The U.S. economy is a massive aggregation of moving parts, some in plain sight and some hidden from view. The average citizen feels like they have very little control over such an enormous system, but when a presidential election comes around, they will look to evaluate the incumbent. The Dow Jones Industrial Average is one of the go-to proxies for presidential evaluation concerning the economy.

The Dow Jones Industrial Average is a price-weighted index of 30 Blue-Chip U.S. companies in various major industries, not including utilities and transportation. It is one of the oldest and most followed indexes currently in use.

Though the Dow is often used as a proxy for gauging the health of an economy during a presidential term, it does not always reflect the actual state of the economy. The DJIA may thrive when the whole economy suffers or vice versa. Furthermore, market indexes are not necessarily a measure of a president’s actions. Global economic crises, catastrophes, social movements, acts of other political elements, or even acts of previous presidents can impact the economy.

24/7 Wall St. reviewed the change in the Dow Jones Average (DJA) and the Dow Jones Industrial Average (DJIA) under each president since Charles Henry Dow began publishing his index in 1885. We measured the adjusted closing values (non-inflation adjusted) from the end of each president’s first month to the end of their last month in office and calculated the percentage change.

Since Charles Dow published his first letters, the DJA/DJIA has changed in its index makeup. Consequently, we utilized adjusted data to form a consistent series. Samuel H. Williamson provided this as “Daily Closing Values of the DJA in the United States, 1885 to Present” for MeasuringWorth, which was founded to create tools for economic historians.

So, we know that the Dow is not an accurate indicator of presidential economic performance. We’re going to go ahead and evaluate them anyway because it’s interesting. We’ll also take a look at policies and events that may have had an impact on the economy during their terms. (For other ways of evaluating presidents, read: The Most (and Least) Effective US Presidents, According to Historians ).

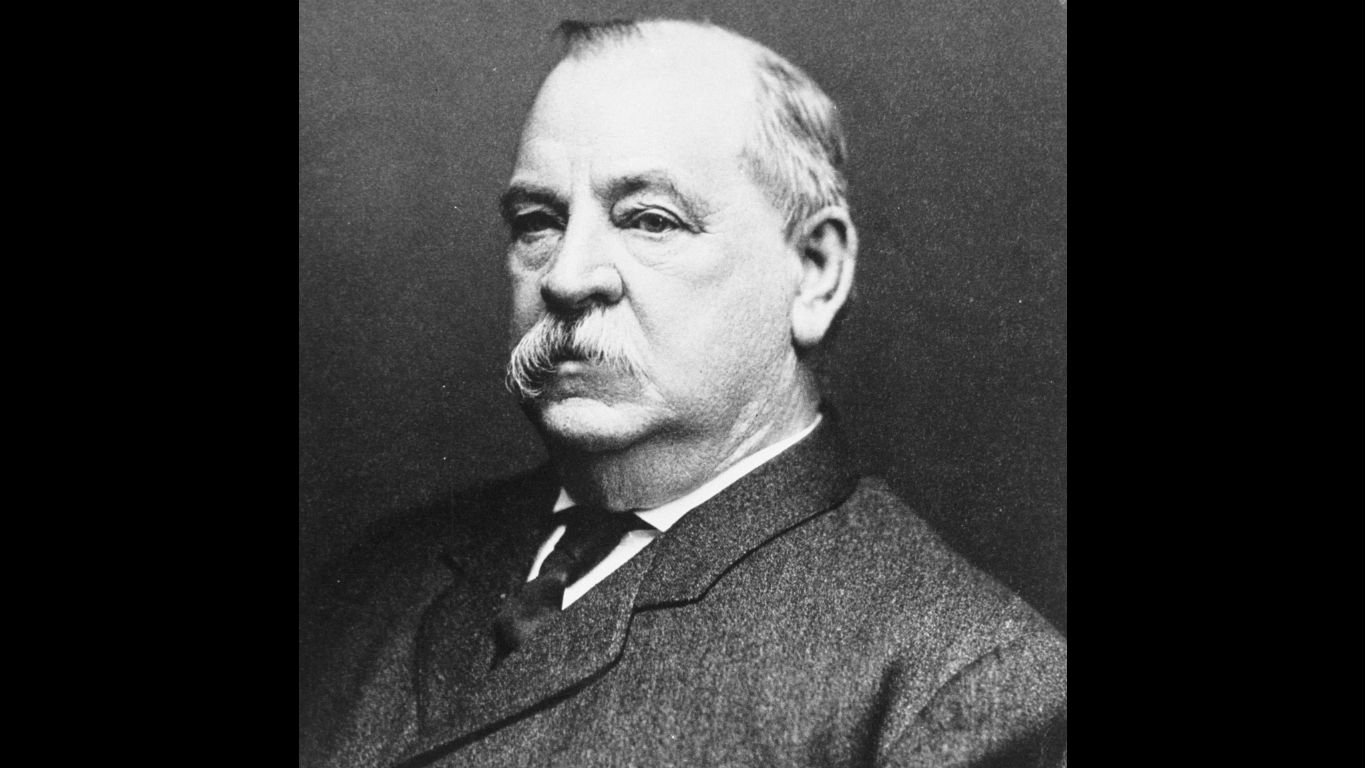

Grover Cleveland

- Served: March 4, 1885 – March 4, 1889

- Dow Jones Average (DJA) performance: +29.6%

- DJA high point: 12/3/1886, 43.1434

- DJA low point: 7/2/1885, 30.2968

- Party affiliation: Democratic

Elected during an extended period of economic growth, which Mark Twain satirically referred to as the “Gilded Age,” Grover Cleveland succeeded Chester A. Arthur, who left office due to ill health. Soon after his inauguration, Cleveland began reducing federal employees while focusing on merit for appointments rather than awarding them as spoils. He was an isolationist who nonetheless emphasized the modernization of the military. He vetoed over 400 bills, including providing pensions for military veterans. Cleveland was also an advocate of the gold standard and resisted calls for the unlimited production of silver coins. This was a period of significant labor strife, culminating in the deadly Chicago Haymarket Riot and bombing in 1886. The DJA (not yet the “Industrial Average”) experienced growth of 29.6% during this administration.

