, the town’s population peaked to roughly 16,000 before dropping to its current level.

Though Snyder residents do not have especially high incomes — the typical household earns $50,325 a year — the area’s poverty rate of 9.3% is lower than both national and state rates. The relative lack of financial hardship is due in large part to a low cost of living. Goods and services are 11% less expensive on Snyder than they are nationwide, on average.

47. Storm Lake, Iowa

> Population: 10,768

> 5 yr. population change: +3.2%

> Median home value: $111,700 (bottom 20%)

> Median household income: $43,226

Storm Lake, Iowa, is one of the least expensive places to live in the country. Most American homeowners spend more than $12,000 annually on housing. In Storm Lake, most pay less than $8,000 on housing each year.

Storm Lake the city occupies the northern shore of Storm Lake. Proximity to the lake provides residents with beach access for swimming, boating, fishing, and other outdoor activities. The city also has a number of other outdoor amenities, including hiking and cross country ski trails, as well as campgrounds.

[in-text-ad-2]

46. Bridgeport, West Virginia

> Population: 8,364

> 5 yr. population change: +3.9%

> Median home value: $199,000

> Median household income: $80,462

Bridgeport is the only West Virginia city to rank among the best places to live. In Bridgeport, 45.3% of adults have graduated from college, nearly the highest share of cities in the state. The high college attainment rate has likely contributed to the town’s relatively high median household income of $80,462 a year. Not only is Bridgeport wealthy, but it is also inexpensive. Goods and services are 15% less expensive than average in the city.

When it comes to culture and entertainment, Bridgeport residents have options. The city is home to a far higher concentration of restaurants, bars, recreation centers, golf courses, and movie theatres than is typical nationwide.

45. Hays, Kansas

> Population: 21,073

> 5 yr. population change: +3.3%

> Median home value: $161,800

> Median household income: $45,795

A healthy job market is extremely important for people considering moving to an area, both because it means they are more like to be able to earn an income, and because low unemployment is usually a sign of regional prosperity, which translates into a better tax base for the local government to draw on to improve services and infrastructure, as well as schools.

Hays has an annual unemployment rate of just 3.6%, compared to the national annual unemployment rate of 4.4%. Also, sometimes an unemployment rate can fail to represent the true employment situation, as people who give up looking for work entirely are not counted in the unemployment rate. In Hays, over 73.6% of the working age population are employed, compared to just 58.8% of all working age Americans.

[in-text-ad]

44. Albert Lea, Minnesota

> Population: 17,775

> 5 yr. population change: -1.5% (bottom 20%)

> Median home value: $95,200 (bottom 20%)

> Median household income: $42,128

Albert Lea is a small Minnesota city with 17,800 residents located about 100 miles south of downtown Minneapolis. A number of Minnesota cities rank among the best cities to live, and of these, Albert Lea is by far the most affordable. Nationwide, the typical home is worth 3.3 times the national median household income. In Albert Lea, the typical home has a value of $95,200, just 2.3 times the city’s median household income of $41,128. Overall, goods and services are 19% less expensive in Albert Lea than they are nationwide on average.

Albert Lea is also safe, with one of the lowest annual violent crime rates in the country of just 85 incidents per 100,000 people, compared to a national violent crime rate of 383 per 100,000.

43. Andover, Kansas

> Population: 12,477

> 5 yr. population change: +9.8%

> Median home value: $176,200

> Median household income: $85,230 (top 20%)

Andover is one of the wealthiest cities in Kansas. The typical Andover household earns $85,230 a year, nearly $30,000 higher than the U.S. median income. A dollar also goes a long way in Andover, as goods and services in the city are about 11% less expensive than they are on average nationwide.

This suburb of Wichita was decimated by a powerful F5 tornado in 1991, but its residents rebuilt the town, and Andover continues to thrive. Over the past five years, Andover’s population has grown nearly 10%, more than double the national population growth of 3.9%.

42. Hutchinson, Minnesota

> Population: 13,891

> 5 yr. population change: -2.1% (bottom 10%)

> Median home value: $138,600

> Median household income: $52,864

Hutchinson is a relatively safe city. It’s violent crime rate of 159 incidents per 100,000 residents is less than half the U.S. violent crime rate. Like many other communities in Minnesota, Hutchinson borders several lakes, which provide residents and visitors alike with opportunities for outdoor activities like swimming. The parks department also notes that there are many nearby hiking trails.

Unlike most cities on this list, Hutchinson is not attracting new residents at a fast enough rate to grow. The town’s population fell by 2.1% in the past five years, even as the U.S. population climbed 3.9% over the same period.

[in-text-ad-2]

41. Sturgeon Bay, Wisconsin

> Population: 9,007

> 5 yr. population change: -1.7% (bottom 20%)

> Median home value: $136,500

> Median household income: $48,377

Sturgeon Bay is is located on the Door Peninsula, on the shores of Lake Michigan. In addition to offering residents many beautiful views of the lake, Sturgeon Bay is a great city for people interested in dining and drinking out. Relative to the population, there are roughly five times as many bars and three times as many restaurants and places to eat as is typical nationwide. Sturgeon bay also has several interesting attractions, including the Door County Maritime Museum and the Cana Island Lighthouse.

