On Jan. 20, President Donald Trump left office, leaving behind a complicated and controversial legacy. What is not disputed, however, is that the stock market rallied during his presidency, with the Dow Jones Industrial Average exceeding 30,000 for the first time in history.

Using the performance of shares of major publicly traded companies as a measure of the health of the economy is a highly contentious practice. Many have pointed to the seeming disconnect between the stock market and the economy, pointing to the fact that the Dow has been hitting record highs even as millions of Americans remain out of work and small businesses continue to struggle amid the now year-long COVID-19 pandemic.

Still, for some, the performance of the Dow Jones Industrial Average stock index is often used as a proxy for overall economic prosperity. The best known stock market index, the Dow tracks the value of 30 public company stocks that together represent all major industries except for transportation and utilities.

The U.S. economy is subject to complex, interconnected forces too innumerable for any one person to account for or anticipate. Still, when it comes to the health of the economy, the buck often stops at the president’s desk.

The Dow’s performance is not always directly linked to decisions the sitting commander in chief makes. More often, the direction of the index is attributable to factors beyond the president’s control, from geopolitical incidents to decisions made by the Federal Reserve or even a previous president.

The Dow’s performance has varied under each president. Under a handful of administrations, the DJIA dropped, dropping as much as 82%. Under the leadership of other presidents, the Dow more than tripled.

24/7 Wall St. reviewed the Dow’s performance under every president since the end of World War I, calculating the percent change in the index during each president’s term. We used non-inflation adjusted month-end closing values for each president’s first and last months in office.

While President Trump leaves office with a net gain in stocks, the market certainly went through some turbulence, including one of the worst stock market crashes in history. This is how the COVID-19 stock market crash in March compares to others throughout history.

Click here to see what the stock market did under every president in the last 100 years.

Warren G. Harding

> DJIA performance: +23.4%

> Served from: March 3, 1921 – Aug. 2, 1923

> Months in office: 29

> Party affiliation: Republican

The first president elected to office after WWI, Warren Harding served during a post-war economic boom. Harding also enacted several significant economic and social changes, including lower taxes, increased tariffs, and strict immigration restrictions. Though his administration is now remembered for its numerous scandals, the Dow climbed 23.4% from his inauguration until his death in office, a little more than two years later.

[in-text-ad]

Calvin Coolidge

> DJIA performance: +230.5%

> Served from: Aug. 2, 1923 – March 4, 1929

> Months in office: 67

> Party affiliation: Republican

President Calvin Coolidge presided over the largest gains in the Dow of any president since the end of WWI. Vice president to Warren Harding, Coolidge found himself in the Oval Office following Harding’s sudden death in 1923. Coolidge cleaned up the widespread corruption of Harding’s administration, cut income, gift, and inheritance taxes, reduced government spending, and adopted a pro-business posture.

Coolidge served during a decade of unprecedented growth in wealth, consumerism, and urbanization that came to be known as the Roaring Twenties. Under Coolidge, the Dow shot up 230.5%. Just six months after Coolidge left office in March 1929, the United States slipped into an economic depression that wiped out all stock market gains accumulated during his presidency.