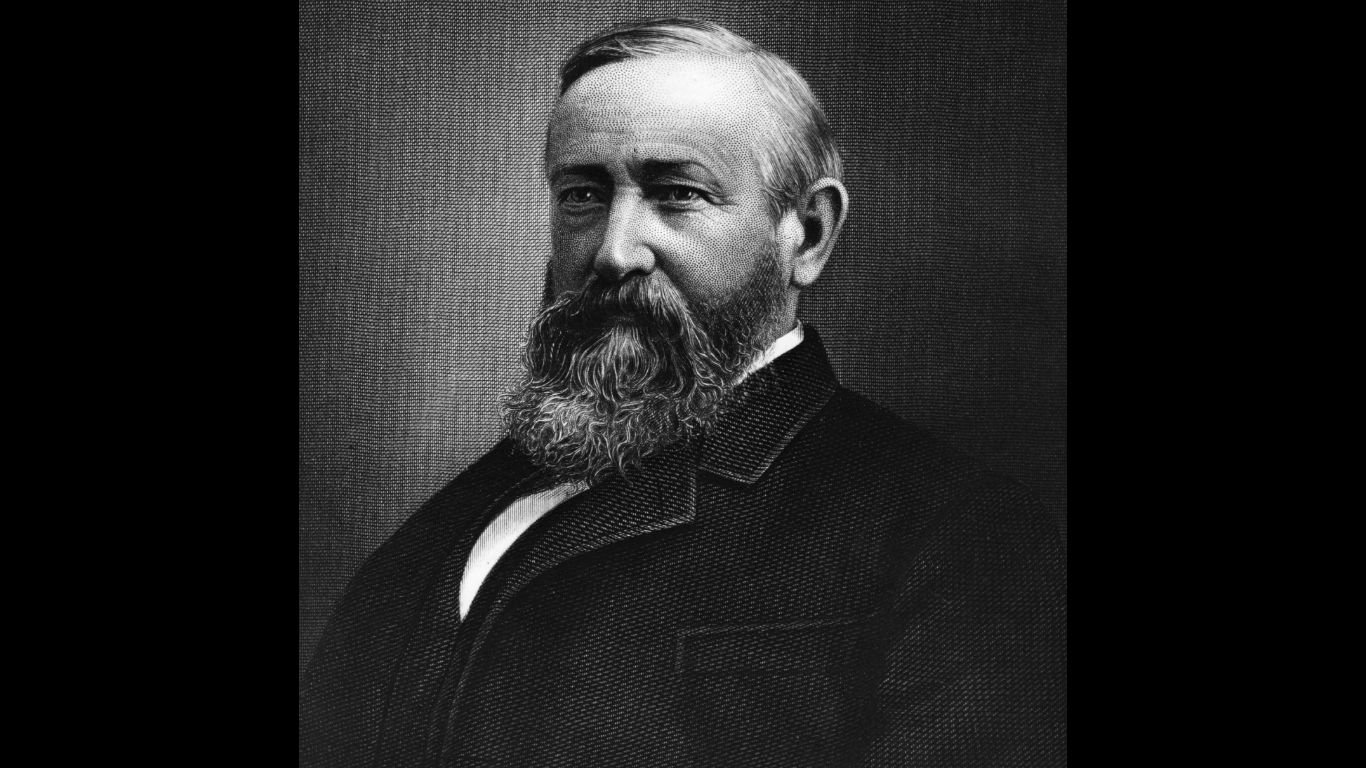

Benjamin Harrison

- Served: March 4, 1889 – March 4, 1893

- DJA performance: -5.8%

- DJA high point: 6/4/1890, 45.6568

- DJA low point: 12/8/1890, 33.8436

- Party affiliation: Republican

After Cleveland’s first term, he failed to be re-elected, losing to Benjamin Harrison, who had a Republican mandate to raise tariffs. Some also hoped he would push a pro-silver monetary agenda, which he did in part. He raised tariffs, which allowed for record federal spending. Harrison approved a bill for military pensions, which were made possible by the tariff surplus. He also persuaded European countries to lift an embargo on American pork, which was keeping American pork producers out of the European market. Like Cleveland before him, he also appropriated funds for military modernization for the Navy in particular. During Harrison’s term, national forest reserves were created, the Sherman Antitrust Act was passed, and six western states were brought into the Union. The DJA dropped 5.8% during the Harrison administration.

Grover Cleveland

- Served: March 4, 1893 – March 4, 1897

- DJA/Industrial Average performance: -19.8%

- DJA/Industrial Average high point: 4/5/1893, 38.6259

- DJA/Industrial Average low point: 8/8/1896, 24.3604

- Party affiliation: Democratic

After public disappointment with the performance of Benjamin Harrison, Cleveland was brought back for a second term and elected by a sizable margin. Shortly after his election, the Panic of 1893 began. This depression lasted through 1897 and was believed to be partly due to economic policies enacted by Benjamin, especially concerning silver coinage production and its impact on the gold supply. It may have been the result of global commodities prices, as there was a wheat shortage that occurred after an 1890 crop failure in Argentina and the wheat market crash in 1893. The Pullman labor strike may have also impacted prices and confidence. In 1894, Cleveland signed the Wilson-Gorman Tariff Act, which reduced some tariffs. During this administration, the DJA transitioned into the DJIA. The market had fallen 19.8% by the end of Cleveland’s second administration.

