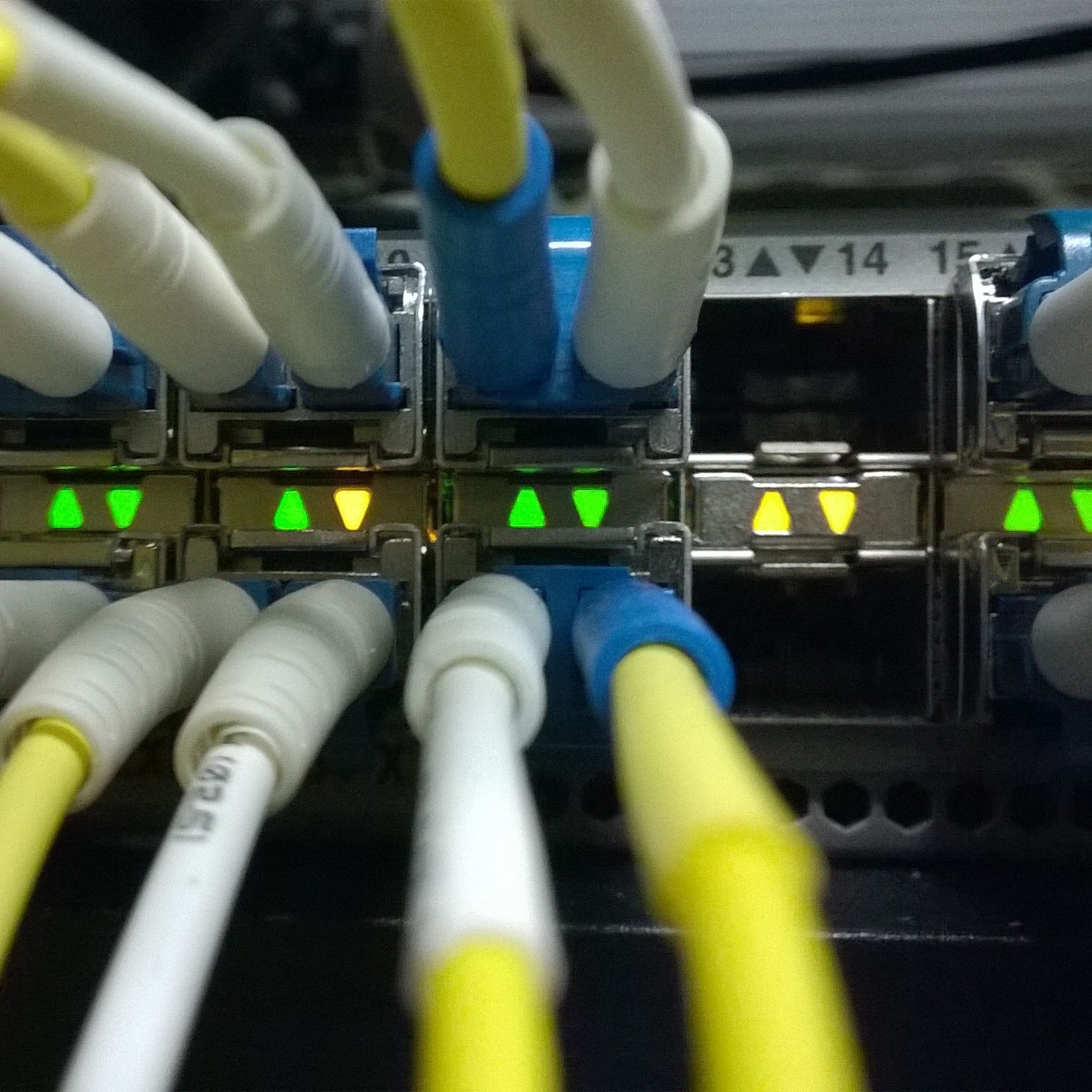

Source: Thinkstock

On a constant currency basis, revenues were down 10% year over year and up 6% sequentially. For the year to date, revenues are down 2% on a constant currency basis.

What Nokia wants to focus on, however, is its pending $17 billion merger with France’s Alcatel-Lucent (NYSE: ALU). The merger recently received approval from regulators in China and France to add to earlier OKs from the European Union and the United States. The company now expects to make the initial exchange offer in the first quarter of 2016.

For its part, Alcatel-Lucent reported a net loss of €206 million (about $225 million), but investors didn’t seem to mind, pushing the shares up nearly 8% in Paris trading.

For Nokia’s investors the other big news was a €4 billion ($4.38 billion) share buyback program and a €3 billion ($3.28 billion) deleveraging plan. According to Thursday’s announcement of the two programs, the cost savings from the merger are being sped up, with Nokia now targeting approximately €900 million of operating cost synergies in 2018, compared to its earlier target to achieve approximately €900 million of operating cost synergies in 2019. The two programs depend on closing the Alcatel-Lucent merger, and the sale of Nokia’s HERE mapping technology to a consortium comprised of Audi, BMW and Daimler for €2.8 billion, also scheduled to be completed in the first quarter.

Nokia’s stock traded up about 9% in early trading Thursday, at $7.24 in a 52-week range of $5.71 to $8.44. The consensus price target on the stock is $8.75.

Alcatel-Lucent traded up about 7.6%, at $3.89 in a 52-week range of $2.86 to $4.96. The consensus price target on the stock is $4.39.

ALSO READ: The 10 Most Profitable Companies in the World

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.