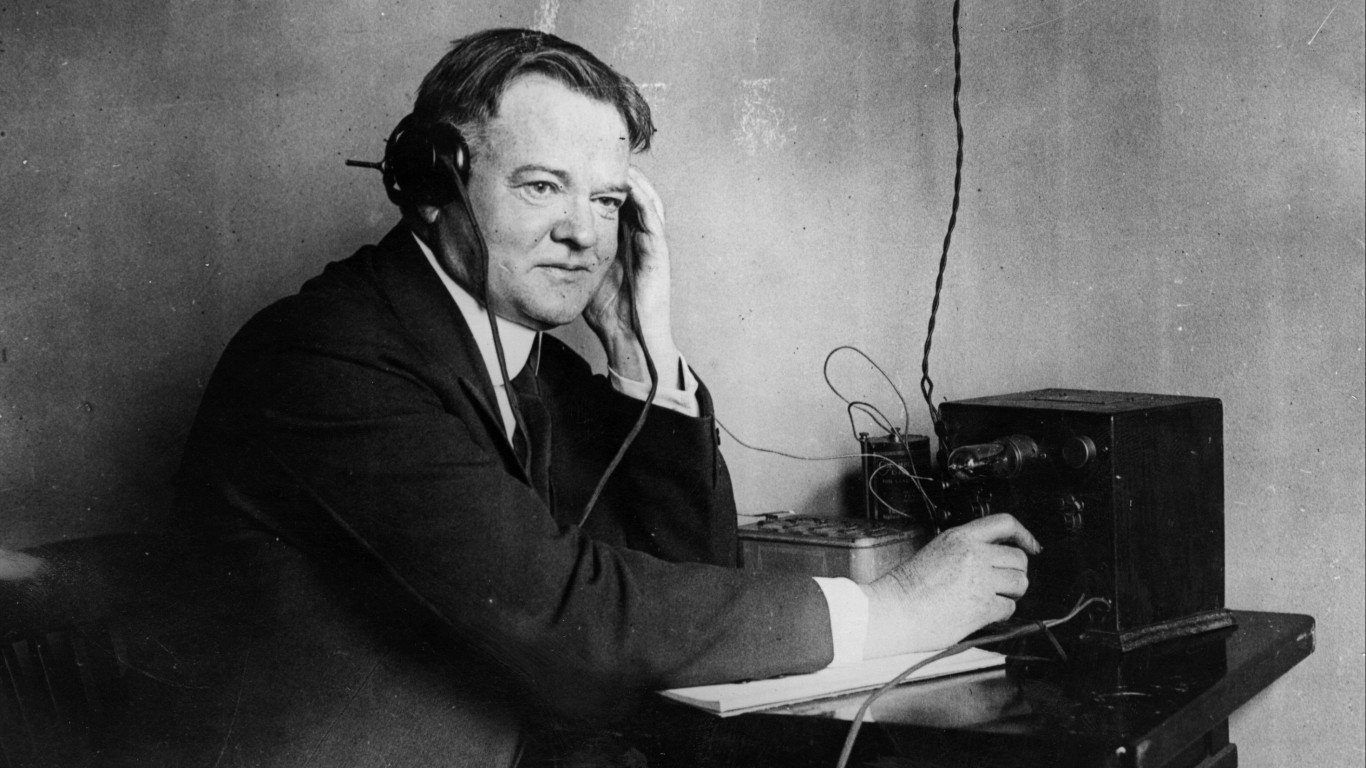

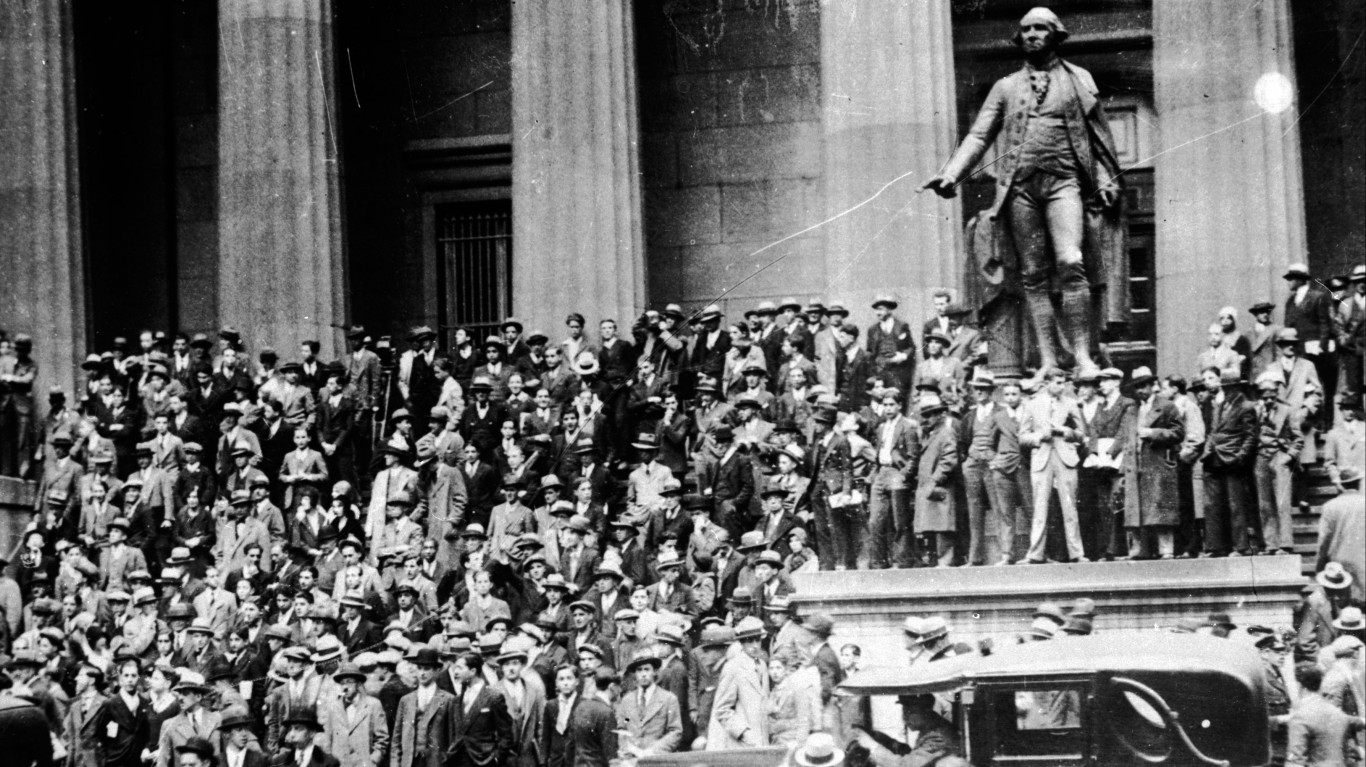

Herbert Hoover

> DJIA performance: -82.1%

> Served from: March 4, 1929 – March 4, 1933

> Months in office: 48

> Party affiliation: Republican

President Herbert Hoover presided over the worst economic downturn in U.S. history. Supported by rapid economic expansion in the 1920s, the stock market soared leading up to Hoover’s presidency. However, by the end of the decade, unemployment and consumer debt began to rise, while productivity fell, and the fundamentals were no longer there. In October 1929, just eight months after Hoover took office, the bottom dropped out. The stock market plummeted in a massive selloff and continued to plunge for much of Hoover’s presidency. Hoover’s efforts to revitalize the economy by supporting financial institutions with government loans proved insufficient.

The Dow Jones Industrial Average fell by a staggering 82.1% under Hoover. Due largely to poor economic conditions, Hoover was a single-term president, losing to Democrat Franklin D. Roosevelt by a landslide.

Franklin D. Roosevelt

> DJIA performance: +198.6%

> Served from: March 4, 1933 – April 12, 1945

> Months in office: 145

> Party affiliation: Democratic

President Franklin Roosevelt served as president longer than anyone in history. Elected to office four times, Roosevelt sat in the Oval Office for 145 months and presided over some of the most tumultuous times in American — and world — history. Taking office during the height of the Great Depression, Roosevelt began implementing his “New Deal” policies to turn the economy around. Unpopular with the business community, Roosevelt tightened finance regulation by creating the Federal Deposit Insurance Corporation and SEC as well as a pension system with the Social Security Act.

