Whether you are a consumer, a business owner, an investor or merely a saver, the next big thing for the markets that comes with serious economic risks is the impending interest rate hike cycle. A consensus is building that interest rate hikes might not be imminent, but most pundits and indications are calling for the rate hike cycle to begin in 2015. That being said, 24/7 Wall St. has laid out 10 different reasons why the Federal Reserve is unlikely to hike interest rates too far or too fast. Source: Thinkstock

Source: Thinkstock

The same points are also aimed at offering consumers and investors a reason to not panic about the higher interest rates ahead. Still, it seems a very safe bet to think that higher rates are coming. After all, we cannot expect a zero-percent short-term rate environment to persist for another five to seven years.

24/7 Wall St. has gathered and reviewed all the recent U.S. and international trends in the financial markets and the monthly economic reports. While we do expect higher interest rates to come this year, via Janet Yellen rate hikes, there just seems to be an overwhelming number of data points that keep pointing toward the argument that the public just doesn’t have to worry about rates rising too fast nor that rates will be raised too high.

As a reminder, raising interest rates generally cools off a hot economy. This is far from a hot economy. Lifting rates too fast, or too high, would likely harm what has already been one of the weakest economic recoveries of modern times. It remains obvious that Yellen and Fed presidents want higher rates, but it would be illogical that they want to kill the economy. They have also admitted that they are data-dependent. As an unofficial safety net, something we will address here, the Federal Reserve also has an implied conflict of interest or a vested interest in not raising interest rates too high and too fast.

ALSO READ: The 20 Largest Privately Held Companies in America

Most of the issues addressed are U.S.-centric, but they almost all have international ramifications. Issues highlighted are gross domestic product (GDP), the dollar, that inherent conflict of interest, deflation versus inflation, fed funds futures, central bank targets in Europe and Japan, payrolls and employment issues, housing, consumer spending and retail, industrial production and capacity utilization.

There are many things that can of course derail interest rate expectations, in both ways. The stock market has hit new all-time highs. The rate-sensitive sectors like utilities, real estate investment trusts (REITS) and other dividend payers have seen their shares weaken. Some talk of dollar-euro parity still persists, and oil has backed off sharply from old highs, even if it has stabilized.

To keep this from being a dissertation, many broad issued had to be skimmed over. Tax rates ahead and the geopolitical climate matter. Credit spreads, particularly in the junk bond sector, remain a concern. The price of oil, industrial metals, food commodities, gold and other commodities have to be considered. The 30-year Treasury has seen its yield rise almost 50 basis points in the past month, but it is still barely 3.0% — and the 10-year Treasury yield is still close to 2.25% despite a rise of 40 basis points.

What if the global economy has really bottomed, and what if things become better than expected, versus what we are seeing today? If the perfect storm occurs, then interest rate hikes could easily go further than expected. The problem under that scenario of rates rising higher or too fast is that this could almost instantly trigger another serious slowdown or worse, which likely would generate another easing cycle and perhaps come with reinstated quantitative easing trends in the aftermath.

One key issue to consider here is what “too high and too fast” really means. Can fed funds be raised to 1.0%? Absolutely. Can that happen in two months or in two Federal Open Market Committee (FOMC) meetings? Not likely. Still, a 1.0% fed funds rate likely would be a welcomed event by us and many others — just do not expect that to happen overnight. Can fed funds be raised to 3.0%? That would not be welcomed any time soon, nor would it accomplish anything other than killing the effort of the past six or seven years.

These are the 10 reasons featured by 24/7 Wall St. that the Federal Reserve just cannot panic into rate hikes too fast and why they cannot raise interest rates too high. These were not tasked in any specific order. There are of course many more supporting issues, but, again, this is not meant to be a dissertation.

ALSO READ: 15 Companies Losing the Most Money

SPECIAL NOTE: Please note that all images used as supporting material can be expanded by clicking on them. This view on fed funds rate hikes is based on the most recent trends and releases, but readers should not interpret this as a prediction of economic numbers for the summer, fall and into 2016. Again, interest rate hikes are almost certainly coming and long-dated bonds are trying to price that in.

