Americans with a bachelor’s degree are nearly half as likely to be unemployed as those with only a high school diploma. While earning a college degree is a proven way to reduce the likelihood of unemployment, not all undergraduate fields of study provide equally solid job security.

Using data from the U.S. Census Bureau’s 2019 American Community Survey, 24/7 Wall St. identified the college majors with the highest unemployment rates. Across all labor force participants with a bachelor’s degree, the annual unemployment rate stood at 2.6% in 2019. Among the majors on this list, the unemployment rate at that time ranged from 3.6% to over 8%.

While those who majored in the academic disciplines on this list are more likely to be unemployed than most college graduates, most are still far less likely to be unemployed than those without a college degree. According to the same survey, the unemployment rate among those of all education levels was is 4.5% in 2019.

It is important to note that since 2019, the U.S. job market has changed markedly, largely as a result of the COVID-19 pandemic. Unemployment soared from a multi-decade low to a high not seen since the Great Depression in just a matter of months, affecting Americans of all education levels. Here is a look at the American brands that went bankrupt during COVID.

As student debt soars in the United States, job security in future career prospects is not the only factor for students to consider when choosing a major. Earning potential will also affect the financial footing of college graduates — and though these majors on this list have higher than average unemployment, many of those who are working are relatively well compensated. For 10 majors on this list, average salaries are higher than the average annual salary of $63,448 among working college graduates. Here is a look at the states where people struggle most with student debt.

Click here to see college majors with the highest unemployment.

Click here to read our detailed methodology.

25. Advertising and public relations

> Unemployment rate: 3.6%

> Avg. salary: $62,333

> Undergrad degree holders with a master’s or professional degree or higher: 18.2%

> Undergrad degree holders in labor force: 260,685

Advertising and public relations is a relatively population major, as over a quarter of a million Americans in the labor force have a degree in the subject. The unemployment rate among them is 3.6%, slightly higher than the 2.6% jobless rate among all college graduates.

While some jobs that this major prepares graduates for, like public relations specialists or advertising managers, are projected to grow faster than average in the coming years, others are not. For example, demand for advertising sales agents is projected to fall by 6% over the decade ending in 2029 as advertising in print media becomes less common as digital mediums expand their reach.

[in-text-ad]

24. Fine arts

> Unemployment rate: 3.6%

> Avg. salary: $41,678

> Undergrad degree holders with a master’s or professional degree or higher: 24.6%

> Undergrad degree holders in labor force: 623,113

Fine arts is one of the most popular majors offered at American colleges and universities. There are over 620,000 people in the labor force who studied fine arts. The major is also one of the less practical for those looking to for a secure career, as 3.6% of those with the degree are unemployed, a full percentage point higher than the jobless rate among all college graduates.

Fine arts is typically an interdisciplinary major that draws from creative art and music as well as the history of these disciplines.

23. General social sciences

> Unemployment rate: 3.7%

> Avg. salary: $46,076

> Undergrad degree holders with a master’s or professional degree or higher: 39.1%

> Undergrad degree holders in labor force: 142,784

General social sciences is an interdisciplinary liberal arts major that is designed to offer students courses in a broad cross section of social sciences such as sociology, anthropology, history, economics, and psychology.

The major does not explicitly prepare students for a single occupation or career path. Partially as a result, the unemployment rate of 3.7% among the 142,784 labor force participants who majored in general social sciences is higher than the 2.6% average unemployment rate among all bachelor’s degree holders in the labor force.