Despite dipping at the outset of America’s entrance to WWII, the Dow shot up by nearly 200% under Roosevelt.

[in-text-ad-2]

Harry S. Truman

> DJIA performance: +75.2%

> Served from: April 12, 1945 – Jan. 20, 1953

> Months in office: 93

> Party affiliation: Democratic

President Harry Truman became commander in chief during the final year of WWII, following the death of Franklin Roosevelt. During Truman’s second year in office, the stock market collapsed amid a spike in inflation and a high degree of speculation in the stock market at the end of the war. In the following years, the country slipped into a recession, unemployment spiked, railroad workers went on strike, and production of consumer goods was not meeting demand. Still, Truman ran for a second term and won, despite longshot odds.

In his second term, the economy turned around, and the unemployment rate fell from a high of 7.9% to below 3.0%. The stock market surged, more than making up for losses in his first term. From Truman’s first month in office to his last, the Dow soared 75.2%.

Dwight D. Eisenhower

> DJIA performance: +123.7%

> Served from: Jan. 20, 1953 – Jan. 20, 1961

> Months in office: 96

> Party affiliation: Republican

Though a Republican, President Dwight Eisenhower continued the social welfare policies of his Democratic predecessors Roosevelt and Truman. He also strengthened Social Security, raised the minimum wage, and created the largest public works initiative in American history — the Interstate Highway System.

Though his administration weathered three recessions and growing unemployment, Eisenhower’s eight years in office were marked by steady growth in the stock market, with the Dow climbing 123.7%.