1. U.S. GDP Better Than Most, but Far Too Weak

The United States is supposed to be the best-looking entrant at the ugly contest when it comes to major global economies. So what gives with GDP in 2015? It came in at a paltry 0.2% in the first quarter of 2015, compared to a gain of 2.2% in the fourth quarter of 2014. Even if there is a debate about how first-quarter GDP is traditionally undercounted, the reality is that the economic growth is very weak.

Also, the GDP price index actually decreased to -1.5% after a reading of -0.1% in the fourth quarter. The Bureau of Economic Analysis (BEA) threw everything but the kitchen sink in the explanation: personal consumption expenditure (PCE), slower exports, low nonresidential fixed investment, slow state and local government spending, a deceleration in residential fixed investment. An upturn in federal spending kept it from being worse.

A recent Wall Street Journal poll of economists put GDP for all of 2015 sliding down to 2.2% growth from a 2.7% prior target. Freddie Mac recently revised down its forecast for economic growth in 2015 to 2.3% from 2.6%. What if economic numbers remain weak in the second half?

With the reminder that U.S. GDP is said to be 70% or so tied to consumer spending, the translation of continued weak retail spending just does not bode well for the underlying growth of the economy. Blame weather, blame port strikes, blame the desire to save and blame whatever else you want, but ultimately enough factors make for an underlying problem.

ALSO READ: Companies With the Best (and Worst) Reputations

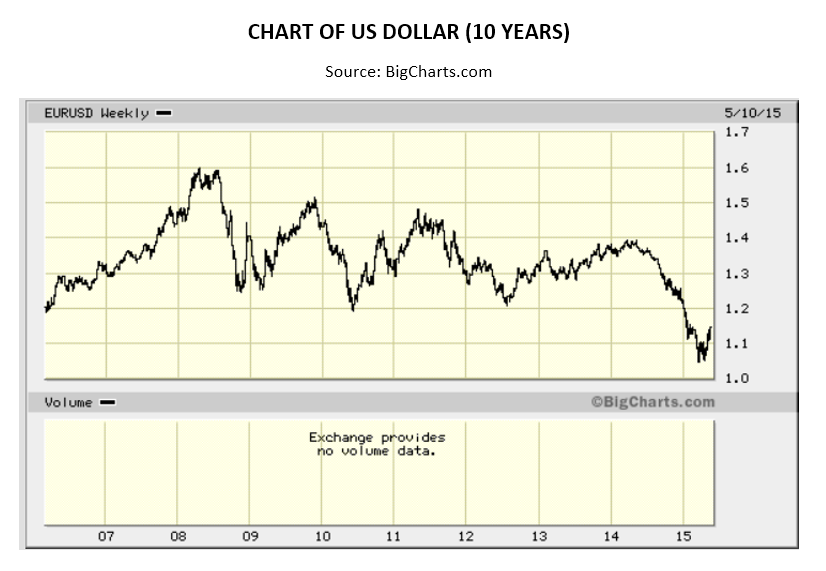

2. Strong Dollar: Is It Enemy Number One?

A rising U.S. dollar against the yen, euro and other currencies has been a serious issue during first-quarter earnings and even in the end of 2014. The euro went from $1.37 in the past 52-weeks down to about $1.04, before finally recovering back above $1.10. What is key is that American goods suddenly cost 20% to 30% more. While this has abated as of April and May, rising interest rates would theoretically make for a stronger dollar again.

At issue is that deposits simply chase higher relative interest rates, particularly if it is one of the reserve currencies. If the Fed raises rates too far too fast, then they just make U.S. companies that much less competitive again — and that drives all the economic numbers south, a symbiotic relationship that is just hard to avoid. If the euro and dollar reach parity, the biggest U.S. multinational companies will be hurting. As a reminder, the euro was at $1.18 on its formal launch.

If the Fed takes interest rates up too fast, the flood of foreign currencies being converted to buy dollars could just send our multinational corporate giants into further uncompetitive positions. Visiting Paris or Tokyo may now be cheaper than it has been in years, but that doesn’t exactly drive the U.S. economy, and most likely it doesn’t come into Janet Yellen’s.

ALSO READ: 7 Cars Buyers Cannot Wait to Trade In

3. The Unofficial Fed-Treasury Conflict of Interest

The Federal Reserve is supposed to be independent of politics, and it is supposed to be independent of the Treasury for operational purposes. The Fed has a dual mandate: to help foster price stability and to help foster full employment.

