U.S. home sales skyrocketed during the COVID-19 pandemic – hitting a 15-year high of 6.1 million in 2021. The spike in demand, coupled with declining inventory, have put upward pressure on housing prices. Renters have not been spared, as housing has become one of the key drivers of surging U.S. inflation.

According to the Economic Policy Institute, a nonprofit think tank, a single adult can expect to pay an estimated $11,026 on housing in 2022. This amount varies across the country, however, from state to state and city to city.

Using data from the EPI’s Family Budget Calculator, 24/7 Wall St. identified the metro area with the highest housing costs in every state. Metro areas in each state were ranked on 2022 estimates of housing and utility costs for a modest studio apartment.

It is important to note that four states – Delaware, New Hampshire, Rhode Island, and Vermont – each have only one metro area. As a result, the metro area in these places ranks as having the highest housing costs by default only.

Among the metro areas on this list, housing costs for a single adult range from about $7,700 to $28,200, and in most cases they are over $1,000 higher than housing costs across the state as a whole. Higher housing costs in these places are often a reflection of what residents can afford. The majority of metro areas on this list have a higher median household income than the statewide median. Here is a look at the income needed to be middle class in each state.

Home values also tend to be higher in areas with high housing costs, and in most metro areas on this list, the median home value is above the comparable statewide median. Here is a look at the mortgage rate in America every year since 1972.

Click here to see the metro area with the highest housing costs in each state

Click here to read our detailed methodology

Alabama: Birmingham-Hoover

> Est. annual housing costs: $9,804 (Alabama: $7,476)

> Median household income: $59,185 (Alabama: $52,035)

> Homeownership rate: 69.2% (Alabama: 69.2%)

> Median home value: $171,400 (Alabama: $149,600)

> No. of metros considered in ranking: 12

[in-text-ad]

Alaska: Anchorage

> Est. annual housing costs: $10,524 (Alaska: $10,316)

> Median household income: $82,890 (Alaska: $77,790)

> Homeownership rate: 65.6% (Alaska: 64.8%)

> Median home value: $301,100 (Alaska: $275,600)

> No. of metros considered in ranking: 2

Arizona: Flagstaff

> Est. annual housing costs: $12,312 (Arizona: $10,143)

> Median household income: $59,000 (Arizona: $61,529)

> Homeownership rate: 60.8% (Arizona: 65.3%)

> Median home value: $299,100 (Arizona: $242,000)

> No. of metros considered in ranking: 7

Arkansas: Little Rock-North Little Rock-Conway

> Est. annual housing costs: $8,424 (Arkansas: $6,808)

> Median household income: $55,983 (Arkansas: $49,475)

> Homeownership rate: 63.9% (Arkansas: 65.8%)

> Median home value: $157,900 (Arkansas: $133,600)

> No. of metros considered in ranking: 6

[in-text-ad-2]

California: San Francisco-Oakland-Berkeley

> Est. annual housing costs: $28,200 (California: $16,349)

> Median household income: $110,837 (California: $78,672)

> Homeownership rate: 55.0% (California: 55.3%)

> Median home value: $888,500 (California: $538,500)

> No. of metros considered in ranking: 26

Colorado: Boulder

> Est. annual housing costs: $15,348 (Colorado: $12,463)

> Median household income: $87,476 (Colorado: $75,231)

> Homeownership rate: 63.6% (Colorado: 66.2%)

> Median home value: $539,100 (Colorado: $369,900)

> No. of metros considered in ranking: 7

[in-text-ad]

Connecticut: New Haven-Milford

> Est. annual housing costs: $12,660 (Connecticut: $11,547)

> Median household income: $71,370 (Connecticut: $79,855)

> Homeownership rate: 62.1% (Connecticut: 66.1%)

> Median home value: $252,300 (Connecticut: $279,700)

> No. of metros considered in ranking: 4

Delaware: Dover

> Est. annual housing costs: $10,536 (Delaware: $10,148)

> Median household income: $60,117 (Delaware: $69,110)

> Homeownership rate: 68.8% (Delaware: 71.4%)

> Median home value: $226,600 (Delaware: $258,300)

> No. of metros considered in ranking: 1

*Because Dover is the only eligible metro in Delaware, it is the metro with the highest housing costs by default.