[in-text-ad]

John F. Kennedy

> DJIA performance: +15.8%

> Served from: Jan. 20, 1961 – Nov. 22, 1963

> Months in office: 34

> Party affiliation: Democratic

President John Kennedy’s time in the Oval Office was marked by the geopolitical turmoil of the botched Bay of Pigs invasion and the Cuban Missile Crisis. Some of the tumult was also economic. Determined to address inflation upon taking office, Kennedy implemented a steel price rollback (steel being a widely used raw material). The business community did not react favorably and the Dow tanked.

Despite the setback, the Dow improved overall under Kennedy’s watch. Many attribute the market rally that continued through the end of his presidency to Kennedy’s economic initiatives, which included increased minimum wage, expanded unemployment and social security benefits, more highway spending, and lower tax rates. From the day Kennedy took office until his assassination nearly three years later, the Dow climbed 15.8%.

Lyndon B. Johnson

> DJIA performance: +26.1%

> Served from: Nov. 22, 1963 – Jan. 20, 1969

> Months in office: 62

> Party affiliation: Democratic

Along with Bill Clinton, Lyndon Johnson is one of only two post-WWII presidents to lead over steady, uninterrupted unemployment improvement. Due in part to his major policy implementations aimed at creating a “Great Society” — in addition to the escalating war in Vietnam — government hiring picked up during Johnson’s White House tenure. Under Johnson, the unemployment rate fell from 5.5% to 3.4%. Over the same period, the stock market made significant gains, with the Dow climbing 26.1%.

