Data center designer, builder and operator Switch Inc. (NYSE: SWCH) last night priced its initial public offering (IPO) at $17, above the expected range of $14 to $16. Friday morning the company sold 31.25 million shares and raised $531 million at a market cap of around $3.9 billion.

Shares bounced more than 46% higher briefly before settling back to post a gain of around 32%. Underwriters included Goldman Sachs, JPMorgan, BMO Capital Markets, Wells Fargo Securities, Citi, Credit Suisse, Jefferies, BTIG, Raymond James, Stifel and William Blair.

The IPO is the largest in the tech sector since the $3.4 billion Snap Inc. (NYSE: SNAP) deal last March.

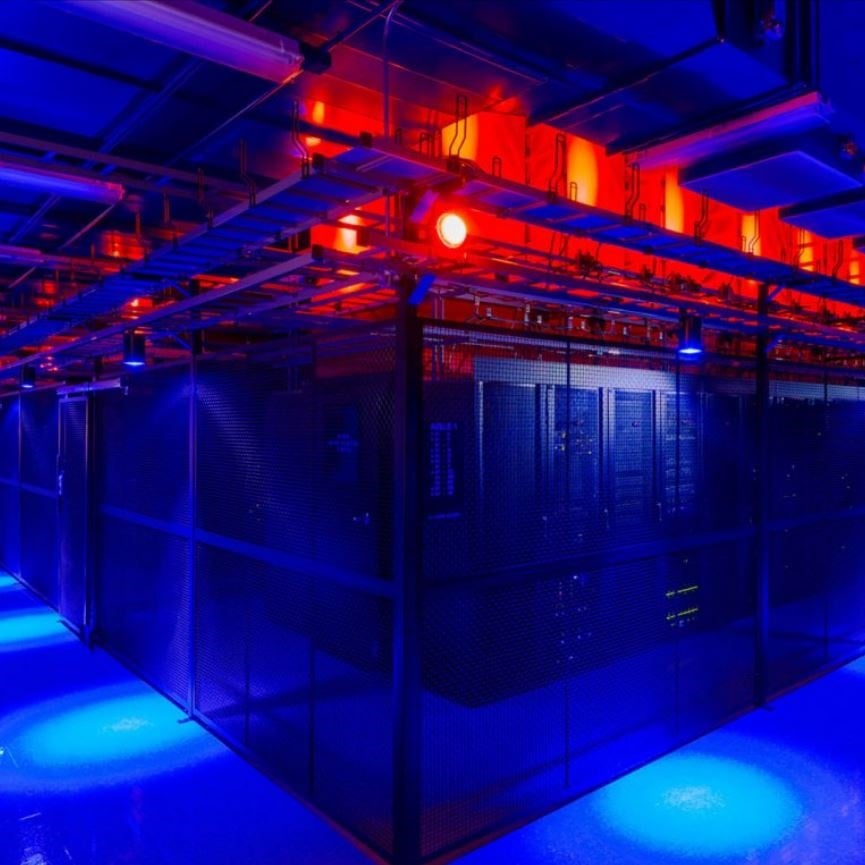

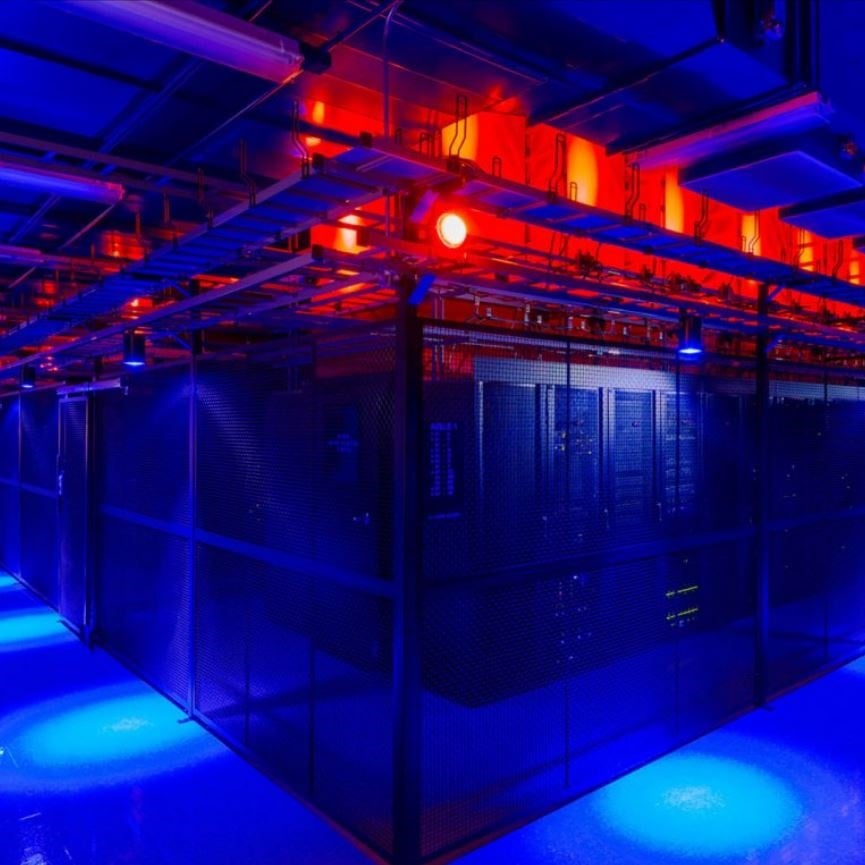

Switch claims more than 800 customers for its three data center locations, encompassing 10 colocation centers on some 4 million square feet of floor space. The three centers are located in Las Vegas, Reno and Grand Rapids. A fourth, in Atlanta, has been announced.

About 95% of the company’s revenues come from recurring revenue streams from colocation (cabinet and power) services and connectivity devices. Customer contracts typically run for three to five years. That predictability of revenue is a big plus for the company.

So are the prospects for increased data traffic over the next several years and demand for more and faster data transfer as the Internet of Things expands at a compound annual growth rate of 68% from 2015 through 2020.

At noon Friday, Switch shares traded at $22.11, up 30% for the offering price of $17. Nearly 33 million shares had changed hands so far Friday.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.