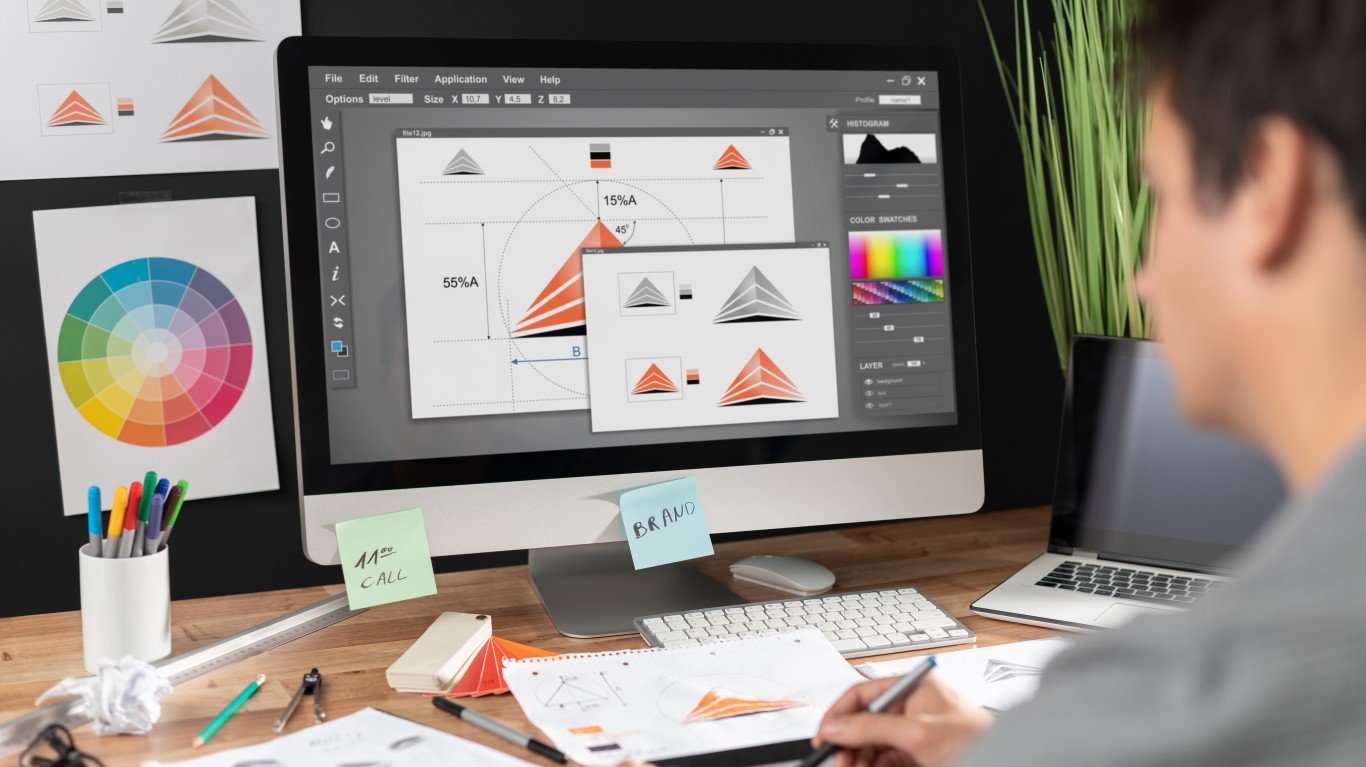

22. Commercial art and graphic design

> Unemployment rate: 3.7%

> Avg. salary: $48,646

> Undergrad degree holders with a master’s or professional degree or higher: 11.8%

> Undergrad degree holders in labor force: 628,766

Commercial art and graphic design majors learn different computer skills and design principles to create commercial applications such as advertising. Students in the field can choose from many possible occupations upon graduation, including web development, interior design, and illustration.

Labor force participants who studied commercial art are slightly more likely to be unemployed than the typical bachelor’s degree holder in the labor force. Still, the 3.7% jobless rate among those with a degree in commercial art and graphic design is below the 4.5% unemployment rate among workers of all education levels.

[in-text-ad-2]

21. Oceanography

> Unemployment rate: 3.8%

> Avg. salary: $59,760

> Undergrad degree holders with a master’s or professional degree or higher: 43.5%

> Undergrad degree holders in labor force: 19,388

Oceanography is the scientific study of both the physical and biological properties of the sea. Jobs for oceanographers include ocean drillers, marine archaeologists, hydrologists, and marine biologists.

There are more than 19,000 labor force participants in the United States with an undergraduate degree in oceanography — and about 3.8% of them are unemployed, above the 2.6% jobless rate among college graduates but below the 4.5% unemployment rate among all education levels.

20. Interdisciplinary social sciences

> Unemployment rate: 3.9%

> Avg. salary: $51,391

> Undergrad degree holders with a master’s or professional degree or higher: 40.7%

> Undergrad degree holders in labor force: 97,831

Interdisciplinary social sciences students study the connection between social sciences, such as anthropology or political science, and other related fields of study. An interdisciplinary major, this degree does not prepare students for a specific career or occupation. Rather, graduates gain broad knowledge in a variety of disciplines that can be applied to any number of fields.

Still, likely due in part to the lack of specialization, interdisciplinary social science majors are slightly more likely to be out of work than most other college graduates. An estimated 3.9% of labor force participants with the degree are unemployed, compared to just 2.6% of all bachelor’s degree holders.