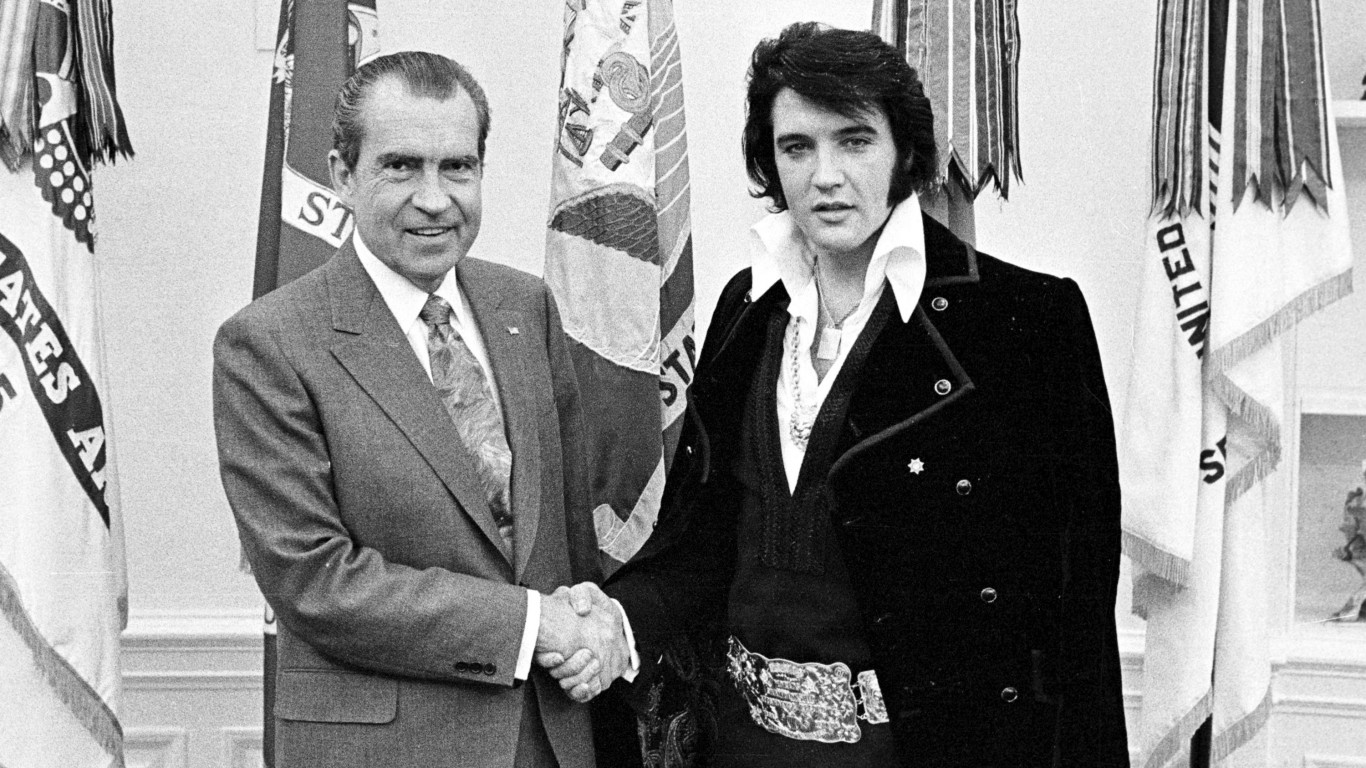

Richard M. Nixon

> DJIA performance: -28.3%

> Served from: Jan. 20, 1969 – Aug. 9, 1974

> Months in office: 67

> Party affiliation: Republican

Richard Nixon, the 37th president of the United States served in tumultuous economic times. Perhaps the most significant market events were the product of his own doing. In 1971, Nixon ordered a freeze on all prices and wages in the United States for 90 days to get inflation under control. Though the policy was ultimately a failure, it initially led to a market rally that fizzled later during his term. Watergate also had considerable influence over investor sentiment. From the time Nixon was named as a Watergate conspirator in March 1974 to his resignation five months later, investor confidence was on a downward trend.

As a whole, the Nixon era was not a good time for stock market investors. The DJIA tumbled 28.3% while Nixon was in the White House.

[in-text-ad-2]

Gerald R. Ford

> DJIA performance: +40.6%

> Served from: Aug. 9, 1974 – Jan. 20, 1977

> Months in office: 29

> Party affiliation: Republican

The stock market performed relatively well under President Gerald Ford, despite high unemployment and inflation. In the 29 months of Ford’s presidency, the Dow climbed by 40.6%. Under Ford, major changes came to equity markets. On May 1, 1975 — now commonly known on Wall Street as May Day — the Securities and Exchange Commission eliminated fixed commissions for stock trading. Before this change, investors all paid the same fee for every trade, no matter how large. After this change, with fees set by competition, investing became a viable option for more of the population.

James Carter

> DJIA performance: -0.7%

> Served from: Jan. 20, 1977 – Jan. 20, 1981

> Months in office: 48

> Party affiliation: Democratic

During his four years, President Jimmy Carter struggled to adequately address the most serious economic issues of the day: inflation and unemployment. Though the unemployment rate dipped during the middle of his presidency, it was above 7% both when he entered and left office. A flagging economy was one of several reasons Carter lost to Republican challenger Ronald Reagan in the 1980 general election. Over the course of Carter’s single term in the White House, the Dow remained effectively flat.

[in-text-ad]

Ronald Reagan

> DJIA performance: +147.3%

> Served from: Jan. 20, 1981 – Jan. 20, 1989

> Months in office: 96

> Party affiliation: Republican

President Ronald Reagan was voted into the White House due in part to the widespread perception that his predecessor and political opponent, Jimmy Carter, had not done enough for the economy. An advocate for small government, Reagan cut taxes, social spending, and regulations on business, and increased military spending. Under Reagan’s economic policies, the United States accumulated deficits and became a debtor nation for the first time since WWI.

Less than half a year into Reagan’s presidency, the U.S. economy slipped into a recession. A year later — before the recession officially ended — the Dow surged and, with one glaring exception, barely stopped to slow down for the remainder of Reagan’s presidency. Despite the Black Monday crash of 1987, in which the Dow lost nearly 22% of its value in a single day, the Dow soared 147.3% under Reagan.