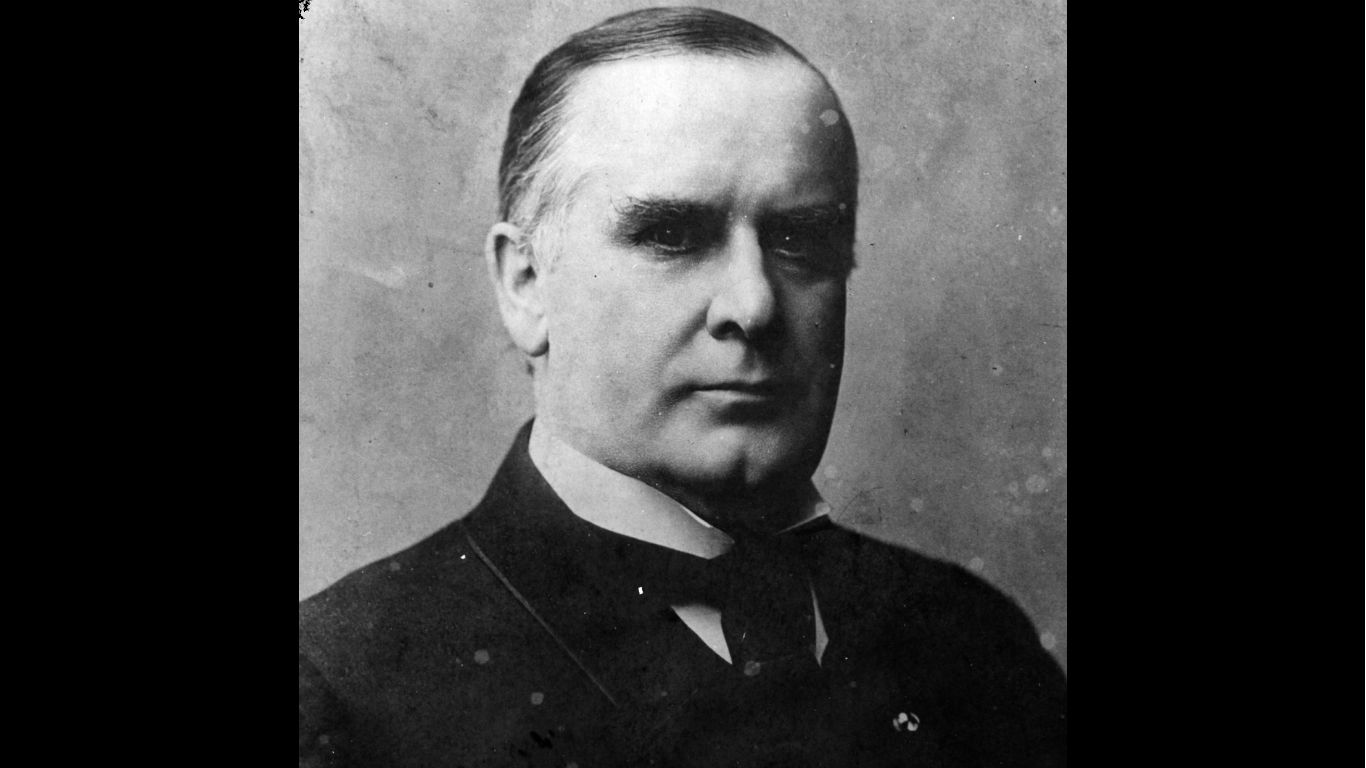

William McKinley

- Served: March 4, 1897-September 14, 1901

- DJIA performance: +67.4%

- DJIA high point: 6/17/1901, 57.3305

- DJIA low point: 4/23/1897, 28.1964

- Party affiliation: Republican

After such a dismal economic performance, Cleveland lost the next election and was replaced by William McKinley. Fortunately, the depression ended in 1897, and the next few years saw rapid economic growth. McKinley signed a bill overturning Cleveland’s tariff reductions during that first year. 1898 brought the Spanish-American War, which the United States won, securing the additions of Puerto Rico, Guam, and the Philippines. Hawaii was annexed as a territory in the same year. In 1900, McKinley settled the silver issue when he signed the Gold Standard Act into law. McKinley ran for and won reelection on the strength of expansion and a strong economy. During his time in office, the DJIA rose 67.4%. He was assassinated in 1901.

Theodore Roosevelt

- Served: September 14, 1901-March 4, 1909

- DJIA performance: +29.2%

- DJIA high point: 1/19/1906, 75.4541

- DJIA low point: 11/9/1903, 30.8776

- Party affiliation: Republican

Vice President Teddy Roosevelt ascended to the presidency upon William McKinley’s assassination in 1901. Roosevelt was part of the Progressive Movement, advocating for reform and social change. His “Square Deal” platform called for fairness for all citizens, trust-breaking, railroad regulation, and pure and healthy food. He also embarked on a conservation program, establishing national parks, monuments, and forests. During his administration, the Panama Canal was also established. Roosevelt advocated naval expansion, upgrading equipment, and adding ships and men. After serving out McKinley’s term, he ran for and won reelection. Near the end of his second term, there was a short global recession known as the Bankers Panic of 1907. The market corrected itself by the end of his administration. He did not seek a third term. The Dow rose 29.2% during his time in office.

William Howard Taft

Source: Hulton Archive / Getty Images

Source: Hulton Archive / Getty Images

- Served: March 4, 1909-March 4, 1913

- DJIA performance: -6.0%

- DJIA high point: 11/19/1909, 73.6447

- DJIA low point: 9/25/1911, 53.4332

- Party affiliation: Republican

During Roosevelt’s second term, he groomed William Howard Taft as his successor. Taft won the nomination and then the 1908 election. His term was relatively uneventful. He continued Roosevelt’s antitrust policies but did not share Roosevelt’s more progressive aims. This included tariff and taxation policies that tried to walk a middle ground but alienated all sides. By the next election, Roosevelt was so upset with Taft’s conservatism that he formed his own party, splitting the Republican vote and ushering in the Democratic administration of Woodrow Wilson. During Taft’s time in office, the DJIA fell by 6%.

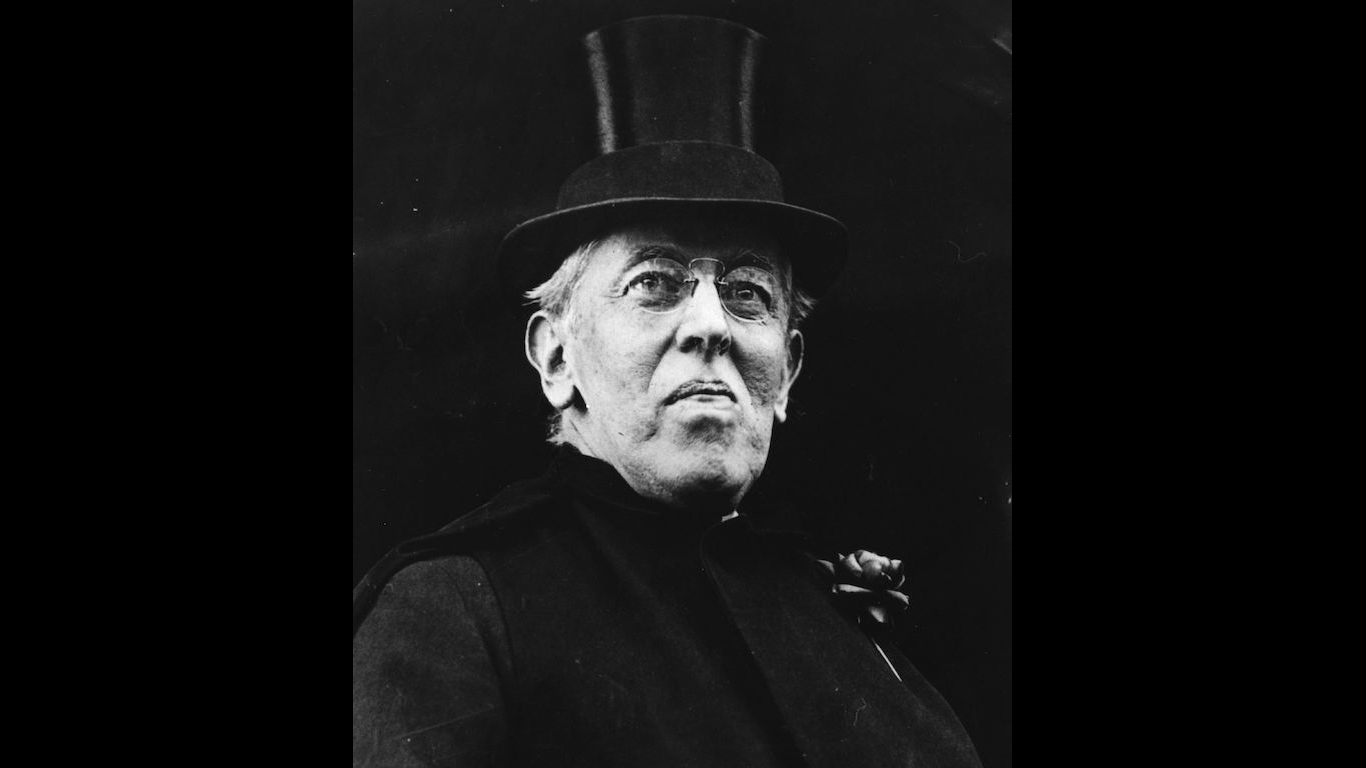

Woodrow Wilson

- Served: March 4, 1913-March 4, 1921

- DJIA performance: +27.8%

- DJIA high point: 11/3/1919, 119.62

- DJIA low point: 7/30/1914, 52.3197

- Party affiliation: Democratic

During Woodrow Wilson’s first year in office, he signed into law the Revenue Act of 1913, which reduced tariffs and reintroduced an income tax. He also created the Federal Reserve System, which had some support after the 1907 crisis. He also signed into law the Clayton Antitrust Act and an act establishing the Federal Trade Commission to address anti-competitive practices. Internationally, Wilson supported several interventions in Latin America. During his administration, though, the events that had the most significant impacts on economies worldwide were World War I and the 1918 influenza pandemic. During Wilson’s time in office, the DJIA rose by 27.8%.