[in-text-ad]

19. Humanities

> Unemployment rate: 3.9%

> Avg. salary: $50,152

> Undergrad degree holders with a master’s or professional degree or higher: 37.3%

> Undergrad degree holders in labor force: 62,617

The humanities are a broad classification of academic disciplines that includes fields such as English, history, philosophy, classics, and languages. While a humanities degree does not lead directly to a specific career path or occupation, it develops students’ research, writing, and critical thinking skills.

There are over 62,600 Americans in the labor force with a humanities degree, and 3.9% of them are unemployed — above the 2.6% jobless rate among college graduates but below the 4.5% unemployment rate among all education levels.

18. Cosmetology services and culinary arts

> Unemployment rate: 4.1%

> Avg. salary: $43,194

> Undergrad degree holders with a master’s or professional degree or higher: 6.1%

> Undergrad degree holders in labor force: 66,859

Cosmetology services and culinary arts is a major that prepares students for careers in two distinct fields — personal hair, skin, and nail care and cooking and food preparation. Just under 67,000 labor force participants have a bachelor’s degree in the major, and 4.1% of them are unemployed.

Multiple years of postsecondary education is not always necessary for jobs in cosmetology or the culinary arts, and only 6.1% of Americans with this major have gone on to earn a professional, graduate, or doctorate degree, compared to 32.8% of all bachelor’s degree holders who have earned an advanced degree.

17. Genetics

> Unemployment rate: 4.1%

> Avg. salary: $88,409

> Undergrad degree holders with a master’s or professional degree or higher: 57.9%

> Undergrad degree holders in labor force: 25,293

Genetics is the scientific study of genes, DNA, and heredity in biological organisms. The major is broad in scope and students can choose to focus on any number of specializations, including medicine, agriculture, and biotechnology. Many of the careers and occupations that genetics majors pursue require further education beyond the undergraduate level, and 57.9% of those who choose the major go on to earn a higher degree like a master’s or doctorate.

There are more than 25,000 Americans in the labor force who majored in genetics, and the jobless rate among them is 4.1% — above the 2.6% rate among college graduates but below the 4.5% unemployment rate among all education levels.

[in-text-ad-2]

16. Mass media

> Unemployment rate: 4.1%

> Avg. salary: $57,481

> Undergrad degree holders with a master’s or professional degree or higher: 18.3%

> Undergrad degree holders in labor force: 339,021

Mass communication majors study the transmission of information, such as news and entertainment, through mediums such as newspapers, magazines, television, and film. Careers that await mass media majors include journalism, public relations, photography, broadcasting, and advertising, among others.

The internet has been a major disruptive force for mass communications as newspapers across the country have been going out of business, and once strong ratings for certain broadcast television slots have plummeted. Likely partially as a result, a higher than average 4.1% share of mass media majors in the labor force are unemployed.

15. Cognitive science and biopsychology

> Unemployment rate: 4.1%

> Avg. salary: $78,131

> Undergrad degree holders with a master’s or professional degree or higher: 43.9%

> Undergrad degree holders in labor force: 21,987

Cognitive science and biopsychology is an interdisciplinary major in which students study about the human mind and psychological processes that are rooted in biology, such as behavior genetics. A relatively small major, only about 22,000 Americans in the labor force chose cognitive science and biopsychology as undergraduates.

Unemployment is slightly higher among those who studied cognitive science and biopsychology than it is among all college graduates, as the jobless rate is about 4.1%, compared to 2.6%.

[in-text-ad]

14. Food science

> Unemployment rate: 4.1%

> Avg. salary: $65,212

> Undergrad degree holders with a master’s or professional degree or higher: 44.5%

> Undergrad degree holders in labor force: 43,767

Food science is a major that encompasses the study of nearly all aspects of food, including its consumption, chemical make-up, and manufacturing. Careers for those who study food science include quality testing, food production, and famine prevention.

The jobless rate among the nearly 44,000 Americans who majored in food science is 4.1% — above the 2.6% rate among college graduates but below the 4.5% unemployment rate among all education levels.

13. Drama and theater arts

> Unemployment rate: 4.2%

> Avg. salary: $47,527

> Undergrad degree holders with a master’s or professional degree or higher: 28.8%

> Undergrad degree holders in labor force: 260,895

Drama and theater arts is one of the more popular majors, with nearly 261,000 bachelor’s degree holders in the labor force. However, jobs in the performing arts can be highly competitive and difficult to obtain. The unemployment rate among those who chose drama and theater arts as a major is 4.2% — higher than it is for the vast majority of those with a degree in other academic disciplines.

During the COVID-19 pandemic, indoor theatrical performances were cancelled across the United States. The 4.2% jobless rate in 2019 among those who studied drama and theater likely spiked far higher in 2020 and 2021.

