Interest rate and inflation concerns have absolutely blasted the technology sector recently. While some of the selling may continue, Stifel semiconductor capital equipment analysts Patrick Ho and Brian Chin and their team say now is the time to start buying some of the top stocks in the industry. With a pledge from President Joe Biden to help the chip sector as a tailwind, and continued demand expected as the year goes on, aggressive investors may want to start nibbling at some of the top stocks now.

[in-text-ad]

With the industry leaders looking to expand as demand for semiconductors has grown exponentially, the beat-down on the sector after a strong 2020 really comes as no huge surprise. Stifel remains very bullish and noted this:

With recent volatility in tech stocks and some concerns over demand, we wanted to reiterate our positive stance on the group and note that this recent sell-off is now overdone. Our recent checks indicate that broader demand at leading foundry and memory manufacturers remains firmly intact, most notably at the advanced nodes. While there are clearly pockets of weakness (and perhaps a possible looming inventory correction) related to some Chinese markets (like low to mid-range smartphones), advanced nodes across mobility (high-end smartphones) and high-performance computing (HPC) remain in high demand. In fact, for several of these markets, there are some supply constraints, but overall wafer starts remain on track (or have even been raised). We believe demand trends continue to be very healthy, and there have been no changes in terms of 2021 capex/equipment spending plans.

The analysts remain focused on five top stocks that are all rated Buy at the firm. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Applied Materials

