Housing

Rising Cash-Out Refinancings: Return of the Housing Bubble or Normalcy?

Published:

Last Updated:

If you were in the business of flipping houses or buying a home and using it as a personal piggy bank each time the equity in the home rose, you were familiar with the strategy of cash-out refinancing. While the numbers today are far from alarming compared to the last decade before the boom and bust, Freddie Mac has released its second quarter refinance analysis showing an uptick in the so-called cash-out refinancing levels. Source: Thinkstock

Source: Thinkstock

The good news in the report is that borrowers will continue to save over $1 billion in aggregate interest payments over the coming year. Borrowers also continued to shorten their payment terms and build equity in their homes. Some 40% of those who refinanced shortened their loan term. This was roughly the same as the previous quarter, but it was the highest since 1992.

Here is where you might start to get a bubble watch from some market observers — Freddie Mac said:

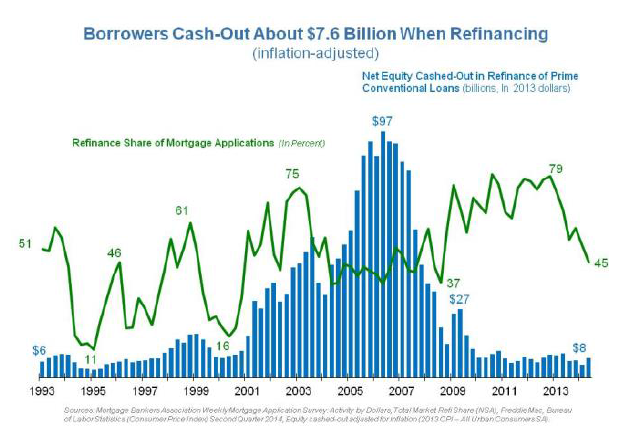

In the second quarter, an estimated $7.8 billion in net home equity was cashed out during refinances of conventional prime-credit home mortgages compared to the revised first quarter estimate of $5.0 billion. This remains low compared to historical volumes. The peak in cash-out refinance volume was $84 billion during the second quarter of 2006.

Again, this uptick in cash-out refinancing is being represented as far from alarming. Freddie Mac said that this the annual cash-out volumes during 2010 through 2013 have been the smallest since 1997, if you adjusted inflation. The problem is that 2010 was still very tough times, and it wasn’t until 2013 that the housing boom was peaking, and home values have risen since.

ALSO READ: Will Homebuilders Revisit 52-Week Lows Soon?

For those who are looking for any evidence of a return of a housing bubble, we would point out that this is far from bubble levels. It may just be a bounce off of a trough. Still, the risk is that all bubbles have to start somewhere — and some may argue that this is just the start of the return to lunacy.

Freddie Mac represented that home equity grew by about $4.1 trillion in aggregate during the two-year period through March 31, 2014. As you would guess, much of that gain was attributable to home value gains. The average rate cut in refinancing was about 1.4 percentage points in the second quarter, so on a $200,000 loan it translates to savings of about $2,800 in interest during the next 12 months. Those who the HARP refinancing option will save an average of $3,200 in total interest payments during the first 12 months.

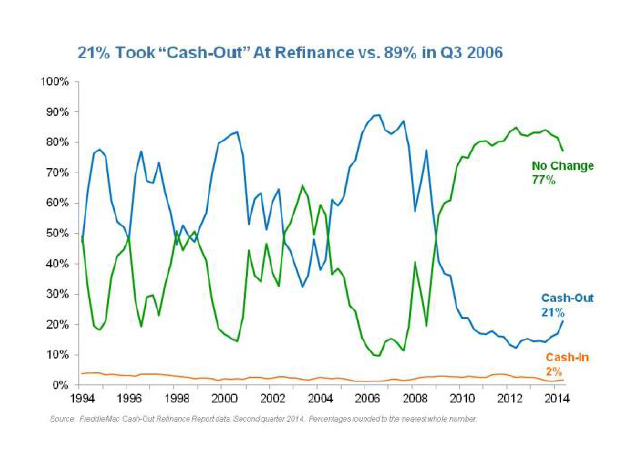

Here is where another alert or alarm may be seen, even if it is too soon to sound any alarms. Some 79% of those who refinanced their first mortgage maintained the same loan amount or lowered their principal balance by paying in additional money at the closing table. This is down by 4% from the previous quarter, and it is down from a peak of 88% during the second quarter of 2012.

So, this means that some 12% of those doing refinancing were using the cash-out refinance two years ago. Now this means that closer to 21% of homeowners doing refinancings are taking cash out now. This may not be evidence that the nation is using their home as a piggy bank, but it is a trend that has to be watched.

We would also point out that the median age of the original loan outstanding before refinance rose to 7.3 years during the first quarter. This was the highest age of a loan for refinancing since the analysis began in 1985 and was unchanged from the previous quarter.

Refinance activity fell below 50% of all mortgage financing. Since 2008, homeowners cashed-out approximately $215 billion in home equity, adjusted for inflation, up about $2.8 billion over the last quarter. Freddie Mac maintained that American households are not cashing out equity at rates that had been seen historically. Freddie Mac further said as a softening tool:

Regardless of the minimal level of cash-out refinance activity, when we couple it with lower mortgage rates and shorter terms homeowners have taken out through refinance over the past couple years, they have accelerated principal pay down and contributed to the rebound in home-equity accumulation.

We would further point out that the Freddie Mac analysis does not track the use of funds made available from these refinances. That means that we do not know if the cash-out is being used to pay down higher debt or student loans, nor do we know if it is being used to buy new cars or jet skis. Also, the analysis does not track loans paid off in entirety, with no new loan placed.

We will leave the outcome of this verdict up to you. It may seem like a mountain being made out of a molehill. The skeptics may say that this is people forgetting about the trouble that the nation found itself in. We may not know if this trend is an alarm for another few quarters — or even another few years.

ALSO READ: Cities With the Most Abandoned Homes

The images below are from Freddie Mac and are meant to show current cash-out refinancing activity versus the past. These images can be enlarged.

Source: Freddie Mac

Source: Freddie Mac Source: Freddie Mac

Source: Freddie Mac

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.