Florida: Miami-Fort Lauderdale-Pompano Beach

> Est. annual housing costs: $12,684 (Florida: $11,076)

> Median household income: $59,030 (Florida: $57,703)

> Homeownership rate: 59.8% (Florida: 66.2%)

> Median home value: $298,400 (Florida: $232,000)

> No. of metros considered in ranking: 22

[in-text-ad-2]

Georgia: Atlanta-Sandy Springs-Alpharetta

> Est. annual housing costs: $12,192 (Georgia: $10,106)

> Median household income: $71,193 (Georgia: $61,224)

> Homeownership rate: 64.2% (Georgia: 64.0%)

> Median home value: $233,700 (Georgia: $190,200)

> No. of metros considered in ranking: 14

Hawaii: Urban Honolulu

> Est. annual housing costs: $17,196 (Hawaii: $16,151)

> Median household income: $87,722 (Hawaii: $83,173)

> Homeownership rate: 57.5% (Hawaii: 60.3%)

> Median home value: $702,300 (Hawaii: $636,400)

> No. of metros considered in ranking: 2

[in-text-ad]

Idaho: Boise City

> Est. annual housing costs: $8,196 (Idaho: $7,517)

> Median household income: $64,717 (Idaho: $58,915)

> Homeownership rate: 71.0% (Idaho: 70.8%)

> Median home value: $268,500 (Idaho: $235,600)

> No. of metros considered in ranking: 5

Illinois: Chicago-Naperville-Elgin

> Est. annual housing costs: $12,144 (Illinois: $10,427)

> Median household income: $74,621 (Illinois: $68,428)

> Homeownership rate: 64.8% (Illinois: 66.3%)

> Median home value: $247,400 (Illinois: $202,100)

> No. of metros considered in ranking: 9

Indiana: Columbus

> Est. annual housing costs: $9,120 (Indiana: $7,294)

> Median household income: $66,978 (Indiana: $58,235)

> Homeownership rate: 70.9% (Indiana: 69.5%)

> Median home value: $163,400 (Indiana: $148,900)

> No. of metros considered in ranking: 12

[in-text-ad-2]

Iowa: Ames

> Est. annual housing costs: $8,988 (Iowa: $6,816)

> Median household income: $60,442 (Iowa: $61,836)

> Homeownership rate: 59.7% (Iowa: 71.2%)

> Median home value: $179,700 (Iowa: $153,900)

> No. of metros considered in ranking: 8

Kansas: Manhattan

> Est. annual housing costs: $8,580 (Kansas: $7,689)

> Median household income: $54,488 (Kansas: $61,091)

> Homeownership rate: 49.1% (Kansas: 66.2%)

> Median home value: $180,500 (Kansas: $157,600)

> No. of metros considered in ranking: 4

[in-text-ad]

Kentucky: Bowling Green

> Est. annual housing costs: $7,872 (Kentucky: $6,892)

> Median household income: $51,591 (Kentucky: $52,238)

> Homeownership rate: 62.7% (Kentucky: 67.6%)

> Median home value: $161,500 (Kentucky: $147,100)

> No. of metros considered in ranking: 5

Louisiana: Baton Rouge

> Est. annual housing costs: $9,528 (Louisiana: $8,172)

> Median household income: $60,043 (Louisiana: $50,800)

> Homeownership rate: 69.7% (Louisiana: 66.6%)

> Median home value: $190,000 (Louisiana: $168,100)

> No. of metros considered in ranking: 9

Maine: Portland-South Portland

> Est. annual housing costs: $13,056 (Maine: $9,478)

> Median household income: $72,552 (Maine: $59,489)

> Homeownership rate: 72.1% (Maine: 72.9%)

> Median home value: $273,100 (Maine: $198,000)

