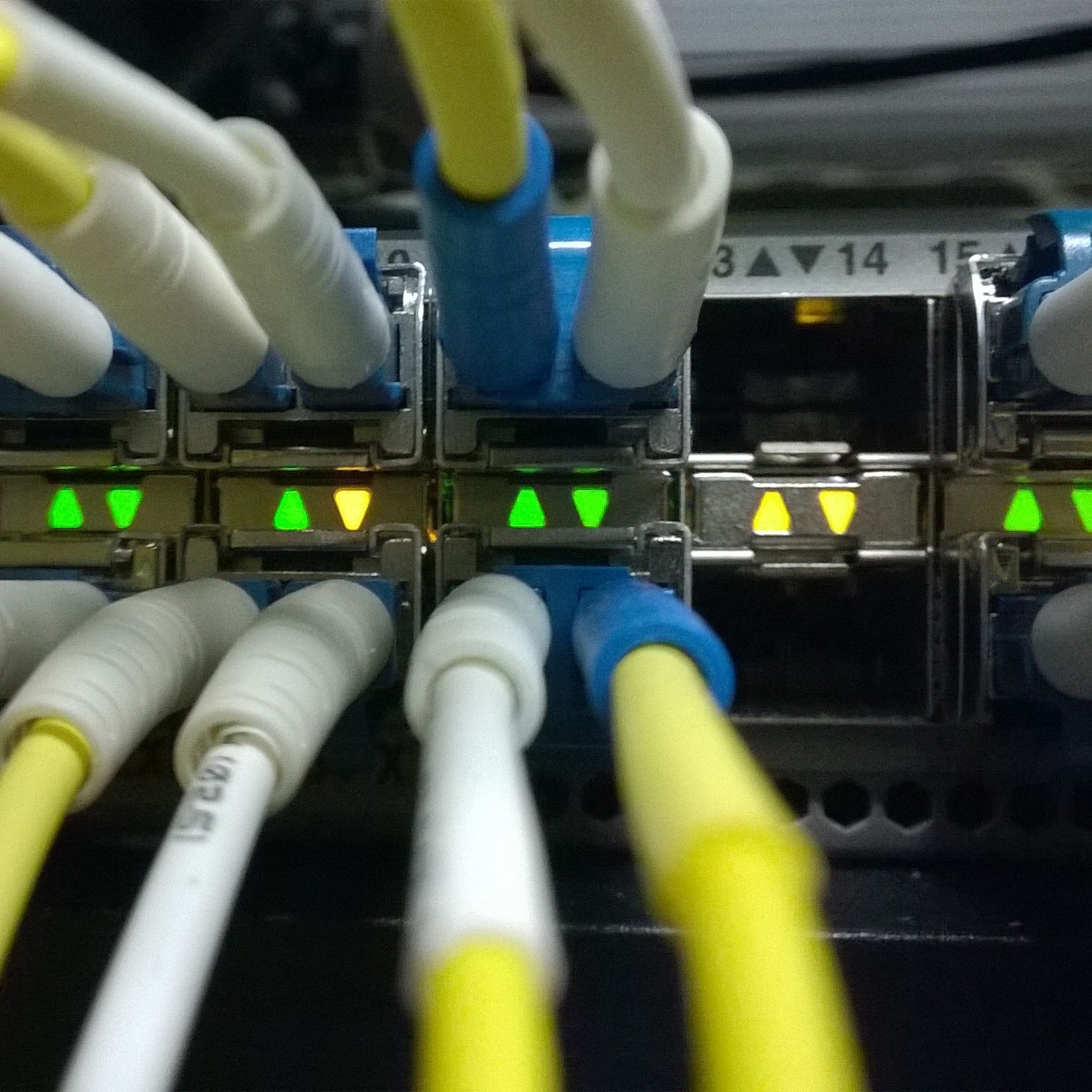

Xtera Communications has filed an S-1 form with the U.S. Securities and Exchange Commission (SEC) for its initial public offering (IPO). The company expects to price 5.5 million shares in the range of $9 to $11, with an overallotment option for an additional 825,000 shares. At the maximum price, the entire offering is value up to $69.575 million. The company intends to file on the Nasdaq Global Market under the symbol XCOM. Source: Thinkstock

Source: Thinkstock

The underwriters for the offering are Needham, Cowen and BMO Capital Markets.

This is a leading provider of high-capacity, cost-effective optical transport solutions, supporting the high growth in global demand for bandwidth. The company sells its high-capacity optical transport solutions to telecommunications service providers, content service providers, enterprises and government entities worldwide to support their deployments of long-haul terrestrial and submarine optical cable networks. Xtera believes that its proprietary Wise Raman optical amplification technology allows for capacity and reach performance advantages over competitive products that are based on conventional Erbium-Doped Fiber Amplifier, or EDFA, technology.

For some background, optical networks are communications networks that carry voice, video and data traffic across optical fiber cables using multiple wavelengths of light. Through the use of light as a transmission medium, optical networks deliver significantly more data transport capacity and less external signal interference compared to traditional copper transport technology. Optical transport networks are classified into two segments: long-haul networks, including terrestrial and submarine networks that carry traffic between cities, countries and continents, and metro networks that carry traffic within cities or large metropolitan areas. Long-haul networks, also referred to as optical backbone networks, serve as the foundation for telecommunication and data transport services.

In the filing Xtera said:

We believe that we differentiate ourselves from our competitors through our innovative, proprietary products and our industry-leading cost-efficient operating structure. We have developed a portfolio of intellectual property with more than 180 U.S. and foreign patents and patent applications. We have operations in the United States and the United Kingdom, with an engineering team that includes industry-recognized technical experts.

The company’s solutions are capable of spanning over 1,500 kilometers with capacity of 64 terabits per second. The solutions are purpose-built for varying customer demands of capacity, reach and cost. The modular nature of solutions allows for capital-efficient capacity expansion over time, as the customer’s bandwidth needs grow.

The company intends to use the net proceeds from this offering for working capital and general corporate purposes.

ALSO READ: 4 Top Jefferies Value Stocks to Buy This Week

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.