Ever since Apple Inc. (NASDAQ: AAPL) CEO Tim Cook put a stake in the ground declaring in 2016 that augmented reality (AR) was the “more interesting” of the AR-VR (virtual reality) pair, the company has purchased 3D sensors for its iPhone from Lumentum Holdings Inc. (NASDAQ: LITE). In Lumentum’s 2020 fiscal year that ended in June, Apple accounted for 26% of the company’s net revenue.

Before markets opened Tuesday, Lumentum announced that it had agreed to purchase Coherent Inc. (NASDAQ: COHR) in a cash and stock transaction valued at $5.7 billion. Coherent did not come cheap.

According to the announcement, Lumentum is paying $100 per share in cash and 1.1851 shares of stock for each share of Coherent stock. At Friday’s closing price of $106.52 for Lumentum stock, that’s a total of around $226.25 per share for Coherent, whose stock closed at $151.95 on Friday. That’s a premium of 49%.

Lumentum said it will finance the cash portion of the deal with cash on hand and a new debt facility of $2.1 billion. At the end of September, Lumentum reported about $1.6 billion in cash and short-term investments. The transaction is expected to close in the second half of this year.

Coherent is a leading producer of photonics and lasers in a number of markets, including aerospace and defense. Lumentum is the world’s largest supplier of 3D sensors for smartphone and data communications manufacturers like Apple, ZTE and Huawei. As the company noted in the announcement, “the combination [with Coherent] accelerates Lumentum’s penetration of the more than $10 billion market for lasers and photonics outside of the communications and 3D sensing applications.”