> No. of metros considered in ranking: 3

[in-text-ad-2]

Maryland: Baltimore-Columbia-Towson

> Est. annual housing costs: $11,004 (Maryland: $13,489)

> Median household income: $83,811 (Maryland: $87,063)

> Homeownership rate: 66.6% (Maryland: 67.1%)

> Median home value: $307,200 (Maryland: $325,400)

> No. of metros considered in ranking: 5

Massachusetts: Boston-Cambridge-Newton

> Est. annual housing costs: $20,904 (Massachusetts: $16,239)

> Median household income: $93,537 (Massachusetts: $84,385)

> Homeownership rate: 61.7% (Massachusetts: 62.5%)

> Median home value: $461,500 (Massachusetts: $398,800)

> No. of metros considered in ranking: 5

[in-text-ad]

Michigan: Ann Arbor

> Est. annual housing costs: $12,348 (Michigan: $8,040)

> Median household income: $75,730 (Michigan: $59,234)

> Homeownership rate: 61.5% (Michigan: 71.7%)

> Median home value: $278,500 (Michigan: $162,600)

> No. of metros considered in ranking: 14

Minnesota: Minneapolis-St. Paul-Bloomington

> Est. annual housing costs: $10,776 (Minnesota: $9,306)

> Median household income: $82,887 (Minnesota: $73,382)

> Homeownership rate: 70.4% (Minnesota: 71.9%)

> Median home value: $271,600 (Minnesota: $235,700)

> No. of metros considered in ranking: 5

Mississippi: Jackson

> Est. annual housing costs: $8,976 (Mississippi: $7,274)

> Median household income: $53,639 (Mississippi: $46,511)

> Homeownership rate: 67.6% (Mississippi: 68.8%)

> Median home value: $148,300 (Mississippi: $125,500)

> No. of metros considered in ranking: 3

[in-text-ad-2]

Missouri: Kansas City

> Est. annual housing costs: $8,772 (Missouri: $7,411)

> Median household income: $69,240 (Missouri: $57,290)

> Homeownership rate: 65.2% (Missouri: 67.1%)

> Median home value: $196,000 (Missouri: $163,600)

> No. of metros considered in ranking: 8

Montana: Missoula

> Est. annual housing costs: $8,220 (Montana: $7,639)

> Median household income: $56,247 (Montana: $56,539)

> Homeownership rate: 58.6% (Montana: 68.5%)

> Median home value: $302,200 (Montana: $244,900)

> No. of metros considered in ranking: 3

[in-text-ad]

Nebraska: Omaha-Council Bluffs

> Est. annual housing costs: $8,340 (Nebraska: $7,311)

> Median household income: $69,439 (Nebraska: $63,015)

> Homeownership rate: 65.8% (Nebraska: 66.2%)

> Median home value: $181,200 (Nebraska: $164,000)

> No. of metros considered in ranking: 2

Nevada: Reno

> Est. annual housing costs: $9,636 (Nevada: $9,212)

> Median household income: $68,214 (Nevada: $62,043)

> Homeownership rate: 58.2% (Nevada: 57.1%)

> Median home value: $359,500 (Nevada: $290,200)

> No. of metros considered in ranking: 3

New Hampshire: Manchester-Nashua

> Est. annual housing costs: $10,752 (New Hampshire: $10,550)

> Median household income: $82,099 (New Hampshire: $77,923)

> Homeownership rate: 65.7% (New Hampshire: 71.2%)

> Median home value: $287,900 (New Hampshire: $272,300)

> No. of metros considered in ranking: 1

*Because Manchester-Nashua is the only eligible metro in New Hampshire, it is the metro with the highest housing costs by default.