40. Paradise Valley, Arizona

> Population: 13,833

> 5 yr. population change: +5.6%

> Median home value: $1,332,600 (top 10%)

> Median household income: $173,487 (top 10%)

Most houses in Paradise Valley, Arizona, are worth over $1.3 million, more than seven times the U.S. median home value. Paradise Valley residents are able to afford such expensive houses because of their relatively high incomes. The typical household in the city earns $173,487 a year, one of the highest median household incomes in the country.

Paradise Valley lives up to its name as a popular destination to relax. The town is home to several resorts and a number of high end golf courses. Located just north of Phoenix and Scottsdale, it is also known for its high-end dining and nightlife.

[in-text-ad]

39. North Liberty, Iowa

> Population: 16,984

> 5 yr. population change: +35.2% (top 10%)

> Median home value: $188,400

> Median household income: $77,752

Having a job can be important to maintaining a good quality of life. Those with jobs are far less likely to live in poverty and struggle financially and otherwise. In North Liberty, virtually anyone who wants to work does so. Over the five years through 2016, the city’s unemployment rate has averaged less than 1%, compared to a national average of 7.4%. The city’s labor force participation rate of 85.3% is well above the comparable 63.5% national rate.

As a sign of the desirability of the city, North Liberty’s population has grown by 35.2% in the last five years alone, many times greater than the national growth rate of 3.9%.

38. Brandon, South Dakota

> Population: 9,674

> 5 yr. population change: +13.7% (top 10%)

> Median home value: $183,000

> Median household income: $75,424

Population growth tends to indicate that an area is flourishing economically. Often, such economic strength comes with job growth. In Brandon, South Dakota, the population grew by 13.7% over the last five years, 3.5 times the national population growth over the same period.

Still, the city, located just a few miles northeast of Sioux Falls, remains relatively small, with a population of less than 10,000. As is often the case with smaller towns and cities on this list, crime is uncommon in Brandon. There were just 258 property crimes reported in the city in 2017 per 100,000 residents, less than one-ninth the national property crime rate of 2,362 per 100,000.

37. Snoqualmie, Washington

> Population: 12,510

> 5 yr. population change: +28.3% (top 10%)

> Median home value: $471,800 (top 10%)

> Median household income: $131,453 (top 10%)

Snoqualmie, Washington, is one of the safest places in the country. There were just 15 violent crimes for every 100,000 city residents in 2017, one of the lowest violent crime rates in the country. The town’s property crime rate of 1,077 incidents per 100,000 residents is also less than half the national rate.

Areas with higher median household incomes tend to have less crime than lower income areas. The median annual household income in Snoqualmie, which is within commuting distance of Seattle, is $131,453 a year, one of the higher incomes among American cities. In addition to the culture and entertainment Seattle has to offer, Snoqualmie has a higher than typical concentration of restaurants, bars, museums, and movie theatres.

[in-text-ad-2]

36. Buda, Texas

> Population: 11,936

> 5 yr. population change: +72.0% (top 10%)

> Median home value: $201,500

> Median household income: $72,020

Buda, Texas’ five year annual average unemployment rate of 4.4% is below the national figure of 7.4%. The unemployment rate only includes those who are looking for work, and the job market in Buda is even more favorable than the unemployment rate suggests. Places with healthy job markets tend to have higher labor force participation, a sign fewer people have given up looking for work. In Buda, 71.7% of the working-age population is employed, much higher than the national employment rate of 58.4% of the population.

Poverty can have wide-reaching negative effects not just on the individuals that earn low incomes, but also on entire areas. Buda has one of the lowest poverty rates in the country. Just 4.0% of the city’s population lives in poverty, compared to 15.1% of the U.S. population.

35. Los Alamos, New Mexico

> Population: 11,733

> 5 yr. population change: -2.9% (bottom 10%)

> Median home value: $277,700

> Median household income: $101,535 (top 20%)

The only city in New Mexico to rank among the best places to live, Los Alamos is flush with history, cultural amenities, and parks. These include a science museum, a theatre, nearly 100 public art installations, a network of over 90 miles of hiking trails, and the Manhattan Project National Historical Park — a monument to the city’s critical role in World War II and development of the atomic bomb. Los Alamos also has one of the best public high schools in New Mexico, according to U.S. News & World Report.

Many living in the area work at the Los Alamos National Laboratory, a facility run by the U.S. Department of Energy with a $2.6 billion budget primarily allocated to weapons development.

[in-text-ad]

34. Highland Park, Texas

> Population: 8,986

> 5 yr. population change: +4.8%

> Median home value: $1,253,600 (top 10%)

> Median household income: $189,485 (top 10%)

Highland Park, Texas, is one of the wealthiest communities in the United States. The typical household earns nearly $190,000 a year, well more than triple the national median household income of $55,322 a year. Just north of downtown Dallas, Highland Park residents have easy access to employment and entertainment in a major city.

The town and surrounding area boast multiple shopping complexes, including Highland Park Village — the first planned outdoor shopping center in the United States — the Frontiers of Flight Museum, Lakeside Park and its 14 acres of trails, the Museum of Biblical Art, and the Dallas Children’s Theater.

The Cincinnati suburb of Wyoming, Ohio, ranks among the best cities to live in due in part to its affordability. Goods and services are 15% less expensive in Wyoming than they are nationwide on average. Not only does a dollar go a long way in the city, but many residents are also relatively wealthy. The typical household in the city earns nearly $120,700 a year, more than double the median household income nationwide of $55,322.

