Though property taxes are generally set by local authorities such as cities, counties, and school boards, states often establish parameters in order to keep tax rates somewhat uniform. Each state, however, has different parameters, and as a result, what homeowners end up paying out of pocket can vary considerably from state to state.

In some parts of the country, property taxes are so low as to be almost trivial. In others, however, they can be a major financial burden.

Using data from tax policy research organization the Tax Foundation, 24/7 Wall St. reviewed total annual property tax collections as a share of the total value of owner-occupied housing units at the state level to identify the states with the highest (and lowest) property taxes.

It is important to note that a low property tax rate does not necessarily mean a low overall tax burden. State and local governments need to meet their financial obligations one way or another, and a low effective property tax rate can often mean that other tax rates, like sales or income taxes, might be higher.

To determine the states with the highest and lowest property taxes, 24/7 Wall St. calculated the effective property tax rate — the total amount of property taxes paid annually as a percentage of the total value of all occupied homes — for all 50 states using data from the U.S. Census Bureau’s 2019 American Community Survey. Data on median home value, median household income, and population also came from the 2019 ACS. Data on state and local property tax revenue used to calculate per capita property taxes came from the Census Bureau’s 2018 Annual Survey of State and Local Government Finances and were adjusted for the adult population using the total number of residents 18 years and up.

Click here to see the states with the lowest and highest property taxes.

50. Hawaii

> Aggregate property taxes paid: 0.31% of state home value

> Per capita property taxes: $1,362 (21st lowest)

> Median home value: $669,200 (the highest)

> Homeownership rate: 60.2% (4th lowest)

> Median household income: $83,102 (4th highest)

[in-text-ad]

49. Alabama

> Aggregate property taxes paid: 0.37% of state home value

> Per capita property taxes: $596 (the lowest)

> Median home value: $154,000 (6th lowest)

> Homeownership rate: 68.8% (15th highest)

> Median household income: $51,734 (5th lowest)

48. Louisiana

> Aggregate property taxes paid: 0.51% of state home value

> Per capita property taxes: $896 (7th lowest)

> Median home value: $172,100 (13th lowest)

> Homeownership rate: 66.5% (25th highest)

> Median household income: $51,073 (4th lowest)