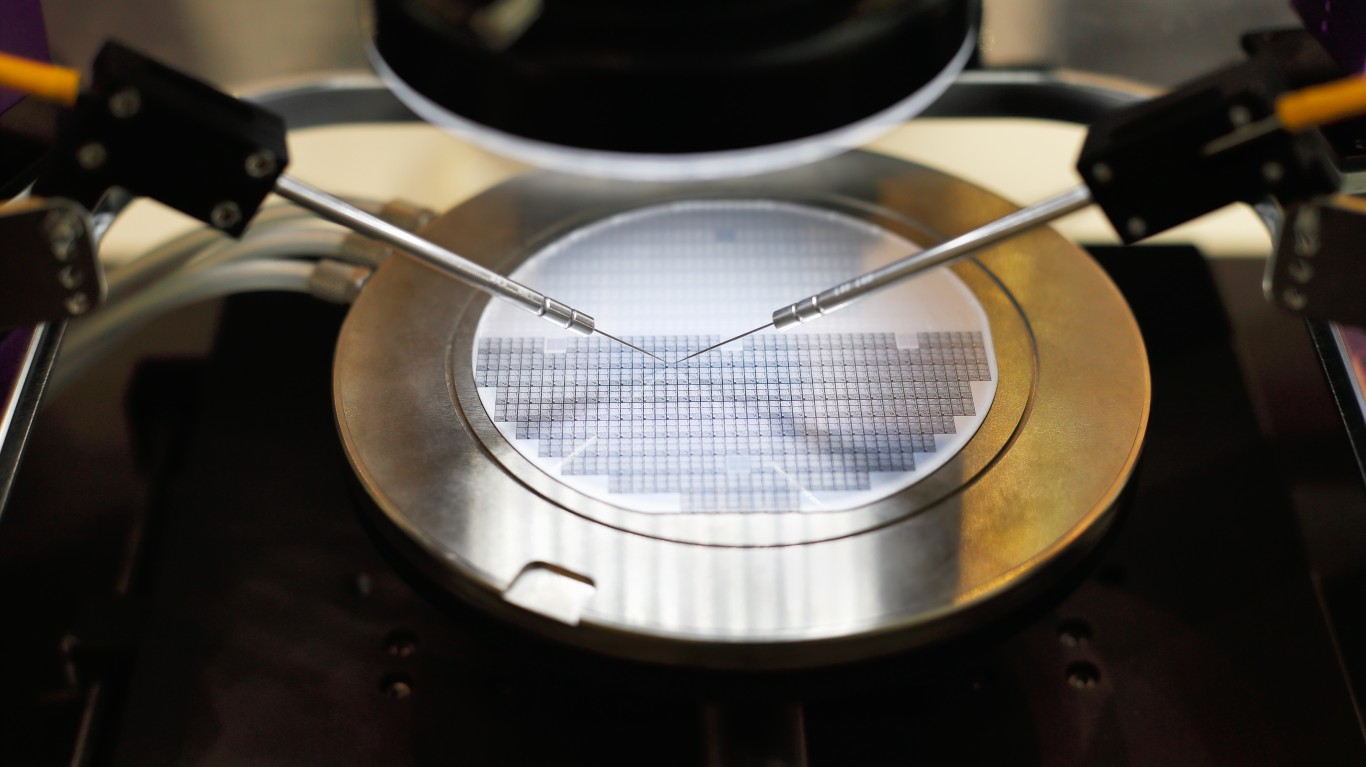

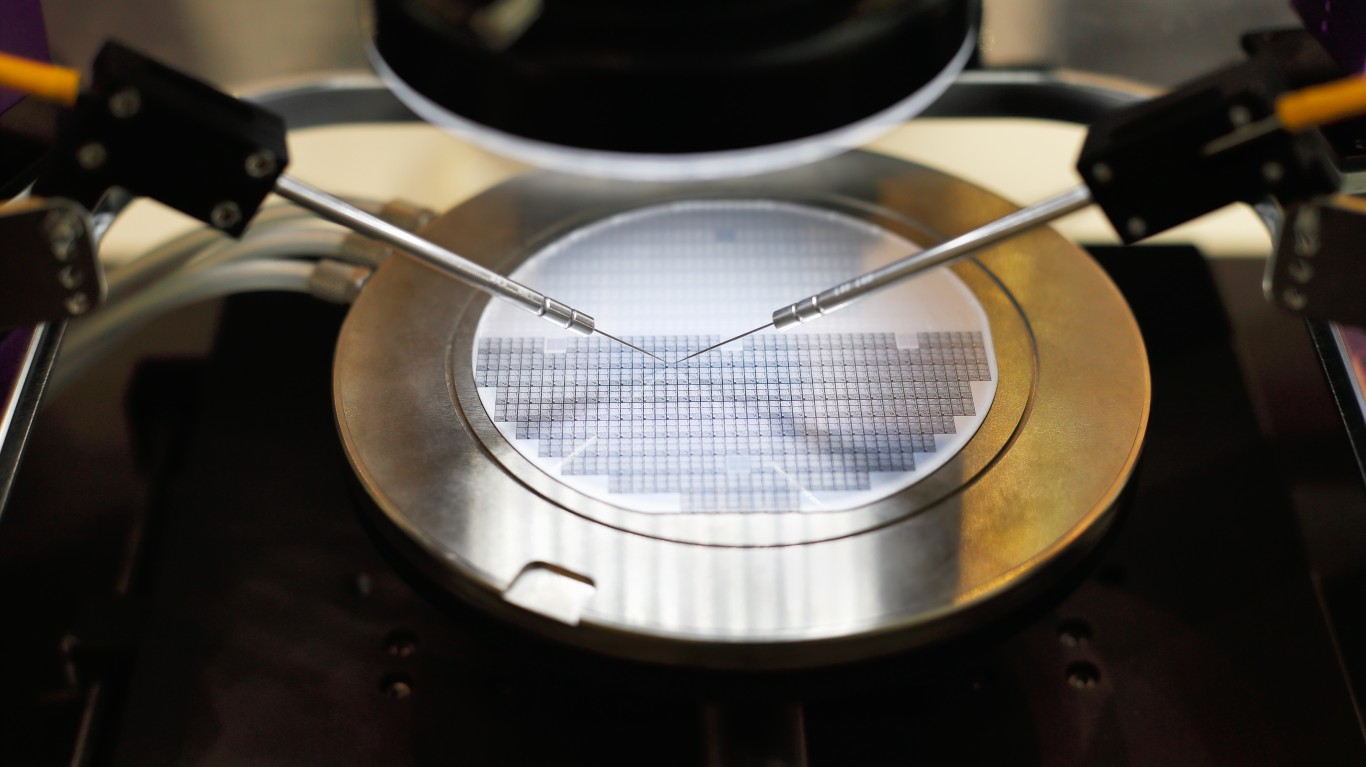

This is a premier semiconductor capital equipment stock. Applied Materials Inc. (NASDAQ: AMAT) provides manufacturing equipment, services and software to the semiconductor, display and related industries. It operates through three segments.

The Semiconductor Systems segment develops, manufactures and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits. This segment also offers various technologies, including epitaxy, ion implantation, oxidation/nitridation, rapid thermal processing, physical vapor deposition, chemical vapor deposition, chemical mechanical planarization, electrochemical deposition, atomic layer deposition, etching and selective deposition and removal, as well as metrology and inspection tools.

The Applied Global Services segment provides integrated solutions to optimize equipment and fab performance and productivity comprising spares, upgrades, services, remanufactured earlier generation equipment and factory automation software for semiconductor, display and other products.

The Display and Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes and other display technologies for TVs, monitors, laptops, personal computers, electronic tablets, smartphones and other consumer-oriented devices, as well as equipment for processing flexible substrates.

Investors receive just a 0.74% dividend. The Stifel price target for the shares is $160, while the Wall Street consensus is $155.28. Applied Materials stock rose over 4% on Thursday to close at $130.31 a share.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.