Wyoming is also safe. The city recorded just 35 violent crimes per 100,000 people in 2017, a small fraction of the 383 per 100,000 national violent crime rate.

32. East Grand Rapids, Michigan

> Population: 11,297

> 5 yr. population change: +5.2%

> Median home value: $303,400

> Median household income: $118,393 (top 10%)

East Grand Rapids is the wealthiest city in Michigan and one of the wealthiest cities in the United States. The typical area household earns over $118,000 a year compared to the $55,322 the typical household earns nationwide. City residents also benefit from a low cost of living as goods and services are 7% less expensive in East Grand Rapids than they are on average nationwide.

In addition to entertainment and cultural attractions in nearby Grand Rapids, East Grand Rapids has 10 parks, including a lake with a boat launch, miles of trails, playgrounds, and a baseball field.

[in-text-ad-2]

31. Thief River Falls, Minnesota

> Population: 8,726

> 5 yr. population change: +1.9%

> Median home value: $111,200 (bottom 20%)

> Median household income: $42,734

Named centuries ago for an outcast from the Sioux Native American tribe who lived as an outlaw in the region, Thief River Falls is one of six Minnesota cities to rank among the best places to live. Like other high ranking cities in the state, the city is affordable. Median monthly housing costs total just $613, and only $580 for renters. For comparison, monthly housing costs nationwide are $1,012, and $949 for renters.

Contrary to what its name may suggest, Thief River Falls is a safe city. The city’s violent crime rate of 125 incidents per 100,000 people is less than a third the comparable national violent crime rate of 383 per 100,000.

30. Elk River, Minnesota

> Population: 23,743

> 5 yr. population change: +4.2%

> Median home value: $214,900

> Median household income: $83,585 (top 20%)

The poverty rate in Elk River, Minnesota, is 7.0%, less than half of the nationwide poverty rate of 15.1%. Elk River residents tend to earn high incomes, as most households in the area earn over $83,500 a year. Areas where residents earn higher incomes tend to report lower crime rates and Elk River is no exception. The city’s violent crime rate of 98 incidents for every 100,000 people, is well below the nationwide violent crime rate of 383 per 100,000.

[in-text-ad]

29. Spencer, Iowa

> Population: 11,172

> 5 yr. population change: -0.3%

> Median home value: $119,700

> Median household income: $45,559

Residents of Spencer, Iowa, benefit from some unique conditions that can greatly improve overall quality of life.

First, housing costs in Spencer, Iowa are well below the average costs across the country. The typical resident pays less than $700 a month on housing — compared to the median monthly housing cost of over $1,000 nationwide. Additionally, while long commutes and traffic congestion are a considerable source of stress in some parts of the country, they are not as much of a factor in Spencer. The average commute time in the northern Iowa city is less than 15 minutes, well below the 26 minute national average.

28. Falls Church, Virginia

> Population: 13,597

> 5 yr. population change: +14.8% (top 10%)

> Median home value: $724,000 (top 10%)

> Median household income: $115,244 (top 10%)

Located just outside Washington D.C. and Arlington, Virginia, Falls Church is an ideal place for many government workers and contractors to commute from. A fairly large share of city residents, 19.8%, commute to work via public transportation, as the town has a stop on the Washington metro area’s train service. In addition to cultural and entertainment attractions in D.C., Falls Church residents have some 500 restaurants for every 100,000 in their own city, more than double the national concentration.

Many of the people living in the city are affluent. The typical Falls Church household earns $115,244 a year, more than double the median household income nationwide. The city’s poverty rate of 2.7% is less than one-fifth of the nationwide poverty rate.

27. Jamestown, North Dakota

> Population: 15,441

> 5 yr. population change: +1.0%

> Median home value: $120,100

> Median household income: $49,086

The typical household in Jamestown, North Dakota, earns $49,086 a year, slightly less than the median income nationwide of $55,322 a year. Still, because costs are relatively low in Jamestown, a dollar goes further in the city. Median monthly housing costs in the city are just $646, well below the corresponding national median of $1,012. Also, the job market in the city has been relatively strong in recent years. The city’s five-year average unemployment rate stands at 2.4%, less one-third of the comparable rate nationwide of 7.4%.

Jamestown is one of three North Dakota cities along the I 94 corridor to rank among the best places to live.

[in-text-ad-2]

26. Pierre, South Dakota

> Population: 13,959

> 5 yr. population change: +2.2%

> Median home value: $164,900

> Median household income: $54,868

Most American homeowners spend more than $12,000 per year on housing. In Pierre, South Dakota, most spend less than $8,500 annually. Lower housing costs allow residents to use their money on food, clothes, or add it to their savings. Overall, the cost of living is lower in Pierre, as goods and services are 85% less expensive than they are on average nationwide.

Pierre, South Dakota’s capital, is home to many outdoor amenities largely thanks to its proximity to the Missouri River. Both Farm Island and LaFramboise Island, located in the river next to the city, offer residents the opportunity to take part in outdoor activities like swimming and hiking.