The Fed now holds over $4 trillion in debt assets of the U.S. government’s Treasury securities, agency debt and mortgages combined. If the Fed raises rates too fast, in theory it hurts that value of the paper it owns, even if it can reinvest principal and interest at higher rates.

ALSO READ: 9 States Running Out of Water

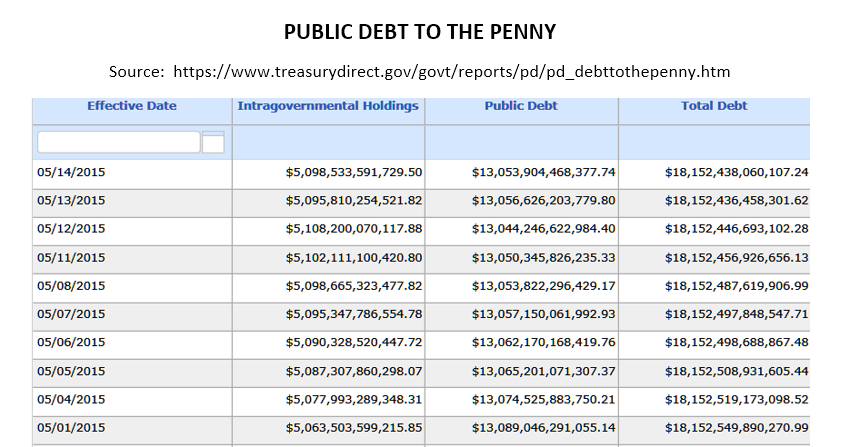

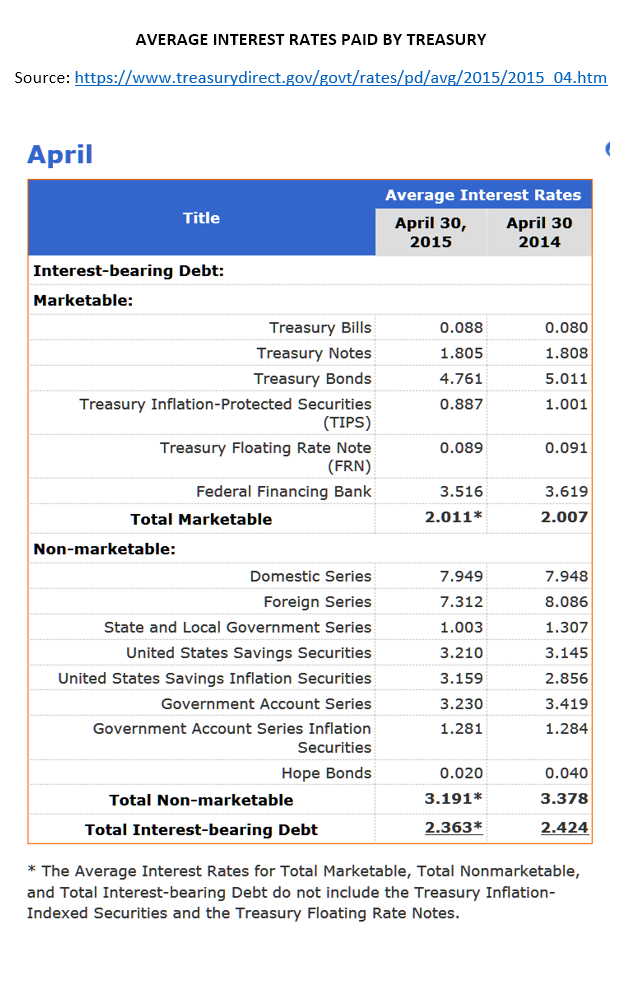

Also, if the Fed raises rates it drives up borrowing costs for the Treasury through time. The official debt to the penny (see below) was last shown as $18.1 trillion in total, so a theoretical 1% unilateral rise in interest rates would ultimately add another $181 billion in annual debt servicing costs, if you tallied all the debt truly as Federal direct obligation debt.

That extra $181 billion per year figure of course would take years to occur as the existing fixed coupon rates do not change, but this is still serious money to consider several years out.

The average fixed interest rate being paid on that debt was 2.363% in April 2015, versus 2.424% a year earlier, and total non-marketable average interest rates were 3.191% as of April 2015, versus 3.378% a year earlier. It may seem blasphemous to some to ask if there is a conflict of interest here, but it may be far less conspiracy theory if you consider what is in the interest of the nation.

