Americans with a bachelor’s degree are nearly half as likely to be unemployed than those with only a high school diploma, according to January 2020 data from the Bureau of Labor Statistics. While earning a college degree is a proven way to reduce the likelihood of unemployment, not all undergraduate fields of study feed into careers with equally solid job security.

Using data from the U.S. Census Bureau’s 2018 American Community Survey, 24/7 Wall St. identified the college majors with the lowest unemployment rates. Across all labor force participants with a bachelor’s degree, the annual unemployment rate stood at 2.6% in 2018. Among the majors on this list, the unemployment rate at that time ranged from 1.6% down to effectively zero.

It is important to note that since 2018, the U.S. job market has changed markedly, largely as a result of the COVID-19 pandemic. Unemployment soared from a multi-decade low to a high not seen since the Great Depression in just a matter of months, affecting Americans of all education levels. Here is a list of American businesses that might not survive the coronavirus.

Still, while the economic recovery remains uncertain, many of the majors on this list lead to careers that will likely remain in demand for years to come.

The higher job security among college graduates who chose the majors on this list does not necessarily mean these jobs will also come with high salaries. While workers from six majors on this list have average annual incomes in the six-figure range, many other majors on the list have salaries lower than the average annual salary of $61,519 among working college graduates. While educators are considered an essential class of worker in the United States, many of the lowest-paying majors on this list are in the field of education, with several having average annual salaries below $40,000 a year. Here is a list of the college majors that pay off the most.

Click here to see the college majors with the lowest unemployment

25. Communication disorders sciences and services

> Unemployment rate: 1.6%

> Avg. salary: $45,930

> BA holders with a master’s degree: 69.5%

> BA holders in labor force: 240,185

Communication disorders sciences and services majors study scientific treatment options for individuals with speech, hearing, and a range of cognitive communication problems caused by a disability, disease, or injury. Of the 240,185 labor force participants who studied communication disorders as undergraduates, only 1.6% are unemployed, well below the pre-pandemic 2.6% unemployment rate among all labor force participants with a bachelor’s degree.

[in-text-ad]

24. Plant science and agronomy

> Unemployment rate: 1.6%

> Avg. salary: $49,743

> BA holders with a master’s degree: 26.7%

> BA holders in labor force: 95,235

Students who major in plant science and agronomy learn about different agricultural crops and the factors that would maximize their yield. To that end, they typically study a variety of topics, including pest control, soil quality, and weed control. Those who decide to major in this field typically have a demonstrated interest in biology, chemistry, and environmental science.

The careers available to those who major in plant science and agronomy — which include conservation scientists, crop farmers, and ranchers — are relatively secure. The unemployment rate among the more than 95,000 Americans with this degree is just 1.6%.

23. Health and medical preparatory programs

> Unemployment rate: 1.5%

> Avg. salary: $106,017

> BA holders with a master’s degree: 48.6%

> BA holders in labor force: 101,712

Americans who decide to go into health care are less likely to be unemployed than those in the vast majority of careers. Of the more than 100,000 Americans in the labor force who majored in health and medical preparatory programs, only 1.5% are unemployed.

Many jobs in medicine and health care require additional education beyond undergraduate. Nearly half of all Americans in the labor force who majored in health and medical preparatory programs have at least a master’s degree, and more than a quarter have a doctorate.

22. Elementary education

> Unemployment rate: 1.5%

> Avg. salary: $27,542

> BA holders with a master’s degree: 44.0%

> BA holders in labor force: 1,364,551

Teachers are needed in every town in the United States, and as long as Americans continue to have children, teachers will be in demand. Of the 1.4 million people in the workforce who majored in elementary education, only 1.5% are unemployed.

The kinds of careers the majors on this list have often require a postgraduate degree. While elementary school teachers do not necessarily need a master’s degree, many earn them to improve their skill set and for higher pay. Some 44% of Americans in the labor force who majored in elementary education have a master’s degree. Despite this, the major has one of the lower average annual salaries, at $27,542, less than half the average across all occupations of $61,539.