25. Batesville, Arkansas

> Population: 10,579

> 5 yr. population change: +4.5%

> Median home value: $120,400

> Median household income: $42,143

Batesville, Arkansas, ranks among the best U.S. cities to live in largely due to its affordability and community attractions and amenities. Most homeowners in Batesville pay less than $1,000 a year in property taxes, less than half the amount the typical American homeowner pays. The Overall annual housing costs typically come to about $7,500 a year, roughly $4,600 less than the median costs nationwide. On the whole, good and services are 16% less expensive on average in Batesville than they are typically nationwide.

With roots as far back as 1804, Batesville is the second oldest city in Arkansas. The city, which avoided destruction in the Civil War, has a number of historic buildings and sites. The are attractions in the area for nearly every taste and preference, including antique stores, art galleries, an annual film festival, and the Batesville Motor Speedway.

[in-text-ad]

24. McPherson, Kansas

> Population: 13,212

> 5 yr. population change: 0.0%

> Median home value: $135,800

> Median household income: $54,057

The median household income in McPherson, Kansas of $54,057 a year is just below the national median of $55,322. However, a dollar goes a long way in McPherson as goods and services are 14% less expensive than they are on average nationwide. Indeed, extreme financial hardship is relatively rare in the city. Just 7.3% of residents live in poverty compared to 15.1% of Americans.

McPherson residents also have many options when it comes to entertainment and recreation. The city has a far greater than typical concentration of restaurants, fitness centers, museums, golf courses, and movie theatres.

23. Pella, Iowa

> Population: 10,280

> 5 yr. population change: -0.6% (bottom 20%)

> Median home value: $175,300

> Median household income: $60,568

Pella, Iowa, is characterized by high incomes and low living expenses. The typical city household earns over $60,000 a year, compared to the national median household income of $55,322 a year. Meanwhile, typical monthly housing costs in the city total just $884, compared to over $1,000 on average nationwide.

Quality of life in Pella also benefits from its high walkability. Over 13% of commuters in the city walk to work, more than four times the 2.8% share nationwide. Similarly, while long commutes and traffic congestion are a considerable source of stress in some parts of the country, they are not as stressful a factor in Pella. The average commute time in the city is just under 11 minutes, less than half the 26 minute national average.

22. Johnston, Iowa

> Population: 19,491

> 5 yr. population change: +18.5% (top 10%)

> Median home value: $237,600

> Median household income: $95,565 (top 20%)

The small Des Moines suburb of Johnston is one of several cities in Iowa to rank among the best places to live. With access to jobs in and around the state capital, Johnston’s five-year average unemployment rate of 3.8% is well below the comparable national rate of 7.4%. Many jobs in the area are high paying as the typical Johnston household earns $95,565 a year, well above the national median income of $55,322. A dollar also goes a long way in the city as goods and services are 19% less expensive in Johnston on average than they are nationwide.

Like many cities on this list, Johnston is growing rapidly. In the last five years, the city’s population grew 18.5%. For reference, the U.S. population grew by 3.9% over the same period.

[in-text-ad-2]

21. Franklin Park, Pennsylvania

> Population: 14,228

> 5 yr. population change: +7.9%

> Median home value: $312,200

> Median household income: $121,661 (top 10%)

Franklin Park, Pennsylvania, is a borough just outside of Pittsburgh. The area has a relatively high share of residents with high educational attainment. A whopping 70% of town adults hold at least a bachelor’s degree, one of the higher college attainment rates among U.S. cities. Those college degrees are more qualified for specialized jobs that tend to have higher salaries. In Franklin Park, the median household income of $121,661 a year is one of the highest in the country.

Like many affluent, well educated areas, Franklin Park is relatively safe. The community’s violent crime rate of 14 incidents per 100,000 people is one of the lowest in the country. Nationwide, there were 383 violent crimes for every 100,000 people in 2017.

20. Bath, Maine

> Population: 8,334

> 5 yr. population change: -3.6% (bottom 10%)

> Median home value: $164,600

> Median household income: $42,275

Bath is the only city in Maine and the broader New England region to rank among the best places to live. Bolstered largely by Bath Iron Works, a shipbuilding plant operated by defense giant General Dynamics, the city’s job market is relatively strong. Annual unemployment in the city, located near the mouth of the Kennebec River, stands at 3.2%, well below the 4.4% national rate. Many residents also benefit from the city’s walkability as more than one in 10 commuters in Bath walk to work, more than triple the comparable national share. The city is also relatively safe, and also has a high concentration of restaurants, fitness centers, museums, and libraries.

Despite its advantages, Bath is one of only a handful of cities on this list to be shrinking in size. Over the last five years, Bath’s population declined by 3.6%, even as the total U.S. population grew 3.9%.

[in-text-ad]

19. Palos Verdes Estates, California

> Population: 13,582

> 5 yr. population change: +1.3%

> Median home value: $1,609,500 (top 10%)

> Median household income: $200,766 (top 10%)

Located along the Pacific Coast less than 30 miles from L.A., Palos Verdes Estates is the only California city to rank among the best places to live. One of the wealthiest neighborhoods in the country, the typical household earns over $200,000 a year, more than triple the national median household income of $55,322. Crime is virtually unheard of in Palos Verdes Estates as its violent crime rate of 22 incidents per 100,000 people is a small fraction of the national violent crime rate of 383 per 100,000.

That the city ranks among the best to live in may not come as a surprise to those familiar with it, as it is a master-planned city, designed by the Olmsted Brothers, sons of Frederick Law Olmsted — architect of New York City’s Central Park and the Stanford University campus.