[in-text-ad-2]

New Jersey: Trenton-Princeton

> Est. annual housing costs: $12,180 (New Jersey: $13,895)

> Median household income: $83,306 (New Jersey: $85,245)

> Homeownership rate: 63.5% (New Jersey: 64.0%)

> Median home value: $290,100 (New Jersey: $343,500)

> No. of metros considered in ranking: 4

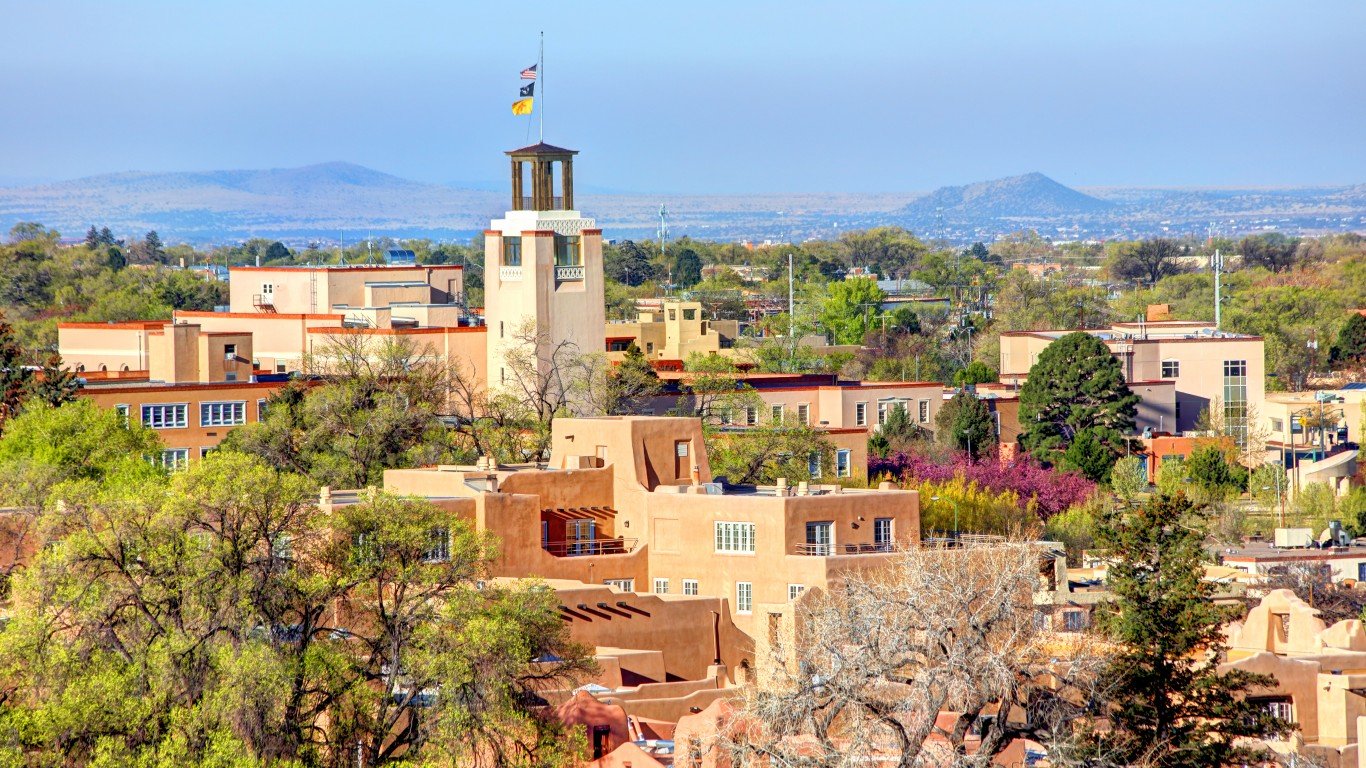

New Mexico: Santa Fe

> Est. annual housing costs: $9,648 (New Mexico: $7,822)

> Median household income: $60,668 (New Mexico: $51,243)

> Homeownership rate: 71.2% (New Mexico: 68.0%)

> Median home value: $294,800 (New Mexico: $175,700)

> No. of metros considered in ranking: 4

[in-text-ad]

New York: New York-Newark-Jersey City

> Est. annual housing costs: $21,120 (New York: $15,849)