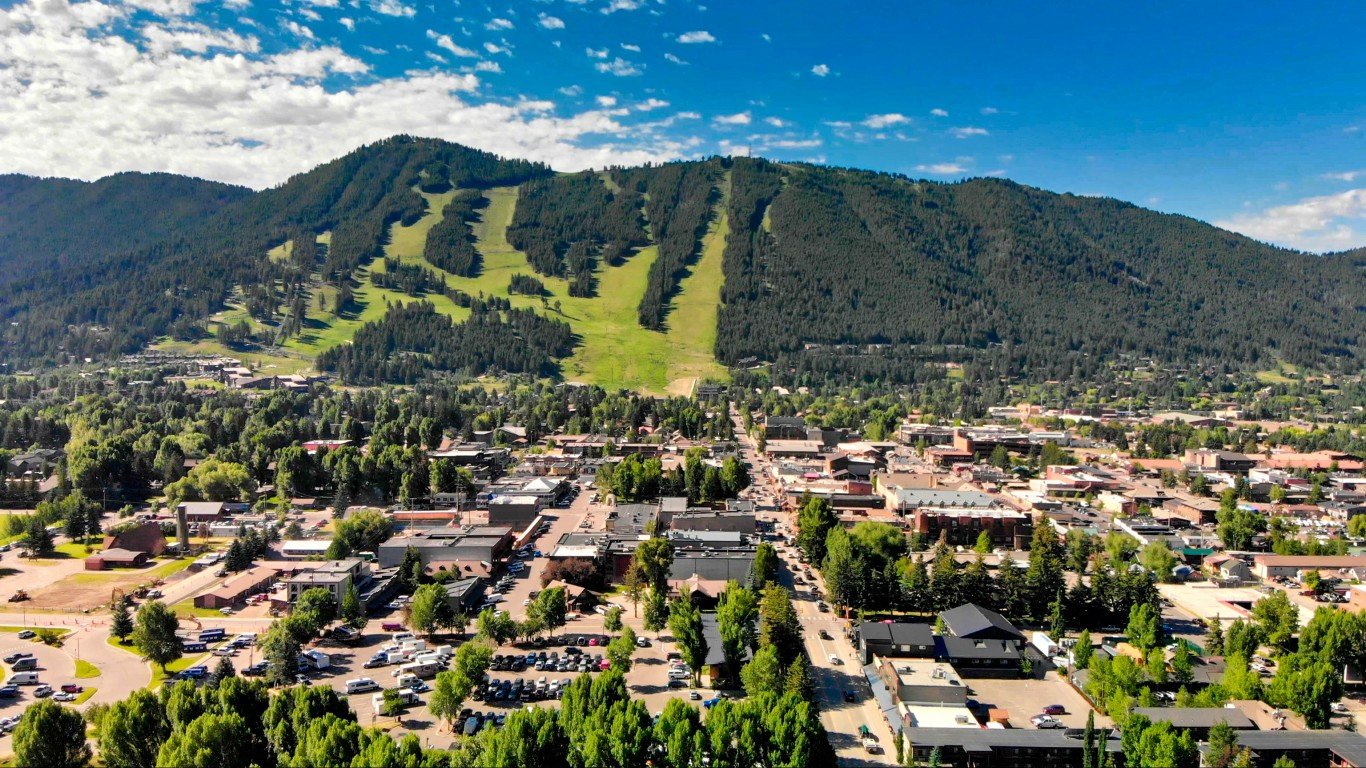

47. Wyoming

> Aggregate property taxes paid: 0.51% of state home value

> Per capita property taxes: $2,008 (11th highest)

> Median home value: $235,200 (23rd highest)

> Homeownership rate: 71.9% (4th highest)

> Median household income: $65,003 (19th highest)

[in-text-ad-2]

46. Colorado

> Aggregate property taxes paid: 0.52% of state home value

> Per capita property taxes: $1,597 (24th highest)

> Median home value: $394,600 (4th highest)

> Homeownership rate: 65.9% (19th lowest)

> Median household income: $77,127 (9th highest)

45. West Virginia

> Aggregate property taxes paid: 0.53% of state home value

> Per capita property taxes: $956 (9th lowest)

> Median home value: $124,600 (the lowest)

> Homeownership rate: 73.4% (the highest)

> Median household income: $48,850 (2nd lowest)

[in-text-ad]

44. South Carolina

> Aggregate property taxes paid: 0.53% of state home value

> Per capita property taxes: $1,196 (19th lowest)

> Median home value: $179,800 (15th lowest)

> Homeownership rate: 70.3% (12th highest)

> Median household income: $56,227 (10th lowest)

43. Utah

> Aggregate property taxes paid: 0.56% of state home value

> Per capita property taxes: $1,052 (14th lowest)

> Median home value: $330,300 (10th highest)

> Homeownership rate: 70.6% (9th highest)

> Median household income: $75,780 (11th highest)

42. Nevada

> Aggregate property taxes paid: 0.56% of state home value

> Per capita property taxes: $1,026 (12th lowest)

> Median home value: $317,800 (11th highest)

> Homeownership rate: 56.6% (3rd lowest)

> Median household income: $63,276 (24th highest)

[in-text-ad-2]

41. Delaware

> Aggregate property taxes paid: 0.59% of state home value

> Per capita property taxes: $923 (8th lowest)

> Median home value: $261,700 (17th highest)

> Homeownership rate: 70.3% (11th highest)

> Median household income: $70,176 (16th highest)

40. New Mexico

> Aggregate property taxes paid: 0.59% of state home value

> Per capita property taxes: $831 (5th lowest)

> Median home value: $180,900 (16th lowest)

> Homeownership rate: 68.1% (17th highest)

> Median household income: $51,945 (6th lowest)

[in-text-ad]

39. Arizona

> Aggregate property taxes paid: 0.60% of state home value

> Per capita property taxes: $1,106 (17th lowest)

> Median home value: $255,900 (18th highest)

> Homeownership rate: 65.3% (15th lowest)

> Median household income: $62,055 (23rd lowest)

38. Arkansas

> Aggregate property taxes paid: 0.61% of state home value

> Per capita property taxes: $774 (3rd lowest)

> Median home value: $136,200 (3rd lowest)

> Homeownership rate: 65.5% (17th lowest)

> Median household income: $48,952 (3rd lowest)

37. Mississippi

> Aggregate property taxes paid: 0.63% of state home value

> Per capita property taxes: $1,063 (15th lowest)

> Median home value: $128,200 (2nd lowest)

> Homeownership rate: 67.3% (19th highest)

> Median household income: $45,792 (the lowest)

[in-text-ad-2]

36. Tennessee

> Aggregate property taxes paid: 0.63% of state home value

> Per capita property taxes: $793 (4th lowest)

> Median home value: $191,900 (18th lowest)

> Homeownership rate: 66.5% (24th highest)