[in-text-ad-2]

21. Computer networking and telecommunications

> Unemployment rate: 1.5%

> Avg. salary: $70,477

> BA holders with a master’s degree: 18.2%

> BA holders in labor force: 71,208

The unemployment rate among labor force participants who majored in computer networking and telecommunications is just 1.5%. Students who choose this major study communications technology, primarily phones and computers, learning the latest advancements and what is likely coming in the near future.

A computer networking and telecommunications background can prepare students for careers in high-demand jobs, including network systems analysts, computer systems analysts, and network administrators.

20. Zoology

> Unemployment rate: 1.5%

> Avg. salary: $84,304

> BA holders with a master’s degree: 48.8%

> BA holders in labor force: 111,086

Zoology is a subset of biology that focuses on animals of all types, including vertebrates, invertebrates, insects, birds, reptiles, and mammals. Zoology is comprehensive in scope, as majors look within organisms, such as the chemical makeup of their bodies, as well as populations of animals and how they adapt to their environment. The kinds of careers many zoology majors go into, including veterinary medicine and animal caretaking, are in high demand. Partially as a result, the unemployment rate among zoology majors is just 1.5%.

[in-text-ad]

19. Teacher education: multiple levels

> Unemployment rate: 1.5%

> Avg. salary: $30,670

> BA holders with a master’s degree: 46.1%

> BA holders in labor force: 108,133

Teacher education for multiple levels is one of several majors that lead to jobs in education on this list. Like the other education-related majors, it is one of the lowest paying fields on this list, with an average salary less than half the average salary among all college graduates. Over 100,000 Americans in the labor force studied multiple level education as undergraduates, and only 1.5% of them are unemployed. The major is more versatile than many of the others in education on this list as it prepares the undergraduates to teach multiple age groups — from elementary school to middle and high school.

18. Applied mathematics

> Unemployment rate: 1.5%

> Avg. salary: $100,742

> BA holders with a master’s degree: 44.2%

> BA holders in labor force: 40,617

As its name suggests, applied mathematics is the study of using math to solve real world problems as well as anticipating problems that have yet to arise. Applied mathematics majors have a number of career options upon graduating, including working as financial analysts, statisticians, or even software developers.

Not only do applied math majors who enter the labor force have high-job security — the major has a 1.5% unemployment rate — they also have high salaries. Among workers with an applied mathematics degree, the average annual salary is $100,742, well above the average across all occupations of $61,539.

17. Actuarial science

> Unemployment rate: 1.5%

> Avg. salary: $110,110

> BA holders with a master’s degree: 27.7%

> BA holders in labor force: 21,074

For those going into college interested in working as an actuary — someone who measures business risk and uncertainty — actuarial science is an appropriate field of study. Actuaries are typically employed by insurance companies or other large firms with pension plans. Demand for actuaries is projected to grow by about 20% over the next decade.

It is important to note, however, that a relatively limited number of schools offer a major in actuarial science. These schools include New York University and the University of Connecticut. After receiving a bachelor’s degree — which does not necessarily need to be in actuarial science — actuaries need to pass a series of exams to become accredited.

[in-text-ad-2]

16. Animal sciences

> Unemployment rate: 1.5%

> Avg. salary: $57,057

> BA holders with a master’s degree: 27.3%

> BA holders in labor force: 162,319

Animal science majors learn about breeding, feeding, and managing livestock, poultry, and other domesticated animals used in food production. Americans who major in this field often go on to careers in ranching, dairy farming, and food science. The unemployment rate among the 162,319 Americans in the labor force who majored in animal sciences is just 1.5%.

15. Social science or history teacher education

> Unemployment rate: 1.5%

> Avg. salary: $36,001

> BA holders with a master’s degree: 48.0%

> BA holders in labor force: 137,777

Social studies and history teachers instruct students about national or world history while putting current events in a broader context. Teachers are pillars of society and will be in demand for the foreseeable future. Social science or history teacher education is one of several fields on this list whose majors tend to have careers in education. Like other education-related majors on the list, it also has among the lowest average pay.