Source: Treasury Direct

Source: Treasury Direct

ALSO READ: 5 Big Oil Stocks to Buy for the Rest of 2015

4. The Inflation and Deflation Boogeyman

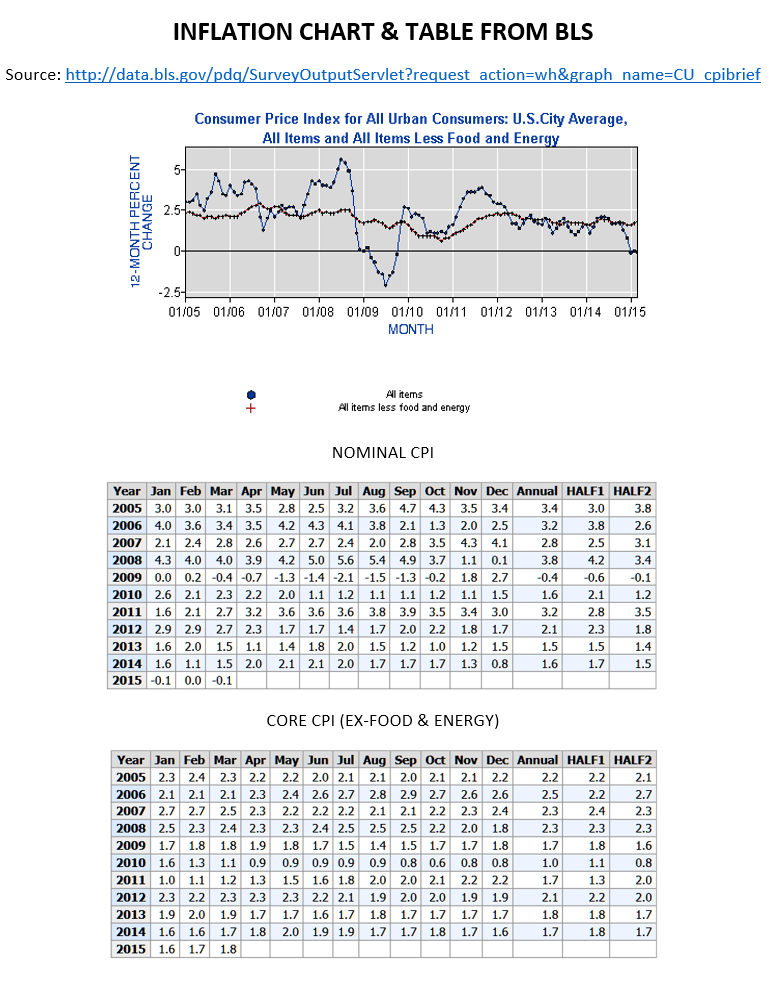

Inflation in America is elusive at this time, and it is also one of those double-edged swords: Not enough inflation brings little opportunity, but too much inflation erodes buying power for those on set salaries and fixed budgets. The Fed wants 2.0% to 2.5% inflation, but it has been unable to get inflation. Even the 10-year Treasury does not yet yield 2.5%, even if it may get there again.

Then there is deflation, the true boogeyman. Falling prices lead to bad news all around because everything you own is worth less money each day, and everything you want to buy will be cheaper the next day. Deflation leads to falling wages, causes lower home and asset prices, and leaves nowhere to hide. Those trillions of dollars in quantitative easing and stimulus from the United States, Europe and Japan may have simply thwarted deflation rather than created all the hyperinflation so many were worried about.

So if raising interest rates are meant to ward off higher prices, and we have no higher prices in aggregate and are worried about deflation, won’t the Fed just risk creating further deflationary pressure if it raises interest rates too much?

ALSO READ: 5 Top Potential Biotech Buyout Candidates

Consumer prices — Consumer Price Index (CPI) — were -0.1% or 0.0% for the first three months of 2015 and were only at 2.0% during six of the 24 months during 2013 to 2014. Backing out food and energy, CPI was up 2.0% for only two of the 24 months during 2013 and 2014. Oil and energy costs may be the biggest inflation-deflation wedge, but the Fed does not buy oil and the Treasury does not print it.