Warren G. Harding

- Served: March 4, 1921-August 9, 1923

- DJIA performance: +23.4%

- DJIA high point: 3/20/1923, 105.38

- DJIA low point: 8/24/1921, 63.9

- Party affiliation: Republican

Though Wilson suffered a stroke near the end of his second term, he wanted to run for reelection. He did not win his party’s nomination, however, and the Democratic ticket lost to Warren G. Harding. Harding came into office at the beginning of a boom that followed the end of WWI, the influenza pandemic, and the depression of 1920-1921. He pieced together legislation resulting in lower taxes, higher tariffs, and immigration restrictions. Harding formally ended WWI and pursued naval disarmament. He also began to step down military involvement in South America. With the automobile’s rising popularity and the radio industry’s growth, Harding signed the Highway Act of 1921, which provided funds for extensive road construction and pushed for the voluntary licensing of radio frequencies. Harding died in office. The DJIA experienced a growth of 23.4% during this administration.

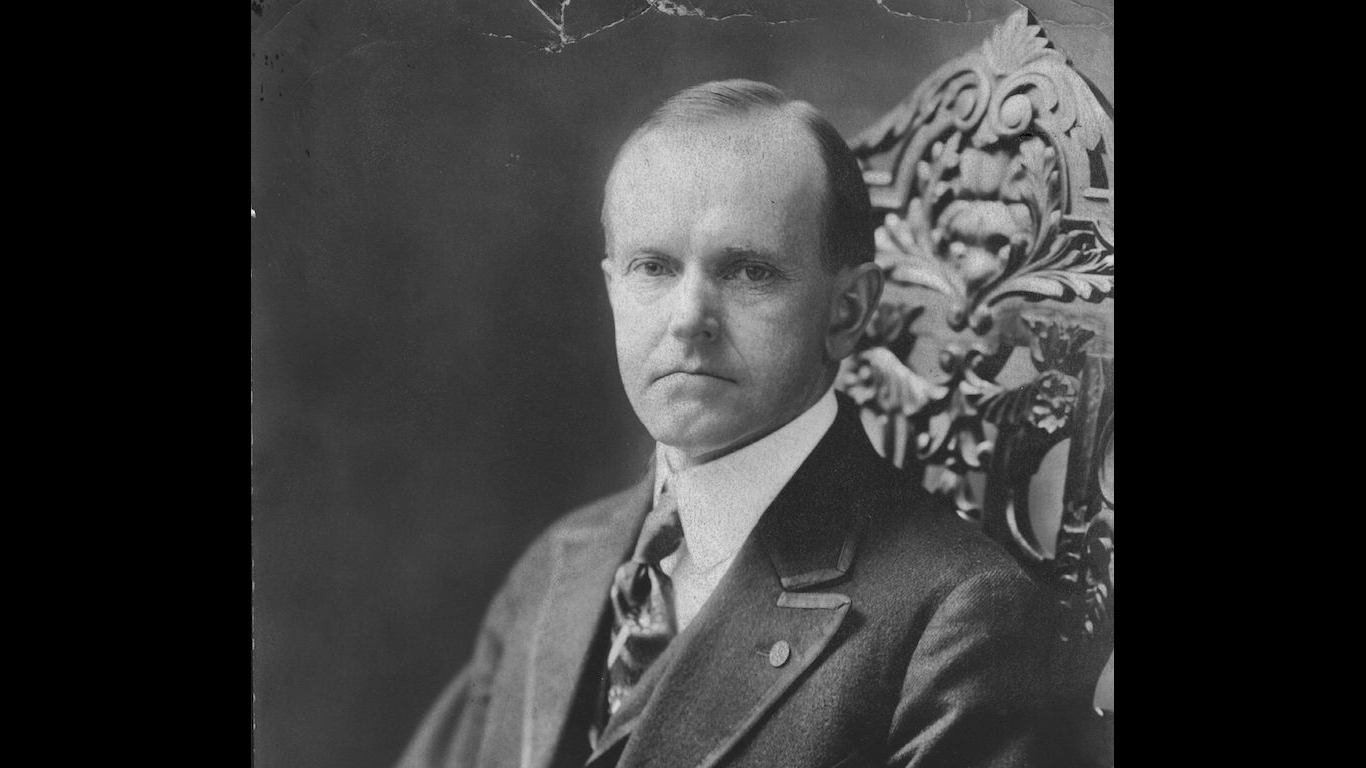

Calvin Coolidge

- Served: August 9, 1923-March 4, 1929

- DJIA performance: +230.5%

- DJIA high point: 2/5/1929, 322.06

- DJIA low point: 10/27/1923, 85.76

- Party affiliation: Republican

After Harding’s death, Vice President Calvin Coolidge was appointed President. Coolidge cut inheritance, gift, and inheritance taxes and reduced government spending. He tended to believe in a hands-off government and favored pro-business policies. President Coolidge served two terms and presided over the Roaring Twenties, a period of unprecedented American growth. The Dow experienced the most significant growth under any president at 230.5%.