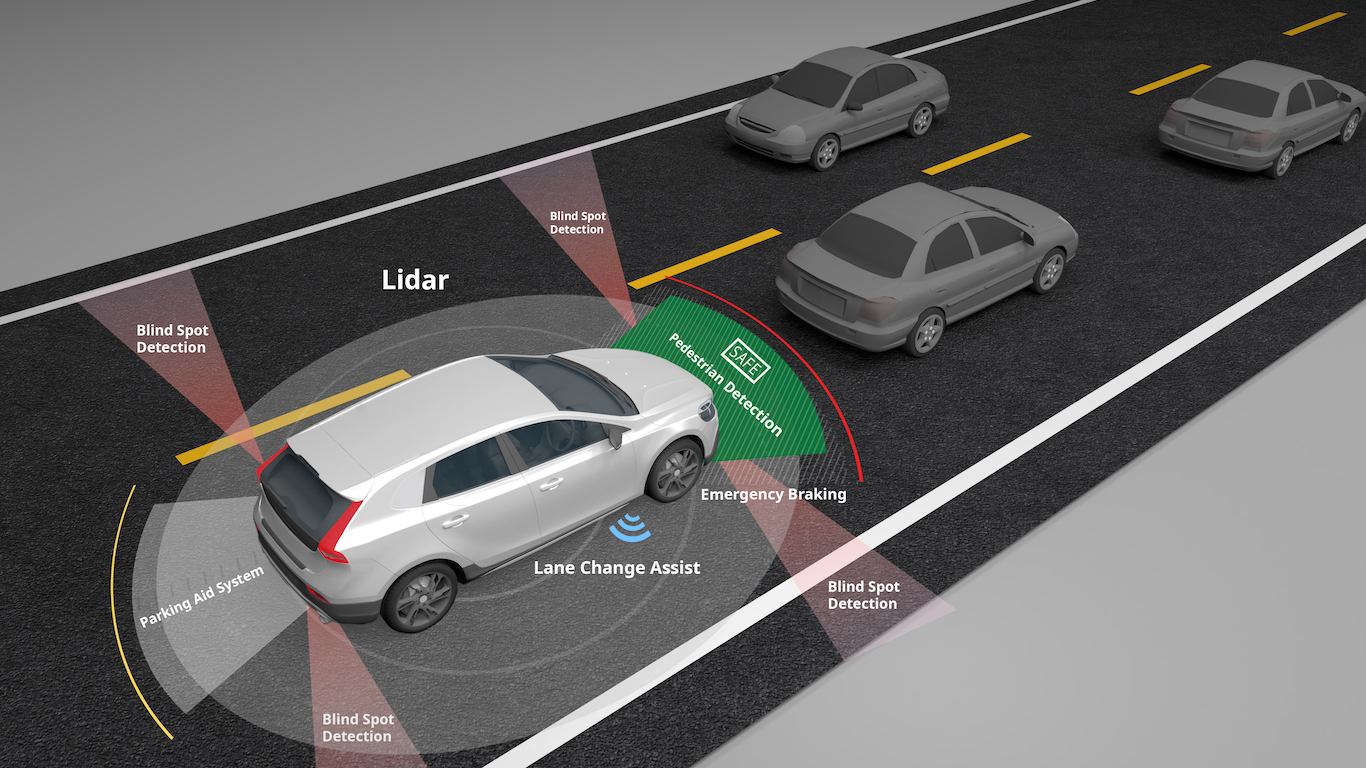

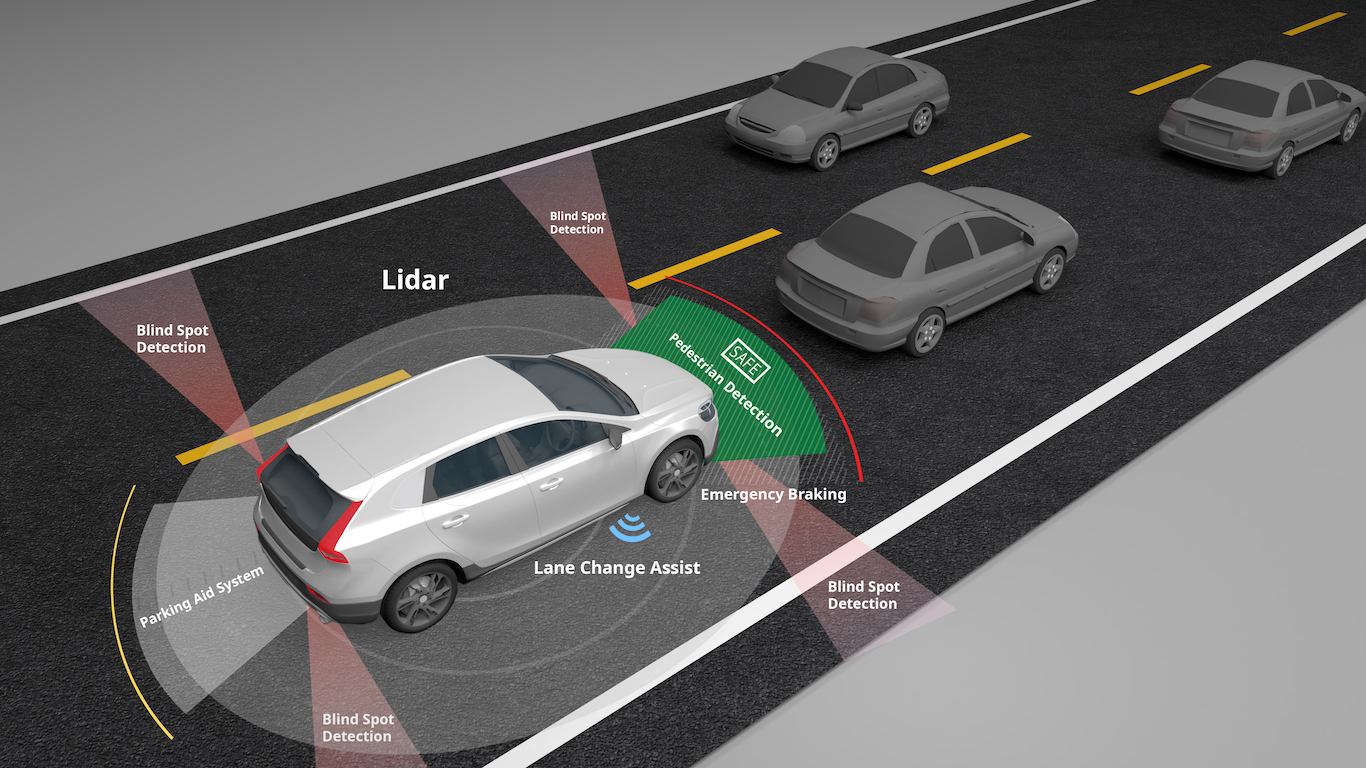

Alan Lowe, Lumentum’s CEO, commented, “By increasing our scale, expanding our portfolio, and bolstering our R&D capabilities at a time when global markets are increasingly relying on photonics products and technologies, we are confident in our combined ability to pursue exciting new growth opportunities.” Among those opportunities are the build-out of 5G networks, electric and autonomous vehicles and energy storage.

Lumentum shareholders are not wild about the deal and took the shares down by about 10% in Tuesday’s premarket trading. Most are probably wondering why Lumentum is paying such a rich premium. Why couldn’t the company start paying a dividend or return cash to shareholders with a share buyback?

For one thing, Huawei, which accounted for 13.2% of Lumentum’s business last fiscal year, is a veritable pariah and Lumentum needs to do something to replace sales to what has been its second-largest customer. The company clearly decided it was time to go big or go home. This deal is transformational for Lumentum, even if it should have a hard time selling it.

Coherent shareholders, however, are loving it. The stock was up more than 35% Tuesday morning, trading at $205.90. The stock’s prior 52-week range was $78.21 to $179.05, and the consensus 12-month price target was $158.00. Coherent is a lightly traded stock, with just under 200,000 shares traded daily on average. Over 720,000 shares changed hands in the first 90 minutes of trading on Tuesday.

Lumentum shares were last seen at $94.75, in a 52-week range of $59.06 to $112.08. The stock’s 12-month price target is $109.25.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.