> Median household income: $56,071 (9th lowest)

35. Idaho

> Aggregate property taxes paid: 0.65% of state home value

> Per capita property taxes: $1,001 (11th lowest)

> Median home value: $255,200 (19th highest)

> Homeownership rate: 71.6% (6th highest)

> Median household income: $60,999 (20th lowest)

[in-text-ad]

34. California

> Aggregate property taxes paid: 0.70% of state home value

> Per capita property taxes: $1,678 (18th highest)

> Median home value: $568,500 (2nd highest)

> Homeownership rate: 54.9% (2nd lowest)

> Median household income: $80,440 (5th highest)

33. Montana

> Aggregate property taxes paid: 0.74% of state home value

> Per capita property taxes: $1,698 (15th highest)

> Median home value: $253,600 (20th highest)

> Homeownership rate: 68.9% (14th highest)

> Median household income: $57,153 (11th lowest)

32. North Carolina

> Aggregate property taxes paid: 0.78% of state home value

> Per capita property taxes: $983 (10th lowest)

> Median home value: $193,200 (20th lowest)

> Homeownership rate: 65.3% (16th lowest)

> Median household income: $57,341 (12th lowest)

[in-text-ad-2]

31. Kentucky

> Aggregate property taxes paid: 0.78% of state home value

> Per capita property taxes: $844 (6th lowest)

> Median home value: $151,700 (5th lowest)

> Homeownership rate: 67.0% (22nd highest)

> Median household income: $52,295 (7th lowest)

30. Indiana

> Aggregate property taxes paid: 0.81% of state home value

> Per capita property taxes: $1,028 (13th lowest)

> Median home value: $156,000 (7th lowest)

> Homeownership rate: 69.3% (13th highest)

> Median household income: $57,603 (14th lowest)

[in-text-ad]

29. Oklahoma

> Aggregate property taxes paid: 0.83% of state home value

> Per capita property taxes: $767 (2nd lowest)

> Median home value: $147,000 (4th lowest)

> Homeownership rate: 65.5% (18th lowest)

> Median household income: $54,449 (8th lowest)

28. Virginia

> Aggregate property taxes paid: 0.84% of state home value

> Per capita property taxes: $1,693 (16th highest)

> Median home value: $288,800 (12th highest)

> Homeownership rate: 66.1% (22nd lowest)

> Median household income: $76,456 (10th highest)

27. Washington

> Aggregate property taxes paid: 0.84% of state home value

> Per capita property taxes: $1,626 (22nd highest)

> Median home value: $387,600 (5th highest)

> Homeownership rate: 63.1% (10th lowest)

> Median household income: $78,687 (7th highest)

[in-text-ad-2]

26. Florida

> Aggregate property taxes paid: 0.86% of state home value

> Per capita property taxes: $1,363 (22nd lowest)

> Median home value: $245,100 (22nd highest)

> Homeownership rate: 66.2% (23rd lowest)

> Median household income: $59,227 (17th lowest)

25. Georgia

> Aggregate property taxes paid: 0.87% of state home value

> Per capita property taxes: $1,193 (18th lowest)

> Median home value: $202,500 (24th lowest)

> Homeownership rate: 64.1% (12th lowest)

> Median household income: $61,980 (22nd lowest)

[in-text-ad]

24. North Dakota

> Aggregate property taxes paid: 0.88% of state home value

> Per capita property taxes: $1,640 (20th highest)

> Median home value: $205,400 (25th lowest)

> Homeownership rate: 61.3% (5th lowest)

> Median household income: $64,577 (20th highest)

23. Oregon

> Aggregate property taxes paid: 0.91% of state home value

> Per capita property taxes: $1,544 (24th lowest)

> Median home value: $354,600 (6th highest)

> Homeownership rate: 62.9% (9th lowest)

> Median household income: $67,058 (18th highest)

22. Missouri

> Aggregate property taxes paid: 0.96% of state home value

> Per capita property taxes: $1,070 (16th lowest)

> Median home value: $168,000 (11th lowest)

> Homeownership rate: 67.1% (21st highest)

> Median household income: $57,409 (13th lowest)

[in-text-ad-2]

21. Alaska

> Aggregate property taxes paid: 0.98% of state home value

> Per capita property taxes: $2,206 (10th highest)

> Median home value: $281,200 (15th highest)

> Homeownership rate: 64.7% (13th lowest)

> Median household income: $75,463 (12th highest)

20. Maryland

> Aggregate property taxes paid: 1.01% of state home value

> Per capita property taxes: $1,691 (17th highest)

> Median home value: $332,500 (9th highest)