The trend of producer prices — Producer Price Index (PPI) — has been even lower than CPI trends, which might lead consumer prices lower for the months ahead. If oil stays closer $60 or approachs $70 again, maybe the deflationary pressure will end. Again, the Fed does not buy oil and the Treasury cannot print it.

ALSO READ: 9 Oil and Gas Stocks Analysts Want You to Buy Now

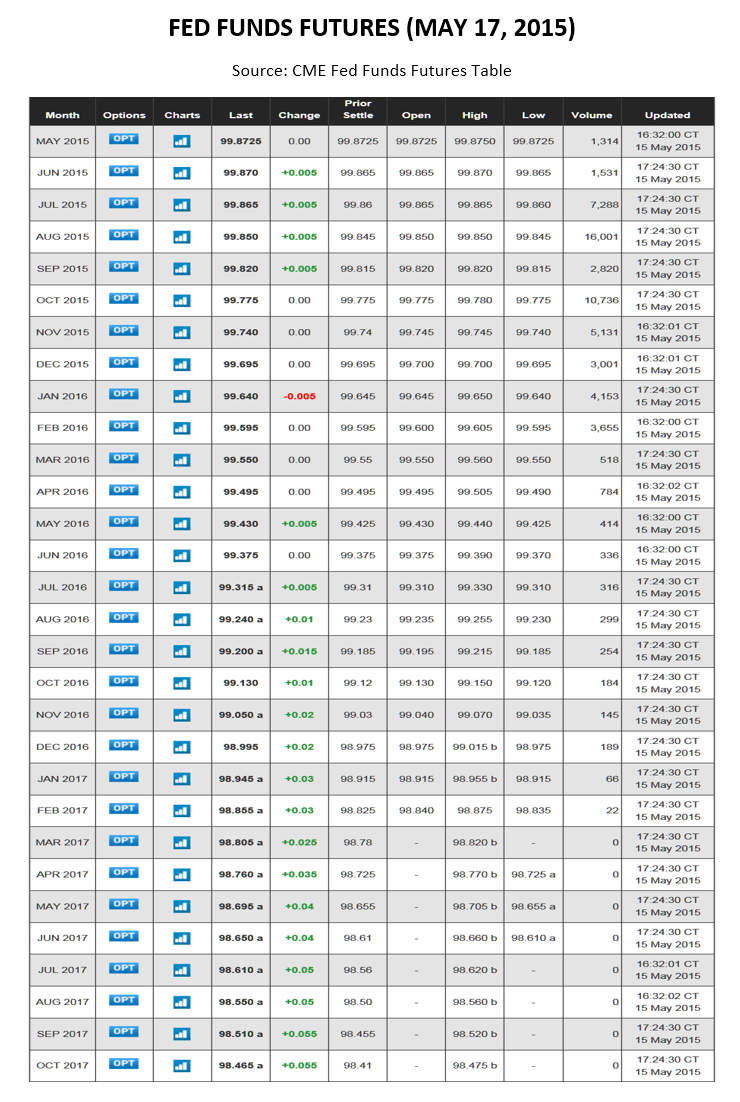

5. Fed Funds Futures Downplay Serious or Rapid Rate Hikes

Market pundits, economists, politicians, Fed governors and Treasury employees can spitball all they want about where interest rates are going. There is a real market out there for fed funds, and that is the 30-day federal funds futures trading every day on the CME.

The CME describes each underlying unit as “Interest on Fed Funds having a face value of $5,000,000 for one month calculated on a 30-day basis at a rate equal to the average overnight Fed Funds rate for the contract month.”

The most active contracts by volume are July 2015 to February 2016. Market pundits still talk about a June rate hike being on the table, but the reality is that fed funds futures currently do not show an expected rate hike (100% priced in) until November 2015. The fed funds futures also do not really seem too concerned about an August or even September time frame as of mid-May.

ALSO READ: 4 Stocks to Buy for the Coming Interest Rates Increases

Now, let’s go further out. Fed funds futures do not have a 100% priced-in chance of a 0.50% fed funds rate until April of 2016, with a better-than-not chance not coming into play until January of February of 2016. And for the timing of when fed funds will hit a whopping 1.00%, the 100% chance is currently not until December 2016, with a better-than-not chance only in November of 2016.