18. Whitefish Bay, Wisconsin

> Population: 14,088

> 5 yr. population change: +0.4%

> Median home value: $350,700 (top 20%)

> Median household income: $105,156 (top 10%)

Whitefish Bay, a Milwaukee suburb along the shore of Lake Michigan, is one of two Wisconsin cities to rank among the 50 best places to live. The high quality of life in Whitefish Bay is partially the result of a strong job market. The area’s average unemployment rate over the last five years stands at just 3.2% — less than half the comparable nationwide rate of of 7.4%.

Whitefish Bay is also one of the safest communities in the country with a violent crime rate of just 36 incidents per 100,000 people. For reference, there were 383 violent crimes per 100,000 people nationwide in 2017.

Incorporated in 1985, Trophy Club, Texas is one of the newer towns on this list. The first master planned community in Texas, the town was built around a country club, which was originally planned to house the trophies legendary professional golfer Ben Hogan won during his golfing career.

Trophy Club is one of the safest cities in the United States. The town’s violent crime rate of 15 incidents per 100,000 people is a fraction of the 383 per 100,000 national violent crime rate. Serious financial hardship is also uncommon in Trophy Club. Just 2.2% of town residents live below the poverty line, well below the 15.1% U.S. poverty rate.

[in-text-ad-2]

16. Dickinson, North Dakota

> Population: 21,985

> 5 yr. population change: +25.3% (top 10%)

> Median home value: $224,800

> Median household income: $74,838

Like several other North Dakota cities on this list, Dickinson has been transformed by the recent oil boom. The city has experienced one of the larger population increases in recent years among American cities, as those seeking to work in oil fields flocked to Dickinson and other areas like it. In the last half decade, Dickinson’s population spiked by 25.3%. For reference, the U.S. population grew by just 3.9% over the same period.

The cost of living in Dickinson is about 12% lower than average nationwide, and residents tend to be relatively affluent. The city’s median household income of $74,838 is nearly $20,000 higher than that of the typical American household.

15. Powell, Ohio

> Population: 12,436

> 5 yr. population change: +11.6%

> Median home value: $348,000 (top 20%)

> Median household income: $132,917 (top 10%)

Like many cities on this list, Powell, Ohio is located only a short distance from a major city. Located just north of Columbus, Powell residents are within commuting distance of the state capital. Jobs tend to be concentrated in major cities, and many in Powell likely commute to jobs in Columbus as an average of just 3.1% of Powell’s labor force have been out of work in the last five years.

Likely thanks in part to the area’s healthy economy, the city’s residents also tend to have high incomes. More than half of Powell households earn more than $130,000 a year, and the city’s poverty rate of just 0.3% is also nearly the lowest of any city in the country.

[in-text-ad]

Waynesboro, an independent city in northern Virginia, is notable for its affordability, safety, and scenic beauty. Goods and services in the city are about 7% less expensive than they are nationwide on average. Additionally, the violent crime rate of 182 incidents per 100,000 people is less than half the U.S. violent crime rate of 383 per 100,000.

Located in the Shenandoah Valley, Waynesboro residents have easy access to the scenic Blue Ridge Parkway and a section of the Appalachian Trail. The South River cuts through the city, providing a water trail for residents to fish and enjoy by boat. Waynesboro also has a higher than typical concentration of restaurants, movie theatres, and museums.

13. Sartell, Minnesota

> Population: 16,442

> 5 yr. population change: +8.3%

> Median home value: $180,300

> Median household income: $71,959

Sartell, Minnesota, ranks as one of the best cities to live in largely because its residents tend to be relatively financially secure. Just 4.0% of residents live below the poverty line, less than a third of the U.S. poverty rate. The typical household in Sartell earns over $16,000 more than the typical American household.

The city, which straddles the Mississippi River, has a wide array of recreational options for residents. Sartell boasts has 28 parks and 48 miles of trails. These amenities, as well as those in the nearby city of St. Cloud, make Sartell a desirable place to live. In the past seven years, the city’s population has increased by more than 20%, nearly quadruple the 5.7% national population growth.

12. Tega Cay, South Carolina

> Population: 9,026

> 5 yr. population change: +23.3% (top 10%)

> Median home value: $301,200

> Median household income: $120,346 (top 10%)

Tega Cay ranks as one of the best cities to live in part because of its relatively high income, and in part due to the many associated benefits that come with affluence. The city’s median household income of over $120,000 is more than double the U.S. median. In a city where a high percentage of affluent households, there are also very few low-income residents. Just 0.9% of residents live in poverty.

Tega Cay lies near the border of the Carolinas and Lake Wiley. The water access gives residents a chance to swim, boat, and fish. As a tourist destination, the city has a high number of bars and restaurants per resident. Though it is a small town, Tega Cay is growing quickly. It was home to fewer than 5,000 people in 2009. As of 2016, more than 9,000 people lived there.

[in-text-ad-2]

11. Carroll, Iowa

> Population: 9,990

> 5 yr. population change: -0.9% (bottom 20%)

> Median home value: $137,600

> Median household income: $45,170

One of the safest cities in the country, Carroll’s violent crime rate of 20 incidents per 100,000 people is a fraction of the national violent crime rate of 383 per 100,000. Low crime rates tend to occur in areas where few residents struggle to find work, and joblessness is also not a problem for most of the Carroll labor force. Over the last five years, average unemployment in the city stood at 1.6%, well below the comparable 7.4% national rate.