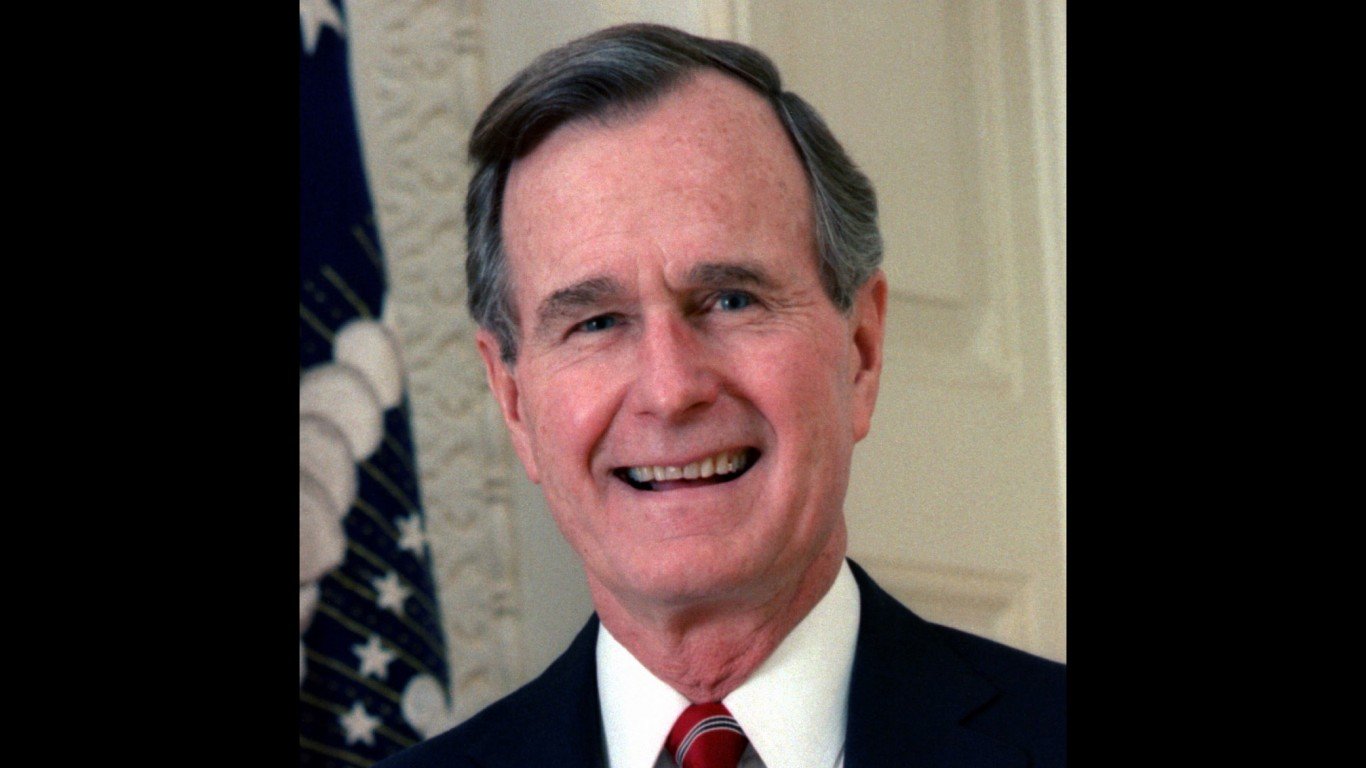

George H. W. Bush

> DJIA performance: +41.3%

> Served from: Jan. 20, 1989 – Jan. 20, 1993

> Months in office: 48

> Party affiliation: Republican

President George H. W. Bush presided over some of the most seismic geopolitical shifts in history. During Bush’s time in office, the Berlin Wall fell and Germany was unified, the Soviet Union collapsed, and the Cold War ended. Also under Bush, Iraq was swiftly and successfully driven from Kuwait by American forces during the Gulf War.

Due to a brief recession and apparent neglect of pressing domestic issues, Bush was a single-term president. Still, the stock market performed relatively well under him. During his four years in office, the Dow climbed 41.3%.

William J. Clinton

> DJIA performance: +228.9%

> Served from: Jan. 20, 1993 – Jan. 20, 2001

> Months in office: 96

> Party affiliation: Democratic

The DJIA skyrocketed by nearly 230% under President Bill Clinton. Over the course of Clinton’s two terms — defined by nearly unprecedented peace and economic prosperity — the unemployment rate fell from about 7% to 4%, inflation dipped to its lowest level in 30 years, the government achieved a budget surplus, and the administration signed an agreement eliminating trade barriers between the United States, Canada, and Mexico. Within two months of Clinton’s departure from office, the United States fell into a recession for the first time since George H.W. Bush was in office.