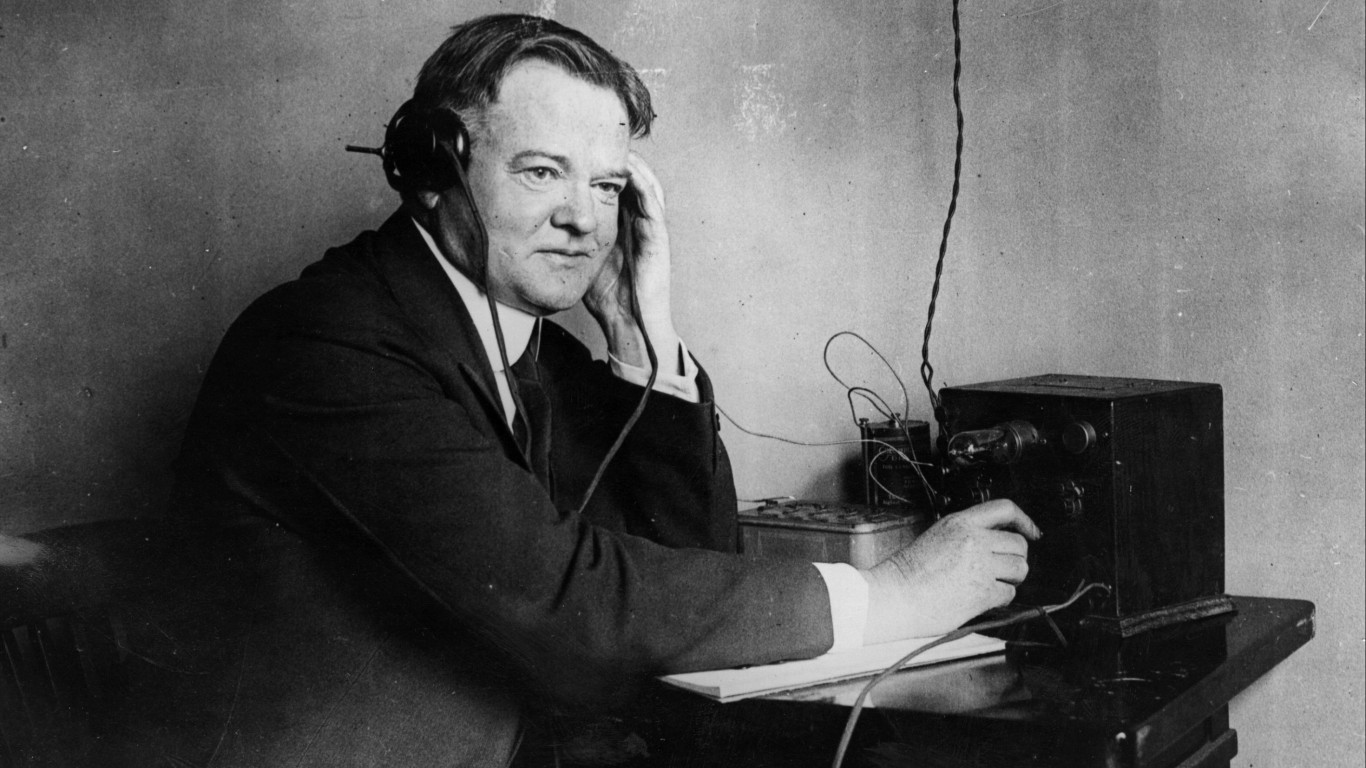

Herbert Hoover

- Served: March 4, 1929-March 4, 1933

- DJIA performance: -82.1%

- DJIA high point: 9/3/1929, 381.17

- DJIA low point: 7/8/1932, 41.22

- Party affiliation: Republican

The goodwill felt toward the Republican Calvin Coolidge was extended to the party’s next nominee, Herbert Hoover. Unfortunately for him, the economic bubble of the Roaring Twenties burst on October 29, 1929. The market crash of that day ushered in the Great Depression, the worst financial crash in U.S. history. Very little that Hoover tried appeared to work. The Smoot-Hawley Tariff dampened international trade. Hoover tried to increase revenue through the Revenue Act of 1932, which increased taxes across the board but didn’t have the desired effect. Also, in 1932, he signed into law the Emergency Relief and Construction Act, which created public works programs to stimulate employment and provided funds for low-income housing. His administration presided over record unemployment and consumer debt; the Dow lost over 82%. Hoover was a one-term president, losing in a landslide to Franklin D. Roosevelt in the 1932 election.

Franklin D. Roosevelt

- Served: March 4, 1933-April 12, 1945

- DJIA performance: +198.6%

- DJIA high point: 3/10/1937, 194.4

- DJIA low point: 3/31/1933, 55.4

- Party affiliation: Democratic

Franklin D. Roosevelt’s electoral victory was a referendum on Herbert Hoover’s management of the Depression. Roosevelt wasted little time enacting programs and reforms in his first 100 days, including banking and monetary reform. He established the Securities and Exchange Commission to provide oversight of the stock market. Prohibition was also repealed during this period. Public works projects were expanded in the following years, relief was provided to farmers and rural residents, housing assistance was provided, and trade was liberalized. After this, the Social Security Administration was established, collective bargaining rights for laborers were established, child labor laws were passed, consumer rights laws were passed, and, finally, the Housing Act of 1937 established the United States Housing Authority. The Great Depression was all but over by the end of 1937, but World War II wasn’t far off. Roosevelt died in office at the beginning of his fourth term in 1945. The Dow climbed nearly 200% during his presidency.

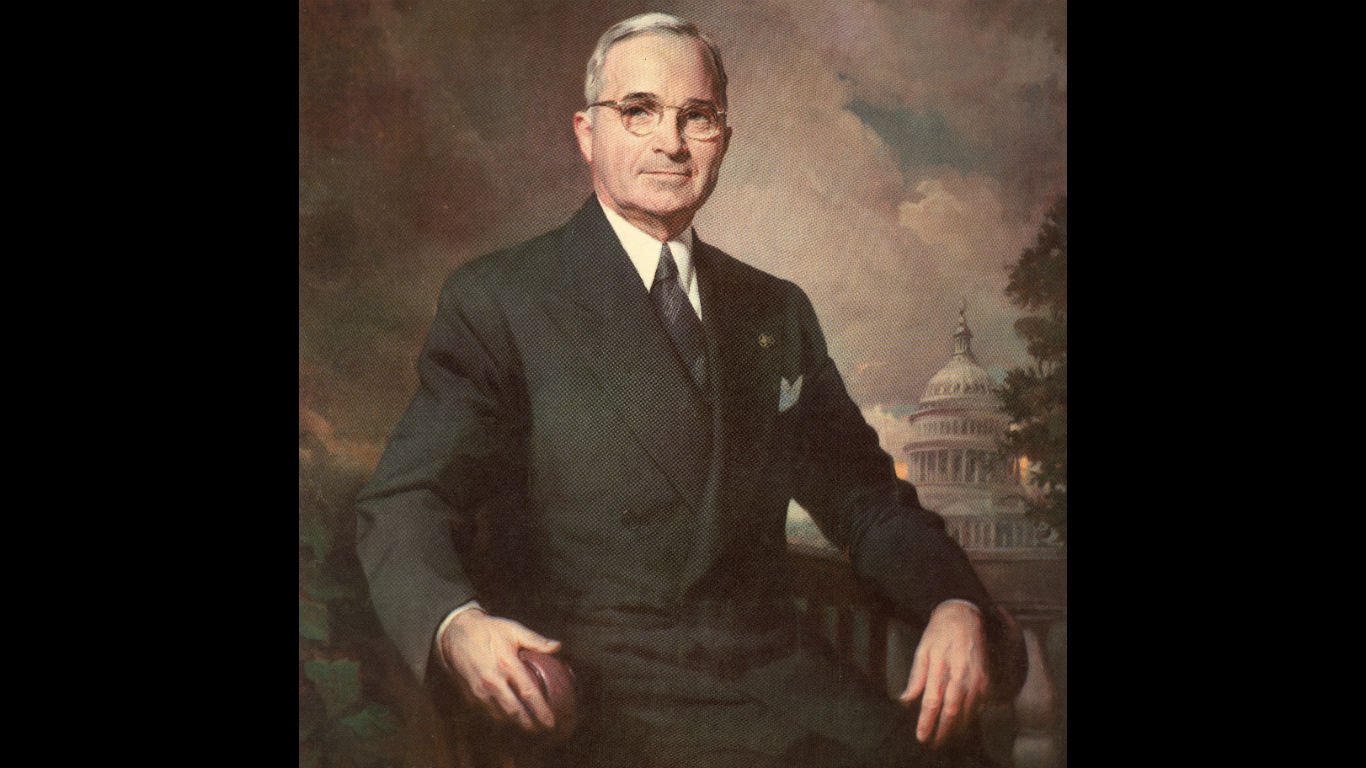

Harry S. Truman

- Served: April 12, 1945-January 20, 1953

- DJIA performance: +75.2%

- DJIA high point: 1/5/1953, 293.79

- DJIA low point: 7/26/1945, 160.91

- Party affiliation: Democratic

After the death of Franklin D. Roosevelt, Vice-President Harry S. Truman took over as president. He presided over World War II’s final year, followed by a stock market collapse in his second year. A recession with lagging production and high unemployment characterized this period. There was also a railroad workers’ strike at that time. He managed to navigate these challenges and win a second term. During these four years, the economy improved, and unemployment dropped. The defense budget was increased during this term to address communism. The Marshall Plan was enacted in Europe to stabilize the economy and provide a bulwark against Soviet Russia. It was during this time that the Korean War occurred. Truman opted not to run for another term. Post-war growth resulted in an increase of 75.2% in the Dow.