Carroll residents have access to a dozen parks, several miles of trails, two golf courses, a brewing company, a winery and vineyard, and college and high school baseball games at the Merchants Park stadium.

10. New Ulm, Minnesota

> Population: 13,279

> 5 yr. population change: -1.6% (bottom 20%)

> Median home value: $133,100

> Median household income: $52,244

Residents of New Ulm, Minnesota, are more likely to work and earn high incomes, on average, than those in most other Americans. The town’s poverty rate of 8.5% is well below the national poverty rate of 15.1%. Also, the town’s five-year average unemployment rate of 2.6% is 4.8 percentage points below the comparable nationwide rate.

These numbers are better than the comparable national figures despite the fact that New Ulm residents tend to not be especially affluent. The town’s median household income of $52,244 a year is several thousand dollars lower than the U.S. median household income. Unlike almost all other places on this list, New Ulm’s population shrank over the past five years. During a time when the U.S. population grew 3.9%, New Ulm’s population dropped 1.6%.

[in-text-ad]

9. Chatham, Illinois

> Population: 12,569

> 5 yr. population change: +11.2%

> Median home value: $178,900

> Median household income: $80,808

Chatham, Illinois, a small village just outside of the state capital of Springfield, is one of the best places to live in the country. A relatively safe place, Chatham’s violent crime rate of 103 incidents per 100,000 people is less than a third of the U.S. rate of 383 violent crimes per 100,000 people. Chatham’s job market is also relatively strong. Just 4.1% of the area workforce has been unemployed on average over the last five years, compared to the 7.4% national five-year unemployment rate.

Chatham and the surrounding area has a number of amenities and attractions for residents to enjoy. Historic sites include the Lincoln Tomb, Lincoln Home National Historic Site, and the Old State Capitol. Activity venues in the area include the Interurban Bike Trail, Lake Springfield, and the Henson Robinson Zoo. The region also hosts the Illinois State Fair.

8. New Albany, Ohio

> Population: 9,384

> 5 yr. population change: +25.3% (top 10%)

> Median home value: $492,400 (top 10%)

> Median household income: $191,375 (top 10%)

New Albany, Ohio, is one of the most affluent cities in the country. The median household income of $191,375 is one of the five highest of U.S. cities. More affluent areas tend to have a number of advantages to livability over low-income cities, including lower crime rates. There were just 36.9 violent crimes reported per 100,000 residents in New Albany, less than a 10th of the nationwide crime rate.

New Albany has many amenities for residents, including over 600 acres of parks and sports fields. It also appears to have high quality schools. There are a number of factors that can draw people to certain towns, including jobs, schools, and amenities. New Albany excels in many of these aspects, and its population growth rate reflects that. The town’s population grew by more than 25% over the past five years, compared to the national growth rate of just 3.9%.