[in-text-ad-2]

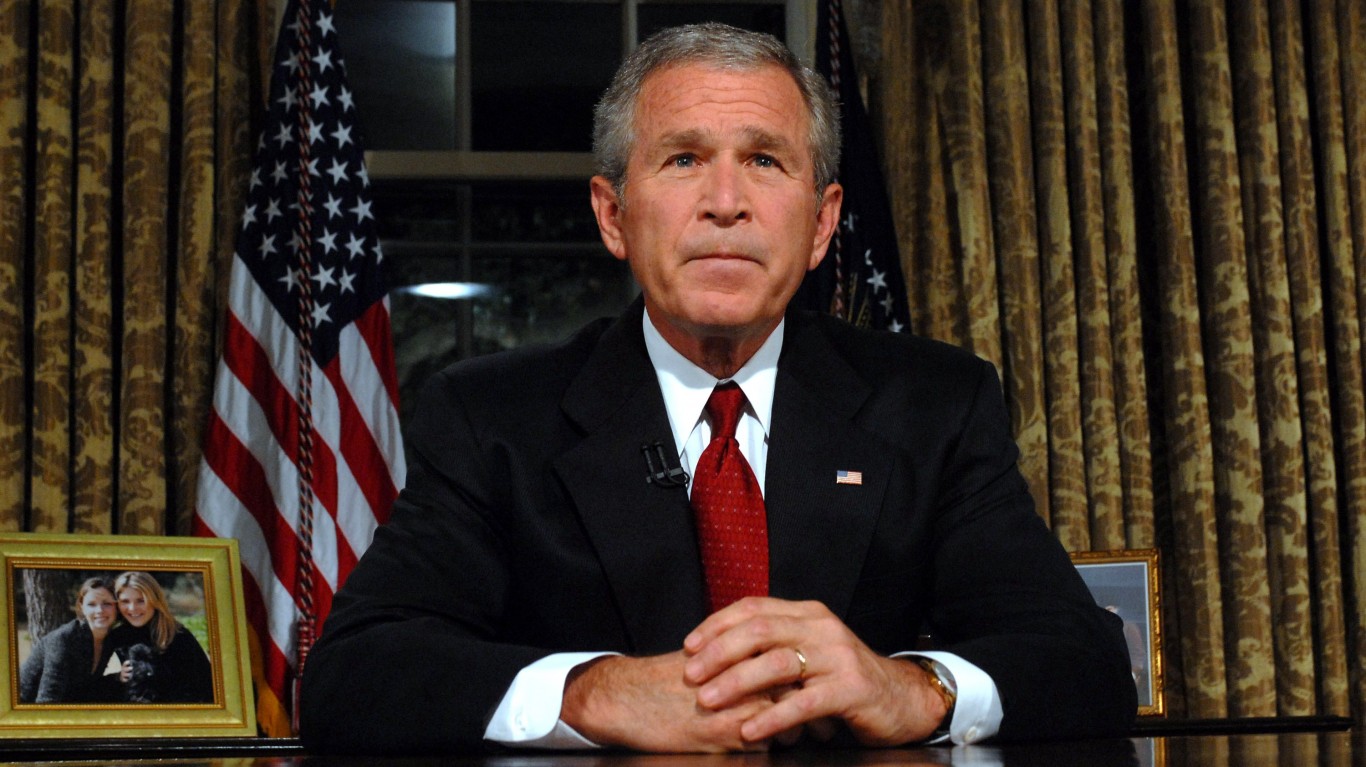

George W. Bush

> DJIA performance: -26.5%

> Served from: Jan. 20, 2001 – Jan. 20, 2009

> Months in office: 96

> Party affiliation: Republican

Under President George W. Bush, the stock market was roiled by several major geopolitical events. After the terror attacks of Sept. 11, 2001, which occurred during Bush’s first year in office, the markets were closed for several days. On the first day of trading following the attacks, the DJIA plunged 14% in a massive selloff. Though the market would regain its previous value in less than a month, the War on Terror and turmoil in the Middle East undercut investor confidence.

By 2007, well into Bush’s second term, the DJIA reached its highest point in history at the time. However, later that year, stock markets responded to the onset of the subprime mortgage crisis and the unravelling of the largest economic downturn since the Great Depression of the 1930s — the Dow lost more than half of its value over 18 months. Bush left office during a historic selloff, with the Dow down 26.5% under his leadership.

Barack Obama

> DJIA performance: +148.3%

> Served from: Jan. 20, 2009 – Jan. 20, 2017

> Months in office: 96

> Party affiliation: Democratic

When Barack Obama took office in January 2009, the U.S. economy was in freefall. Reeling from the effects of the continuing recession that had begun under his predecessor, President Bush, the Dow fell more than 9% in Obama’s first month in office. In the years to follow, the Dow climbed steadily as the economy began to slowly recover from the Great Recession.