Dwight D. Eisenhower

- Served: January 20, 1953-January 20, 1961

- DJIA performance: +123.7%

- DJIA high point: 1/5/1960, 685.47

- DJIA low point: 9/14/1953, 255.49

- Party affiliation: Republican

The Democratic nominee for president, Adlai Stevenson, was defeated in the 1952 election by former U.S. general Dwight D. Eisenhower. Though a Republican, Eisenhower continued the social welfare policies of Roosevelt and Truman. He strengthened the Social Security program and raised the minimum wage. Militarily, he focused on a policy of nuclear deterrence, building the U.S. arsenal. He was elected to a second term in 1956, which also saw the passing of the Federal Highway Act, providing for creating the Interstate Highway System. In 1958, there was a blip of a recession, but by the end of his stay in office, the DJIA had risen by 123.7%.

John F. Kennedy

- Served: January 20, 1961-November 22, 1963

- DJIA performance: +15.8%

- DJIA high point: 12/2/1963, 751.91

- DJIA low point: 1/31/1961, 648.2

- Party affiliation: Democratic

After Eisenhower left office, the Democratic nominee, John F. Kennedy, won the 1960 presidential election. Dramatic events, such as the Bay of Pigs and the Cuban Missile Crisis, marked Kennedy’s administration. On the economic front, Kennedy increased military spending, relaxed some monetary policies, presided over a tariff reduction with the European Common Market, and enforced a steel price rollback that preceded a drop in the Dow. The administration also increased the minimum wage, expanded unemployment and social security benefits, increased highway spending, and lowered tax rates. During Kennedy’s presidency, the U.S. experienced its first non-war, non-recession deficit. Kennedy was assassinated on November 22, 1963. During his term, the Dow Jones Industrial Average increased by 15.8%.

Lyndon B. Johnson

- Served: November 22, 1963-January 20, 1969

- DJIA performance: +26.1%

- DJIA high point: 2/9/1966, 995.15

- DJIA low point: 10/7/1966, 744.32

- Party affiliation: Democratic

After Kennedy’s assassination, Lyndon B. Johnson, the Vice President, was sworn into office. Johnson pushed through several bills and programs that made up his Great Society initiative during his administration. These included acts addressing privacy, civil rights, education, health, and welfare and economic programs addressing transportation, consumer protection, housing, and labor. His administration saw increased government hiring and continuously improving unemployment rates. He won reelection in 1964. Johnson’s terms also saw an expansion of involvement in Vietnam. The Dow rose by 26.1% during Johnson’s presidency. He elected not to run in 1968.

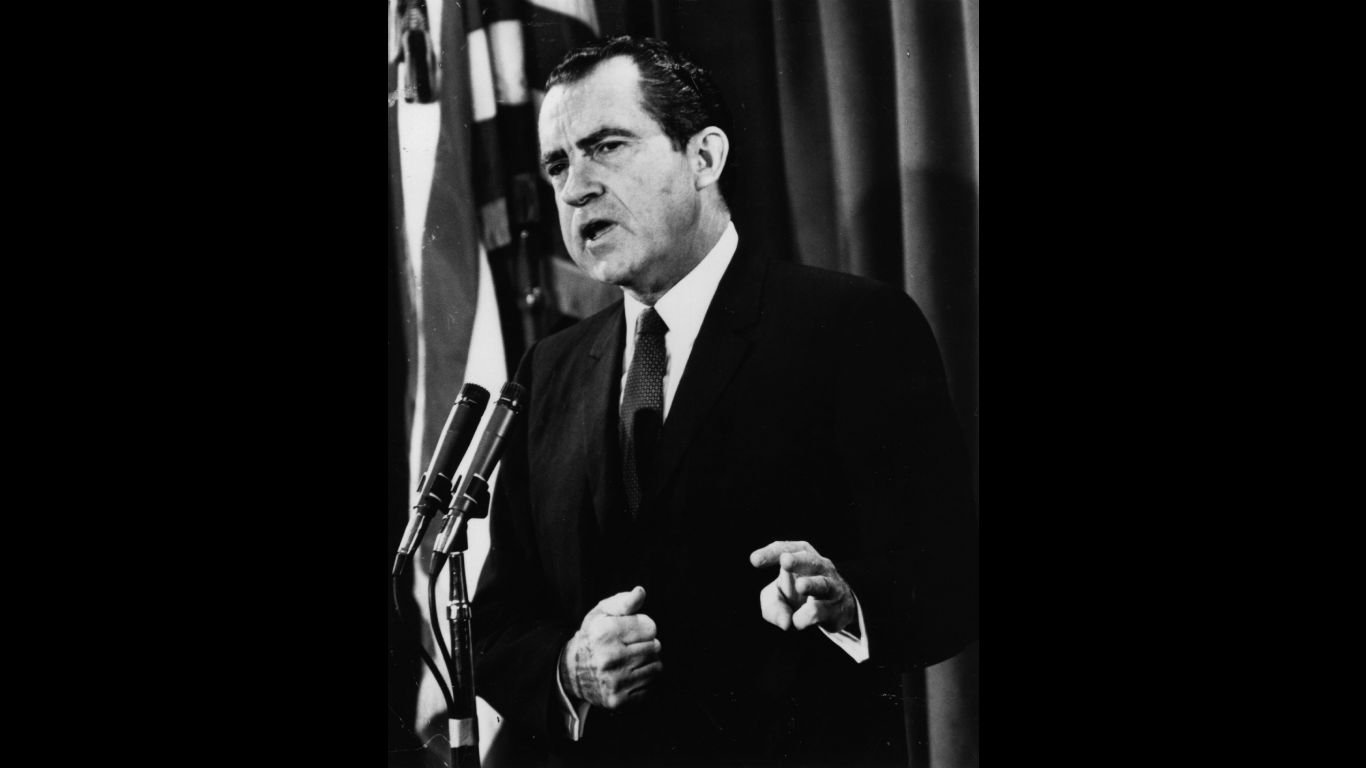

Richard Nixon

- Served: January 20, 1969-August 9, 1974

- DJIA performance: -28.3%

- DJIA high point: 1/11/1973, 1,051.7

- DJIA low point: 5/26/1970, 631.16

- Party affiliation: Republican

Richard Nixon won the 1968 presidential election against the Democratic nominee, Hubert Humphrey, and an independent, George Wallace. During Noxon’s presidency, he adopted several environmental policies and established the Environmental Protection Agency (EPA) in 1970. In 1971, in an attempt to combat inflation, Nixon announced a 90-day wage and price freeze and began the elimination of the gold standard by “temporarily” ending the convertibility of dollars to gold by foreign governments. After his reelection in 1972, Nixon established more price controls in 1973. The Yom Kippur War in the Middle East led to an oil crisis in the U.S. in the same year. Nixon left office in 1974 under scrutiny for the Watergate scandal. During his time in office, the DJIA dropped by 28.3%.