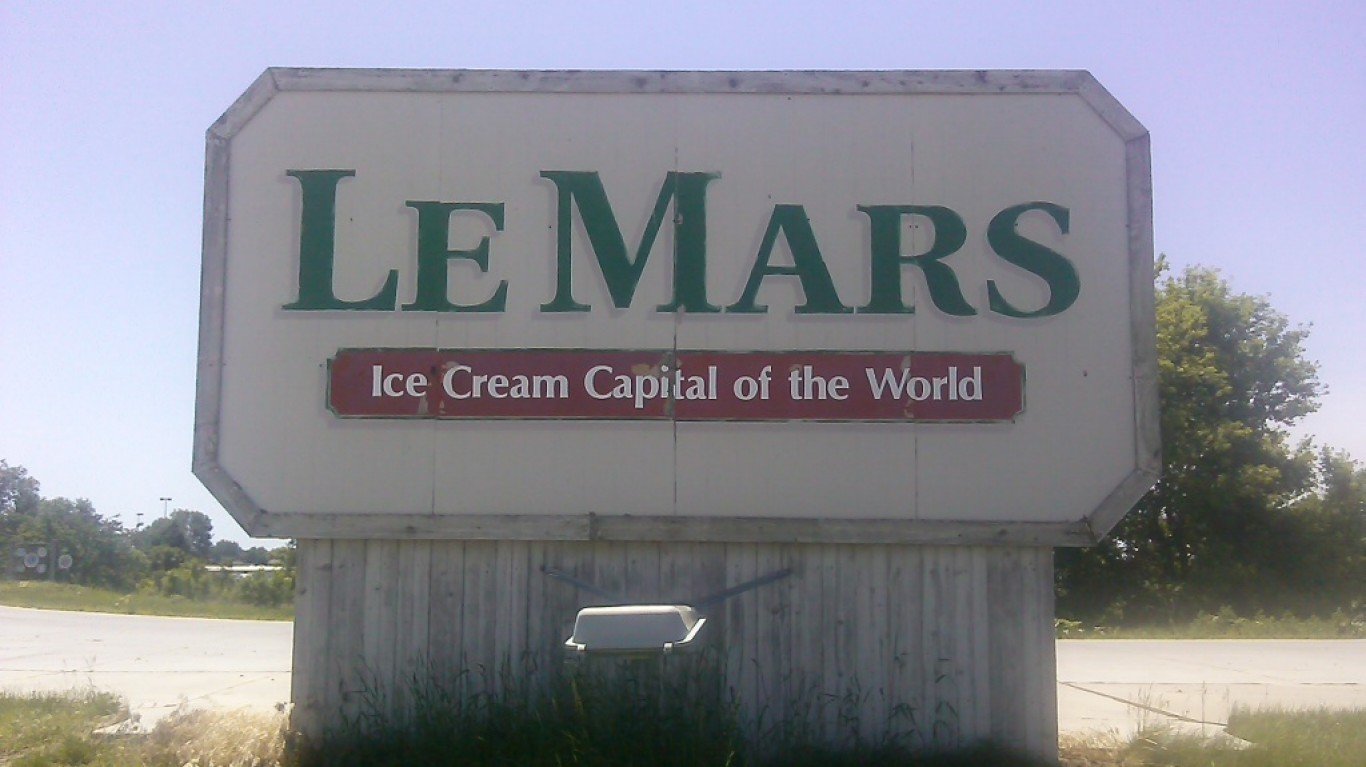

7. Le Mars, Iowa

> Population: 9,826

> 5 yr. population change: +1.0%

> Median home value: $139,400

> Median household income: $56,851

Le Mars, Iowa, is among the most affordable cities in the United States. Goods and services in the city cost about 15% less on average than they do nationwide. Housing is particularly inexpensive, with the typical household spending $8,124 a year, about $4,000 less than the average annual housing cost nationwide.

The city also has its share of attractions. Home to a Blue Bunny ice cream manufacturing plant, Le Mars churns out more ice cream from a single company than any other city, earning itself the nickname “The Ice Cream Capital of the World.” The city and surrounding area also boast a history museum, an art museum, a golf course, a campground, and of course, an ice cream museum.

[in-text-ad-2]

6. Ladue, Missouri

> Population: 8,579

> 5 yr. population change: +1.1%

> Median home value: $771,500 (top 10%)

> Median household income: $186,371 (top 10%)

The wealthiest city in Missouri, Ladue’s median household income of $186,371 a year is more than triple the national median income of $55,322. Not only is Ladue a wealthy city, but also inexpensive. Goods and services are 11% cheaper on average in Ladue than they are typically nationwide.

With easy access to jobs in nearby St. Louis, Ladue residents who want a job generally have no trouble finding one. Over the last five years, unemployment stood at just 2.0% in the city, a fraction of the comparable national rate of 7.4%. In addition to cultural attractions and entertainment venues in St. Louis, Ladue residents enjoy a greater than typical concentration of restaurants, fitness and recreation centers, golf courses, and museums within their own city limits.

5. Winnetka, Illinois

> Population: 12,437

> 5 yr. population change: +2.3%

> Median home value: $989,600 (top 10%)

> Median household income: $207,857 (top 10%)

Winnetka is a small village that sits on the shores of Lake Michigan about 15 miles north of downtown Chicago. By far the wealthiest city in the state, the typical Winnetka household earns $207,857 a year. Winnetka residents working in Chicago have options when it comes to transit, as over one-quarter of commuters use public transportation — an alternative most Americans do not have.

In the village, downtown shops were described by the Chicago Tribune in 2012 as reminiscent of the Hamptons on Long Island in New York, without the celebrities. Winnetka boasts four beaches, a boat launch, several parks, a tennis club, golf course, ice rink, and forest preserve areas, all open to the public.

[in-text-ad]

4. Dumas, Texas

> Population: 14,963

> 5 yr. population change: +4.2%

> Median home value: $106,800 (bottom 20%)

> Median household income: $50,773

Located about 50 miles north of Amarillo in northern Texas, Dumas ranks among the best cities to live in largely due to its affordability. Goods and services in the city are about 12% less expensive than they are nationwide on average. Housing is particularly cheap. The typical area homeowner spends just $704 a month on housing compared to an average monthly cost of over $1,000 nationwide.

The city also has fewer crimes, a lower jobless rate, and a greater concentration of restaurants, bars, movie theaters, and museums than the United States as a whole.

3. Perryton, Texas

> Population: 9,343

> 5 yr. population change: +3.9%

> Median home value: $88,400 (bottom 10%)

> Median household income: $46,535

Perryton, Texas, is one of the least expensive cities in the United States. The typical area homeowner spends just $627 per month on housing, while the typical American homeowner spends over $1,000. Overall, goods and services are 13% less expensive in Perryton than average nationwide.

The north Texas city is an oil town, benefiting economically from nearby oil drilling in the mid-20th century. In the last five years, unemployment in Perrytown has been lower than the national average.

2. Mandan, North Dakota

> Population: 20,613

> 5 yr. population change: +14.2% (top 10%)

> Median home value: $175,400

> Median household income: $60,034

Of the four cities in North Dakota to make this list, Mandan ranks the highest. Mandan residents benefit from a low cost of living — 13% lower than average nationwide — a five-year average unemployment rate of 2.0%, and a violent crime rate that is less than half the national rate. Mandan residents also have access to jobs, entertainment, and cultural attractions in Bismarck, the state capital located on the opposite side the Missouri River.

Recently, business leaders, elected officials, and ordinary citizens established a committee to form a comprehensive plan to improve Mandan over the coming decade. The committee’s accomplishments include broadened business support and incentives, the creation of annual festivals and events, public education improvements, and increased communication regarding local elections.