> Median household income: $81,951 (New York: $71,117)

> Homeownership rate: 51.6% (New York: 54.1%)

> Median home value: $465,400 (New York: $325,000)

> No. of metros considered in ranking: 13

North Carolina: Asheville

> Est. annual housing costs: $13,152 (North Carolina: $9,297)

> Median household income: $54,992 (North Carolina: $56,642)

> Homeownership rate: 68.0% (North Carolina: 65.7%)

> Median home value: $232,400 (North Carolina: $182,100)

> No. of metros considered in ranking: 14

North Dakota: Bismarck

> Est. annual housing costs: $8,580 (North Dakota: $7,561)

> Median household income: $72,886 (North Dakota: $65,315)

> Homeownership rate: 70.4% (North Dakota: 62.5%)

> Median home value: $254,900 (North Dakota: $199,900)

> No. of metros considered in ranking: 3

[in-text-ad-2]

Ohio: Columbus

> Est. annual housing costs: $8,604 (Ohio: $7,149)

> Median household income: $66,715 (Ohio: $58,116)

> Homeownership rate: 61.8% (Ohio: 66.3%)

> Median home value: $195,900 (Ohio: $151,400)

> No. of metros considered in ranking: 11

Oklahoma: Oklahoma City

> Est. annual housing costs: $8,460 (Oklahoma: $7,422)

> Median household income: $60,476 (Oklahoma: $53,840)

> Homeownership rate: 64.4% (Oklahoma: 66.1%)

> Median home value: $162,600 (Oklahoma: $142,400)

> No. of metros considered in ranking: 4

[in-text-ad]

Oregon: Portland-Vancouver-Hillsboro

> Est. annual housing costs: $14,940 (Oregon: $11,834)

> Median household income: $77,511 (Oregon: $65,667)

> Homeownership rate: 62.3% (Oregon: 62.8%)

> Median home value: $392,000 (Oregon: $336,700)

> No. of metros considered in ranking: 8

Pennsylvania: Philadelphia-Camden-Wilmington

> Est. annual housing costs: $10,800 (Pennsylvania: $8,935)

> Median household income: $74,825 (Pennsylvania: $63,627)

> Homeownership rate: 67.2% (Pennsylvania: 69.0%)

> Median home value: $259,500 (Pennsylvania: $187,500)

> No. of metros considered in ranking: 17

Rhode Island: Providence-Warwick

> Est. annual housing costs: $10,176 (Rhode Island: $10,672)

> Median household income: $70,676 (Rhode Island: $70,305)

> Homeownership rate: 62.0% (Rhode Island: 61.6%)

> Median home value: $290,500 (Rhode Island: $276,600)

> No. of metros considered in ranking: 1

*Because Providence-Warwick is the only eligible metro in Rhode Island, it is the metro with the highest housing costs by default.

[in-text-ad-2]

South Carolina: Charleston-North Charleston

> Est. annual housing costs: $12,000 (South Carolina: $8,930)

> Median household income: $65,894 (South Carolina: $54,864)

> Homeownership rate: 66.8% (South Carolina: 70.1%)

> Median home value: $249,800 (South Carolina: $170,100)

> No. of metros considered in ranking: 7

South Dakota: Sioux Falls

> Est. annual housing costs: $7,704 (South Dakota: $6,806)

> Median household income: $67,713 (South Dakota: $59,896)

> Homeownership rate: 66.2% (South Dakota: 68.0%)

> Median home value: $208,400 (South Dakota: $174,600)

> No. of metros considered in ranking: 2

[in-text-ad]

Tennessee: Nashville-Davidson-Murfreesboro-Franklin

> Est. annual housing costs: $11,976 (Tennessee: $8,412)

> Median household income: $68,406 (Tennessee: $54,833)

> Homeownership rate: 65.6% (Tennessee: 66.5%)

> Median home value: $262,900 (Tennessee: $177,600)

> No. of metros considered in ranking: 10

Texas: Midland

> Est. annual housing costs: $13,452 (Texas: $10,028)