Gerald Ford

- Served: August 9, 1974-January 20, 1977

- DJIA performance: +40.6%

- DJIA high point: 9/21/1976, 1,014.79

- DJIA low point: 12/6/1974, 577.6

- Party affiliation: Republican

Upon Richard Nixon’s resignation, Vice President Gerald Ford became President. He inherited what some have called the worst recession since World War II, with high unemployment and inflation. Under his administration, the SEC eliminated fixed commissions for trading fees, opening the stock market to more people. Although he could not reign in inflation, his pardon of Nixon played a significant role in his election loss after completing Nixon’s term. The Dow rose 40.6 % during his presidency.

Jimmy Carter

- Served: January 20, 1977-January 20, 1981

- DJIA performance: -0.7%

- DJIA high point: 1/6/1981, 1,004.69

- DJIA low point: 2/28/1978, 742.12

- Party affiliation: Democratic

Jimmy Carter defeated Gerald Ford in the 1976 election, inheriting the inflation and unemployment that afflicted the previous two presidents. Strangely enough, the economy was experiencing inflation, but it was stagnant. This led to a new economic term—”stagflation.” Carter was unable to fix this economic problem during his term. The fact that it ended with a slew of unfortunate international issues (the 1979 Oil Crisis, Three Mile Island, the Iran Hostage Crisis, the Nicaraguan Revolution, the Soviet invasion of Afghanistan, and the 1980 Olympic boycott) all but assured that this would be his only term. When he left office after his 1980 defeat, the Dow had dropped .7%.

Ronald Reagan

- Served: January 20, 1981-January 20, 1989

- DJIA performance: +147.3%

- DJIA high point: 8/25/1987, 2,722.42

- DJIA low point: 8/12/1982, 776.92

- Party affiliation: Republican

Ronald Reagan defeated Jimmy Carter in the 1980 election under the promise of “Reaganomics”—small government, tax cuts, social spending cuts, regulatory cuts, and increased military spending. These were the focus of Reagan’s two terms. From a recession during his first year in office to the Black Monday Crash of 1987, the economy experienced rapid growth. His administration was characterized by opposition to labor unions, an accelerated arms race with the Soviet Union, and an increased focus on intervention in Central and South America, as illustrated by the U.S. invasion of Grenada. By the end of his time in office, the national debt had tripled, and the U.S. was a debtor nation for the first time since WWI, but the DJIA had grown by 147.3%.

George H. W. Bush

- Served: January 20, 1989-January 20, 1993

- DJIA performance: +41.3%

- DJIA high point: 6/1/1992, 3,413.21

- DJIA low point: 3/23/1989, 2,243.04

- Party affiliation: Republican

Reagan’s Vice President, George H.W. Bush, secured the Republican presidential nomination and defeated the Democratic nominee, Michael Dukakis, in the 1988 election. During Bush’s term in office, there were several geopolitical shifts. The fall of the Berlin Wall marked the end of the Soviet Union, ending the Cold War. The U.S. also responded to Iraq’s invasion of Kuwait by launching the Gulf War to drive Iraqi forces back into their own country. However, a poorly timed recession, deficit increases, and a broken promise not to raise taxes resulted in an election loss despite the 41.3% growth of the DJIA.

Bill Clinton

- Served: January 20, 1993-January 20, 2001

- DJIA performance: +228.9%

- DJIA high point: 1/14/2000, 11,722.98

- DJIA low point: 2/18/1993, 3,302.19

- Party affiliation: Democratic

Bill Clinton won the 1992 presidential election. During his two terms, the end of the Cold War ushered in an era of peace and prosperity. Unemployment and inflation fell, and the country had a budget surplus. In addition, Clinton ratified the North American Free Trade Agreement (NAFTA) after Bush negotiated and signed it during the previous administration. During Clinton’s eight years in office, the Dow Jones Industrial Average climbed 228.9%.