12. Applied mathematics

> Unemployment rate: 4.2%

> Avg. salary: $89,756

> Undergrad degree holders with a master’s or professional degree or higher: 46.2%

> Undergrad degree holders in labor force: 46,043

Applied mathematics majors study the application of math principles to other fields such as engineering or science. An estimated 4.2% of bachelor’s degree holders who studied applied mathematics are unemployed, compared to just 2.6% of all labor force participants with at least a four-year degree.

While workers who majored in applied mathematics are more likely than most college graduates to be unemployed, those who are working are also more likely to have high salaries. The average annual pay among those who studied the subject is $89,756, well above the average salary of $63,448 among all college graduates in the workforce.

[in-text-ad-2]

11. Mining and mineral engineering

> Unemployment rate: 4.3%

> Avg. salary: $87,606

> Undergrad degree holders with a master’s or professional degree or higher: 32.9%

> Undergrad degree holders in labor force: 14,578

Mining and mineral engineering is a highly specialized degree that fewer than 15,000 Americans in the workforce chose as an undergraduate major. Those who choose the major are often studying to become mineral engineers, whose job is to survey, plan, and manage mining operations that remove valuable minerals and metals from the earth for different uses.

An estimated 4.3% of labor force participants who majored in mining and mineral engineering are unemployed, well above the 2.6% jobless rate among all college graduates. Demand for mining engineers is projected to grow by 4% between 2019 and 2029, in line with the projected job growth across all occupations.

10. Ecology

> Unemployment rate: 4.3%

> Avg. salary: $58,371

> Undergrad degree holders with a master’s or professional degree or higher: 35.8%

> Undergrad degree holders in labor force: 86,135

Ecology majors study how living organisms interact with the environment. Course work typically focuses heavily on biology, botany, and genetics. Ecology degree holders often go on to careers as researchers, park rangers, foresters, teachers, environmental analysts, and environmental consultants.

While ecology graduates have a number of career options, a larger than typical share of them struggle to find work. The 4.3% jobless rate among labor force participants with an ecology degree is higher than the unemployment rate for the vast majority of college majors.

[in-text-ad]

9. Industrial and organizational psychology

> Unemployment rate: 4.3%

> Avg. salary: $69,239

> Undergrad degree holders with a master’s or professional degree or higher: 46.6%

> Undergrad degree holders in labor force: 30,520

Industrial and organizational psychology majors study subjects like workplace management, productivity, hierarchy organization to prepare for jobs helping companies improve efficiency in the workplace.

Those with industrial and organizational psychology degrees are in nearly every industry. Still, the jobless rate among the 30,500 American workers with a degree in the field is 4.3%, well above the 2.6% jobless rate among all college graduates.

8. Communication technologies

> Unemployment rate: 4.5%

> Avg. salary: $56,103

> Undergrad degree holders with a master’s or professional degree or higher: 13.4%

> Undergrad degree holders in labor force: 90,436

Communication technologies is a broad major in which students learn about mass communication mediums as well as topics such as economic and management. Degree holders often enter the workforce and become film and video editors, broadcast technicians, and sound engineering technicians.

A larger than average share of graduates with a degree in communication technologies also struggle to find work. Of the nearly 90,500 Americans in the labor force who majored in the subject, 4.5% are unemployed — above the 2.6% rate among college graduates and in line with the 4.5% unemployment rate among all education levels.

7. Nuclear engineering

> Unemployment rate: 4.7%

> Avg. salary: $83,470

> Undergrad degree holders with a master’s or professional degree or higher: 51.3%

> Undergrad degree holders in labor force: 16,560

Renewable electricity production is projected to increase by 42% by 2050. Over the same period, nuclear energy production is projected to decline slightly, and its contribution to the country’s total energy mix will drop by half. Partially as a result, demand for nuclear engineers is projected to decline by 13% over the next decade.

There are 16,560 labor force participants who majored in nuclear engineering, and 4.7% of them are unemployed.

[in-text-ad-2]

6. Film video and photographic arts

> Unemployment rate: 5.0%

> Avg. salary: $52,011

> Undergrad degree holders with a master’s or professional degree or higher: 18.6%

> Undergrad degree holders in labor force: 192,396

Film video and photographic arts study the practical elements of film making and production, such as techniques and communication strategies as well as film theory, history, and criticism. Focus areas in the major include documentary production and photography. Currently, 5.0% of the more than 192,000 labor force participants who studied film video and photographic arts in college are unemployed.

Job prospects will not likely improve for many in the field. Over the next decade, employment for photographers is projected to decline by 4% as digital cameras decrease in price and the number of amateur photographers climbs.

