Amazon.com, Inc. (NASDAQ: AMZN) reported fiscal second-quarter financial results after the markets closed on Thursday. The company said it had $1.07 in earnings per share (EPS) on $29.13 billion in revenue, versus Thomson Reuters consensus estimates that called for $0.58 in EPS on $27.98 billion in revenue. The same period from last year had a net loss of $0.12 per share on $22.72 billion in revenue.

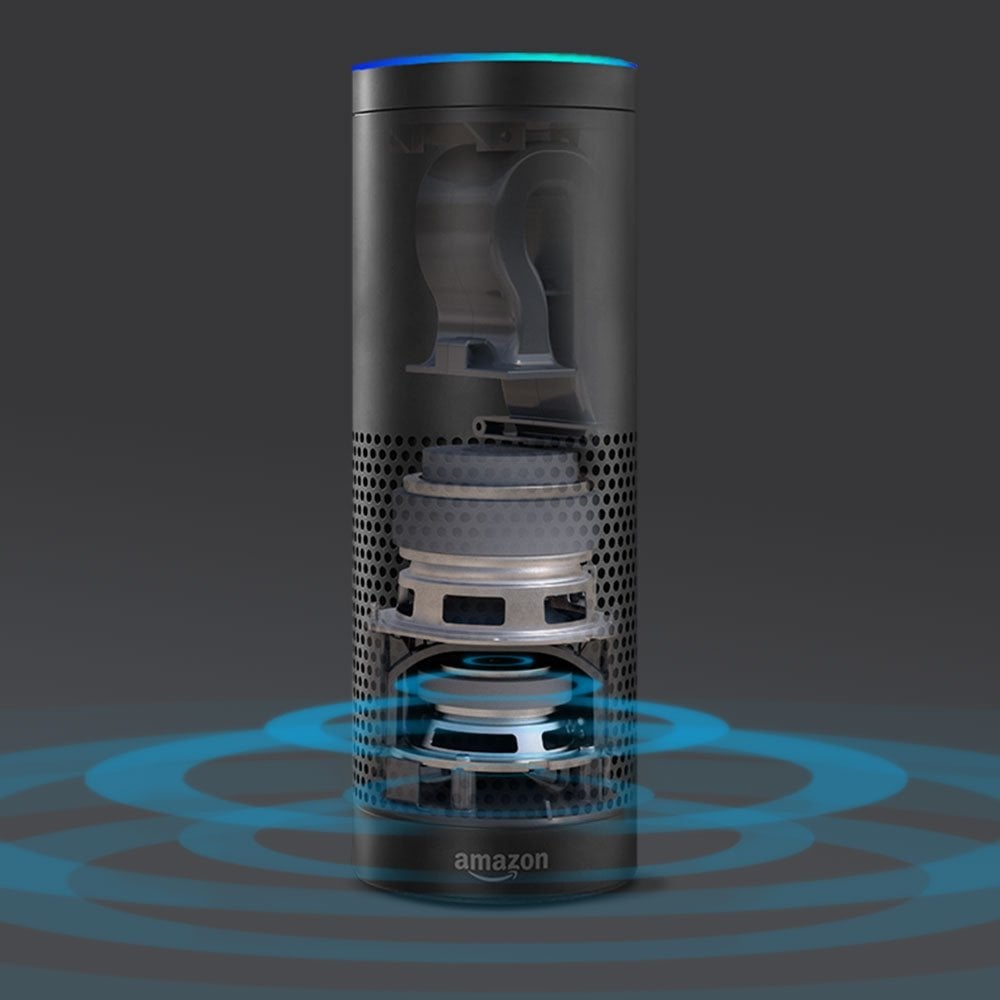

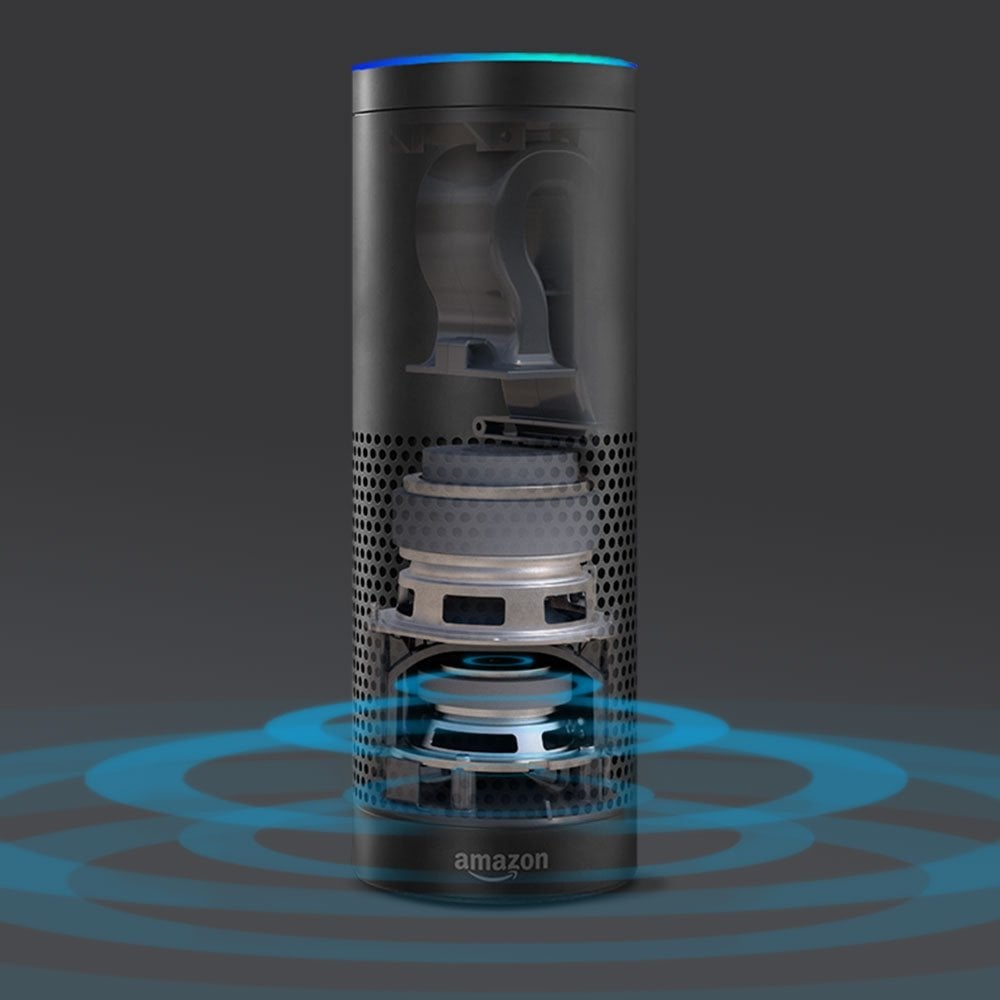

One of the announcements Amazon made this quarter was that Spotify Premium was now available in the U.S. on Echo. Subscribers can also use Alexa—similar to Apple’s Siri—to coordinate playlists and play tracks.

During the quarter, Amazon’s Dash Button more than tripled its lineup of available brands. Customers can now choose from over 100 Dash Buttons, including Brawny, Doritos, Energizer, Purina, Red Bull, and Starbucks, just to name a few.

In terms of guidance for the second quarter, the company expects to have net sales in the range of $28.0 billion to $30.5 billion, or grow between 21% and 32%, also for operating income to be in the range of $375 million to $975 million. There are consensus estimates that are calling for $0.99 in EPS on $28.33 billion in revenue.

As for its business segments, Amazon reported:

- North America net sales grew 27% to $17.00 billion.

- International net sales grew 24% to $9.57 billion.

- AWS net sales grew 64% to $2.57 billion.

Jeff Bezos, founder and CEO of Amazon, commented on earnings:

Amazon devices are the top selling products on Amazon, and customers purchased more than twice as many Fire tablets than first quarter last year. Earlier this week, the $39 Fire TV Stick became the first product ever — from any manufacturer — to pass 100,000 customer reviews, including over 62,000 5 star reviews, also more than any other product ever sold on Amazon. Echo too is off to an incredible start, and we can’t yet manage to keep it in stock despite all efforts. We’re building premium products at non-premium prices, and we’re thrilled so many customers are responding to our approach.

On the books, cash, equivalents, and marketable securities totaled $15.9 billion at the end of the quarter compared to $19.8 billion at the end of 2015.

Shares of Amazon closed Thursday at $602.00, with a consensus analyst price target of $740.49 and a 52-week trading range of $414.55 to $696.44. Following the release of the earnings report the stock was initially up 11% at $670.00 in the after-hours trading session.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.