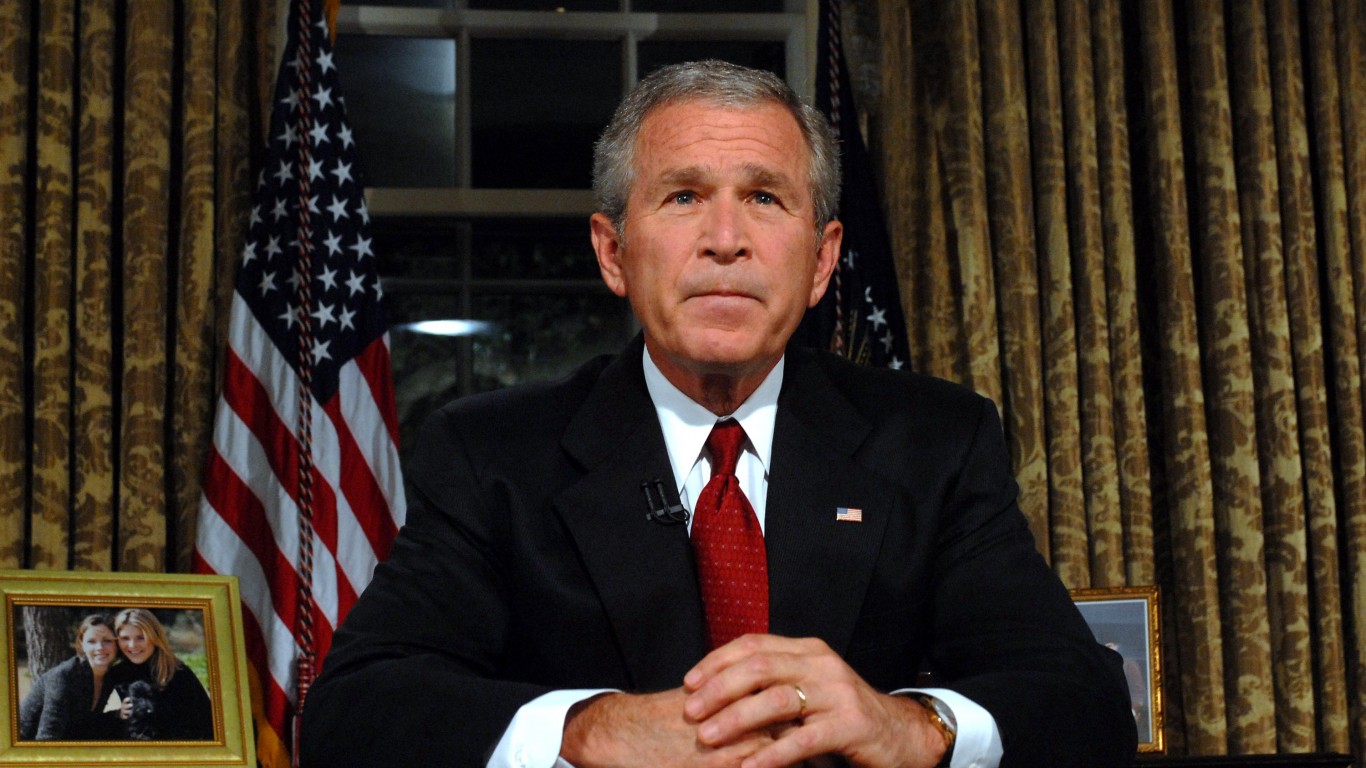

George W. Bush

- Served: January 20, 2001-January 20, 2009

- DJIA performance: -26.5%

- DJIA high point: 10/9/2007, 14,164.53

- DJIA low point: 10/9/2002, 7,286.27

- Party affiliation: Republican

After Clinton left office, George W. Bush, the son of George H.W. Bush, won the 2000 election. It wasn’t long before he faced a significant crisis. The terrorist attacks on 9/11 thrust the country into a prolonged war on terrorism, which resulted in invasions of Afghanistan and Iraq. These conflicts would last throughout his two terms as president. In 2007, predatory lending practices led to a mortgage crisis, as a housing bubble burst, touching off a global recession that would last through 2010. By the end of his last term, the Dow had dropped 26.5%.

Barack Obama

- Served: January 20, 2009-January 20, 2017

- DJIA performance: +148.3%

- DJIA high point: 1/26/2017, 20,100.91

- DJIA low point: 3/9/2009, 6,547.05

- Party affiliation: Democratic

After George Bush’s second term, Barack Obama defeated John McCain in the 2008 presidential election. He took office during the Great Recession, which resulted from the mortgage crisis that began at the end of Bush’s term. The American Recovery and Reinvestment Act of 2009 was a large stimulus package to jumpstart the economy. The administration also approved a bailout for the auto industry, which was on the verge of bankruptcy. In 2011, the Executive Office had difficulty working with Congress to raise the debt ceiling to avoid defaulting on the country’s debt. It was eventually resolved, but it resulted in the U.S. having its credit rating downgraded by Standard & Poor’s. By the end of Obama’s second term, the DJIA had risen by 148.3%.

Donald Trump

- Served: January 20, 2017-January 20, 2021

- DJIA performance: +57.0%

- DJIA high point: 1/20/2021, 31,188.38

- DJIA low point: 3/23/2020, 18,591.93

- Party affiliation: Republican

Donald Trump defeated Democratic nominee Hillary Clinton in the 2016 election. In 2018, he signed the Tax Cut and Jobs Act, reducing personal and corporate taxes and eliminating many deductions. Early in 2020, a new virus caused a global pandemic. The COVID-19 pandemic caused global shutdowns and severely impacted the economy. In 2020, Congress passed the CARES Act, which provided stimulus money for workers and industry. The four-year term resulted in a more significant budget deficit and increased national debt. By the end of the term, the U.S. workforce was smaller than it was at the beginning. The Dow had risen by 57% by the end of Trump’s term.

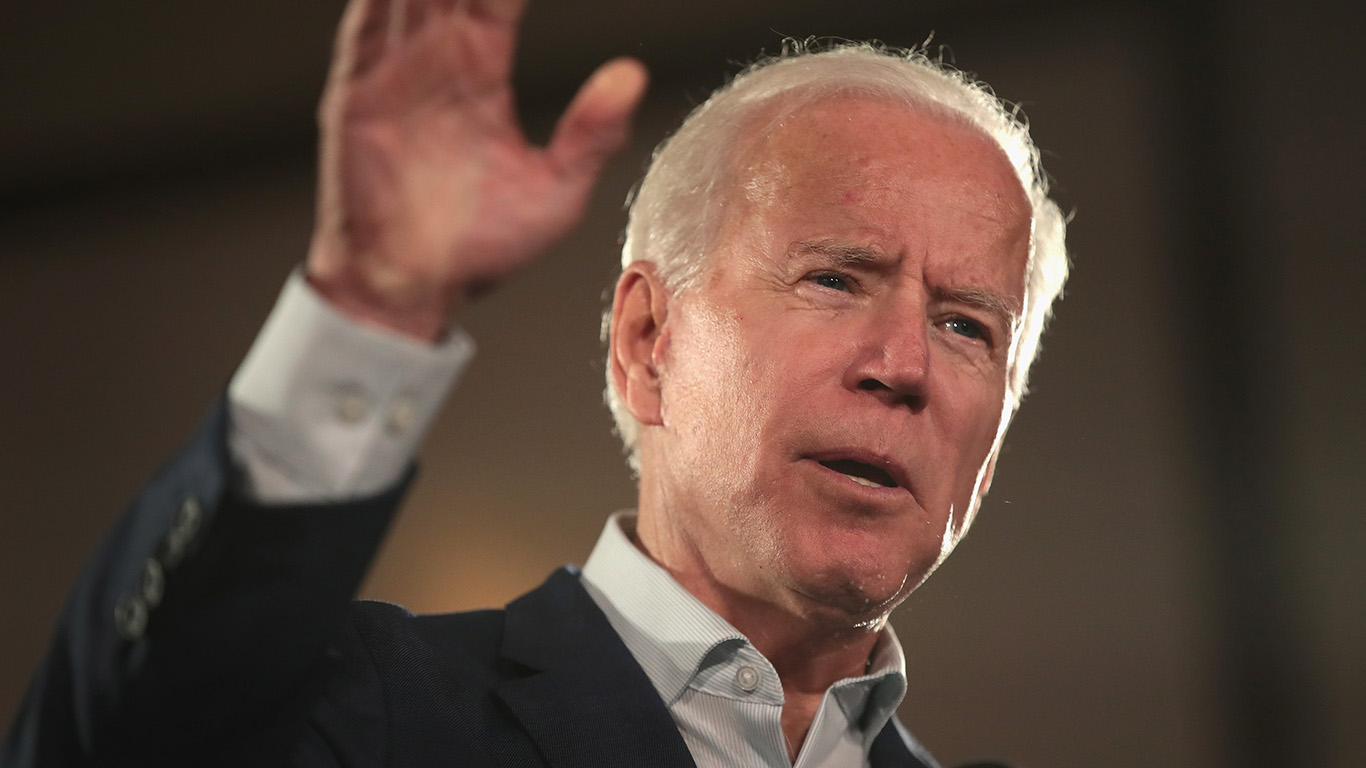

Joe Biden

- Served: January 20, 2021-Incumbent As of March 15, 2024

- DJIA performance: +29.1%

- DJIA high point: 2/23/2024, 39,131.53

- DJIA low point: 9/30/2022, 28,725.51

- Party affiliation: Democratic

Joe Biden defeated President Donald Trump in the 2020 election. The COVID-19 pandemic was still ongoing. Congress passed the American Rescue Plan Act, which built on the CARES Act and provided additional stimulus relief. In 2021, Biden signed the Infrastructure Investment and Jobs Act, which appropriated funds for infrastructure improvements and job creation. In 2023, the government faced another debt ceiling crisis and a banking crisis when five banks failed within a year. As of March 15, 2024, the Dow has increased 29.1% since the beginning of Biden’s presidency.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.