[in-text-ad]

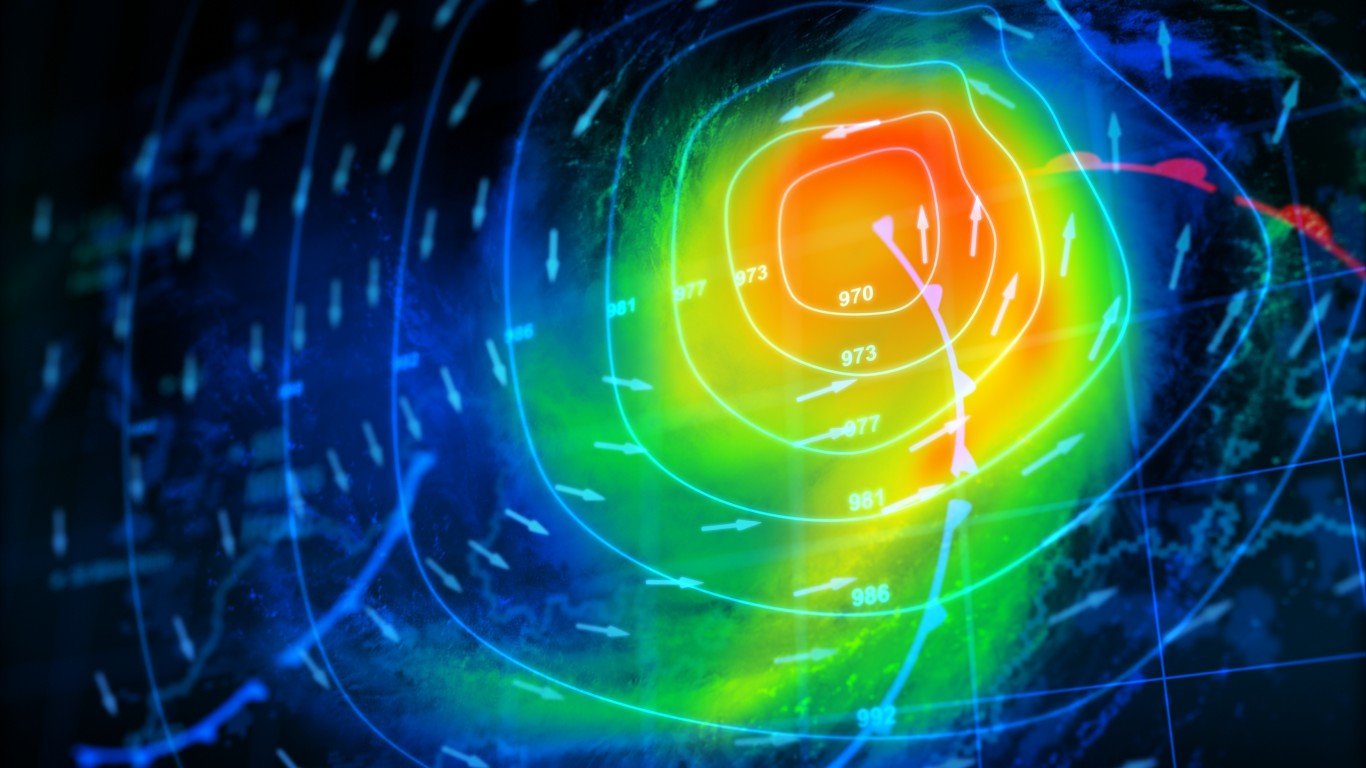

14. Atmospheric sciences and meteorology

> Unemployment rate: 1.4%

> Avg. salary: $66,337

> BA holders with a master’s degree: 48.7%

> BA holders in labor force: 24,331

College students who major in atmospheric sciences and meteorology study the atmosphere, typically in the context of weather and how to forecast it. As certain private businesses are increasingly dependent on understanding weather, for making deliveries or buying and selling renewable energy, demand for atmospheric scientists is expected to remain strong. Employment in the occupation is projected to grow by 8% from 2018 to 2028, faster than the average expected growth across all occupations during that time. Just 1.4% of the 24,331 Americns in the labor force with a degree in atmospheric sciences and meteorology are out of a job.