[in-text-ad-2]

A wealthy suburb of Houston, West University Place ranks as the best city to live in both Texas and the United States. A wealthy city, the median household income in West University Place of nearly $221,000 a year is nearly four times the income the typical American household earns. A dollar also goes far in the city as goods and services are about 5% less expensive than they are nationwide on average. In addition to entertainment and culture in nearby Houston, West University has a far greater concentration of restaurants, bars, fitness centers, museums and theatre companies than is typical nationwide.

West University is also a safe city with a strong job market. The city’s violent crime rate of 64 incidents for every 100,000 people is among the lowest in the nation, as is the city’s five-year average unemployment rate of 2.7%.

For those familiar with some of the cities on this list, their ranking among the best places to live in the country may not come as a surprise. Generally, the places on this list have low violent and property crime rates. Even if not always affluent, they are usually affordable. They are also often steeped in history, culture, and opportunities for entertainment.

Residents of the cities on this list also often take an active interest in the quality of their community. In Mandan, North Dakota, for example, business leaders, elected officials, and ordinary citizens formed a committee to enact a comprehensive plan to improve the city over the coming decade. The committee’s accomplishments include broadened business support and incentives, the creation of annual festivals and events, public education improvements, and increased communication regarding local elections.

Other cities on this list, like Trophy Club, Texas and Palos Verdes Estates, California are master-planned communities, purposefully designed and built to be ideal places to live.

A disproportionate share of cities on this list — 31 out of 50 — are located in the Midwest. Meanwhile, just three communities in the Northeast rank among the best cities to live. This is largely attributable to cost of living.

Only about 10% of towns and cities in the Midwest have a higher cost of living than the nationwide average. Conversely, in 78% of cities and towns in the Northeast, goods and services are more expensive on average than they are nationwide.

Many of the best cities to live in are suburbs of much larger cities. Jobs tend to be concentrated in major cities, which partially explains the low unemployment rates in many communities on this list. Several cities on this list are within commuting distance of major cities like Chicago, Los Angeles, Pittsburgh, and Washington D.C.

To identify the best cities to live in, 24/7 Wall St. created a weighted index of 25 measures that fall into one of four categories: affordability, economy, quality of life, and community.

In the affordability category, the ratio of the median home value to the median income was given full weight. Cities where the median home value is closer to the median household income were rewarded. Cost of living, as determined by the average cost of goods and services in an area relative to the nation as a whole, was given a full weight. Property taxes are largely levied at the local level, and cities where residents pay more property taxes as a percent of their home value were penalized. Property taxes were given a one-quarter weighting.

In the economy category, we gave median household income full weighting. The unemployment rate was also given a full weight. We used five-year average unemployment due to lack of comparable annual data at local levels. Two-year employment growth and share of the total working age population with a job were each given a half weight, favoring areas with more and growing jobs opportunities.

In the quality of life category, the poverty rate was given a full weight, penalizing cities where serious financial hardship is more common. The share of the population that struggles to put food on the table either due to low income or distance from a grocery store, known as the food insecurity rate, was given full weight. A city’s mortality rate, calculated as the number of people who died while in hospital care per hospital by city, was also given full weight. In cases where city level data was not available, mortality rates were imputed from county level data.

The drug overdose mortality rate was given a one-quarter weighting, as was the hospital readmission rate, or the share of those released from the hospital who were readmitted within 30 days. Distance from the center of the city to the nearest hospital was given full weight.

Measures used in the community category include the average travel time to work, which was given full weight. The violent crime rate — the total number of rapes, robberies, murders, and aggravated assaults adjusted per 100,000 people — was given full weight. So too was the property crime rate, which is the total number of burglaries, larcenies, motor vehicle thefts, and incidents of arson per 100,000 people.

The share of commuters either walking, cycling, or taking public transit to work was given half weight. The total number of colleges in the area and the number of restaurants, bars, museums, theatre companies, movie theatres, libraries, and parks per capita were each given a one-quarter weighting.

The number of hospitalizations that would have been prevented by regularly scheduled doctor visits for every 1,000 Medicare enrollees — known as the preventable hospitalization rate — was given half weighting.

To avoid geographic clustering, we only took the top-ranking city in a given county. Our list includes cities, towns, villages, boroughs, and Census designated places. We did not include places with fewer than 8,000 residents in our analysis.

Median household income, median home value, average travel time to work, poverty rate, population, employment-to-population ratio, median property taxes paid, and average unemployment rate are all five-year estimates from the U.S. Census Bureau’s American Community Survey and are for 2016. Overall cost of living is for 2014 and comes from data analysis and aggregation company ATTOM Data Solutions.

The population-adjusted number of entertainment and cultural venues like restaurants and museums comes from the Census Bureau’s County Business Patterns data set, and is for 2016. The number of colleges comes from the Department of Education College Navigator and is as of the 2017-2018 school year.

Violent and property crime rates are from the FBI’s 2017 Uniform Crime Report. Drug overdose mortality rates are from the Centers for Disease Control and Prevention and are for the years 2014-2016. Mortality rates and hospital readmission rates are from the Centers for Medicare and Medicaid Services and are as of June 2015. Preventable hospitalizations are from the latest release from County Health Rankings & Roadmaps, a Robert Wood Johnson Foundation and University of Wisconsin Population Health Institute joint program.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.