The most notable dip in the steadily climbing DJIA occurred in the summer of 2011, halfway through Obama’s first term. That July, the debt ceiling crisis exposed the severity of the political gridlock in Washington and prompted Standard & Poor’s to downgrade the U.S. credit rating. Still, the longest economic recovery in U.S. history began during Obama’s first term, and over the course of his presidency, the Dow surged by 148.3%.

[in-text-ad]

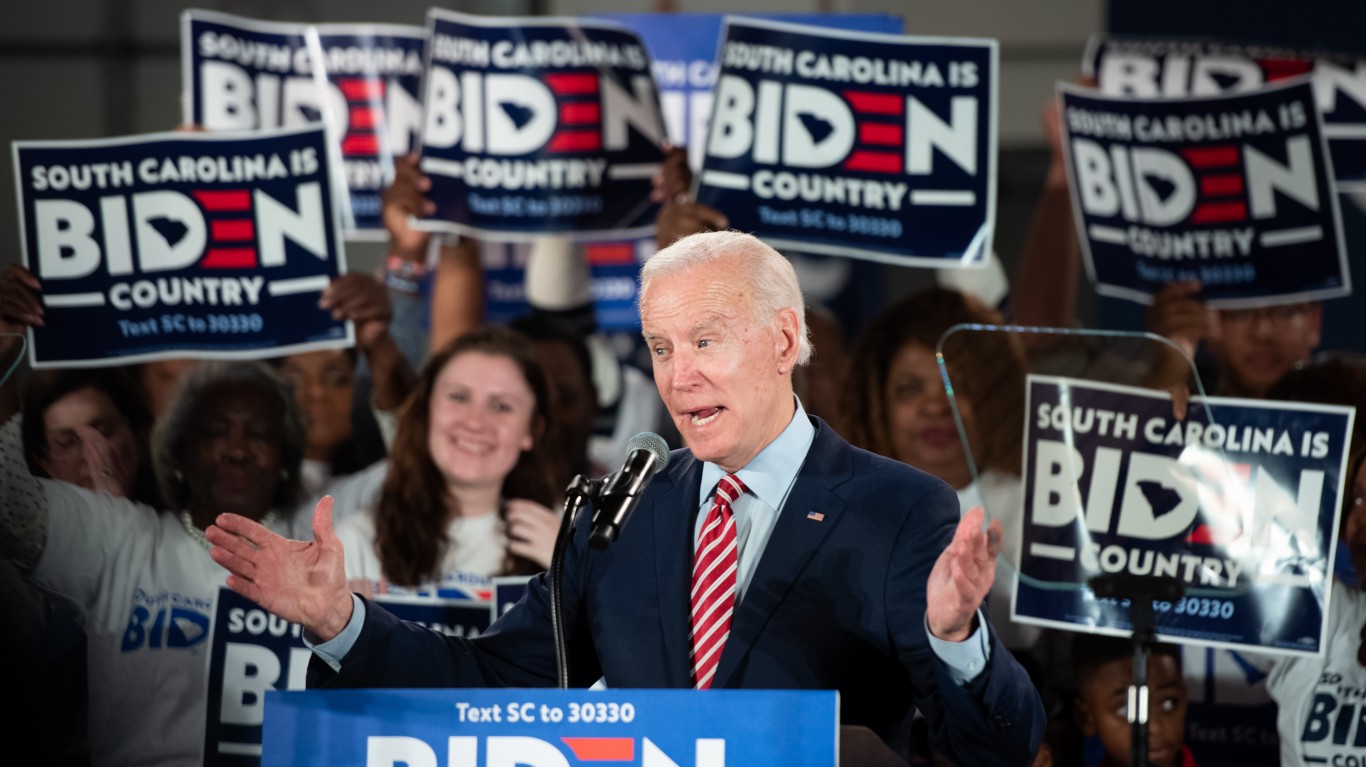

Donald J. Trump

> DJIA performance: +57.0%

> Served from: Jan. 20, 2017 – Jan. 20, 2021

> Months in office: 48

> Party affiliation: Republican

Under President Donald Trump, the Dow topped 25,000 points for the first time in history. Despite some market volatility during, and notably a panic that occurred during the early days of the COVID-19 outbreak, when the Dow declined by 35% over a month, including a 12.9% decline in a single day. The market has since recovered, even as millions of Americans remain out of work, and the DJIA gained a net 57% since Trump entered office on January 20, 2017.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.