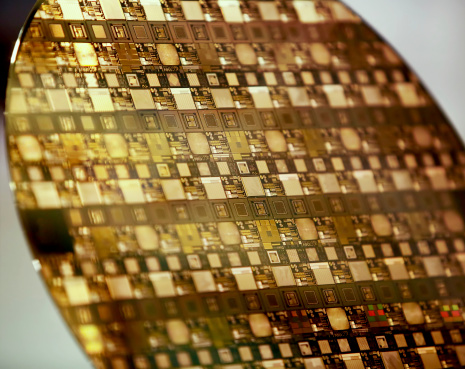

When Intel announced last week higher-than-expected revenue and earnings for the quarter and for the full year, primarily because of improving PC sales, stocks that benefited from those sales also jumped. Intel supplies computer chips, so the companies that make the gear that makes those chips for Intel and other top companies may also see a surge in business. In a new research report, the Semiconductor Equipment analysts at UBS opine that semiconductor wafers could be seeing a large seasonal increase in demand. Source: Thinkstock

Source: Thinkstock

The UBS channel checks found 300 millimeter (mm) semi wafer demand from all of Taiwan was around 1.2 million wafers in May, continuing a strong recovery over the past two months. Their research shows that over the past 12 years, Taiwan semi wafer demand in the June quarter has tracked up 29% quarter-to-quarter on average and up 21% year-over-year for the month of June on improving fab utilization rates.

Given this good news, UBS highlights two top stocks to buy to capitalize on the current business surge. We also cover the other top names in the chip manufacturing sector.

Applied Materials Inc. (NASDAQ: AMAT) has long been the powerhouse name in chip capital equipment. The company is ramping up its efforts to be a bigger player in the NAND sector. For Applied Materials, where its share has been low, this new architecture throws open a new opportunity. Investors are paid a 1.8% dividend. The Thomson/First Call price target is $21.68. Shares closed Friday at $22.37.

ALSO READ: Credit Suisse’s High-Growth Semiconductor Stocks to Buy

ASML Holding N.V. (NASDAQ: ASML) engages in designing, manufacturing, marketing and servicing semiconductor processing equipment used in the fabrication of integrated circuits or chips worldwide. It provides PAS 5500 family products that comprise wafer steppers, and step and scan systems suitable for the i-line, krypton fluoride and argon fluoride processing of wafers. The company returned to earnings per share growth in the December quarter, after eight quarters of decline, clearly on the rebound. Investors are paid a small 0.8% dividend. The consensus price target for this top industry name is $90.35. The stock closed Friday at $89.38.

KLA-Tencor Corp. (NASDAQ: KLAC) is engaged in the design, manufacture and marketing of process control and yield management solutions for the semiconductor and related nanoelectronics industries. With a portfolio of industry standard products and a team of world-class engineers and scientists, the company has created superior solutions for its customers for more than 35 years. Investors are paid a 2.6% dividend. The consensus target is $68.15. Shares ended Friday at $68.57.

Lam Research Corp. (NASDAQ: LRCX) is one of the top stocks to buy now at UBS. The company designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers plasma etch products that remove materials from the wafer to create the features and patterns of a device. The UBS analysts highlight the company and its peers as having a significant equipment opportunity from the NAND evolution. The UBS price target for the stock is $65. The consensus target is slightly lower at $66.24. Lam Research closed Friday at $65.70.

ALSO READ: The Highest-Yielding Dividends That Are Safe to Hold

Teradyne Inc. (NYSE: TER) is another top name to buy at UBS. The company is a leading supplier of automatic test equipment used to test semiconductors, wireless products, data storage and complex electronic systems that serve consumer, communications, industrial and government customers. In 2013, Teradyne had sales of $1.43 billion. Investors receive a 1.3% dividend. The UBS price objective is $24, and the consensus target is $22.97. Teradyne closed Friday at $19.12.

Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM) is one of the largest chip manufacturing companies in the world, often outsourcing business for their larger rivals. Estimates of the company’s worldwide market share vary, but analysts agree that something in the neighborhood of 60% seems to be about right. The company is also involved in researching, developing, designing, manufacturing and selling solid state lighting devices and related applications products and systems, as well as renewable energy and saving related technologies and products. The shareholders are paid a 1.9% dividend. The consensus price target is $21.02. Taiwan Semiconductor closed Friday at $21.09.

While the rebound for chips and chip manufacturing gear is huge in the technology sector, many of these stocks are trading at or above their target prices, as success may have been anticipated earlier in the spring. Investors may want to buy partial positions now and see if the market doesn’t produce a summer swoon to bring prices down to add the balance. These top names are suitable for more aggressive accounts.

ALSO READ: Three Analyst Stocks Projected to Double or More

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.