13. Genetics

> Unemployment rate: 1.2%

> Avg. salary: $87,626

> BA holders with a master’s degree: 56.5%

> BA holders in labor force: 21,425

Genetics majors study how DNA is passed down through generations and such wide ranging implications as evolution and passing on hereditary diseases. Many who study genetics as undergraduates go on to receive graduate degrees in biology, medicine, and veterinary medicine in pursuit of a range of careers, including biomedical engineering, medical science, and forensic science.

As is often the case for graduates with degrees in hard sciences on this list, workers who studied genetics in college are generally well paid, earning an average annual salary of $87,626.

12. Molecular biology

> Unemployment rate: 1.2%

> Avg. salary: $103,049

> BA holders with a master’s degree: 52.6%

> BA holders in labor force: 89,613

Molecular biology is a branch of biology that focuses on cell characteristics and chemical processes within organisms. Molecular biology is an option for undergraduates at many schools, as well as for graduate students. It is one of several majors in the hard sciences to rank on this list. And just like the others, graduates with a degree in molecular biology are well paid with an average salary of $103,049.

Some common jobs awaiting molecular biology students include pharmacists, biological scientists, and clinical laboratory technologists. The unemployment rate among the 89,613 labor force participants with a molecular biology undergraduate degree is just 1.2%.

[in-text-ad-2]

11. Educational psychology

> Unemployment rate: 1.2%

> Avg. salary: $42,825

> BA holders with a master’s degree: 72.1%

> BA holders in labor force: 24,971

Educational psychology students study education through the lens of psychology and apply theories of psychology to improve educational outcomes. They also study environmental effects on education, including those outside the classroom. It is not an especially common major, with fewer than 25,000 Americans in the labor force holding an educational psychology undergraduate degree. Many are working as teachers, psychologists, or managers in school settings, and they are among the least likely labor force participants to be unemployed.

10. Mathematics teacher education

> Unemployment rate: 1.2%

> Avg. salary: $37,587

> BA holders with a master’s degree: 51.7%

> BA holders in labor force: 102,611

Generally, undergraduates who choose a major that steers them into a career in education are far less likely to be unemployed once in the labor force than most American workers. Mathematics teacher education is no exception. Just 1.2% of Americans in the labor force who majored in math instruction are unemployed.

Like many majors on this list, those who select math teacher education are likely to go onto graduate school. However, unlike majors with high graduate school attainment rates, but like many other education-related majors on this list, majoring in mathematics teacher education does not lead to especially high-paying jobs. The average salary for those who majored in teaching math is just $37,587, far lower than the average across all occupations of $61,539.

[in-text-ad]

9. School student counseling

> Unemployment rate: 1.0%

> Avg. salary: $33,660

> BA holders with a master’s degree: 89.5%

> BA holders in labor force: 18,163

School student counselors work with high school and middle school students to assist with their academic, social, and emotional development, and in the decision making process as to what to do after graduation. For those who know going into college that they would like a career as a student counselor, school student counseling is a natural choice for a major. However, in most of the country, student counselors are required to have a master’s degree, and not surprisingly, about nine in every 10 Americans who majored in student counseling as undergraduates continue to complete a graduate degree. Despite the high level of education, the average salary is one of the lowest on the list — like most education-related majors.

According to the Bureau of Labor Statistics, demand for school counselors is projected to grow by 8% between 2018 and 2028 — faster than most other occupations. Currently, just 1.0% of labor force participants who majored in student counseling are unemployed.

8. Special needs education

> Unemployment rate: 1.0%

> Avg. salary: $37,022

> BA holders with a master’s degree: 57.7%

> BA holders in labor force: 266,202

Students who major in special needs education as undergraduates often end up in special educational teaching roles — working with students who have specific emotional, mental, learning, and physical disabilities. Like many education majors on this list, special needs education majors are not especially well paid, with an average annual salary of just $37,022.

Special needs education is one of the more popular majors on this list. Over one-quarter of a million Americans in the labor force majored in the subject — and only 1.0% of them are unemployed.

7. Educational administration and supervision

> Unemployment rate: 0.9%

> Avg. salary: $48,328

> BA holders with a master’s degree: 92.5%

> BA holders in labor force: 44,857

An educational administration and supervision degree prepares students for careers in administrative roles in a variety of educational settings. One of many majors on this list in the education sector, educational administration and supervision majors have an unemployment rate of just 0.9% among them.