The hope is that the markets and the economy will be able to handle a 1.0% fed funds rate. Still, the interest rate sensitivity of the markets just does not lend credence to a rapid rate hike cycle. If this is May of 2015, and the fed funds futures are currently pegging very late in 2016 for a 1.00% fed funds rate (and a 1.50% fed funds is not predicted before June of 2017), why should you be all that worried about rates rising too far and too fast?

Source: CME Fed Funds Futures

Source: CME Fed Funds Futures

ALSO READ: The States With the Most (and Least) Divorces

6. Does the Fed Want to Punish Japan and Europe QE?

24/7 Wall St. will leave it up to you to decide whether there is “a global fix in place” when it comes to world’s central banks and monetary policy. Still, the G10 and G20 are international forums for the governments and central bank governors from the world’s major economies, and they routinely meet regarding the global economy.

While everyone was in a race to devalue their currencies after the recession, it would now seem to be counter-productive in a global economy for the top central bank in the world (the United States) to be the only major country wanting to raise rates too fast when quantitative easing (QE) and a negative interest rate policy is still early in Europe. While Greece keeps coming up as an issue in Europe, that tiny nation has become predictably untrustworthy by Western standards and is perhaps just a sideshow in comparison to the big picture, to the point that it doesn’t deserve further mention.

Japan keeps trying to inflate its economy under Abenomics, and the nation may just keep going with this policy until it no longer can. China’s growth trend has been slow enough of late that its huge growth numbers feel like a recession to most advanced economies. Japan keeps going under Abenomics, but the fundamental issues of an aging population with low growth rates only make the issues around a slow global economy that much more challenging.

ALSO READ: Countries That Hate America the Most

China has now effectively eased up on rates to spur growth, despite mixed regulatory threats from time to time. The reality is that China’s currency is mostly pegged to the U.S. dollar, despite a widening out of trading bands in recent years. If the United States drives up its own dollar, then it effectively drives up the value of the renminbi. That just makes the rest of the world view China as being that much more expensive, and they will take their business elsewhere. For that matter, China has already moved some of its operations elsewhere too.

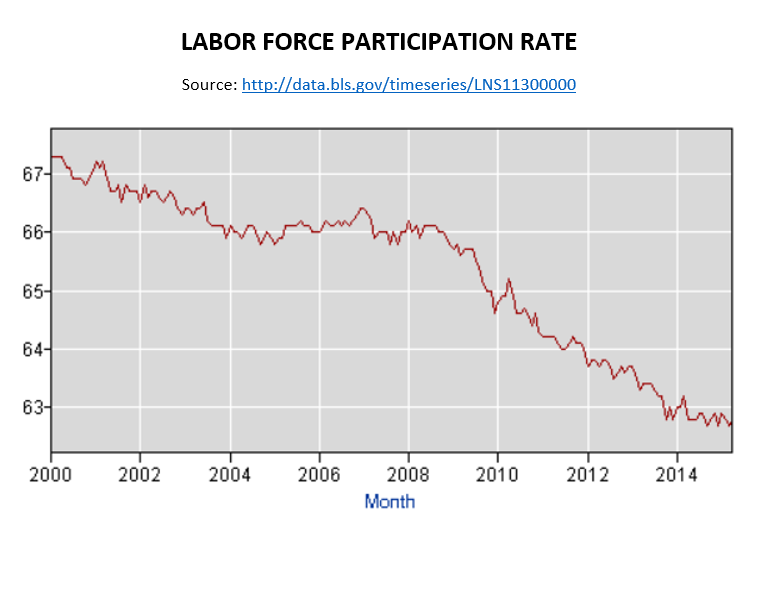

7. Unemployment, Payrolls, Productivity and Wage Inflation

The one issue that has been working well for the Federal Reserve is that the official unemployment figures have been in a downward trend since 2010. One issue to consider here is that the Federal Reserve keeps lowering its benchmark for what the real target is on unemployment, which was last seen at only 5.4% for April of 2015. There is a flip side here though, and that is that the labor force participation rate remains dismal and well under 63% (see below) and the underemployed rate remains above 10%. Nonfarm payrolls rose by 223,000 in April, but the preliminary gain of 126,000 in March was revised to a meager 85,000.

