Apple Inc. (NASDAQ: AAPL) and Tesla Inc. (NASDAQ: TSLA) crossed one another’s paths twice recently. Tesla founder Elon Musk says he once approached Apple about buying Tesla for $60 billion. Tesla’s market cap neared $600 billion recently. Perhaps Apple should have looked at what might have been a bargain more closely.

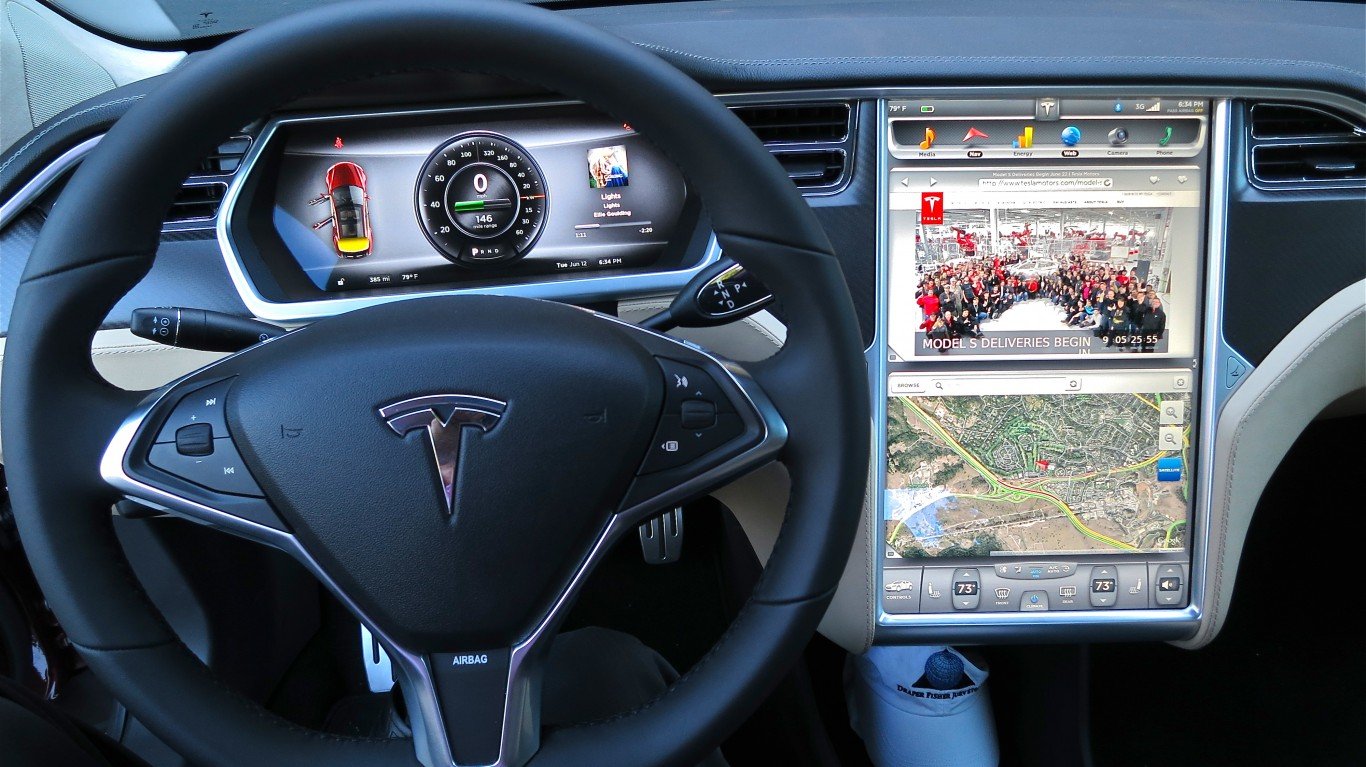

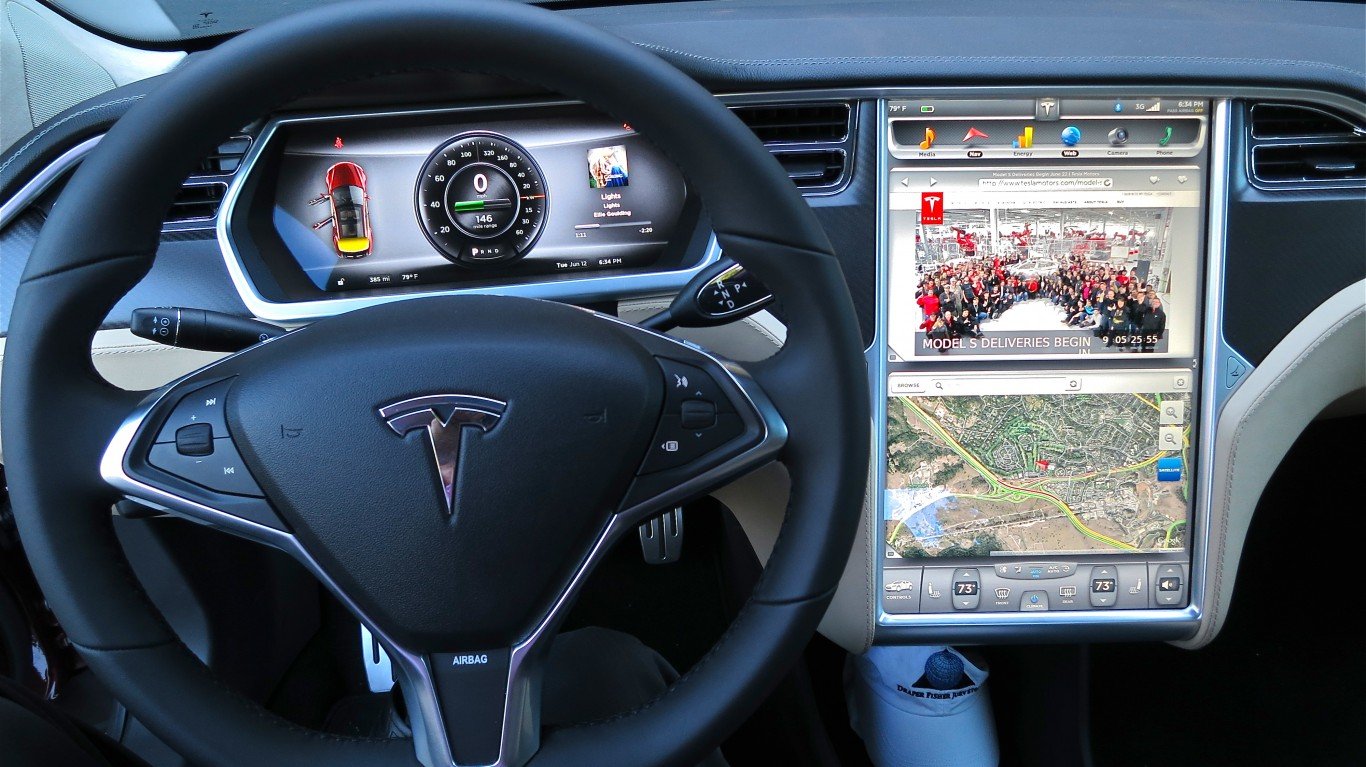

Now, sources say, the iPhone maker wants to have its own car by 2024, and it has started work on advanced electric car motors and self-driving technology. Some Tesla shareholders shuddered and the stock dropped on the news (or perhaps just a rumor).

Tesla has a lead on every other electric vehicle (EV) maker, and that clearly would include Apple, which would be late to the party. Every major car manufacturer in the world wants to catch Tesla, in both the car and truck markets. Electric-powered trucks may sell as many units as cars will. The cost to fuel for a large truck eclipses the similar cost for a car.

Tesla sells only about 500,000 vehicles a year. Global leader Volkswagen sells 10 million. BMW, Daimler (parent of Mercedes), Ford, General Motors, Honda and Toyota sell millions each year. Yet, Tesla’s market cap is larger than all these other companies put together.

Apple does have one thing in common with Tesla. Each has a globally admired brand, known for innovation and product excellence. It is hard to create a brand as attractive to consumers as either one has. That makes marketing products a different proposition than for poorly regarded brands like Ford.

Should Apple mount an effort to get into the car business, Tesla’s shares are bound to suffer. Apple has the best engineers in the world at its disposal. Tesla’s market cap easily could shed billions, if not tens of billions, of dollars due to Apple’s competition.

Tesla’s shares have been under siege for some time by investors who believe it is overvalued. They say Tesla will never sell more than a million cars. It will be crowded by electric cars from several other large companies. Even if the EV market grows, it will be hit with market share erosion. Due to all these causes, the stock has risen too far too fast.

Auto industry experts may argue that Volkswagen represents the largest threat to Tesla. That does not take into account the hundreds of millions of people who already have bought Apple products. Many of them hold great loyalty to the Apple brand. Many can’t wait for an Apple car. That hurts Tesla as much as any other industry player.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.