5. Petroleum engineering

> Unemployment rate: 5.3%

> Avg. salary: $84,648

> Undergrad degree holders with a master’s or professional degree or higher: 31.8%

> Undergrad degree holders in labor force: 30,001

Petroleum engineering majors study oil and gas extraction and the best methods of access to subterranean fossil fuels. The major is math heavy and includes laboratory work. Through 2029, demand for petroleum engineers is projected to grow by 5.3%, slightly faster than the 4% growth among all occupations.

Not all petroleum engineers have a degree in petroleum engineering, however. Many working in the field have degrees with broader application, like mechanical, civil, or chemical engineering. About 5.3% of the 30,000 labor force participants are unemployed.

[in-text-ad]

4. Composition and rhetoric

> Unemployment rate: 5.4%

> Avg. salary: $48,682

> Undergrad degree holders with a master’s or professional degree or higher: 30.0%

> Undergrad degree holders in labor force: 104,846

Composition and rhetoric majors study subjects like creative, professional, technical, business, and scientific writing. Degree holders often work in such occupations as proofreading, editing, teaching, and writing. There are nearly 105,000 Americans in the labor force who majored in composition and rhetoric, and 5.4% of them are unemployed, more than double the 2.6% jobless rate among all bachelor’s degree holders.

Job prospects for composition and rhetoric majors will not likely improve any time soon. According to BLS projections, demand for editors is projected to decline by 7% over the decade ending in 2029, and jobs for writers and authors are expected to contract by 2% over the same period.

3. Computer programming and data processing

> Unemployment rate: 5.6%

> Avg. salary: $65,411

> Undergrad degree holders with a master’s or professional degree or higher: 14.5%

> Undergrad degree holders in labor force: 38,524

Computer programming and data processing majors learn methods of retrieving and storing data electronically, both by using existing systems and programs and by developing their own. The major typically involves courses in business communication, computer systems analysis, word processing, and information technology.

While many majors in computer sciences and engineering fields lead to relatively secure careers, computer programming and data processing does not. The unemployment rate among those who majored in the field is 5.6%, well above the 2.6% average among all labor force participants with a four year degree.

2. Physical sciences

> Unemployment rate: 5.8%

> Avg. salary: $64,317

> Undergrad degree holders with a master’s or professional degree or higher: 42.1%

> Undergrad degree holders in labor force: 10,778

Physical sciences is a broad major that typically includes courses in biology, chemistry, mathematics, and physics. Of the nearly 11,000 labor force participants who majored in physical sciences, 5.8% are unemployed, a far higher than average jobless rate for college graduates.

The high jobless rate among those with a physical science degree may be due in part to the breadth of the subject, as those who majored in one specific category of physical sciences are far less likely to be out work. For example, the unemployment rate among chemistry majors is just 2.3%, and only 1.9% of molecular biology majors are out of work.

[in-text-ad-2]

1. Geological and geophysical engineering

> Unemployment rate: 8.1%

> Avg. salary: $59,837

> Undergrad degree holders with a master’s or professional degree or higher: 32.1%

> Undergrad degree holders in labor force: 8,269

Of all college majors with available employment data, the geological and geophysical engineering major has the highest unemployment rate. About 8,300 members of the labor force majored in the subject, and 8.1% of them are unemployed, more than triple the 2.6% unemployment rate among all college graduates.

The degree is designed to teach students to apply principles of mathematics and geology to solve engineering problems related to construction and to analyze how geological forces can act on existing or planned structures. While jobs for geological engineers are projected to grow on pace with the average across all occupations in the coming years, there are only about 6,300 Americans currently employed as geological engineers, about 2,000 fewer jobs than the number of labor force participants who studied geological and geophysical engineering as undergraduates.

Methodology

To determine the college majors with the highest unemployment rates, 24/7 Wall St. reviewed data on employment status and undergraduate major from the Public Use Microdata Sample summary files of the U.S. Census Bureau’s 2019 American Community Survey. Undergraduate college majors were ranked based on the number of unemployed individuals with a bachelor’s degree in that major as a share of all members of the civilian labor force with that major in 2019. Data on earnings and educational attainment for each major also came from the Census. Data on field of study and employment status are self-reported by the survey’s respondents. To be included in the dataset, the respondents must have graduated and received a bachelor’s degree. While respondents were able to list the field of study for any bachelor’s degree they have received and may have listed multiple majors, only the first major listed was considered in this analysis.

Majors noted as a miscellaneous subset of a more common field of study were excluded from our analysis.

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.