Perhaps the real issue with the Fed and the employment situation is that this remains the weakest post-war recovery of most of our lifetimes. The official unemployment rate of 5.4% is still actually a full 1.0% higher than the economic peaks of 2006 and 2007. Many large employers still claim endlessly that they cannot find workers with enough skills. The so-called U-6 (the total unemployed, plus those marginally attached to the labor force, plus total employed part time for economic reasons, as a percentage of the civilian labor force plus all persons marginally attached to the labor force) is still above 10%.April was shown to be 10.4% not seasonally adjusted and 10.8% seasonally adjusted.

ALSO READ: The 10 Most Popular Stores in America

Another issue to consider is the decline of late in worker productivity. The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm business sector productivity was down by a rate of 1.9% annually during the first quarter of 2015. While this was up from a year earlier, the problem is that the decline in the first quarter of 2015 followed a decline with a -2.1% reading in the fourth quarter of 2014. While output declined and hours worked rose, the reality is that companies will not be eager to keep adding workers if productivity declines.

Is this the start of wage inflation? The BLS recently reported that unit labor costs in the nonfarm business sector were up by 5.0% in the first quarter of 2015, with the breakdown being a gain of 3.1% in hourly compensation, and then including that 1.9% drop in total productivity. The BLS said that, as of the first quarter of 2015, unit labor costs rose by 1.1% over the past four quarters.

8. Housing and Consumer Spending

Consumers are borrowing more again, but retail sales data just are not at all supporting the notion that we are in a hot runaway economy. There also has been an argument that housing has to be strong for a good economy.

ALSO READ: 5 Analyst Stocks Under $10 With Massive Upside Targets

Housing data by and large remains mixed, despite the rising prices that have been seen for average houses in certain parts of the country. Also, the April housing starts gain of 20.2% was over the prior month at 1.13 million annualized, while the gain from a year ago was actually 9.2%. New permits were up by a lesser amount of 6.4% from a year earlier. The latest strength in housing starts was a post-recession high, but this is still barely half of the pre-recession peak — and it still only meets the lower points in housing starts of the 1980s and 1990s.

Freddie Mac said in its 2015 outlook that it was low mortgage rates that have helped to keep homebuyer affordability strong in the face of rising house prices. Housing remains extremely sensitive to interest rates. Each time mortgage rates rise even 0.5% or are feared to rise 1.0%, the media shows over and over how it affects housing affordability and how it can stress the ability for borrowers to get mortgages. It does not seem to matter that many of us remember having mortgage rates of 6% or 8% in years past, let alone in the double-digits in the 1980s.

Retail sales were flat in April, following a 1.1% gain in March. Even if the argument that first quarter GDP is undercounted, a weak reading in April retail sales got the second quarter off to a bad start. Even if you back out autos and gasoline, the retail sales figure from Census was up a mere 0.1%. Americans are spending more at non-store retailers, and their spending is up selectively at other sectors – but not furniture, electronics, department stores and grocery stores.

Again, consumer spending is said to account for about 70% of U.S. GDP. If retail sales remain weak and if consumers are more interested in saving their $750 per household annual pay raise from lower oil prices (or using it to pay down debt), it does not bode well for the argument that consumers will bail out the economy right now. Personal savings in the first quarter of 2015 was the highest since the fourth quarter of 2012.