> Median household income: $82,768 (Texas: $63,826)

> Homeownership rate: 66.8% (Texas: 62.3%)

> Median home value: $231,100 (Texas: $187,200)

> No. of metros considered in ranking: 25

Utah: Salt Lake City

> Est. annual housing costs: $9,948 (Utah: $9,015)

> Median household income: $77,102 (Utah: $74,197)

> Homeownership rate: 68.2% (Utah: 70.5%)

> Median home value: $329,200 (Utah: $305,400)

> No. of metros considered in ranking: 5

[in-text-ad-2]

Vermont: Burlington-South Burlington

> Est. annual housing costs: $13,092 (Vermont: $10,130)

> Median household income: $73,447 (Vermont: $63,477)

> Homeownership rate: 66.8% (Vermont: 71.3%)

> Median home value: $285,200 (Vermont: $230,900)

> No. of metros considered in ranking: 1

*Because Burlington-South Burlington is the only eligible metro in Vermont, it is the metro with the highest housing costs by default.

Virginia: Richmond

> Est. annual housing costs: $11,916 (Virginia: $13,125)

> Median household income: $71,223 (Virginia: $76,398)

> Homeownership rate: 66.6% (Virginia: 66.7%)

> Median home value: $247,500 (Virginia: $282,800)

> No. of metros considered in ranking: 9

[in-text-ad]

Washington: Seattle-Tacoma-Bellevue

> Est. annual housing costs: $18,276 (Washington: $13,473)

> Median household income: $90,790 (Washington: $77,006)

> Homeownership rate: 60.2% (Washington: 63.3%)

> Median home value: $471,900 (Washington: $366,800)

> No. of metros considered in ranking: 10

West Virginia: Morgantown

> Est. annual housing costs: $8,532 (West Virginia: $6,969)

> Median household income: $53,681 (West Virginia: $48,037)

> Homeownership rate: 63.6% (West Virginia: 73.7%)

> Median home value: $181,600 (West Virginia: $123,200)

> No. of metros considered in ranking: 6

Wisconsin: Madison

> Est. annual housing costs: $10,668 (Wisconsin: $7,624)

> Median household income: $73,807 (Wisconsin: $63,293)

> Homeownership rate: 61.8% (Wisconsin: 67.1%)

> Median home value: $260,600 (Wisconsin: $189,200)

> No. of metros considered in ranking: 12

[in-text-ad-2]

Wyoming: Cheyenne

> Est. annual housing costs: $8,304 (Wyoming: $7,858)

> Median household income: $69,369 (Wyoming: $65,304)

> Homeownership rate: 72.6% (Wyoming: 71.0%)

> Median home value: $239,900 (Wyoming: $228,000)

> No. of metros considered in ranking: 2

Methodology

To determine the metro area in each state where single people pay the most for housing, 24/7 Wall St. reviewed data on housing costs from the Economic Policy Institute’s 2022 Family Budget Calculator.

In the Family Budget Calculator, the EPI estimates the housing costs for families to maintain a modest yet adequate standard of living. The budgets are created for 10 family types for U.S. counties and metro areas. We used estimates for a single person with no children. For this family type, the EPI assumes the single person is employed and files federal income taxes as the head of household.

State-level housing cost estimates are aggregated from the county level using five-year estimates of total households from the U.S. Census Bureau’s 2020 American Community Survey.

We used the 384 metropolitan statistical areas as delineated by the United States Office of Management and Budget and used by the Census Bureau as our definition of metros.

To find the metro with the highest housing cost in each state, metros in each state were ranked based on the EPI’s annual housing cost estimates. Ties were broken with five-year estimates of median gross rent from the U.S. Census Bureau’s 2020 American Community Survey.

Additional information on median household income, homeownership rate, and median home value are from the U.S. Census Bureau’s 2020 American Community Survey. Because the Census Bureau didn’t release one-year estimates for 2020 due to data collection issues caused by the COVID-19 pandemic, all ACS data are five-year estimates.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.