> Homeownership rate: 66.8% (23rd highest)

> Median household income: $86,738 (the highest)

[in-text-ad]

19. Minnesota

> Aggregate property taxes paid: 1.05% of state home value

> Per capita property taxes: $1,639 (21st highest)

> Median home value: $246,700 (21st highest)

> Homeownership rate: 71.9% (3rd highest)

> Median household income: $74,593 (13th highest)

18. Massachusetts

> Aggregate property taxes paid: 1.08% of state home value

> Per capita property taxes: $2,562 (6th highest)

> Median home value: $418,600 (3rd highest)

> Homeownership rate: 62.2% (8th lowest)

> Median household income: $85,843 (2nd highest)

17. South Dakota

> Aggregate property taxes paid: 1.14% of state home value

> Per capita property taxes: $1,575 (25th lowest)

> Median home value: $185,000 (17th lowest)

> Homeownership rate: 67.8% (18th highest)

> Median household income: $59,533 (18th lowest)

[in-text-ad-2]

16. Maine

> Aggregate property taxes paid: 1.20% of state home value

> Per capita property taxes: $2,241 (9th highest)

> Median home value: $200,500 (23rd lowest)

> Homeownership rate: 72.2% (2nd highest)

> Median household income: $58,924 (16th lowest)

15. Kansas

> Aggregate property taxes paid: 1.28% of state home value

> Per capita property taxes: $1,604 (23rd highest)

> Median home value: $163,200 (10th lowest)

> Homeownership rate: 66.5% (25th lowest)

> Median household income: $62,087 (24th lowest)

[in-text-ad]

14. New York

> Aggregate property taxes paid: 1.30% of state home value

> Per capita property taxes: $3,037 (4th highest)

> Median home value: $338,700 (8th highest)

> Homeownership rate: 53.5% (the lowest)

> Median household income: $72,108 (14th highest)

13. Michigan

> Aggregate property taxes paid: 1.31% of state home value

> Per capita property taxes: $1,464 (23rd lowest)

> Median home value: $169,600 (12th lowest)

> Homeownership rate: 71.6% (5th highest)

> Median household income: $59,584 (19th lowest)

12. Rhode Island

> Aggregate property taxes paid: 1.37% of state home value

> Per capita property taxes: $2,429 (7th highest)

> Median home value: $283,000 (13th highest)

> Homeownership rate: 61.7% (6th lowest)

> Median household income: $71,169 (15th highest)

[in-text-ad-2]

11. Pennsylvania

> Aggregate property taxes paid: 1.43% of state home value

> Per capita property taxes: $1,584 (25th highest)

> Median home value: $192,600 (19th lowest)

> Homeownership rate: 68.4% (16th highest)

> Median household income: $63,463 (23rd highest)

10. Iowa

> Aggregate property taxes paid: 1.43% of state home value

> Per capita property taxes: $1,698 (14th highest)

> Median home value: $158,900 (9th lowest)

> Homeownership rate: 70.5% (10th highest)

> Median household income: $61,691 (21st lowest)

[in-text-ad]

9. Ohio

> Aggregate property taxes paid: 1.52% of state home value

> Per capita property taxes: $1,355 (20th lowest)

> Median home value: $157,200 (8th lowest)

> Homeownership rate: 66.0% (21st lowest)

> Median household income: $58,642 (15th lowest)

8. Wisconsin

> Aggregate property taxes paid: 1.53% of state home value

> Per capita property taxes: $1,676 (19th highest)

> Median home value: $197,200 (21st lowest)

> Homeownership rate: 67.2% (20th highest)

> Median household income: $64,168 (21st highest)

7. Nebraska

> Aggregate property taxes paid: 1.54% of state home value

> Per capita property taxes: $2,001 (12th highest)

> Median home value: $172,700 (14th lowest)

> Homeownership rate: 66.3% (24th lowest)

> Median household income: $63,229 (25th highest)

[in-text-ad-2]

6. Texas

> Aggregate property taxes paid: 1.60% of state home value

> Per capita property taxes: $1,948 (13th highest)

> Median home value: $200,400 (22nd lowest)

> Homeownership rate: 61.9% (7th lowest)

> Median household income: $64,034 (22nd highest)

5. Connecticut

> Aggregate property taxes paid: 1.73% of state home value

> Per capita property taxes: $3,112 (3rd highest)

> Median home value: $280,700 (16th highest)

> Homeownership rate: 65.0% (14th lowest)

> Median household income: $78,833 (6th highest)

[in-text-ad]