ALSO READ: Major Portfolio Changes for Warren Buffett and Berkshire Hathaway

Source: TradingEconomics.com

Source: TradingEconomics.com

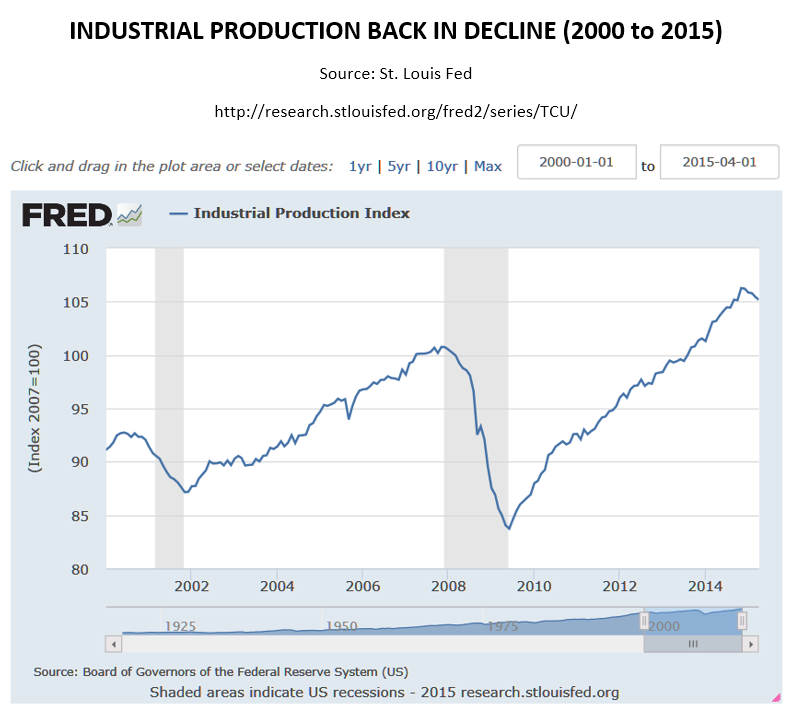

9. Industrial Production in the Toilet

Industrial production in April was down again with a reading of -0.3%, when economists were looking for a meager 0.1% gain. While March was revised to -0.3% from -0.6%, what stands out here is that April marked the fifth consecutive month in which industrial production has been in decline. The culprits are mining, which of course includes oil, as well as output from utilities and stagnant manufacturing.

What really hurts here is that the last real growth in industrial output was in November. Sure, you can blame the strong dollar creating weak exports. But international markets remain weak. Manufacturing output’s only recent gaining month was in March. Output from utilities was -1.3% in April, and mining was negative for the fourth month in a row at -0.8%. A lot can explain this, but at the end of the day enough excuses and exceptional situations just make for a weak economy.

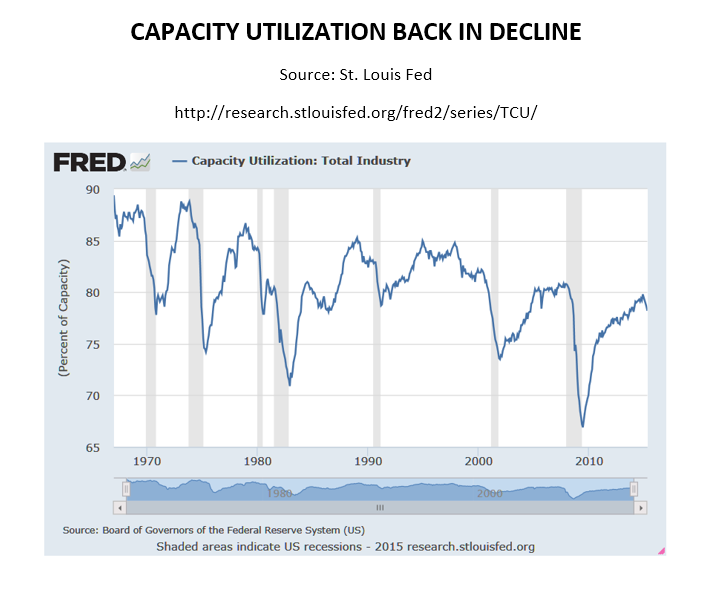

10. The World Is Awash in Unused Capacity

When politicians and economic pundits point out over and over that companies just will not hire or will not build new plants and factories to build for the future, there is another side to this argument, and it is around capacity utilization. Some of the argument can be tied to ongoing demand issues. But when companies have unused capacity, which they really do, what is their impetus to go make big hires and big capital spending projects? The world is awash in excess and unused capacity.

ALSO READ: States Where the Most (and Least) People Work for the Government

With lower industrial production, capacity fell again in April with a reading of 78.2%, versus 78.6% and well under that elusive benchmark of 80.0%. A long-term chart from FRED (below) shows that the closest utilization got to 80.0% post-recession was last November’s 79.8%. It has been in steady decline since.

Politicians and the public can criticize companies all they want about returning capital to shareholders, but until capacity exceeds 80% there is no real point in expecting big capital spending. Capacity was above 80% for most of the 2005 to 2008 period, and it was almost never below 80% from 1992 to just after 2000.

ALSO READ: Credit Suisse’s 3 Most Undervalued MLPs to Buy Now

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.