Unlike other majors in the education field that involve student instruction where graduates earn average salaries in the $30,000 range, administration and supervision majors have an average salary of over $48,000 — still well below the average salary across all occupations of over $61,000.

[in-text-ad-2]

6. Court reporting

> Unemployment rate: 0.7%

> Avg. salary: $45,828

> BA holders with a master’s degree: 6.2%

> BA holders in labor force: 6,396

Court reporting majors learn the legal language used in courtrooms and how to use specific programs and machines to quickly and accurately transcribe what is said in the course of a court proceeding. While most court reporters work in courtrooms and alongside legislatures, others work remotely, typing closed captioning transcripts for broadcast stations to use.

Over the decade between 2018 and 2028, the Bureau of Labor Statistics projects that demand for court reporters will climb by 7% — faster than the projected employment growth across all occupations. Currently, just 0.7% of the more than 6,000 Americans who majored in court reporting are unemployed.

5. Agriculture production and management

> Unemployment rate: 0.7%

> Avg. salary: $62,937

> BA holders with a master’s degree: 10.8%

> BA holders in labor force: 112,886

Agriculture production and management majors learn how to run all aspects of farms and other agricultural businesses — from economics and finances to use of natural resources — during their undergraduate course work. Students who choose this major can opt to focus in different areas, including crop production, animal husbandry, sustainable agriculture, and aquaculture.

With a 0.7% unemployment rate among the 112,886 labor force participants who majored in the field, agriculture production and management offers an educational base for a stable career. Some of the most popular colleges offering this major are Texas A&M, North Dakota State University, and North Carolina State University.

[in-text-ad]

4. Mathematics and computer science

> Unemployment rate: 0.7%

> Avg. salary: $100,580

> BA holders with a master’s degree: 47.9%

> BA holders in labor force: 17,529

Mathematics and computer science is an interdisciplinary major that combines the two fields, drawing concepts and tools from each and connecting them. Those who choose this major have not only some of the most stable career prospects with an unemployment rate of just 0.7%, but also one of the most potentially lucrative careers. The average salary among those who studied math and computer science as undergraduates is $100,580.

3. Oceanography

> Unemployment rate: 0.5%

> Avg. salary: $64,863

> BA holders with a master’s degree: 33.0%

> BA holders in labor force: 19,049

Oceanography majors study the ocean’s chemical and physical properties and how the waters move and interact with the rest of the environment — namely the atmosphere and land. As is the case with many majors on this list, oceanography is a hard science that can incorporate elements of math, biology, physics, and chemistry. Of the more than 19,000 labor force participants who majored in oceanography as undergraduates, only 0.5% are unemployed.

2. Pharmacology

> Unemployment rate: 0.0%

> Avg. salary: $95,683

> BA holders with a master’s degree: 54.6%

> BA holders in labor force: 12,762

College students who choose to major in pharmacology study the chemical makeup of drugs, how they interact with the body and with each other, and their potential uses as treatments for certain diseases and conditions. Occupations associated with pharmacology studies include pharmacist, biomedical scientist, toxicologist, and analytical chemist. Many of these jobs require a postgraduate degree, and over half of all pharmacology majors go on to earn a master’s, and 37.8% earn a doctorate. Pharmacology is one of only two majors where the unemployment rate is effectively 0%.

[in-text-ad-2]

1. Soil science

> Unemployment rate: 0.0%

> Avg. salary: $66,210

> BA holders with a master’s degree: 46.7%

> BA holders in labor force: 5,930

Soil science majors study soil, typically in the context of agriculture, learning the chemical properties of soil, which soils are best suited for specific crops, how to control weeds, as well as conservation and soil management. Students who choose this major often end up working as advisers to crop farmers domestically and abroad, analyzing the mineral content of soil samples, or specializing in a specific crop type.

According to the BLS, the demand for workers in agricultural science is projected to grow faster than average in the coming years as pressing new challenges arise related to population growth and increased demand for resources. Along with pharmacology, soil science is one of only two majors where the unemployment rate is effectively 0%.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.