4. Vermont

> Aggregate property taxes paid: 1.76% of state home value

> Per capita property taxes: $2,740 (5th highest)

> Median home value: $233,200 (24th highest)

> Homeownership rate: 70.9% (8th highest)

> Median household income: $63,001 (25th lowest)

3. New Hampshire

> Aggregate property taxes paid: 1.89% of state home value

> Per capita property taxes: $3,347 (2nd highest)

> Median home value: $281,400 (14th highest)

> Homeownership rate: 71.0% (7th highest)

> Median household income: $77,933 (8th highest)

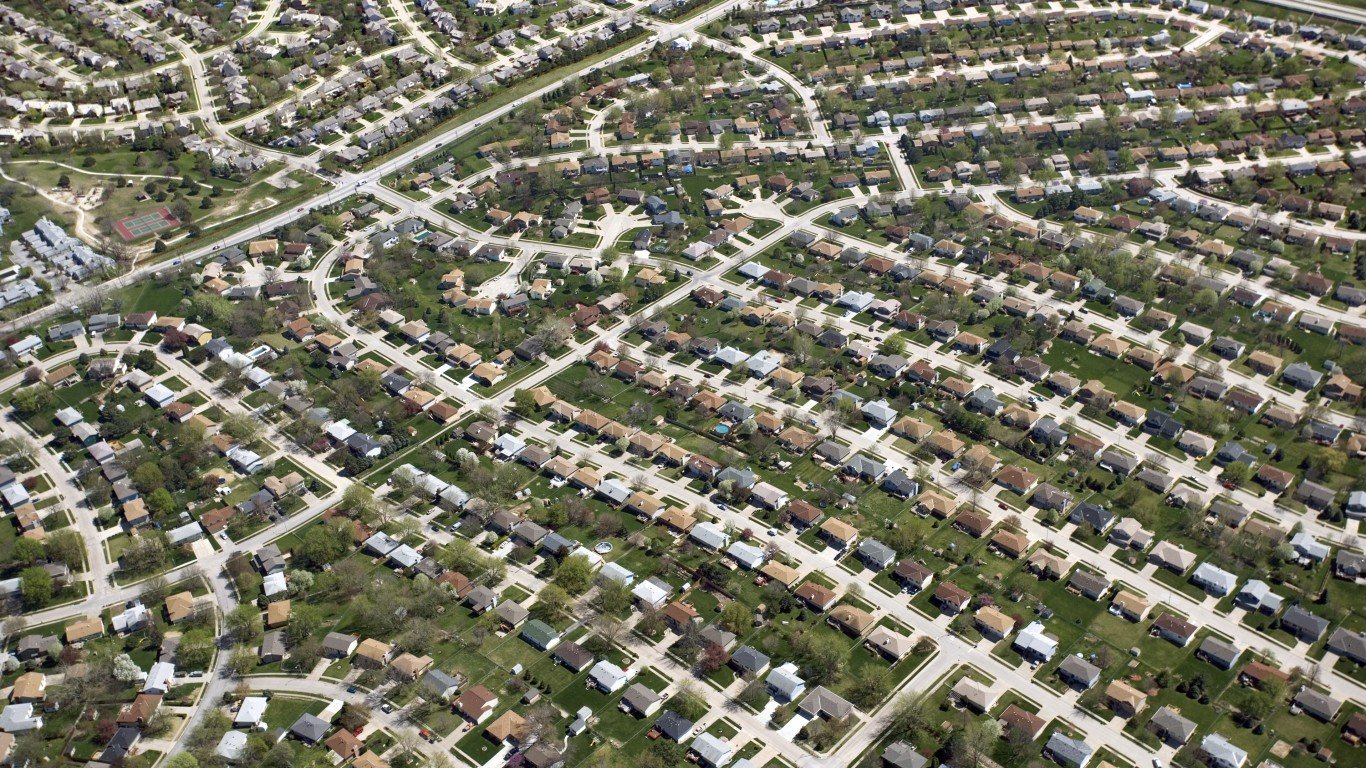

2. Illinois

> Aggregate property taxes paid: 1.97% of state home value

> Per capita property taxes: $2,286 (8th highest)

> Median home value: $209,100 (25th highest)

> Homeownership rate: 66.0% (20th lowest)

> Median household income: $69,187 (17th highest)

[in-text-ad-2]

1. New Jersey

> Aggregate property taxes paid: 2.13% of state home value

> Per capita property taxes: $3,379 (the highest)

> Median home value: $348,800 (7th highest)

> Homeownership rate: 63.3% (11th lowest)

> Median household income: $85,751 (3rd highest)

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.